简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

MultiBank Group Review: A Regulatory Titan or a Master of Liquidation?

Abstract:MultiBank Group is a regulatory paradox, flaunting major licenses while accumulating over 600 complaints of withdrawal denials and system manipulation. The data suggests a 'hotel california' model where capital enters with ease but exits only in your dreams.

The financial markets are littered with the corpses of retail traders who mistook “heavy regulation” for “safety.” The MultiBank Group review reveals a disturbing disconnect between their impressive list of licenses and the reality of 617 complaints filed within the last 90 days. This isn't just a ripple; it is a tidal wave of investor dissatisfaction that spans from withdrawal freezes to outright accusations of system manipulation.

MultiBank Group Regulation: A Shield or a Smoke Screen?

On paper, the MultiBank Group regulation status looks bulletproof. They operate across multiple jurisdictions, holding licenses from Tier-1 regulators like ASIC and MAS. However, the WikiFX audit reveals a darker side: multiple “Unverified” and “Offshore” statuses that offer little to no protection when things go south.

| Regulator | License Type | Status |

|---|---|---|

| ASIC (Australia) | Financial Services | Regulated |

| MAS (Singapore) | CMS License | Regulated |

| CIMA (Cayman Islands) | Investment | Offshore |

| FSC (British Virgin Islands) | Investment | Offshore |

| CYSEC (Cyprus) | Financial Services | Regulated |

| CMA (UAE) | Capital Markets | Regulated |

| VFSC (Vanuatu) | Investment | Offshore |

| VFSC (Vanuatu) | Investment | UNVERIFIED |

| FSA (Seychelles) | Investment | UNVERIFIED |

Despite this “global supervision,” the Spanish (CNMV) and French (AMF) regulators have issued explicit warnings, blacklisting certain MultiBank entities for providing unauthorized services. This proves that having a license in Australia doesn't give a broker a free pass to ignore laws in Europe.

The Vanishing Act: A Forex Withdrawal Nightmare

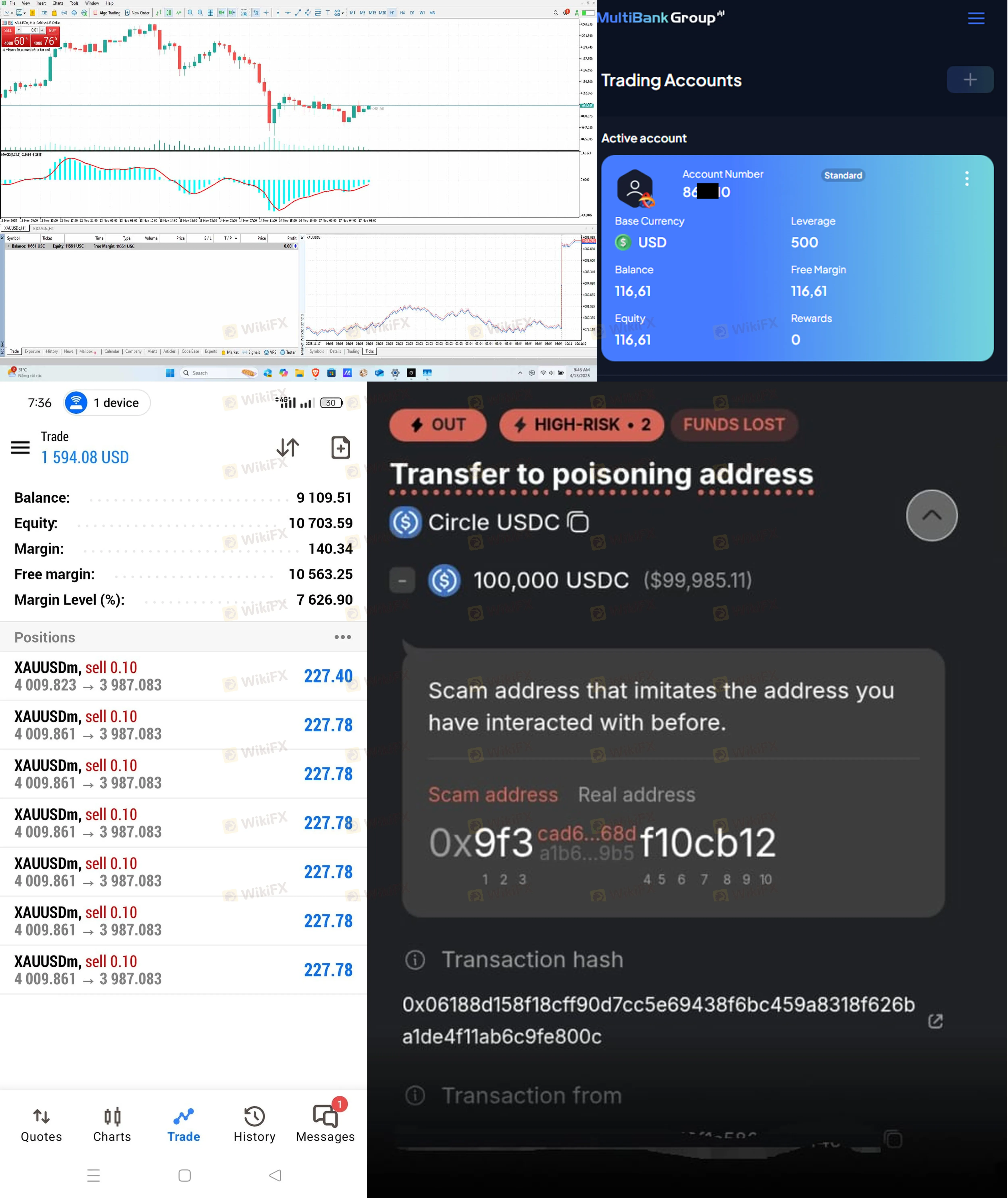

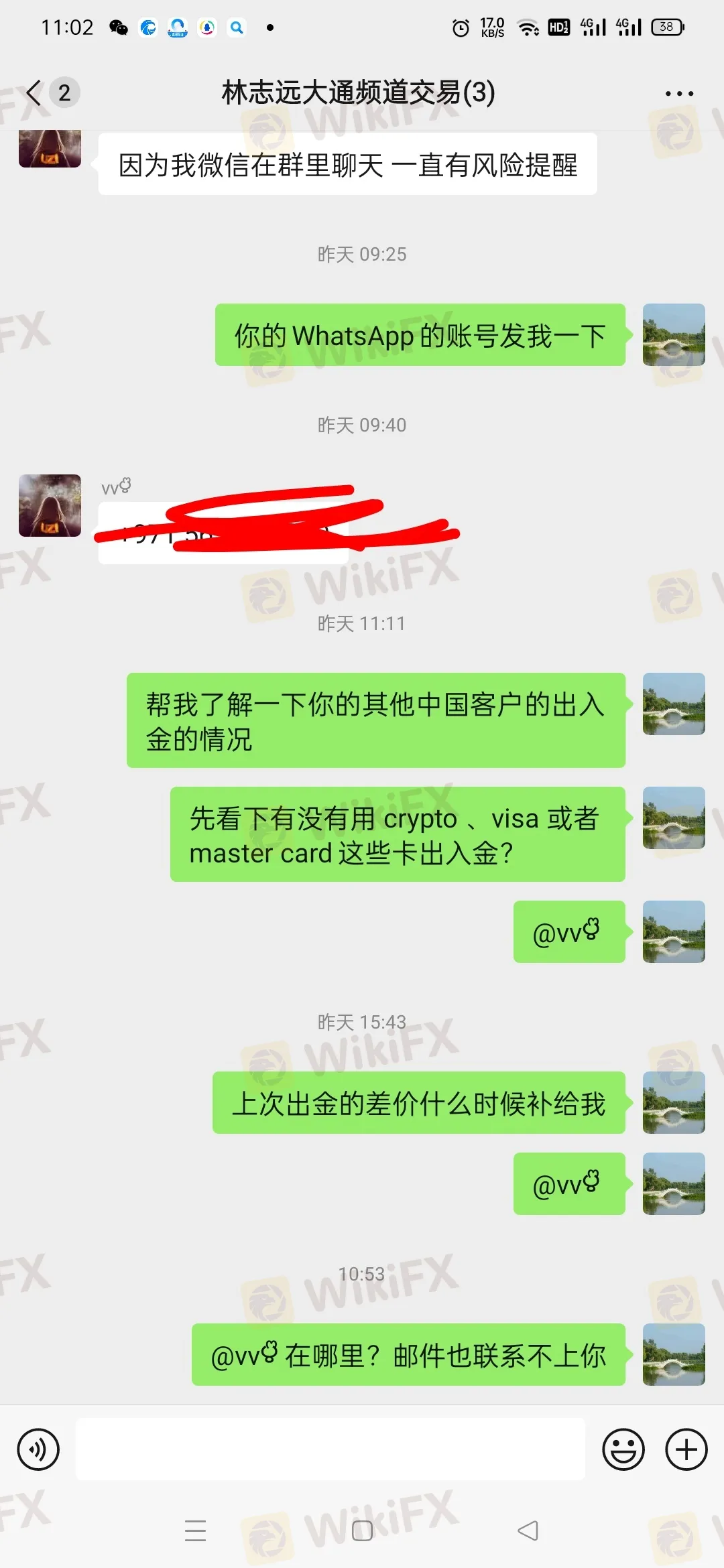

A recurring theme in the recent Forex reports involves the complete inability to withdraw funds. Multiple traders from Vietnam, Indonesia, and China report a sinister pattern: the broker accepts deposits instantly, but withdrawal requests are met with silence, “technical errors,” or bizarre demands for “tax payments.”

Case 4 and 5 highlight a predatory tactic: users who never even traded and simply asked for their deposit back were ignored for 15+ days. Others report that their login access remains active, allowing them to see their profits on a screen, but the funds never actually hit their bank accounts—an “illusory profit” strategy designed to keep the trader engaged until the account is eventually wiped.

Execution Delay and System Ghosting

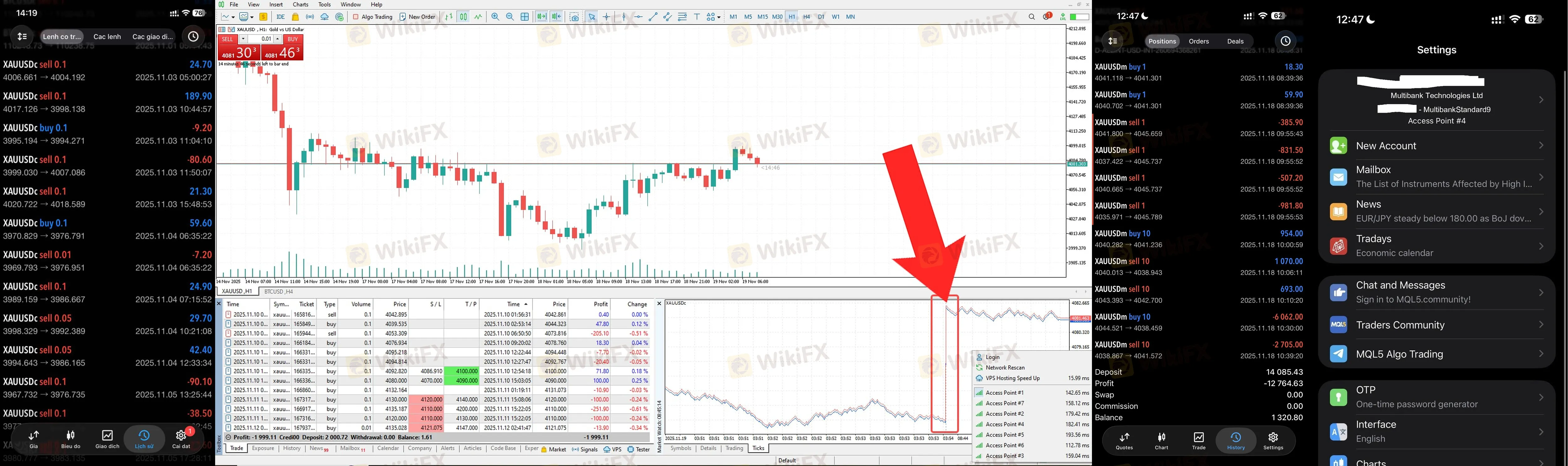

Traders rely on the MultiBank Group broker to provide the “millisecond execution speed” promised in their marketing. Real-world data says otherwise. Case 1 details a 20-second delay in closing a trade, leading to massive slippage. When the trader confronted the “Dealing Desk,” the failure was dismissed as “normal.”

Even more alarming are reports of accounts being “managed” into the ground. Victims claim Relationship Managers (RMs) pressured them to deposit more funds specifically to “hedge” existing losses, only for the entire balance to be liquidated days later.

The Login Warning: Technical “Glitches” as a Tool?

While the platform technically supports MT4 and MT5, Chinese and Southeast Asian traders have reported frequent issues where the login portal or the official website becomes inaccessible for days. In Case 16, a trader reported both the website being down and their account manager going “missing” simultaneously. If you cannot access your login page during a market spike, your capital is essentially at the mercy of the broker's internal dealing desk.

Conclusion: The Truth Behind the 2.54 Rating

With a WikiFX score of 2.54, MultiBank Group is walking a thin line. They leverage their legitimate licenses to lure high-net-worth individuals (with ECN accounts requiring $10,000), while the actual customer support and fund security infrastructure appear to be failing under the weight of 600+ complaints.

Risk Warning: The sheer volume of “Withdrawal Refusal” reports suggests that this Forex entity is currently high-risk. No amount of regulation can compensate for a broker that refuses to return principal capital. Proceed with extreme caution, or better yet, don't proceed at home.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

WikiFX Broker

Latest News

CBN Bolsters Forex Liquidity: Resumes BDC Sales as Reserves Hit $47 Billion

China’s "Deposit Migration" Myth Debunked: A Gradual Shift, Not a Flood

Theos Markets Review 2026: Is this Forex Broker Legit or a Scam?

INVESTIZO Review: Profit Cancellation Claims, Withdrawal Denials & Poor Customer Support

AssetsFX Review : Read This Before You Put Money In it

DeltaFX Broker: No Regulation Exposed

Is Stonefort Legit Company? Understanding the Risks

Mazi Finance Regulatory Status: A Complete Guide to Its Licenses and High-Risk Warnings

Warsh Likes It Hot, And Will Move The Fed's Inflation Target To 2.5-3.5%

datian Review: Examining Slippage and Forced Liquidation Allegations Against the Broker

Currency Calculator