Note

charles SCHWAB

États-Unis | 5 à 10 ans |

États-Unis | 5 à 10 ans |https://www.schwab.com/

Site officiel

Indice de notation

Influence

Influence

AAA

Indice d'influence NO.1

États-Unis 9.97

États-Unis 9.97 Contact

Licence de change

Licence de change

Aucune licence de trading forex n'a été trouvée. Veuillez prendre connaissance des risques.

- Ce courtier ne dispose d'aucune réglementation forex valide. Soyez vigilant !

Informations de base

États-Unis

États-Unis Les utilisateurs qui ont consulté charles SCHWAB ont également consulté..

Neex

VT Markets

fpmarkets

AVATRADE

Source de recherches

Langue de diffusion

Analyse du marché

Diffusion de matériaux

Site web

schwab.com

162.93.215.103schwab.com.hk

162.93.210.100tdameritrade.com

198.200.171.204tdameritrade.com.sg

198.200.171.26tdameritrade.com.hk

198.200.170.20

Diagramme de la généalogie

Entreprises apparentées

Allen, Peter Blake

Directeur exécutif

Date de début

État

Employé

CHARLES SCHWAB & CO. INC.(District of Columbia (United States))

Allen, Peter Blake

Gouverneur

Date de début

État

Employé

CHARLES SCHWAB & CO. INC.(District of Columbia (United States))

Beatty, Jonathan

Directeur exécutif

Date de début

État

Employé

CHARLES SCHWAB & CO. INC.(District of Columbia (United States))

Divulgation réglementaire

Questions et réponses sur le wiki

Does Charles Schwab have any cons?

As much as I appreciate the services offered by Charles Schwab, there are a few areas where I believe they could improve, especially when it comes to the Charles Schwab leverage options available. Schwab offers leverage of up to 2:1 for equities in margin accounts, meaning I can borrow up to 50% of the value of the securities I am trading. While this is typical for most brokers, some advanced traders, including myself, would appreciate a bit more flexibility, especially when trading higher-risk assets like options or futures. For someone like me who trades actively, this conservative approach can sometimes limit my ability to execute more aggressive strategies. Furthermore, Schwab is primarily focused on the U.S. market, and as such, investors looking for easy access to international markets may find this platform limiting. While Schwab does offer global accounts, their international trading options are somewhat restricted compared to brokers that are more focused on global diversification. Another drawback I encountered is that while Schwab offers great customer service, their thinkorswim® platform, which is geared toward advanced traders, can be quite complex for beginners. I recall feeling slightly overwhelmed by the sheer number of tools and features, which I didn’t initially know how to use effectively. For novice traders, this can be a bit intimidating and could potentially delay the learning curve. However, once I became familiar with it, thinkorswim® provided some of the most powerful trading tools I’ve ever used. In conclusion, while these cons are notable, I still find Schwab to be a great platform due to its overall reliability, excellent educational resources, and transparent fee structure.

Is Charles Schwab regulated? Is it safe and legit?

In my experience, Charles Schwab is a reliable and secure brokerage, despite its regulatory status with the SFC being revoked. Schwab operates under U.S. financial regulations, and it is a member of SIPC (Securities Investor Protection Corporation), which offers protection for customers' securities, up to $500,000, including $250,000 in cash. This SIPC protection gives me confidence that my assets are secure, and it provides peace of mind in case of unforeseen circumstances. Additionally, Schwab Bank is FDIC-insured, which means that any funds in my Schwab Bank accounts are covered up to $250,000 per depositor, further adding to the safety of my funds. Although the revocation of SFC regulation might seem concerning for non-U.S. investors, the extensive regulatory framework that Schwab adheres to within the United States ensures that I am well-protected as an investor. When I first registered and logged into my Charles Schwab account, I found that Schwab makes security a top priority, which reassured me. While the revoked status from SFC might limit Schwab's activities in some regions, its extensive regulatory background and customer protection mechanisms make it a trustworthy platform for me. Therefore, despite this revocation, I still feel comfortable with Schwab’s overall security and regulatory compliance.

Which payment methods does Charles Schwab support for deposits?

One of the reasons I continue using Charles Schwab is the variety of methods available for depositing funds. Schwab supports electronic funds transfers (EFT), which allow me to quickly transfer money from my bank account to Schwab. I also appreciate that Schwab accepts wire transfers and checks for deposits, giving me flexibility depending on my situation. I’ve personally used EFT for deposits, and it’s always been a smooth and fast process. Additionally, Schwab allows direct deposit, which is a great feature if I want to automate my contributions. Having the ability to easily deposit funds into my Schwab account ensures that I can invest whenever I want without worrying about the logistics of funding my account. Schwab’s deposit methods are reliable and easy to use, which is why I’ve never encountered any issues when adding funds to my account.

Can I know the details about Charles Schwab's fees?

One of the things I value about Charles Schwab is their transparency regarding fees. As a regular user of their services, I was relieved to discover that they offer commission-free trading for most online stocks, ETFs, and options. This was particularly appealing to me as an active trader, because avoiding commissions means I can keep more of my investment returns. However, I did notice that for options trades, Schwab charges a $0.65 fee per contract, which is fairly typical across the industry. I also encountered some mutual fund transaction fees, particularly for those outside Schwab's OneSource® program, which can go up to $74.95 per trade. Despite these exceptions, I find Schwab’s overall fee structure to be highly competitive. Additionally, Schwab does not charge account maintenance or inactivity fees, and the Charles Schwab minimum deposit requirement for most accounts is $0, which makes it very accessible. I also appreciate that Schwab provides detailed information on all fees upfront, so there are no surprises. I was able to easily find all the pricing details on their website, which helped me make an informed decision. The absence of hidden fees and the simplicity of their pricing structure makes Schwab an appealing option for me. Overall, I feel that Schwab’s fees are reasonable for the value it provides, and I haven’t encountered any unexpected charges.

Avis des utilisateurs6

Ce que vous souhaitez évaluer

Veuillez saisir...

Commentaire 6

TOP

TOP

Chrome

Extension chromée

Enquête réglementaire sur les courtiers Forex du monde entier

Parcourez les sites Web des courtiers forex et identifiez avec précision les courtiers légitimes et frauduleux

Installer immédiatement

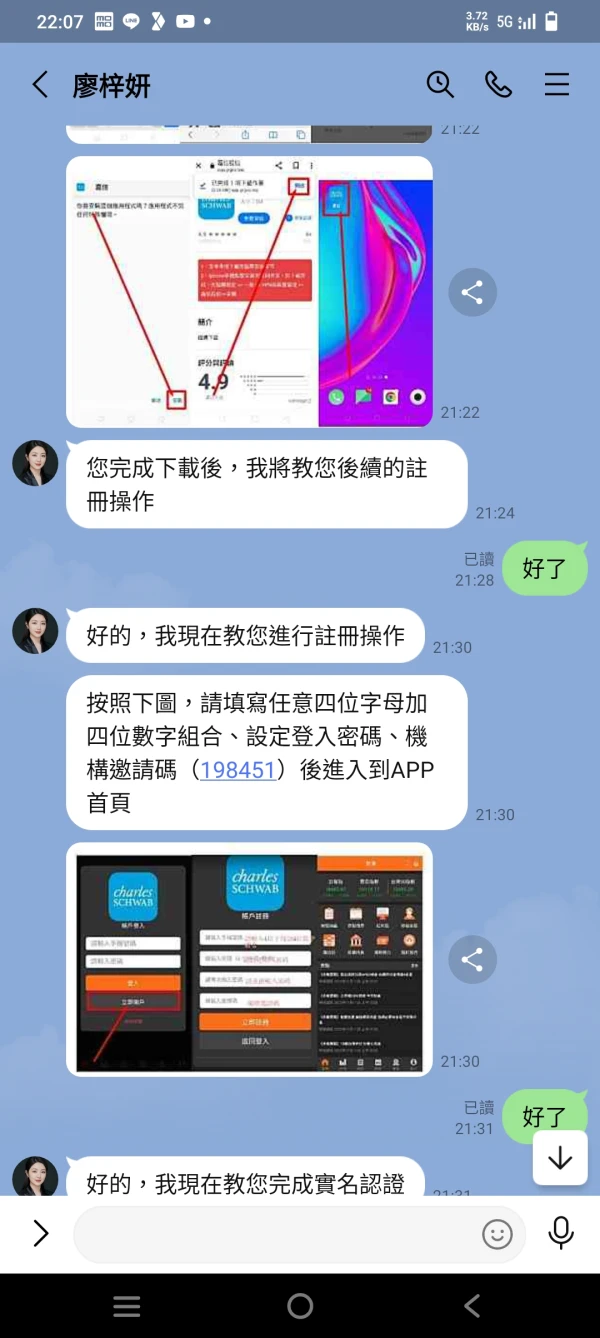

王爺爺

Taïwan

Ce Securities Investment Trust utilise exactement la même méthode que HSBC. Il vous donnera d'abord 20 000 yuans par loterie, puis vous demandera d'investir 100 000 yuans. Les investisseurs étrangers augmentent leurs investissements de 150 000 en 3 jours. Même avec votre principal, vous en avez 270 000, qui peuvent suivre l'opération. Les gains de ces 3 jours vous appartiennent. Au bout de 3 jours, vous investirez intégralement 170 000, ne laissant que votre capital et 3 jours de bénéfices d'exploitation. Vous serez autorisé à retirer un petit montant dans un premier temps, puis progressivement aucun retrait ne sera autorisé. Enfin, ils règlent avec vous et vous demandent d’abord de verser la moitié des bénéfices, puis ils vous remettent le principal et les bénéfices. Ce qui précède est cette nouvelle méthode d’arnaque. J'espère que personne ne sera trompé comme moi.

Divulgation

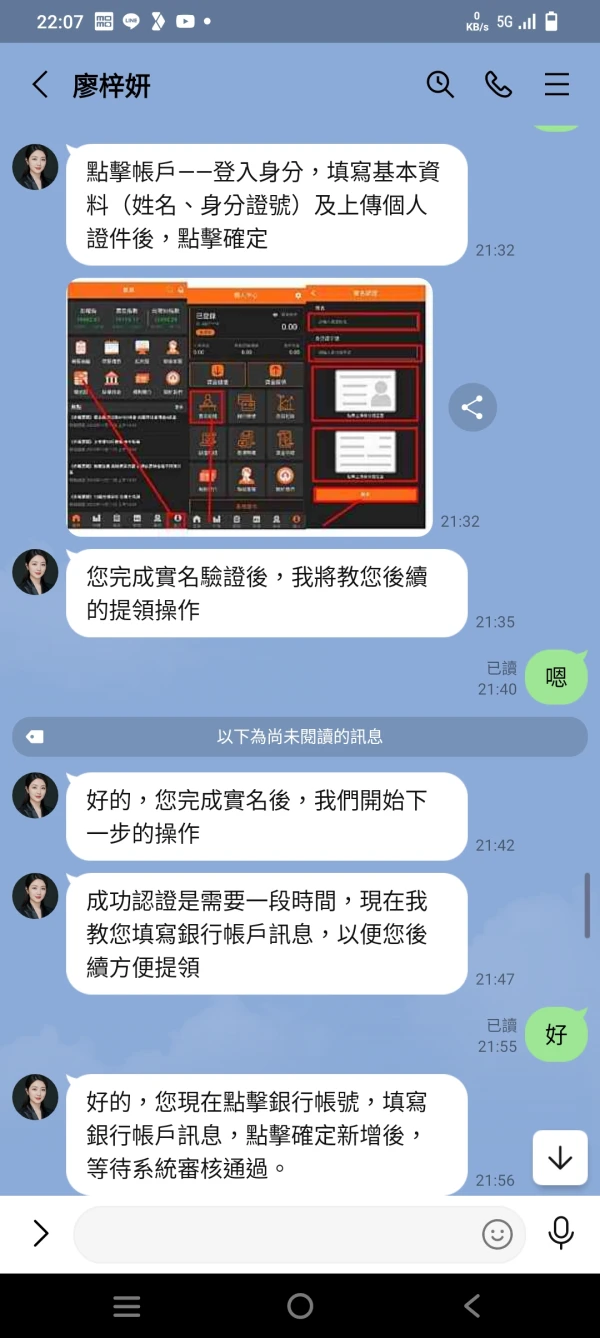

kang Rona

L'Indonésie

Quelqu'un peut-il m'aider concernant le retrait de fonds ? Je crains qu'il y ait une fraude... et beaucoup d'argent a été investi... par CE. Je dois payer 15 % d'impôt sur la valeur du retrait...

Divulgation

Gerhard Van Wyk

Afrique du Sud

J'ai rejoint le 4 mai. chaque fois qu'ils demandent des frais et chaque fois qu'ils mentent sur le paiement. Ils sont très habiles avec les mots.

Divulgation

Đỗ Văn Ngọc

Australie

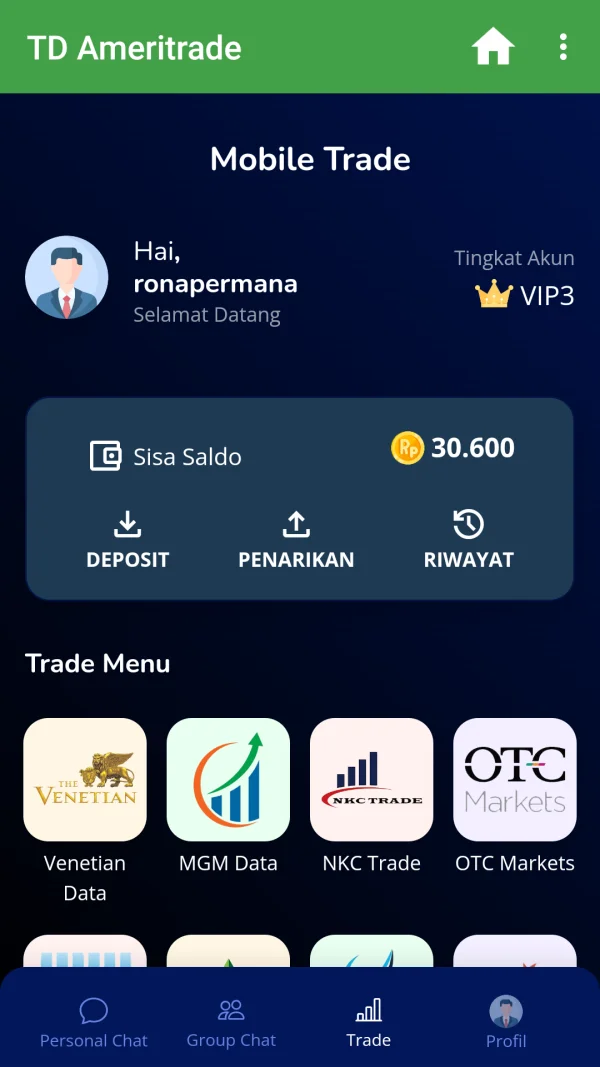

Le site Web de TD Ameritrade a l'air très professionnel, mais j'ai cherché sur tout le site Web et je n'ai trouvé aucune information sur les licences réglementaires. Si une entreprise est strictement réglementée, elle doit le dire haut et fort pour gagner la confiance des clients, non ?

Positifs

♔

Hong Kong

Il en coûte 25 000 $ pour ouvrir un compte chez TD Ameritrade... Pour être honnête, le seuil est un peu élevé pour moi ! Je n'envisage donc pas d'échanger avec lui pour le moment. Il se trouve que je peux attendre et revoir pour voir comment se porte cette entreprise.

Neutre

墨香

L'Argentine

En fait, j'aime l'expérience de trading avec TD A. Je négocie le forex depuis près de deux ans maintenant, mais pas de manière continue ni intensive, car je ne peux pas dire que j'ai beaucoup d'expérience, mais les conditions et les services de TDA ont été satisfaisant pour moi. Je ne comprends pas pourquoi ici wikifx dit que ce n'est pas réglementé, car je peux toujours me retirer normalement.

Positifs