Présentation de l'entreprise

| Invesco Résumé de l'examen | |

| Fondé | 1995 |

| Pays/Région d'enregistrement | États-Unis |

| Réglementation | FSA |

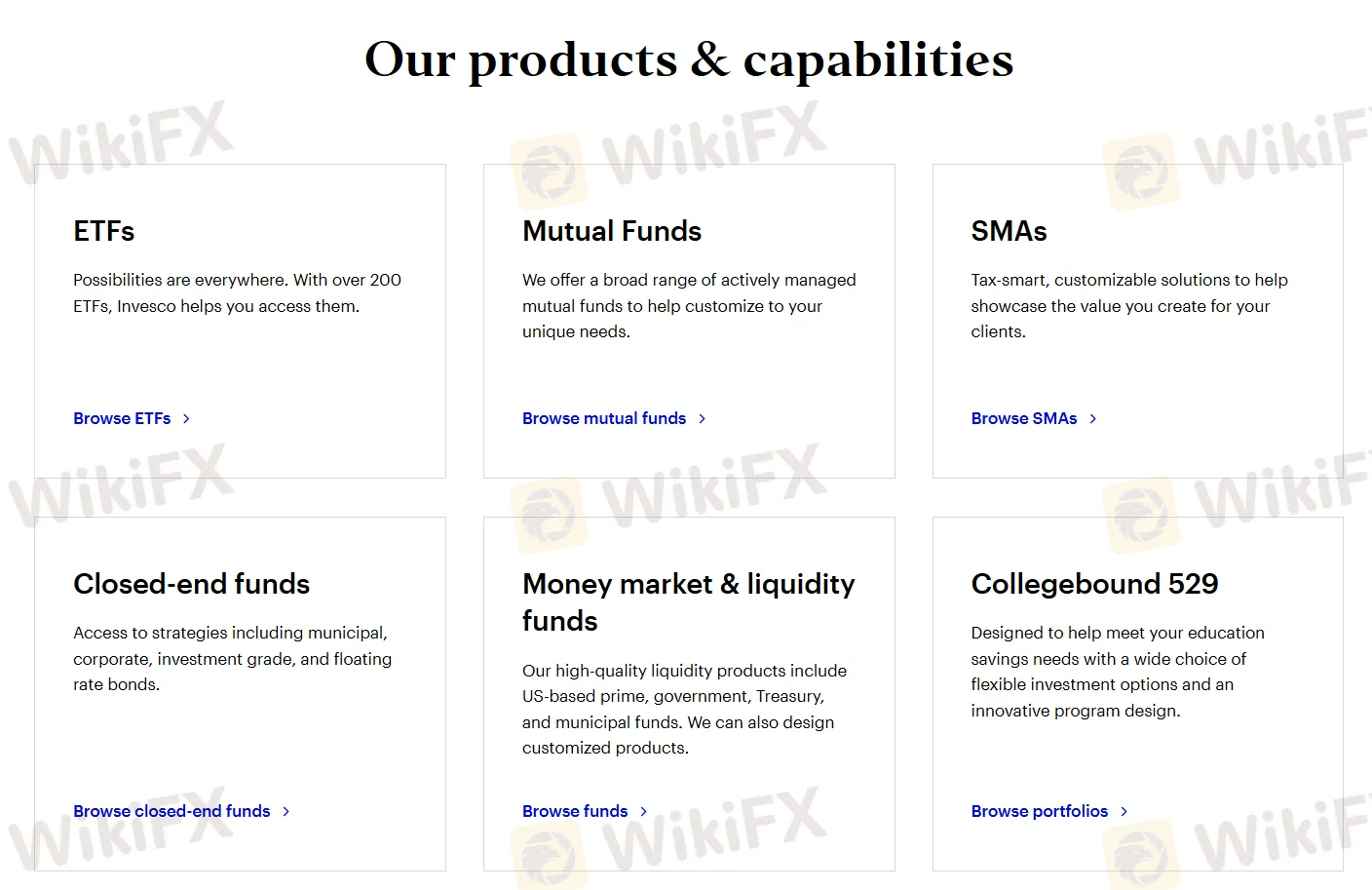

| Produits et services | ETF, fonds communs de placement gérés activement, SMAs, fonds fermés, fonds du marché monétaire et de liquidité, et plans Collegebound 529 |

| Assistance clientèle | États-Unis (800) 959-4246Hors États-Unis (713) 626-1919Ligne investisseur Invesco (800) 246-5463Fonds fermés (800) 341-2929Du lundi au vendredi, de 7h00 à 18h00, heure centrale |

Invesco Information

Invesco est une société de gestion d'investissement mondiale bien établie réglementée par la FSA. La société propose une gamme diversifiée de produits et services financiers, notamment des ETF, des fonds communs de placement, des SMAs, des fonds fermés, des fonds du marché monétaire et des plans 529, offrant des solutions d'investissement standard et sur mesure avec des outils de gestion de compte pratiques.

Avantages et inconvénients

| Avantages | Inconvénients |

|

|

|

|

Invesco est-il légitime ?

Invesco dispose d'une licence de change au détail réglementée par l'Agence des services financiers (FSA) au Japon, avec un numéro de licence 関東財務局長(金商)第306号.

Produits et services

Invesco propose plusieurs produits et capacités financiers, notamment des ETF, des fonds communs de placement gérés activement, des SMAs, des fonds fermés, des fonds du marché monétaire et de liquidité, et des plans Collegebound 529, répondant à divers besoins d'investissement et types de clients. La société propose des solutions prêtes à l'emploi et personnalisables.

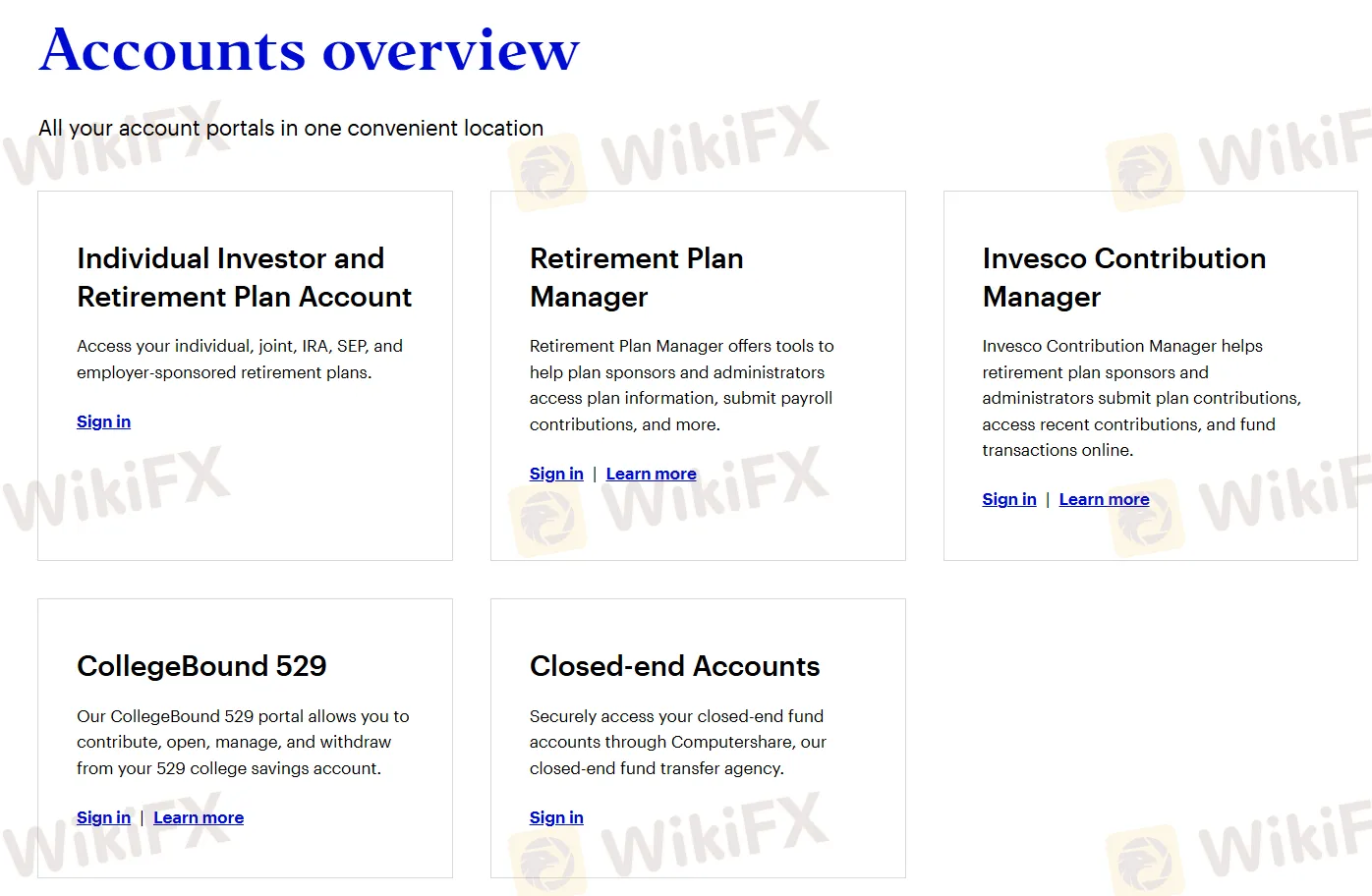

Aperçu des comptes

Invesco offre un accès aux investisseurs individuels et aux comptes de régime de retraite, des outils pour les sponsors et administrateurs de régimes de retraite, une plateforme de gestion des contributions Invesco, un accès aux comptes CollegeBound 529, et un accès sécurisé aux comptes fermés.