Présentation de l'entreprise

| Ata Yatırım Résumé de l'examen | |

| Fondé | 1990 |

| Pays/Région d'enregistrement | Turquie |

| Régulation | Pas de régulation |

| Produits & Services | Actions, contrats à terme, options, obligations, fonds d'investissement, services de courtage, finance d'entreprise, conseil en investissement, gestion de portefeuille et recherche |

| Compte de démonstration | / |

| Effet de levier | / |

| Spread | / |

| Plateforme de trading | Application mobile |

| Dépôt minimum | / |

| Support Client | Formulaire de contact |

| Email: iletisim@atayatirim.com.tr | |

| Tél: 0 (212) 310 60 60 | |

| Réseaux sociaux: X, YouTube, Facebook, Instagram, LinkedIn, Spotify, Blog | |

| Adresse: No:109 K:12 Atakule, Besiktas, Istanbul, 34349, Turquie | |

Informations sur Ata Yatırım

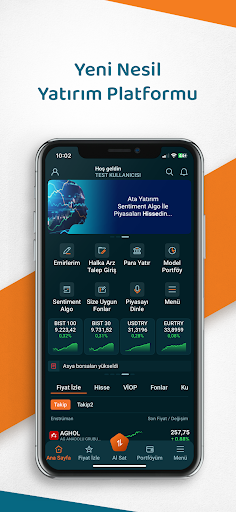

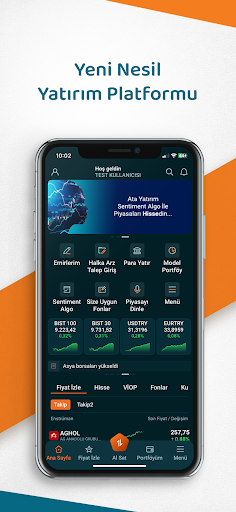

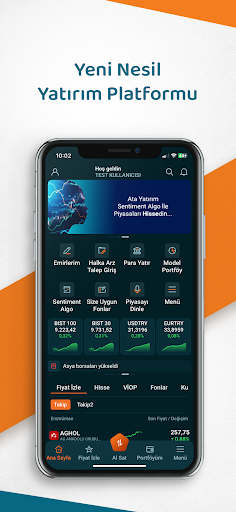

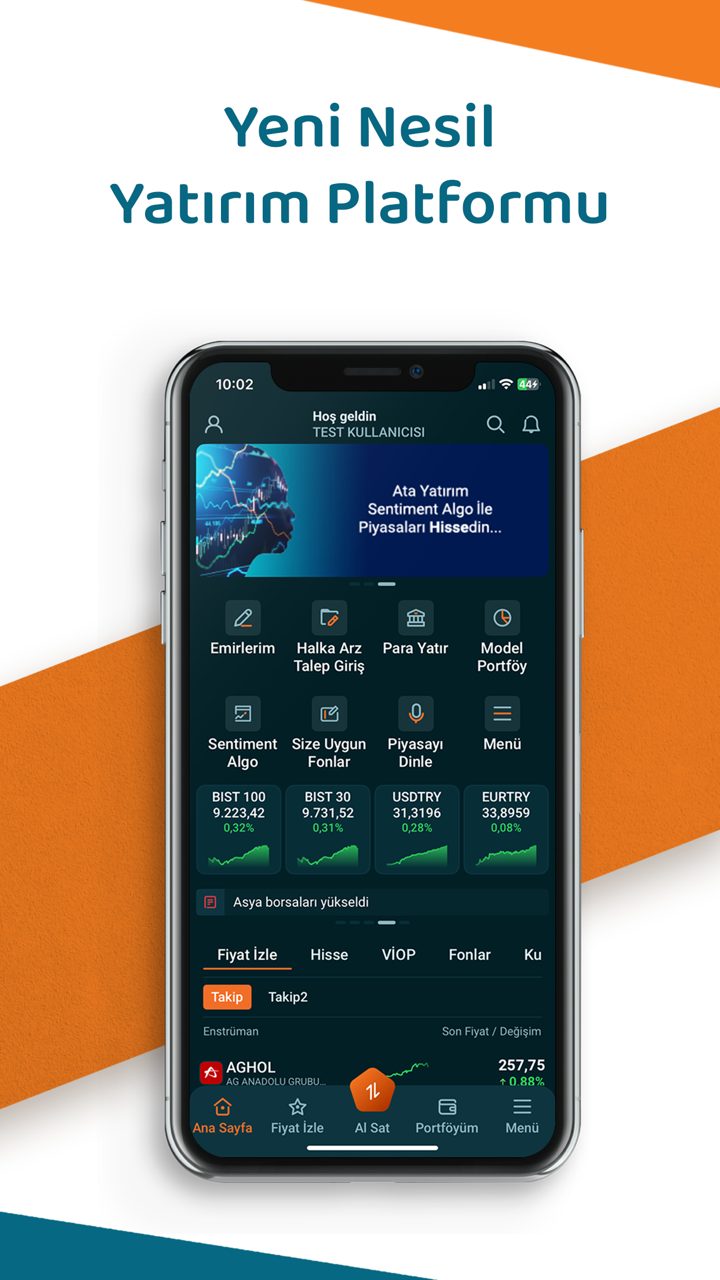

Ata Yatırım, fondé en 1990 et basé en Turquie, est une plateforme non réglementée offrant une gamme complète de services financiers, y compris des plateformes d'investissement comme AtaOnline pour le trading mobile, ainsi que divers produits tels que des actions, des contrats à terme, des fonds et des obligations.

Avantages et Inconvénients

| Avantages | Inconvénients |

| Services complets | Manque de régulation |

| Divers canaux de contact | Informations limitées sur les frais |

| Longue histoire d'opération |

Ata Yatırım est-il légitime ?

Ata Yatırım est une plateforme non réglementée. Le domaine atayatirim.com.tr sur WHOIS a été enregistré le 26 septembre 1997 et expire le 25 septembre 2027.

Que puis-je trader sur Ata Yatırım ?

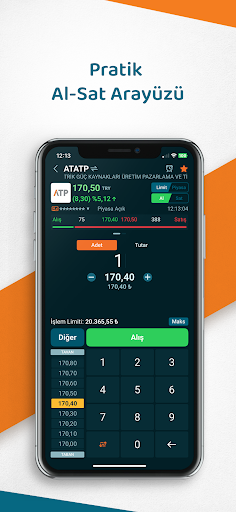

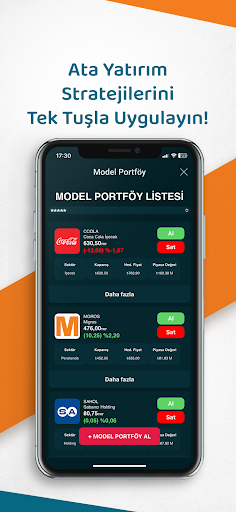

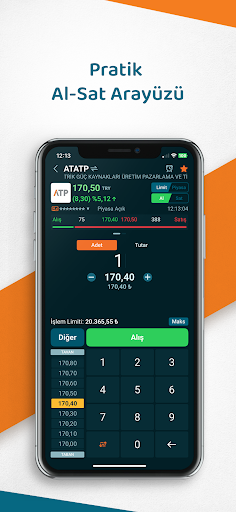

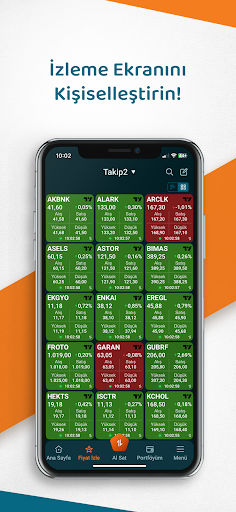

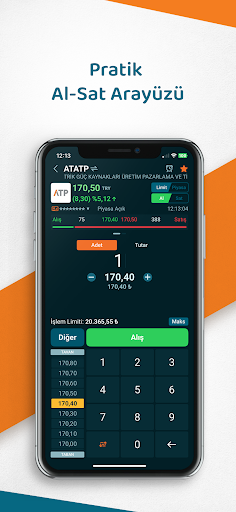

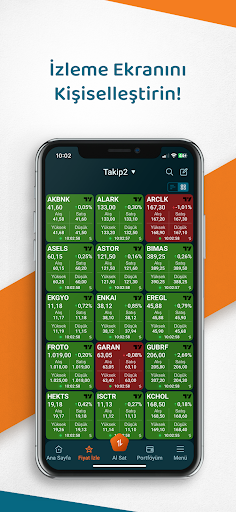

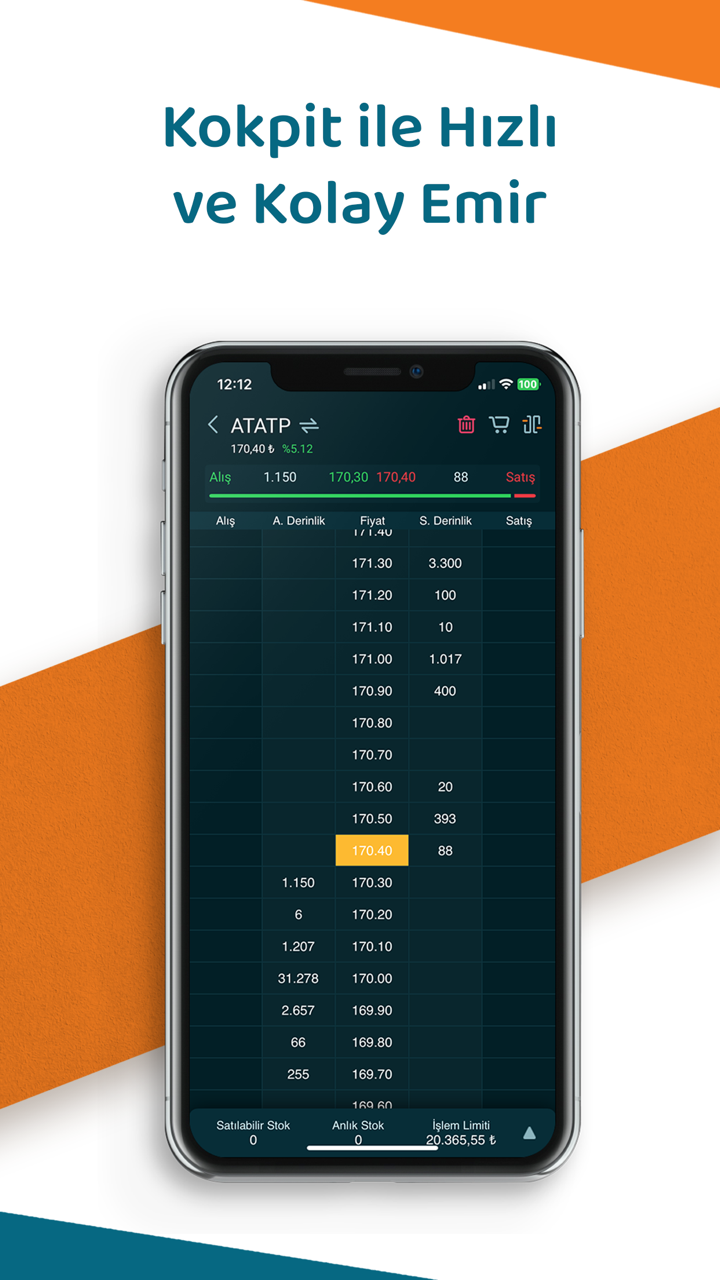

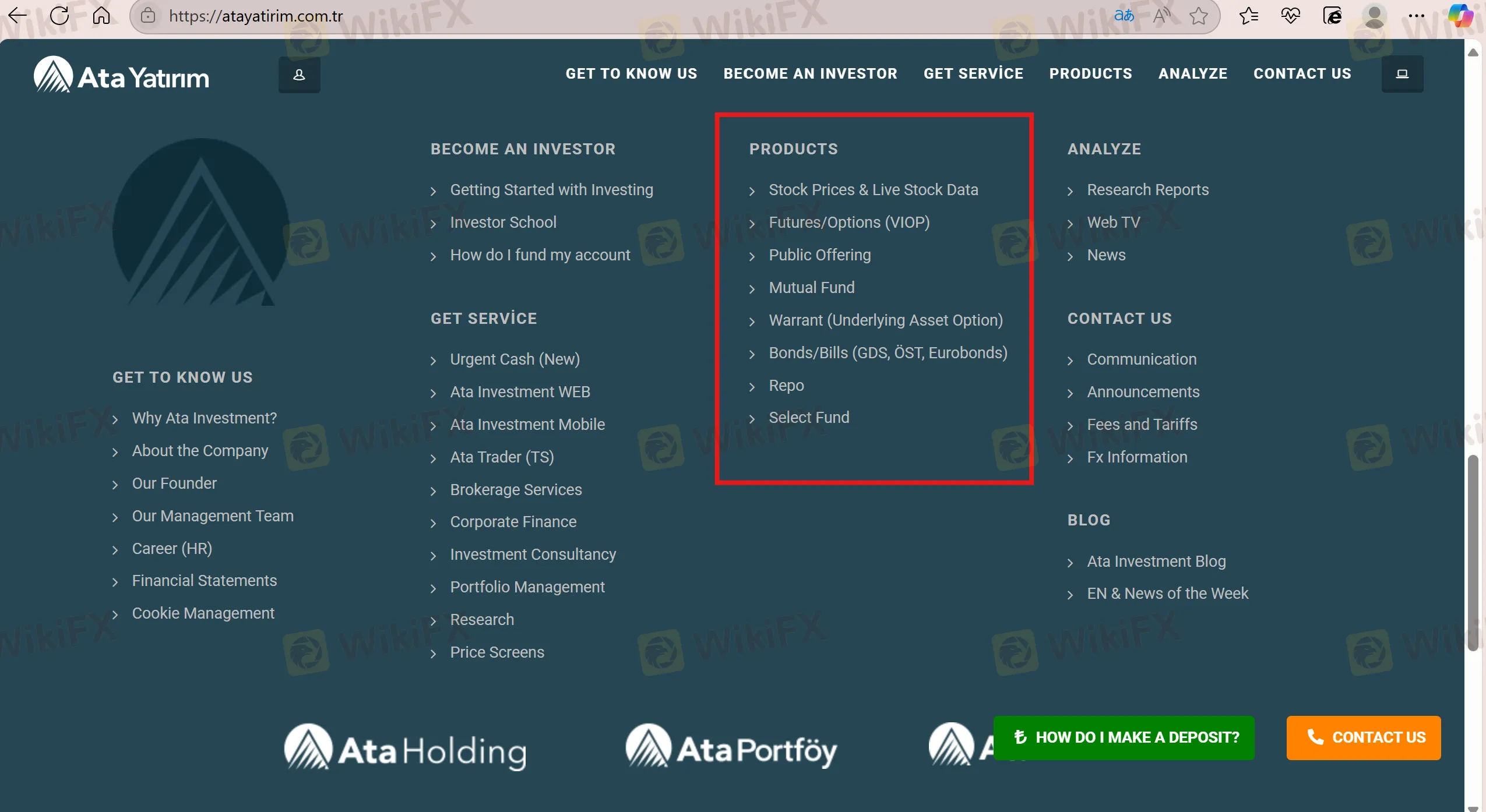

Ata Yatırım propose une variété de produits d'investissement, y compris des prix d'actions et des données en direct, des contrats à terme/options (VIOP), des offres publiques, des fonds d'investissement, des warrants, des obligations/billets, des repo et des fonds sélectionnés.

| Instruments Négociables | Pris en charge |

| Contrats à terme | ✔ |

| Options | ✔ |

| Actions | ✔ |

| Obligations | ✔ |

| Fonds d'investissement | ✔ |

| Forex | ❌ |

| Matières premières | ❌ |

| Cryptomonnaies | ❌ |

Services

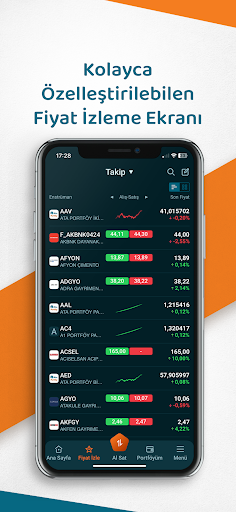

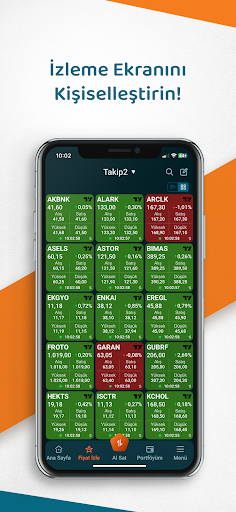

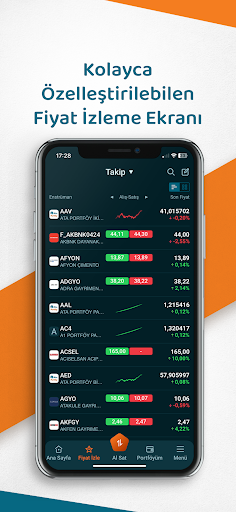

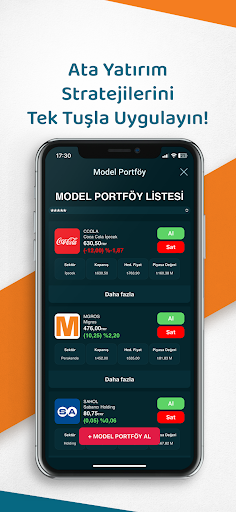

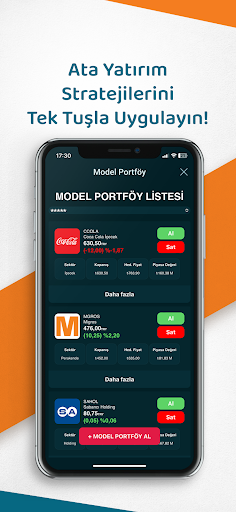

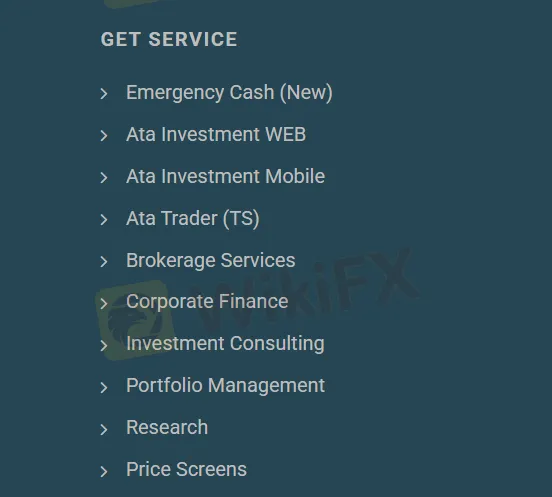

Ata Yatırım propose une gamme de services financiers, y compris des plateformes d'investissement (WEB, Mobile, Trader TS), des services de courtage, des finances d'entreprise, des conseils en investissement, la gestion de portefeuille et de la recherche, ainsi qu'un nouveau service de trésorerie d'urgence et des écrans de prix.

Plateforme de trading

| Plateforme de trading | Pris en charge | Appareils disponibles | Convient pour |

| Application mobile | ✔ | iOS et Android | / |