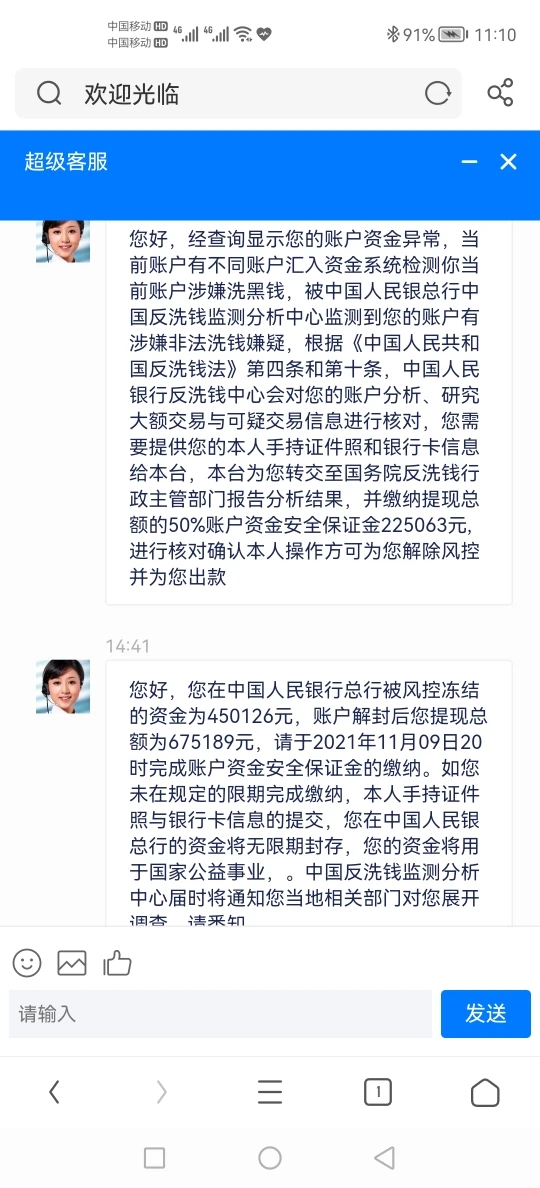

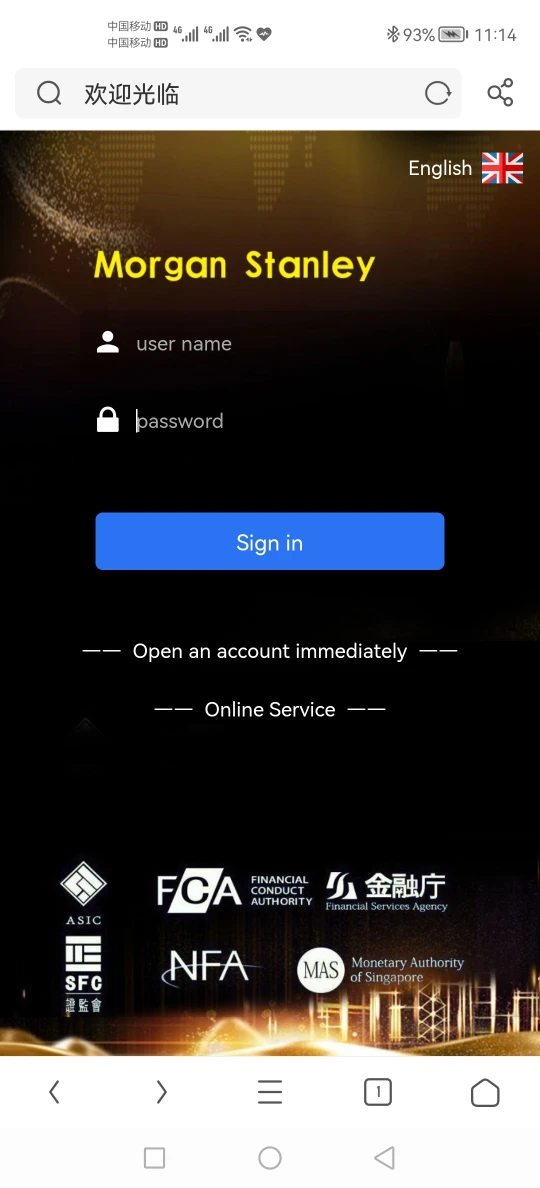

Buod ng kumpanya

| Morgan Stanley Buod ng Pagsusuri | |

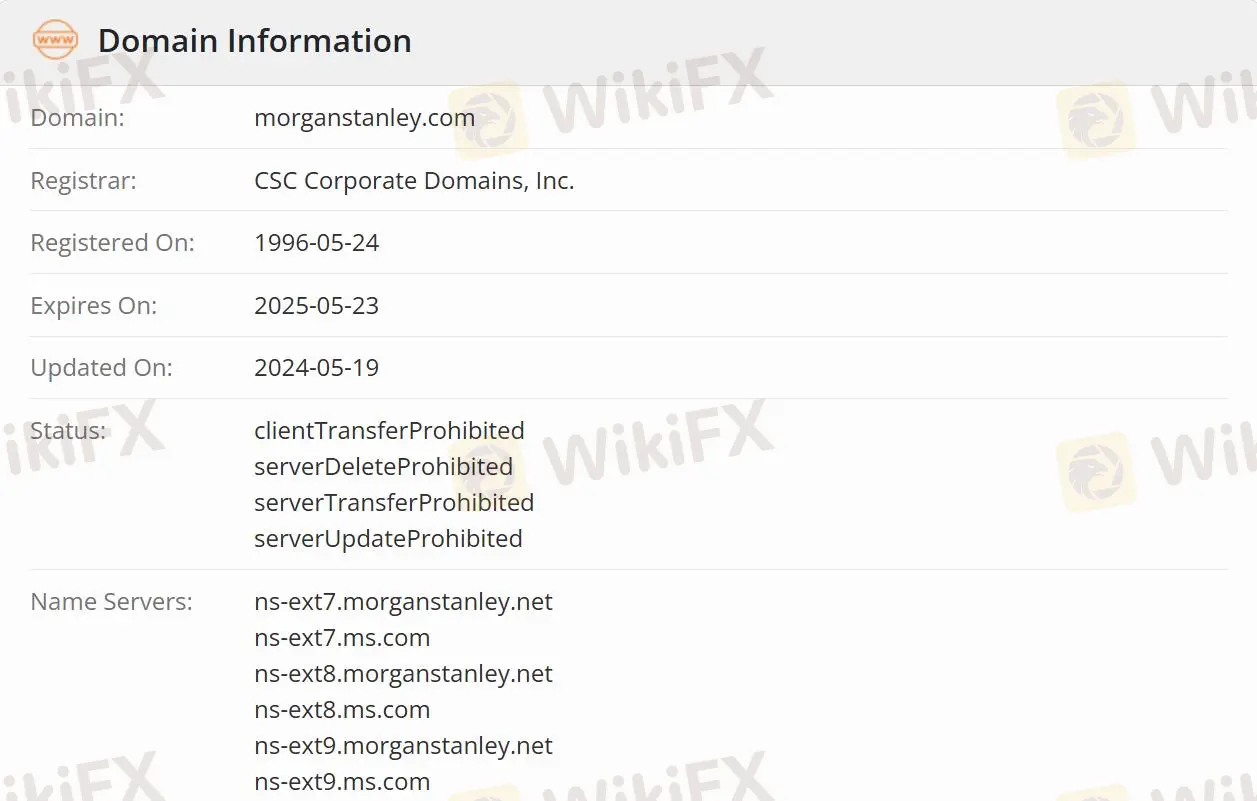

| Itinatag | 1996-05-24 |

| Rehistradong Bansa/Rehiyon | Estados Unidos |

| Regulasyon | Regulado |

| Mga Serbisyo | Pangangasiwa ng Kayamanan, Investment Banking & Capital Markets, Sales & Trading, Pananaliksik, Pamamahala ng Pamumuhunan, Morgan Stanley sa Trabaho, Sustainable Investing, at Inclusive Ventures Group |

| Suporta sa Customer | Social Media: LinkedIn, Instagram, Twitter, Facebook, YouTube |

Totoo ba ang Morgan Stanley?

Ang Morgan Stanley ay awtorisado at regulado ng Canadian Investment Regulatory Organization (CIRO), kaya mas ligtas ito kaysa sa mga reguladong broker. Ngunit hindi maaaring maiwasan ang mga panganib nang lubusan.

Ano ang ginagawa ng Morgan Stanley?

Ang trabaho ng kumpanya ay mayroong 8 pangunahing aspeto kabilang ang pangangasiwa ng kayamanan, investment banking & capital markets, sales & trading, pananaliksik, pamamahala ng pamumuhunan, Morgan Stanley sa trabaho, sustainable investing, at inclusive ventures group.

Pangangasiwa ng Kayamanan: Tumutulong sa mga tao, negosyo, at institusyon na magtayo, pangalagaan, at pamahalaan ang kayamanan.

Investment Banking & Capital Markets: Eksperto sa pagsusuri ng merkado at serbisyong pangpayo at pangangalakal ng kapital para sa mga korporasyon, institusyon, at pamahalaan.

Sales & Trading: Morgan Stanley para sa mga serbisyong pangbenta, pangangalakal, at paggawa ng merkado.

Pananaliksik: Nag-aalok ng pagsusuri ng mga kumpanya, sektor, merkado, at ekonomiya, na tumutulong sa mga kliyente sa kanilang mga desisyon.

Pamamahala ng Pamumuhunan: Nagbibigay ng mga estratehiya sa pamumuhunan sa iba't ibang uri ng mga asset, sa pampubliko at pribadong merkado.

Morgan Stanley sa Trabaho: Nagbibigay ng mga solusyon sa pinansyal sa lugar ng trabaho para sa mga organisasyon at kanilang mga empleyado, na pinagsasama ang payo.

Sustainable Investing: Nag-aalok ng mga sustainable na produkto sa pamumuhunan, nagtataguyod ng mga makabagong solusyon, at nagbibigay ng mga actionable na pananaw sa mga isyu ng pagiging sustainable.

Mga Pagpipilian sa Suporta sa Customer

Maaaring sundan ng mga trader ang Morgan Stanley sa iba't ibang social media, kabilang ang LinkedIn, Instagram, Twitter, Facebook, at YouTube.

| Mga Pagpipilian sa Pakikipag-ugnayan | Mga Detalye |

| Social Media | LinkedIn, Instagram, Twitter, Facebook, YouTube |

| Supported Language | Ingles |

| Website Language | Ingles |

| Physical Address | Morgan Stanley 1585 Broadway New York, NY 10036 |