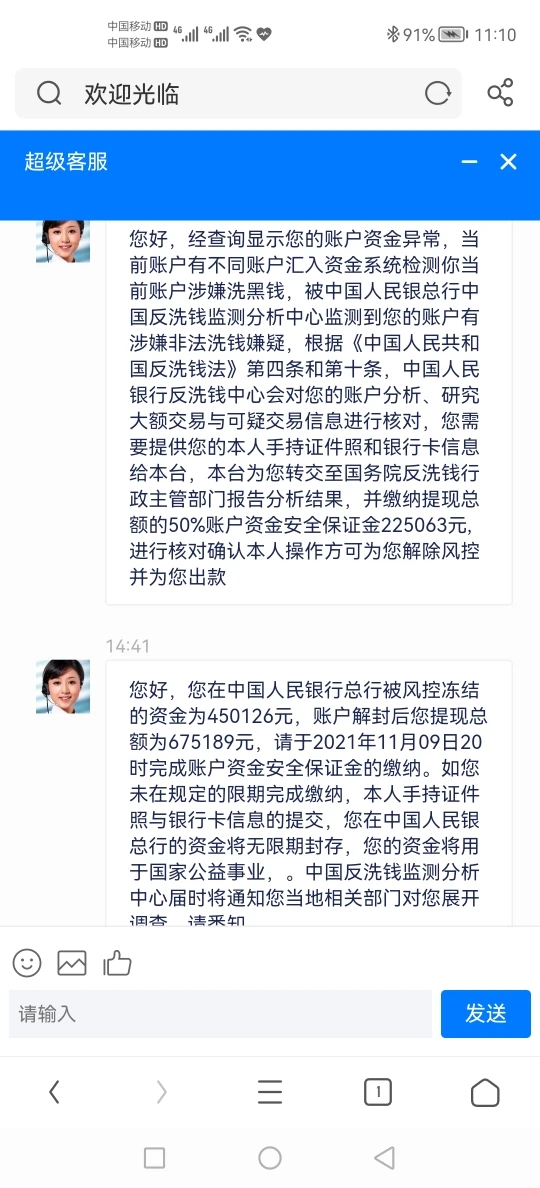

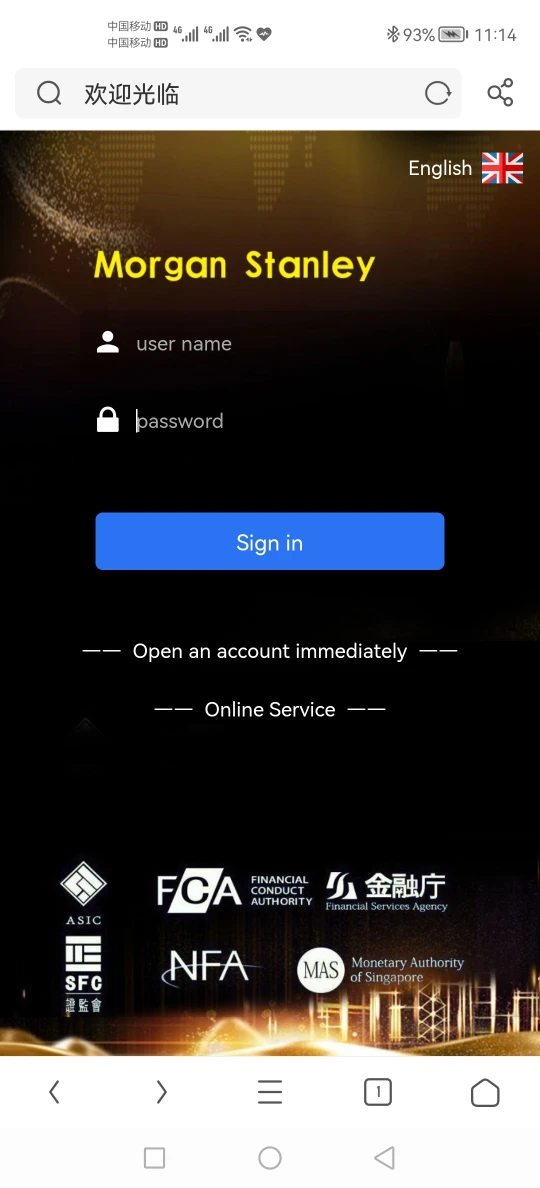

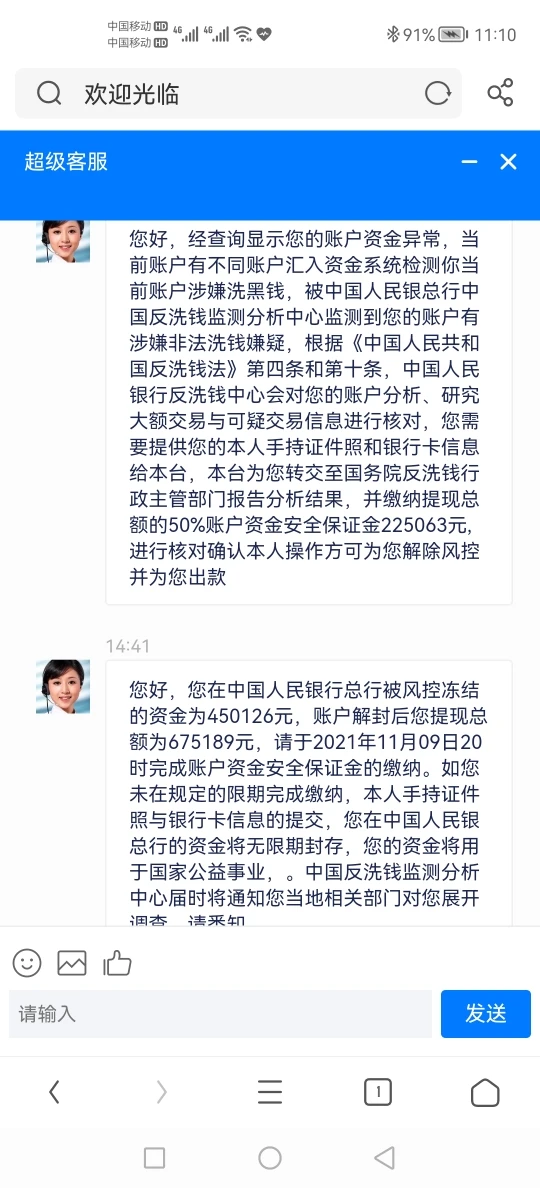

Company Summary

| Morgan StanleyReview Summary | |

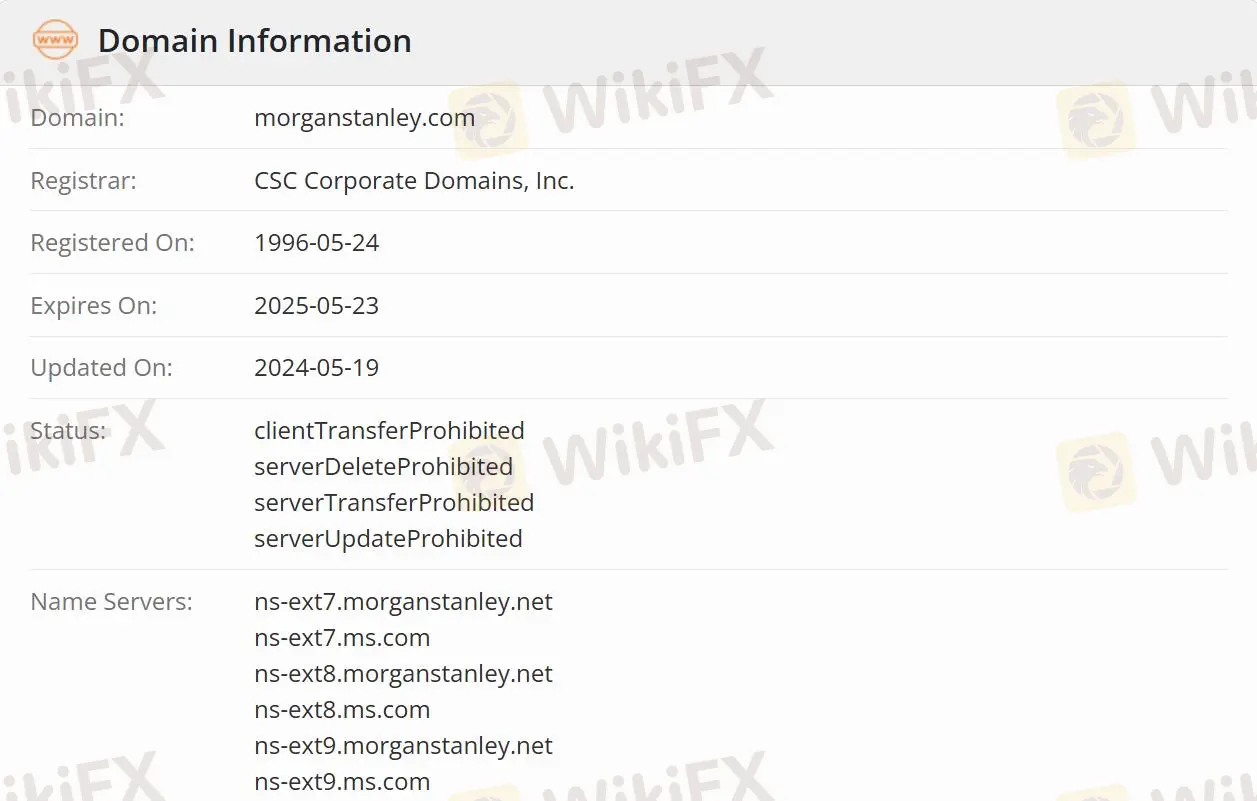

| Founded | 1996-05-24 |

| Registered Country/Region | United States |

| Regulation | Regulated |

| Services | Wealth Management, Investment Banking & Capital Markets, Sales & Trading, Research, Investment Management, Morgan Stanley at Work, Sustainable Investing, and Inclusive Ventures Group |

| Customer Support | Social Media: LinkedIn, Instagram, Twitter, Facebook, YouTube |

Morgan Stanley Information

Morgan Stanley is a broker that helps individuals, families, institutions & governments raise, manage & distribute capital.

Is Morgan Stanley Legit?

Morgan Stanley is authorized and regulated by the Canadian Investment Regulatory Organization(CIRO), making it safer than regulated brokers. But risks cannot be completely avoided.

What does Morgan Stanley do?

The company's work involves 8 major aspects including wealth management, investment banking & capital markets, sales & trading, research, investment management, Morgan Stanley at work, sustainable investing, and inclusive ventures group.

Wealth Management: Help people, businesses and institutions build, preserve and manage wealth.

Investment Banking & Capital Markets: Expertise in market analysis and advisory and capital-raising services for corporations, institutions and governments.

Sales & Trading: Morgan Stanley for sales, trading and market-making services.

Research: Offer analysis of companies, sectors, markets, and economies, helping clients with their decisions.

Investment Management: Provide investment strategies across various asset classes, in public and private markets.

Morgan Stanley at Work: Provide workplace financial solutions for organizations and their employees, combining advice.

Sustainable Investing: Offer sustainable investment products, foster innovative solutions, and provide actionable insights across sustainability issues.

Customer Support Options

Traders can follow Morgan Stanley on various social media, including LinkedIn, Instagram, Twitter, Facebook, and YouTube.

| Contact Options | Details |

| Social Media | LinkedIn, Instagram, Twitter, Facebook, YouTube |

| Supported Language | English |

| Website Language | English |

| Physical Address | Morgan Stanley 1585 Broadway New York, NY 10036 |