Perfil de la compañía

| Banca Akros Resumen de la reseña | |

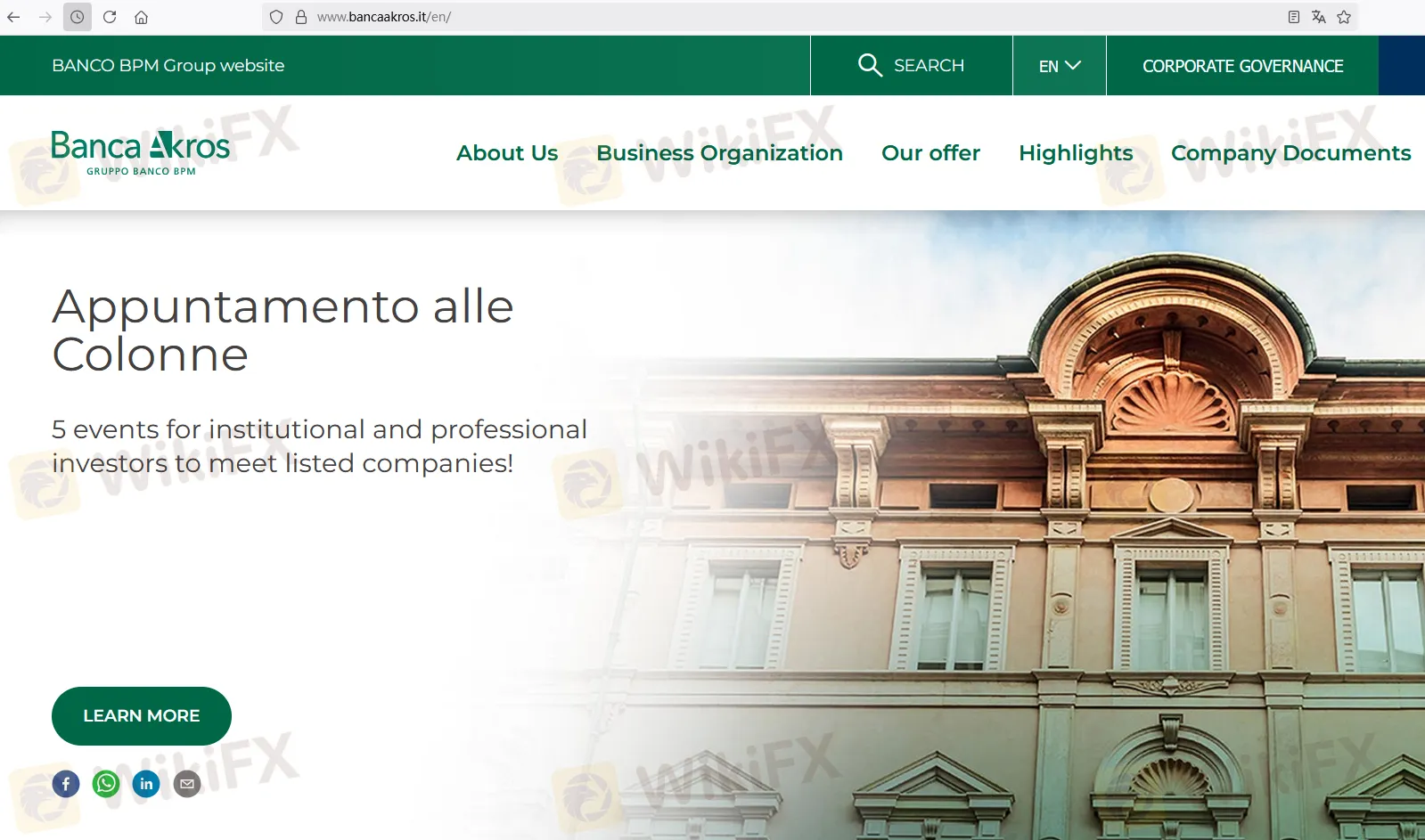

| Fundación | 1997 |

| País/Región Registrada | Italia |

| Regulación | Sin regulación |

| Productos | Renta fija, Acciones, Forex, Materias primas |

| Cuenta Demo | / |

| Apalancamiento | / |

| Spread | / |

| Plataforma de Trading | / |

| Depósito Mínimo | / |

| Soporte al Cliente | Teléfono: +39 02.43444.1 |

| Dirección: Viale Eginardo, n. 29 20149 Milán - Italia | |

Información de Banca Akros

Banca Akros es una empresa de servicios financieros italiana fundada en 1997. Sus principales áreas de negocio incluyen Renta fija, Banca de inversión, Acciones, Investigación, Soluciones para clientes, Forex, Materias primas, Bancos y productos de inversión, y Banca corporativa e institucional. Sin embargo, Banca Akros no tiene regulaciones actualmente.

Pros y Contras

| Pros | Contras |

| Larga historia operativa en Italia | Sin regulación |

| Negocio diversificado | Estructura de tarifas poco clara |

| Sin información sobre depósitos y retiros |

¿Es Banca Akros Legítimo?

No. Banca Akros no tiene regulaciones actualmente. ¡Por favor, tenga en cuenta el riesgo!

Productos

| Productos | Soportados |

| Renta fija | ✔ |

| Acciones | ✔ |

| Forex | ✔ |

| Materias primas | ✔ |

| Índices | ❌ |

| Criptomonedas | ❌ |

| Bonos | ❌ |

| Opciones | ❌ |

| ETFs | ❌ |