Company Summary

| Phillip Capital | Basic Information |

| Company Name | Phillip Capital |

| Founded | 2010 |

| Headquarters | United Arab Emirates |

| Regulations | Not Regulated |

| Tradable Assets | Stocks, Options, Bonds, Futures |

| Account Types | Individual, Joint, Corporate, LCC, LLP, Trust, IRA, Pension Plan, Discretionary |

| Minimum Deposit | Not specified |

| Maximum Leverage | 1:400 |

| Spreads | From $0.03 |

| Commission | Monthly subscription fee ($40-$100), Other specific transaction fees |

| Deposit Methods | Wire transfer, ACH, checks |

| Trading Platforms | Bloomberg EMSX, Bluewater, CQG, CTS T4, eSignal, Multicharts, PhotonTrader, QST, Qbitia, Rithmic, SierraChart, Stealth Trader, Trade Navigator, TT Platform, Zlantrader |

| Customer Support | Phone: +9714 332 5052, Email: salesdubai@phillipcapital.ae |

| Education Resources | General stock market terminology, company activities FAQs |

| Bonus Offerings | None |

Overview of Phillip Capital

Phillip Capital, established in 2010 and based in the United Arab Emirates, is an unregulated trading platform that offers a broad range of over 2,000 trading instruments, including stocks, options, bonds, and futures across 30 exchanges in 16 countries. Despite its extensive global reach and diverse offering, the lack of regulatory oversight presents potential risks for traders. The platform caters to a variety of traders with different account types, from individual to corporate and more specialized accounts like IRA and Pension Plan, all supported by a suite of trading platforms such as Bloomberg EMSX, CQG, and MetaTrader 5. Phillip Capital emphasizes customer engagement and education through its dedicated support channels and comprehensive educational resources, aiming to provide a thorough trading experience.

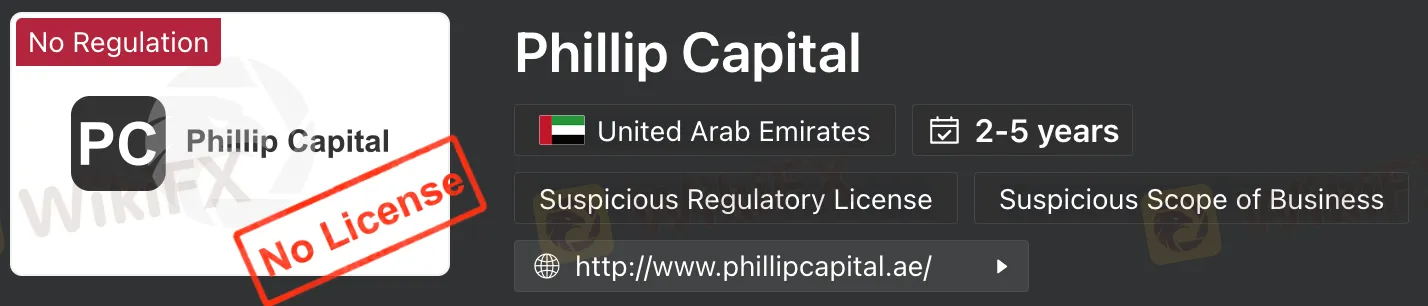

Is Phillip Capital Legit?

Phillip Capital is not regulated. It is important to note that this broker does not have any valid regulation, which means it operates without oversight from recognized financial regulatory authorities. Traders should exercise caution and be aware of the associated risks when considering trading with an unregulated broker like Phillip Capital, as there may be limited avenues for dispute resolution, potential safety and security concerns regarding funds, and a lack of transparency in the broker's business practices. It is advisable for traders to thoroughly research and consider the regulatory status of a broker before engaging in trading activities to ensure a safer and more secure trading experience.

Pros and Cons

Phillip Capital, with its establishment in 2010, offers a comprehensive trading environment that spans across multiple asset classes and global markets, leveraging advanced trading platforms like Bloomberg EMSX and CQG to cater to a diverse clientele. The platform's broad access to over 2,000 instruments on 30 exchanges in 16 countries and its array of account types are tailored to meet various investor needs, supported by educational resources to enhance trading knowledge. However, the lack of regulatory oversight raises concerns about the security of client funds and the transparency of operations, marking a significant consideration for potential clients.

| Pros | Cons |

|

|

|

|

|

|

|

|

|

Trading Instruments

Phillip Capital offers a vast array of trading instruments, including stocks, options, bonds, and futures, across 30 exchanges in 16 countries, totaling over 2,000 instruments. Alongside direct stock market access, it provides comprehensive clearing, financial, and executive services.

Here is a comparison table of trading instruments offered by different brokers:

| Product | Phillip Capital | IG Group | Just2Trade | Forex.com |

| CFDs | No | No | No | Yes |

| Forex | No | Yes | No | Yes |

| Indices | No | Yes | No | Yes |

| Commodities | No | Yes | No | Yes |

| Futures | Yes | Yes | Yes | Yes |

| Cryptocurrencies | No | Yes | No | Yes |

| ETFs | No | Yes | Yes | No |

| Options | Yes | Yes | Yes | Yes |

| Stocks | Yes | No | Yes | Yes |

| ADRs | No | No | Yes | No |

| Bonds | Yes | No | Yes | No |

Account Types

Phillip Capital offers a variety of account types to cater to different entities and financial goals, including Individual, Joint, Corporate, LCC, LLP, Trust, IRA, Pension Plan, and Discretionary accounts. All account types feature a minimum spread value from $0.03 and include a withdrawal commission.

| Account Type | Description |

| Individual | Accounts for traders preferring online trading without a broker. Subscription fee for trading terminal use; minimum deposit $5,000. Options for rental/purchase of exchange trading space for direct trading. |

| Joint | Joint account for several individuals. |

| Corporate | Account designated for corporate trading. |

| LCC, IRA, LLP | Accounts specifically for legal entities. |

| Trust | Trust account. |

| Discretionary | Broker-managed transactions on client's behalf with a $5 commission. Trader retains asset selection and transaction timing rights. |

| Pension Plan | Designed for retirees, offering reduced commissions. |

Leverage

Phillip Capital offers floating leverage up to 1:400, allowing traders to amplify their trading positions.

Here is a comparison table of maximum leverage offered by different brokers:

| Broker | Phillip Capital | FxPro | VantageFX | RoboForex |

| Maximum Leverage | 1:400 | 1:200 | 1:500 | 1:2000 |

Spreads and Commissions

Phillip Capital imposes a variety of fees and commissions for its trading services. There's a monthly subscription fee ranging from $40 to $100 for platform use, with no brokerage commission. Exchange fees are covered by PhillipCapital, funded through the monthly platform rental. Deposits are free, but wire transfers incur a $25 withdrawal fee, excluding bank charges. Bank check withdrawals cost $4, and an NFA fee of $0.02 per lot for US exchanges, plus a CME fee of $0.03 per lot for NYSE/LIFFE and CFE transactions, are applied. Despite no conversion fee for depositing non-USD currencies, the exchange rate could be significantly high. Paper trade confirmations and statements cost between $2.50 and $5, and closing an account costs $100.

Deposit & Withdraw Methods

Phillip Capital offers deposit and withdrawal methods including wire transfers, ACH payments, and checks. Withdrawals require an email request to the broker. Wire transfers incur a $25 fee per transaction, while check withdrawals have a $4 fee. The processing time for withdrawals ranges from 2 to 5 days, varying by client location and payment method.

Trading Platforms

Phillip Capital offers a wide array of trading platforms to cater to diverse trading needs and preferences, including Bloomberg EMSX, Bluewater, various CQG platforms (Mobile, Trader, Q Trader, Integrated Client), CTS T4 solutions (Mobile, Core+Charting, Advanced Data & Charting), eSignal, Multicharts, PhotonTrader, QST, Qbitia, Rithmic R|TRADER and R|TRADER Pro, SierraChart, Stealth Trader, Trade Navigator, TT Platform, and Zlantrader along with its mobile version. This extensive selection allows traders to choose the platform that best fits their strategy, whether they prioritize analytical tools, charting capabilities, or mobile access.

Customer Support

Phillip Capital provides customer support through their Dubai office, accessible via phone at +9714 332 5052 and email at salesdubai@phillipcapital.ae, ensuring clients have direct lines for assistance.

Educational Resources

Phillip Capital offers educational resources covering general stock market terminology and frequently asked questions about the company's activities, available in their Education Section for enhancing client knowledge and understanding.

Conclusion

Phillip Capital offers a diverse and comprehensive trading environment with a wide selection of instruments and platform options, catering to a global clientele. The platform's strengths lie in its vast array of trading instruments and the flexibility of account types, alongside the provision of significant educational resources. However, its unregulated status poses considerable risks, emphasizing the need for potential traders to exercise caution. While Phillip Capital endeavors to provide a rich trading experience with supportive customer service and educational backing, the lack of regulatory oversight remains a critical factor for traders to consider in their decision-making process.

FAQs

Q: What types of assets can I trade with Phillip Capital?

A: Phillip Capital offers trading in stocks, options, bonds, and futures across multiple global exchanges.

Q: How can I contact Phillip Capital's customer support?

A: Customer support can be reached at +9714 332 5052 or via email at salesdubai@phillipcapital.ae.

Q: Is Phillip Capital regulated?

A: No, Phillip Capital operates without regulatory oversight.

Q: What trading platforms are available at Phillip Capital?

A: Phillip Capital provides several platforms including Bloomberg EMSX, CQG, and many others.

Q: Does Phillip Capital offer educational resources?

A: Yes, it offers resources covering stock market terminology and FAQs about the company's activities.

Risk Warning

Online trading involves significant risk, and you may lose all of your invested capital. It is not suitable for all traders or investors. Please ensure that you understand the risks involved and note that the information provided in this review may be subject to change due to the constant updating of the company's services and policies. In addition, the date on which this review was generated may also be an important factor to consider, as information may have changed since then. Therefore, readers are advised to always verify updated information directly with the company before making any decision or taking any action. Responsibility for the use of the information provided in this review rests solely with the reader.