Company Summary

| Capital Trader Review Summary | |

| Founded | 2024-07-10 |

| Registered Country/Region | Cyprus |

| Regulation | Unregulated |

| Market Instruments | Forex, CFDs, Stocks |

| Demo Account | ❌ |

| Leverage | Up to 1:500 |

| Spread | From 0.2 pips (EUR/USD, Average) |

| Trading Platform | Capital Trader WebTrader (Web) |

| Min Deposit | $250 |

| Customer Support | info@capitalltraders.com |

| +442038973562 | |

| 256 Archiepiskopou Makariou III Avenue, Eftapaton Court 3105 Limassol, Cyprus | |

Capital Trader Information

Capital Trader is a broker offering multi-asset trading in forex, stocks, commodities, synthetic indices, CFDs, etc., supporting clients worldwide (note that restrictions may apply in some regions). It provides competitive leverage of up to 1:500 for over 50 currency pairs. It suits experienced investors seeking high leverage and multi-asset trading, as well as novice traders looking to test the waters with small deposits.

Pros and Cons

| Pros | Cons |

| Multiple trading instruments | Unregulated |

| Flexible account types | Ambiguous information (e.g., CFDs leverage ratio) |

| High leverage up to 1:500 | High minimum deposit for premium accounts (starting at $100,000) |

| Multilingual 24/5 customer support | High commission of $30 per lot for XAU/USD in MICRO accounts |

| MT4/MT5 not available |

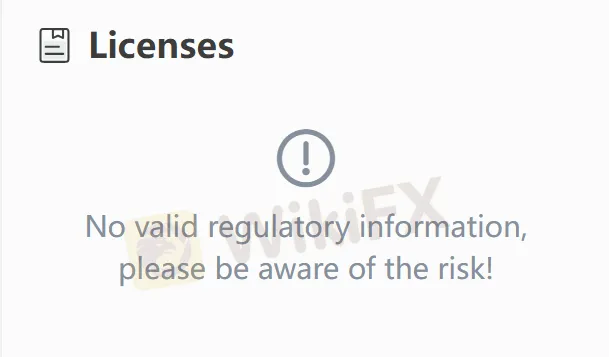

Is Capital Trader Legit?

Capital Trader is not regulated. Even though it claims to hold mainstream regulatory licenses such as FCA and CySEC, traders are advised to check and verify on the official websites of relevant regulatory authorities and prioritize investing with regulated brokers.

What Can I Trade on Capital Trader?

Capital Trader provides forex, stock, and CFD trading services.

| Tradable Instruments | Supported |

| Forex | ✔ |

| CFDs | ✔ |

| Stocks | ✔ |

| Shares | ❌ |

| ETFs | ❌ |

| Bonds | ❌ |

| Mutual Funds | ❌ |

Account Type

| Account Type | STANDARD | PROFESSIONAL | BUSINESS | BUSINESS PLUS |

| Minimum Deposit | From $250 | From $10000 | From $30000 | From $100000 |

| Min Lot Size | 0.01 | 0.01 | 0.01 | 0.01 |

| Trading Platform | Capital Trader webtrader | Capital Trader webtrader | Capital Trader webtrader | Capital Trader webtrader |

| Minimum Deposit | $250 | $10000 | $30000 | $100000 |

| Mobile Trading | Mobile Trading | Mobile Trading | Mobil Trading | Tailored conditions |

| 24-Hour Trading | ✔ | ✔ | ✔ | ✔ |

| Deposit Bonus | 30% | 50% | 100% | |

| Islamic Account | ✔ | ✔ | ✔ |

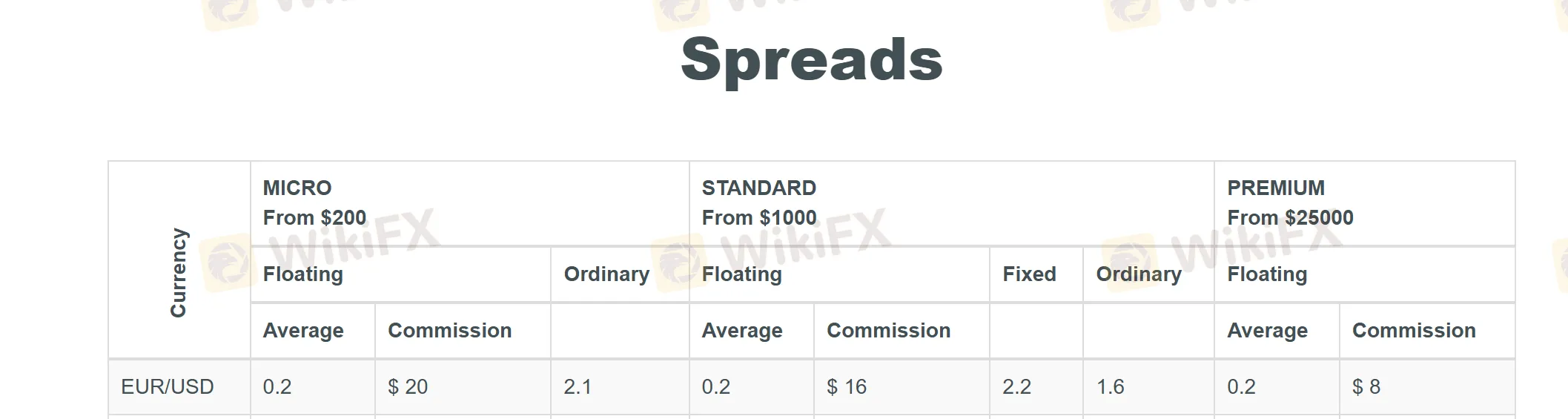

Capital Trader Fees

Capital Trader offers forex floating spreads as low as 0.2 (e.g., EUR/USD in micro accounts), while fixed spreads are higher (e.g., GBP/USD fixed spreads start at 2.1). Precious metals have wider spreads, such as gold/USD with a floating spread of 0.9 (micro account).

Commission for precious metals is $30 per lot. For forex in micro accounts, the commission is $20 per lot (e.g., EUR/USD), while premium accounts offer commissions as low as $8 per lot.

Leverage

The maximum forex leverage is 1:500 (applicable to major currency pairs such as EUR/USD). High leverage is suitable for short-term speculation but carries extremely high risks.

Trading Platform

Capital Trader WebTrader supports web-based operations. Basic accounts support ordinary mobile trading, while BUSINESS PLUS accounts allow customized trading conditions.

| Trading Platform | Supported | Available Devices | Suitable for |

| Capital Trader WebTrader | ✔ | Web | / |

Bonus

Deposit bonuses increase with account tiers: 30% for PROFESSIONAL accounts, 50% for BUSINESS accounts, and 100% for BUSINESS PLUS accounts.