简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

A Promised 12% Return in Days Resulted in a RM335,000 Loss

Abstract:A 51-year-old trader in Pahang has lost more than RM335,000 after falling victim to an online investment scheme that promised a 12% return in just days!

A 51-year-old trader in Pahang has lost more than RM335,000 after falling victim to an online investment scheme that promised swift and generous returns. He first came across this offer through an advertisement on Facebook in November 2024.

According to Pahang police chief Commissioner Datuk Seri Yahaya Othman, the victim was approached shortly after engaging with the advertisement on social media. He was later contacted via WhatsApp by an individual claiming to represent an investment opportunity that guaranteed a 12 per cent return within three to seven days. The proposal appeared straightforward and highly profitable, features that often draw attention in the fast-moving world of online trading.

Encouraged by the prospect of quick gains, the trader began transferring funds in early December. Between 4 December 2025 and 27 January this year, he made 19 separate cash transactions into two different bank accounts. The payments were funded not only by his personal savings but also by money borrowed from friends. In total, the transfers exceeded RM335,000.

During this period, the suspect maintained regular communication with the victim. At one stage, the trader was informed that his investment had generated profits amounting to more than RM2.4 million. The figures, though striking, were presented through digital records that appeared legitimate at first glance.

However, when the victim attempted to withdraw the purported profits, the situation took a sudden turn. He was told that in order to release the funds, he would need to make an additional payment equivalent to 10 per cent of the total profit. This request raised doubts. Faced with mounting demands for further payment, the trader realised that he had likely been deceived.

He lodged a police report at the Kuantan Police Headquarters on 7 February. Authorities have since launched an investigation under Section 420 of the Penal Code for cheating, an offence that carries severe penalties upon conviction.

The case follows a familiar pattern seen in many online investment scams across the region. Fraudsters often promote schemes on social media platforms, promising unusually high returns within a short period. Initial contact is typically made through private messaging services such as WhatsApp, where victims are gradually persuaded to transfer funds. False profit statements are then used to build confidence and encourage larger investments. When victims attempt to withdraw their gains, additional payments are demanded under various pretexts, such as processing fees or taxes.

See these examples here:

Telegram Investment Scam Wiped Out RM91,000 in Days: https://www.wikifx.com/en/newsdetail/202601289834675534.html

In this instance, the promise of a 12 per cent return within days should have raised concerns. In legitimate financial markets, such returns over such a short timeframe are highly improbable and would carry substantial risk. Yet the appeal of fast profits can cloud judgment, even among individuals with trading experience.

Police have reiterated the importance of conducting thorough checks before committing funds to any investment opportunity, particularly those promoted through social media. Investors are urged to verify whether companies are registered with the relevant authorities and to remain cautious of schemes that guarantee fixed, high returns within unusually short periods.

The financial and emotional toll on victims of such scams can be significant. Beyond the immediate monetary loss, individuals often face strained personal relationships and long-term financial hardship, especially when loans are involved.

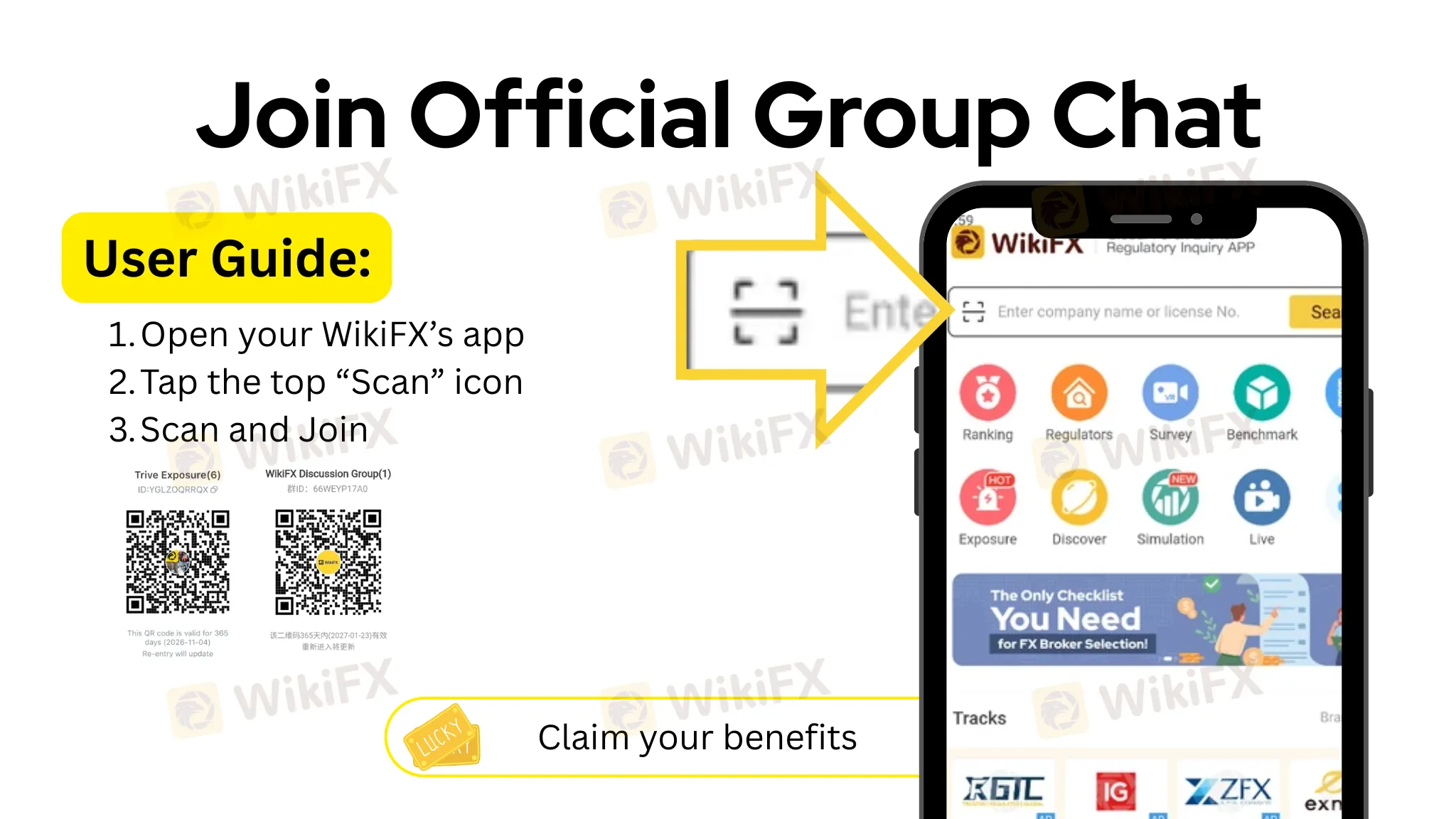

To prevent falling victim to fraudulent schemes like this one, using tools like WikiFX can be a game-changer. WikiFX provides detailed information on brokers, including regulatory status, customer reviews, and safety ratings, allowing users to verify the legitimacy of any investment platform before committing their money. With access to in-depth insights and risk alerts, WikiFX equips potential investors with the resources to make informed decisions and avoid unauthorised or unlicensed entities. By checking with WikiFX, users can confidently protect their savings and avoid the costly traps set by unscrupulous investment syndicates.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

WikiFX Broker

Latest News

If you haven't noticed yet, the crypto market is in free fall, but why?

Emerging Markets: Nigeria's Debt Market Valuation Hits N99.3 Trillion

SkyLine Guide 2026 Thailand — Official Launch of the Judge Panel Formation!

JRJR Review: The Anatomy of a Hong Kong Liquidity Trap

South Africa Macro: Mining Policy Risks Cloud GNU Economic Optimism

JPY In Focus: Takaichi Wins Snap Election to Become Japan's First Female Leader

Vebson Scam Exposure: Forex Withdrawal Failures & Fake Regulation Warning

Amaraa Capital Scam Alert: Forex Fraud Exposure

Galileo FX Exposure: Allegations of Fund Losses Due to Trading Bot-related Issues

EGM Securities Review: Investigating Multiple Withdrawal-related Complaints

Currency Calculator