Abstract:Vebson is listed as high risk on WikiFX, with exposure to unpaid withdrawal cases and misleading claims. Read this forex scam alert before you deposit a cent.

Vebson markets itself as a modern forex and CFD broker, but multiple independent investigations now flag it as a high‑risk platform with clear characteristics of a forex scam. Traders from Pakistan, Portugal, Malaysia, and other regions report blocked withdrawals, false regulatory claims, and abusive tactics, strongly suggesting a coordinated forex investment scam rather than a trustworthy broker.

Vebson Profile and High‑Risk Status

According to WikiFX safety trackers, Vebson is categorized as a high‑risk broker with a very low trust and safety score. Its latest industry rating of around 1.86 out of 10 signals an elevated probability of investor losses and possible fraud, far below the level expected from a legitimate forex broker.

Reports indicate that Vebson operates from offshore jurisdictions such as Saint Lucia, where regulatory oversight and investor protection are minimal. For retail traders, this offshore setup, combined with a low safety score and numerous complaints, is a serious scam alert that should not be ignored.

Fake Regulation and NFA Misrepresentation

One of the most alarming red flags is Vebsons claim to be registered with the U.S. National Futures Association (NFA), a statement that does not match official records. Complainants document that, after checking the NFA registry, Vebson does not appear as a properly registered entity, exposing its regulatory story as misleading at best and deliberately deceptive at worst.

Scam exposure reports and broker safety analyses describe these fake licenses and fabricated regulatory claims as classic markers of forex scams. By pretending to be regulated, Vebson appears to target inexperienced traders who equate “NFA” or other regulator names with safety, even though there is no real supervision.

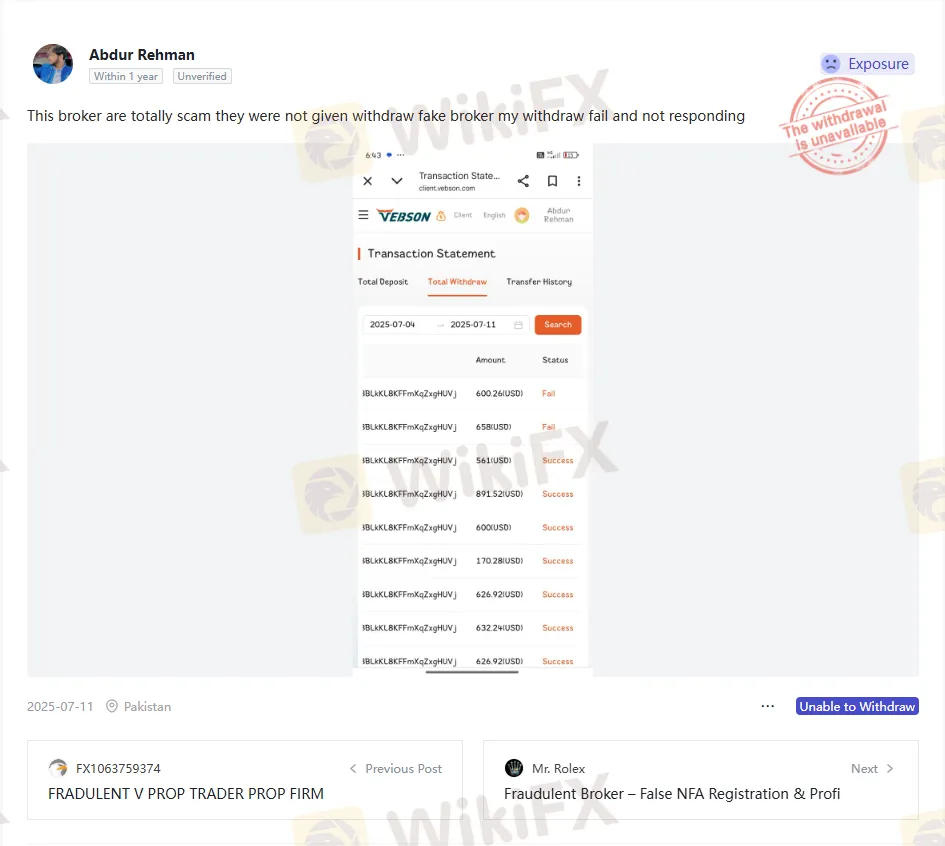

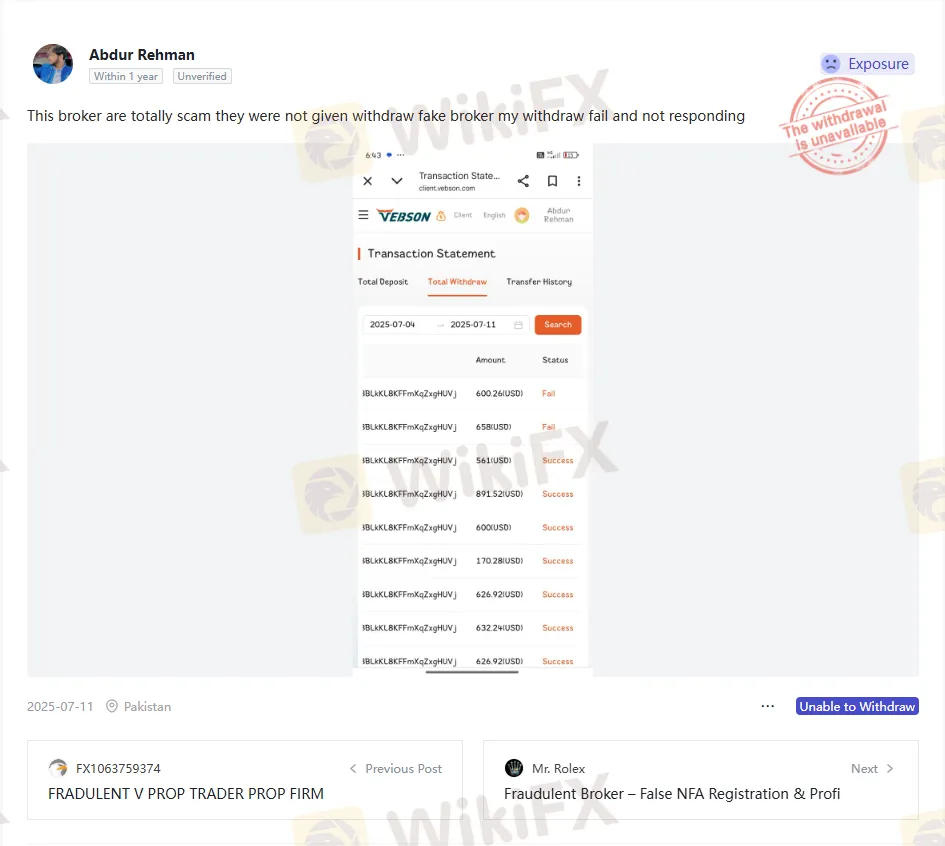

Case 1: Pakistan – Failed Withdrawal and No Response

A complaint dated 2025‑07‑11 from Pakistan bluntly states that Vebson is “totally a scam,” citing a complete failure to process withdrawals. The user reports that their withdrawal request was not honored at all, labeling Vebson a fake broker that simply refused to release funds and then stopped responding.

This pattern aligns with typical forex trading scam behavior, where deposits are accepted smoothly, but any attempt to withdraw money is either ignored or blocked without a valid reason. When a broker keeps clients money while cutting off communication, it effectively functions as a fraud rather than a financial service provider.

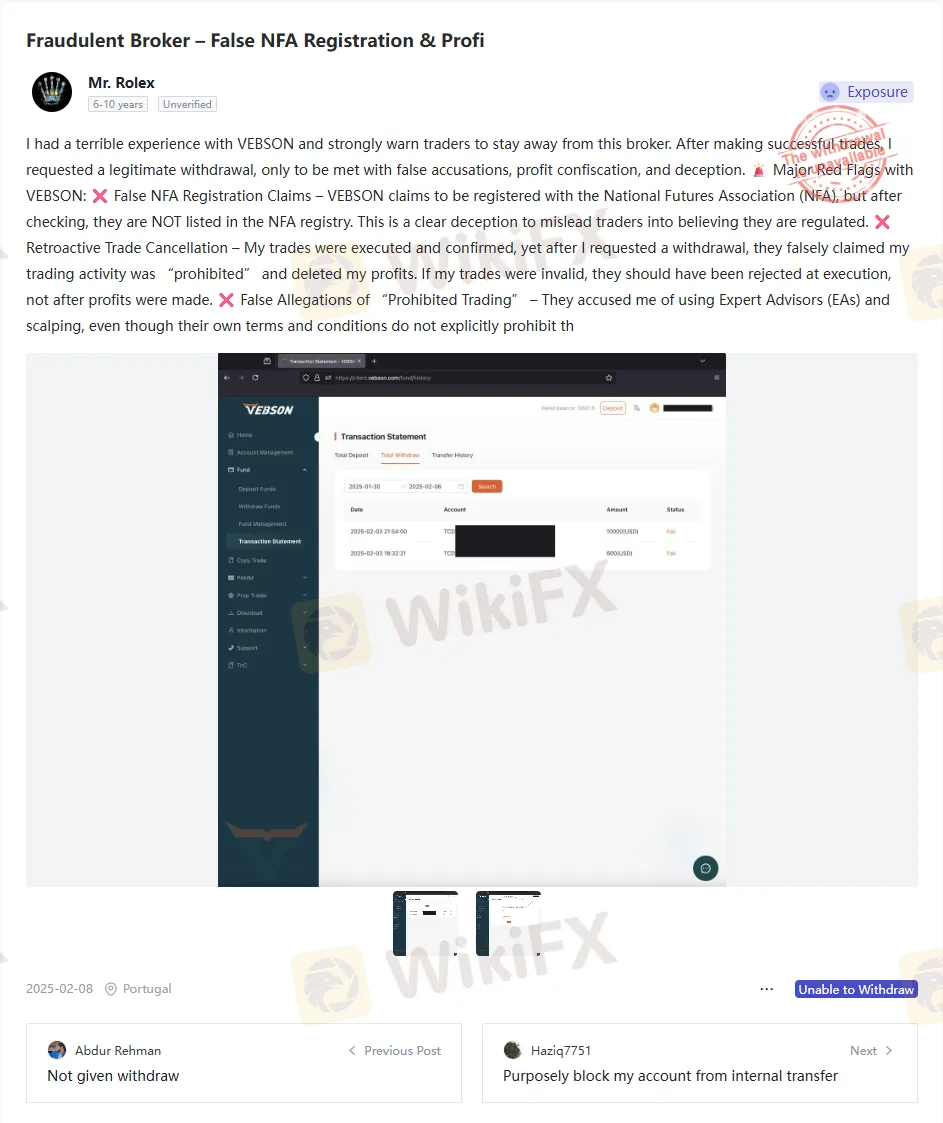

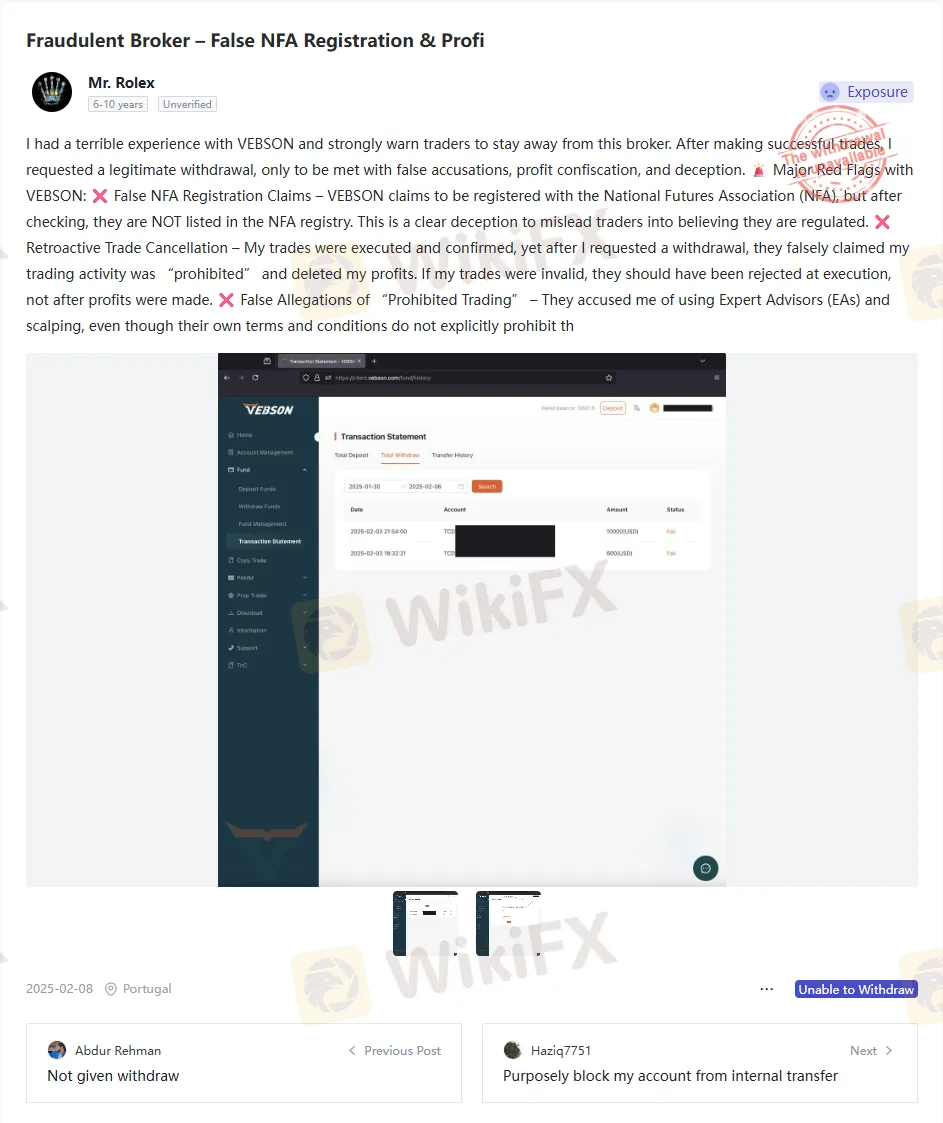

Case 2: Portugal – Profit Confiscation and “Prohibited Trading” Excuse

A detailed 2025‑02‑08 complaint from Portugal describes a severe forex scam scenario involving profit deletion and retroactive accusations. The trader reports making successful, legitimate trades and then requesting a standard withdrawal, only to face sudden claims that their activity was “prohibited,” leading to the confiscation of their profits and a denial of payment.

The exposure notes several specific red flags:

- False NFA registration claims, with Vebson not appearing in the official NFA registry.

- Retroactive trade cancellation, where already‑executed trades were later invalidated after profits were earned.

- False allegations of using Expert Advisors or scalping, even though the brokers own terms did not clearly forbid such strategies.

Legitimate brokers reject non‑compliant trades at execution, not after profits accrue, so this retroactive cancellation is a strong sign of a forex investment scam designed to keep profitable clients from withdrawing their gains.

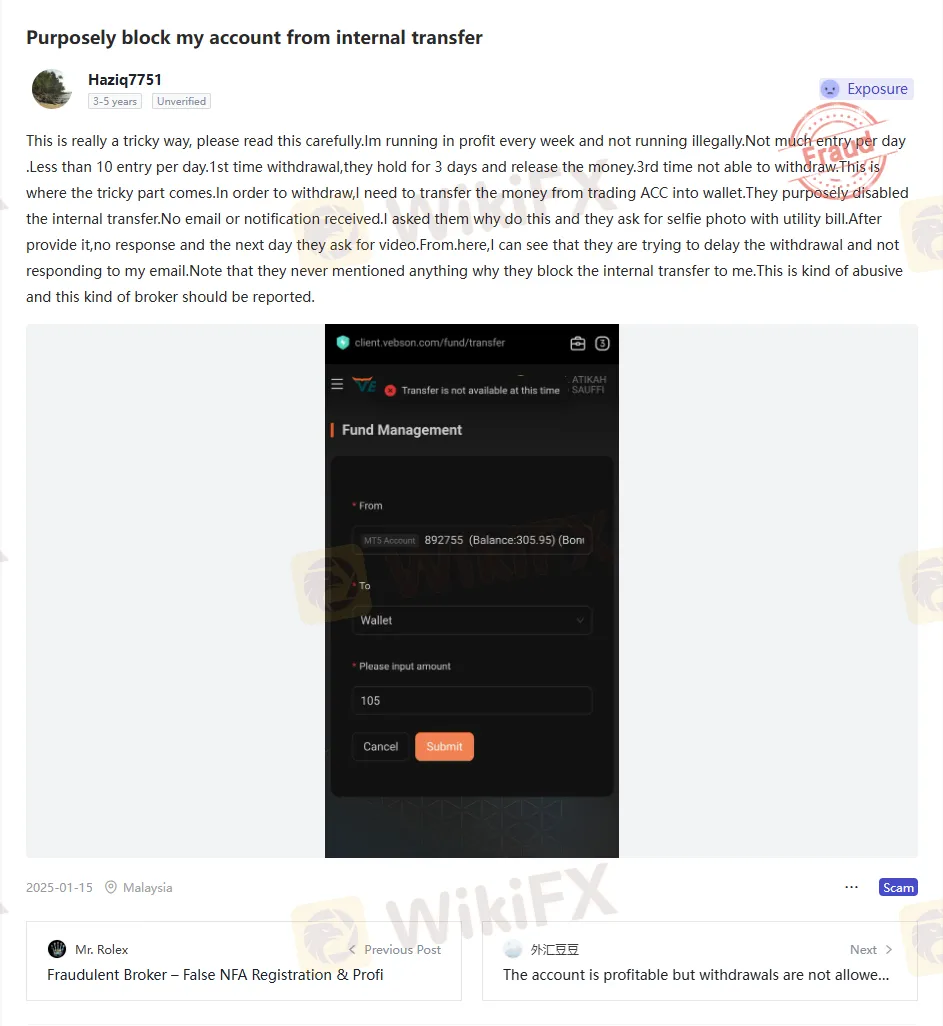

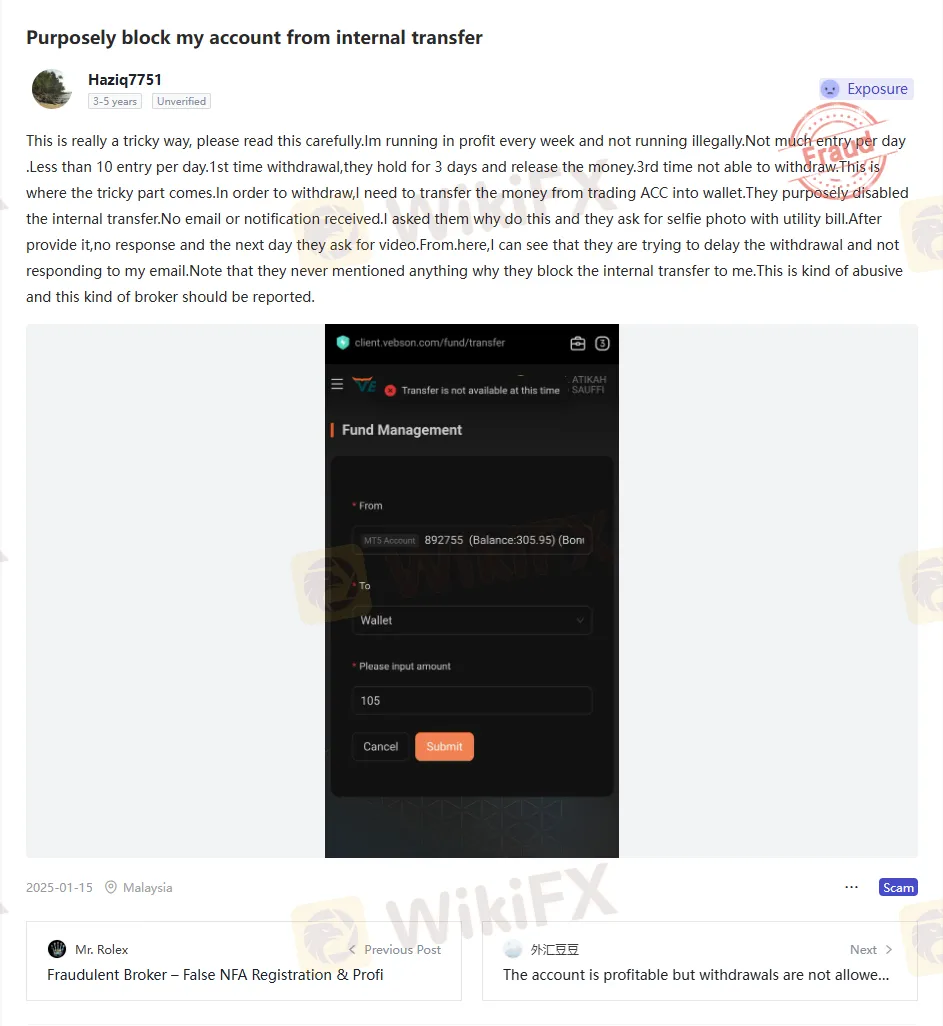

Case 3: Malaysia – Internal Transfer Blocks and KYC Abuse

In a 2025‑01‑15 case from Malaysia, the trader explains that they traded conservatively, with fewer than ten entries per day and consistent, steady profits. The first withdrawal was delayed for three days but eventually processed, giving the impression that the broker was legitimate, which is a common tactic in forex scams.

Trouble reportedly started with the third withdrawal, when Vebson suddenly disabled internal transfers from the trading account to the wallet, a required step to cash out. No prior email or notification was provided, and when the trader asked for an explanation, they were told to submit a selfie with a utility bill, then a video, after which responses slowed or stopped.

This shifting, excessive KYC process during withdrawals—not at account opening—is widely recognized as a delay tactic used by scam brokers to avoid paying clients while pretending to comply with compliance rules. The Malaysian complainant explicitly describes the behavior as abusive and insists that such a broker be reported to the authorities.

Pattern of Forex Scam Tactics

When looking across the Pakistan, Portugal, and Malaysia cases, a clear pattern of forex scam tactics emerges. Traders report blocked or failed withdrawals, profit confiscation after successful trading, and arbitrary reasons, such as “prohibited trading” or sudden geographic restrictions, invoked only when money is requested.

External reviews and exposure articles confirm similar experiences from other regions:

- Unregulated or falsely “regulated” broker structure.

- Account blocks or backend bans immediately after profit generation.

- Hostile or non‑existent customer support when clients seek help.

These behaviors are consistent with known forex scams and forex trading scams, where the primary goal is to capture deposits and trap funds, not to provide fair market access. Any trader evaluating Vebson should view this combination of issues as a clear red flag and an urgent warning.

Safety Tips and Alternatives for Traders

Given Vebsons high‑risk rating, unregulated status, and repeated withdrawal disputes, traders are strongly advised to avoid opening or funding accounts with this broker. If you are already involved, stop depositing immediately, keep detailed records of chats, emails, and transaction logs, and consider submitting formal complaints to financial regulators or consumer protection bodies in your country.

To reduce exposure to forex scams, traders should verify a broker's license directly with recognized regulators such as the NFA, FCA, ASIC, or CySEC rather than relying on claims on a brokers website. Using watchdog tools like WikiFX and similar safety platforms helps assess whether a forex broker is safe or a potential forex investment scam before you risk your capital.