简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Eightcap Detailed Analysis

Abstract:This report is structured to provide readers with actionable insights across multiple dimensions of broker performance. You will find detailed breakdowns of user sentiment analysis, specific strengths and weaknesses identified through review patterns, comparative performance metrics, and practical considerations for potential clients. The analysis distinguishes between isolated incidents and systemic issues, offering context that raw ratings alone cannot provide.

In the increasingly complex landscape of online forex and CFD trading, selecting a reliable broker requires more than reviewing marketing materials and promotional offers. This comprehensive analysis of EightCap provides traders and investors with an objective, data-driven assessment based on actual user experiences across multiple review platforms.

Our analytical methodology centers on aggregating and examining authentic user feedback from diverse sources to deliver an unbiased evaluation of EightCap's services. For this report, we have systematically analyzed 223 verified reviews collected from multiple independent review platforms, referred to throughout this document as Platform A, Platform B, and Platform C to maintain analytical objectivity. This multi-source approach ensures a balanced perspective that captures the full spectrum of client experiences, from retail traders to more experienced market participants.

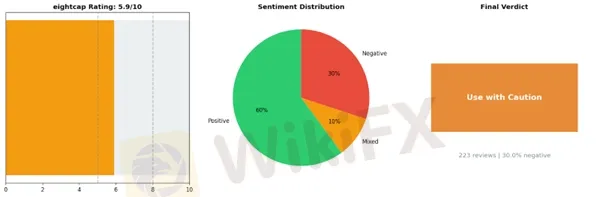

The analysis employs a quantitative scoring system that evaluates key performance indicators including platform reliability, customer service quality, execution speed, fee transparency, withdrawal processes, and overall user satisfaction. Each review has been weighted and categorized to identify patterns, recurring issues, and consistent strengths. The resulting overall rating of 5.90 out of 10, combined with a negative sentiment rate of 30.04%, has led to our system conclusion of “Use with Caution” for EightCap.

This report is structured to provide readers with actionable insights across multiple dimensions of broker performance. You will find detailed breakdowns of user sentiment analysis, specific strengths and weaknesses identified through review patterns, comparative performance metrics, and practical considerations for potential clients. The analysis distinguishes between isolated incidents and systemic issues, offering context that raw ratings alone cannot provide.

Whether you are considering opening an account with EightCap or evaluating your current broker relationship, this report delivers the evidence-based analysis necessary for informed decision-making. Our objective is not to advocate for or against any particular broker, but rather to present comprehensive data that empowers traders to make choices aligned with their individual risk tolerance, trading style, and service expectations. The following sections present our findings with full transparency regarding both positive attributes and areas of concern identified through our review analysis.

Key Issues Requiring Caution with Eightcap

Based on comprehensive user feedback analysis, several concerning patterns have emerged regarding eightcap that warrant careful consideration before opening an account. While the broker maintains regulatory standing, the concentration of complaints around specific operational areas suggests systemic issues that traders should evaluate thoroughly.

Withdrawal Processing and Documentation Requirements

The most significant concern involves withdrawal procedures, with 33 documented cases of delays and rejections. Multiple clients report excessive documentation requests that create substantial processing delays. One particularly troubling pattern involves repeated requests for identical banking information:

“💬 Consumer (CA): ”I am asked to send my bank statements every single time I withdraw from my account. I respond saying it's the same information every time and I don't need the added security for each transaction. Occasionally I understand but every single time I withdraw is such a nuisance. It delays my withdrawal by an addition 7-10 days.“”

This systematic approach to withdrawal verification, while potentially justified under anti-money laundering protocols, appears disproportionate when applied to established clients making routine withdrawals. The 7-10 day delays mentioned repeatedly could pose serious liquidity risks for traders requiring timely access to their capital.

Customer Support Responsiveness and Expertise

With 35 complaints categorized under inadequate support, eightcap demonstrates a troubling gap between client needs and service delivery. The issues extend beyond response times to fundamental knowledge deficiencies among account managers. Traders report that sales representatives fail to address technical inquiries about API functionality and trading signals:

“💬 Graeme Legg (NZ): ”I disliked that the only thing I twice explicitly expressed wanting information about (i.e. api indicators, signals, etc.) when first contacted by an eightcap sales account manager was not addressed in their lip service follow up email.“”

For algorithmic traders and those requiring sophisticated technical support, this knowledge gap represents a material operational risk. The inability to obtain clear answers about platform capabilities could lead to costly misunderstandings and implementation failures.

Fee Transparency and Unexpected Deductions

Eight documented cases highlight concerns about undisclosed charges and unexplained deductions. Clients report significant discrepancies between withdrawal amounts requested and funds received, with some alleging losses of 20% or more. Additionally, promotional terms appear inconsistently applied:

“💬 Customer (DE): ”I deposited $510 and I requested for this credit bonus. Unfortunately, their account manager responsible to my trading account said 'Following a review of your account, we must unfortunately advise that as your account was referred via an Eightcap partner, it [is not eligible].'“”

The rejection of advertised bonuses after deposit, combined with reports of unexplained fee deductions, suggests potential gaps in terms disclosure or inconsistent policy application.

Fund Security Considerations

Twenty complaints raise fundamental questions about fund safety, including concerns about imposter websites and unauthorized deductions. While some cases may involve fraudulent clone sites rather than the legitimate eightcap platform, the existence of such scams targeting the broker's brand creates additional due diligence requirements for prospective clients.

Risk Assessment by Trader Profile

Active traders requiring frequent withdrawals face the highest risk due to documented processing delays. Algorithmic traders should exercise particular caution given reported support knowledge gaps. Small-account holders may find the documentation burden disproportionate to their trading volume, while those relying on promotional incentives should obtain written confirmation of eligibility before depositing.

The concentration of these issues across multiple complaint categories—representing over 100 documented cases—suggests these are not isolated incidents but rather patterns requiring serious consideration before committing capital to this platform.

Positive Aspects of Eightcap That Warrant Careful Consideration

Eightcap has garnered notable praise from its user base, particularly in areas that matter most to active forex traders. The feedback reveals several strengths worth examining, though prospective clients should approach any broker selection with due diligence.

Customer Support Excellence

The most frequently cited positive aspect involves eightcap's customer support infrastructure, with 83 mentions highlighting responsiveness and professionalism. Traders consistently report that support staff demonstrate both accessibility and technical knowledge, which can prove invaluable during critical trading moments.

“💬 Mauricio Tepedino: ”Special thanks to my new agent Johnny, who is absolutely fantastic! Always attentive, professional, and supportive in every detail.“”

This personalized service approach appears particularly beneficial for traders who value ongoing relationships with their account representatives. However, potential clients should verify that support quality remains consistent across different account tiers and geographic regions, as experiences can vary.

Platform Reliability and Reputation

With 43 reviews emphasizing safety and reputation, eightcap appears to have established credibility among long-term users. Traders mention consistent platform performance even during high-volatility periods, which addresses a common pain point in forex trading where execution quality often deteriorates during market stress.

“💬 Richard Lawrie: ”Their platform performance and trade execution are excellent, fast, reliable, and consistent even during high-volatility periods.“”

The competitive spreads and diverse instrument selection—spanning forex, indices, and crypto CFDs—suggest eightcap caters effectively to traders seeking portfolio diversification within a single platform. Nevertheless, traders should independently verify current spread offerings and compare them against their specific trading strategies, as competitive conditions fluctuate across market conditions.

User Experience Design

Twenty-eight reviews highlighting interface usability indicate that eightcap has invested in platform accessibility. The emphasis on transparency and smooth onboarding processes suggests the broker accommodates both experienced traders and those developing their skills.

Cautionary Considerations

While these positive aspects reflect genuine user experiences, several factors warrant careful evaluation. First, the concentration of reviews from specific geographic locations (Brazil, South Africa) may not represent the global service experience. Second, long-term client satisfaction, while encouraging, doesn't guarantee future performance or regulatory consistency across all jurisdictions.

Prospective traders should independently verify eightcap's regulatory status in their specific region, test platform performance with a demo account, and thoroughly review fee structures beyond spreads—including withdrawal fees, inactivity charges, and overnight financing costs. The positive feedback regarding customer support and platform reliability provides a foundation for consideration, but individual trading needs and risk tolerance should ultimately guide broker selection decisions.

eightcap: Strengths vs Issues

Top Strengths:

1. Responsive Customer Support — 83 mentions

2. Good Reputation Safe — 43 mentions

3. User Friendly Interface — 28 mentions

Top Issues:

1. Slow Support No Solutions — 35 mentions

2. Withdrawal Delays Rejection — 33 mentions

3. Fund Safety Issues — 20 mentions

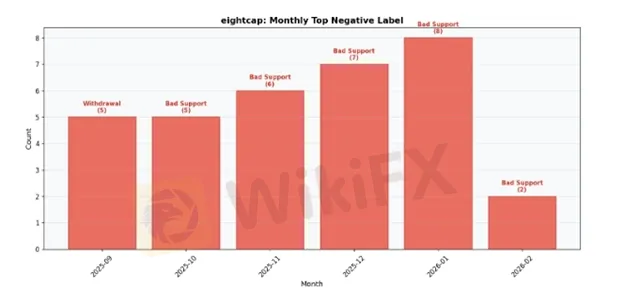

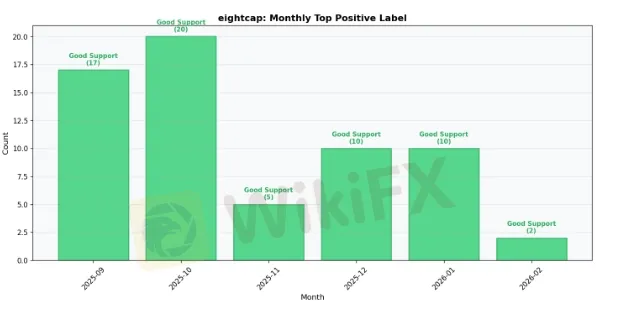

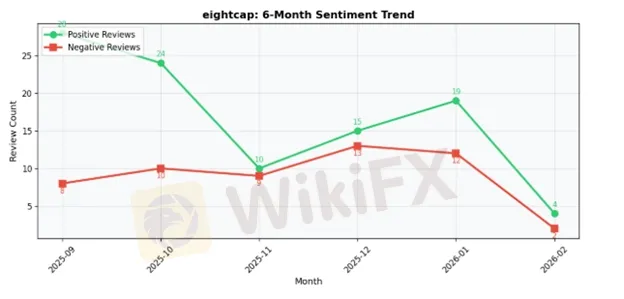

eightcap: 6-Month Review Trend Data

2025-09:

• Total Reviews: 38

• Positive: 28 | Negative: 8

• Top Positive Label: Responsive Customer Support

• Top Negative Label: Withdrawal Delays Rejection

2025-10:

• Total Reviews: 37

• Positive: 24 | Negative: 10

• Top Positive Label: Responsive Customer Support

• Top Negative Label: Slow Support No Solutions

2025-11:

• Total Reviews: 22

• Positive: 10 | Negative: 9

• Top Positive Label: Responsive Customer Support

• Top Negative Label: Slow Support No Solutions

2025-12:

• Total Reviews: 32

• Positive: 15 | Negative: 13

• Top Positive Label: Responsive Customer Support

• Top Negative Label: Slow Support No Solutions

2026-01:

• Total Reviews: 35

• Positive: 19 | Negative: 12

• Top Positive Label: Responsive Customer Support

• Top Negative Label: Slow Support No Solutions

2026-02:

• Total Reviews: 6

• Positive: 4 | Negative: 2

• Top Positive Label: Responsive Customer Support

• Top Negative Label: Slow Support No Solutions

eightcap Final Conclusion

Eightcap presents a mixed performance profile that warrants careful consideration before committing significant capital. With a final rating of 5.90/10 and a concerning negative review rate of 30.04% across 223 trader evaluations, this broker demonstrates both commendable strengths and notable weaknesses that potential clients must weigh carefully.

The broker's primary advantages center around responsive customer support, a solid industry reputation for safety, and an intuitive user interface that facilitates smooth platform navigation. These elements suggest eightcap has invested in creating a professional trading environment with adequate regulatory oversight. The positive feedback regarding customer service responsiveness indicates the broker maintains accessible support channels, which is crucial for traders requiring timely assistance.

However, significant concerns emerge from the negative feedback patterns. The most troubling issues involve withdrawal delays and rejections, fund safety concerns, and instances where support teams fail to provide effective solutions despite being responsive. These problems directly impact the most critical aspect of any broker relationship: the ability to access your own capital reliably. When nearly one-third of reviewers report negative experiences, particularly around withdrawal processes, this cannot be dismissed as isolated incidents.

For beginner traders, eightcap's user-friendly interface offers an accessible entry point, but the withdrawal issues present unacceptable risks when you're still learning to navigate forex markets. New traders should consider brokers with more consistent operational track records until they develop the experience to recognize and address potential problems.

Experienced traders may find eightcap suitable for testing strategies with limited capital, but should maintain primary accounts elsewhere. The platform's usability combined with responsive support could serve secondary trading needs, provided you never deposit more than you can afford to have temporarily inaccessible.

High-volume traders should approach eightcap with particular caution. Withdrawal delays and fund access issues become exponentially more problematic when dealing with substantial capital. The 30% negative rate suggests too much operational inconsistency for professional-scale trading operations.

For scalpers and day traders, platform responsiveness appears adequate based on the user interface praise, but withdrawal reliability concerns make eightcap questionable for strategies requiring frequent capital movements. Swing traders and position traders face similar withdrawal concerns, though less frequent transactions may reduce exposure to these issues.

Critical caveats apply: Never deposit funds you cannot afford to have delayed. Maintain meticulous records of all transactions and communications. Start with minimal deposits to personally verify withdrawal processes before scaling up. Consider eightcap as a supplementary broker rather than your primary trading partner. Eightcap operates in that uncomfortable middle ground—good enough to function, but problematic enough to create genuine concern about capital security and operational reliability.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

WikiFX Broker

Latest News

Capital.com Review: Is Your Money Locked Inside this Broker?

AssetsFX Regulation: A Complete Guide to Licenses and Trading Risks

Grand Capital Review 2026: Is this Broker Safe?

MultiBank Group Review: A Regulatory Titan or a Master of Liquidation?

ZarVista User Reputation: Looking at Real User Reviews to Check if It's Trustworthy

ZaraVista Legitimacy Check: Addressing Fears: Is This a Fake Broker or a Legitimate Trading Partner?

Pinnacle Pips Forex Fraud Exposed

S. Africa Energy Gridlock: Glencore Proposal Stalls Amid Regulatory Clash

TP Trader Academy ‘The Axis Event’: Pioneering Trading Education at the Heart of Tech and Data

XSpot Wealth Exposure: Traders Report Withdrawal Denials & Constant Deposit Pressure

Currency Calculator