简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

US Services Sector Surveys Signal Solid Growth In January, But...

Abstract:Following the dramatic rebound in US Manufacturing survey data - driven by a surge in new orders - '

Following the dramatic rebound in US Manufacturing survey data - driven by a surge in new orders - 'Soft' data has bounced back dramatically from its post-government shutdown lows (which is ironically occurring as the hard data - which was so resilient through the shutdown - has started to roll over)...

...and this morning's Services Sector survey data builds on that rebound

- S&P Global's US Services PMI signaled abetter than expected expansionof 52.7 in January (52.5 exp), rebounding from April 2025 lows.

- ISM's US Services PMI survey also beat expectationsin January (53.8 vs 53.5 exp), but was flat from a revised lower 53.8.

But both still solidly in expansion...

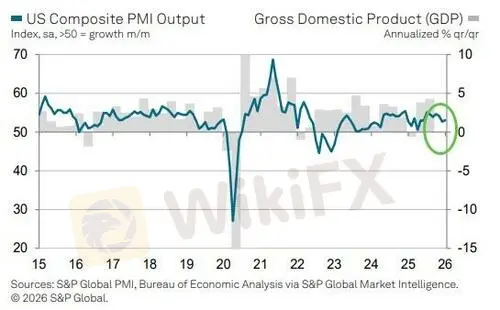

The S&P Global US Composite PMI recorded 53.0 in January. That was up from 52.7 in December and represented a solid rate of growth in private sector activity. Both sectors covered by the survey recorded stronger output expansions, in line with faster gains in new business. Employment meanwhile rose only marginally, while confidence in the outlook softened.

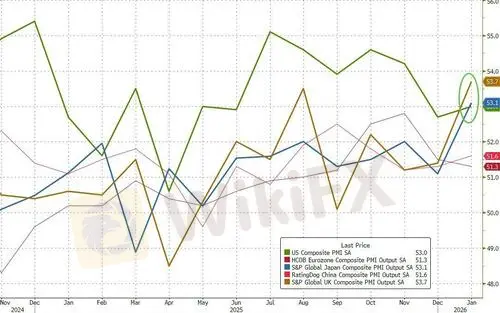

Despite the rebound, US has been overtaken by UK and Japan in terms of global PMIs...

according to Chris Williamson, Chief Business Economist at S&P Global Market Intelligence.

However,that is a lower gear compared to the pace of expansion seen prior to Decembers slowdown, and hints at GDP growth cooling in the first quarter.

Consumer-facing companies are increasingly reporting a challenging environment, with demand for services falling in January having nearly stalled in December, “reflecting low levels of consumer sentiment and cost of living pressures,”Williamson noted.

The ISM data showed a triple whammy of higher prices, lower new orders, and lower employment...

However, as Williamson concludes, “inflationary pressures in the service sector meanwhile remain elevated, blamed on the pass though of tariff related price increases and wage growth, though stiff competition is often reported to have limited the impact on final selling prices.”

However, there is a silver lining, as Williamson concludes:

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

WikiFX Broker

Latest News

XeOne Complete Review: Is It Unregulated and Risky? A Detailed Look

Geopolitical Risk Radar: Russia Nuclear Treaty Expiry Looms; Iran Weighs Diplomacy

Kudotrade Review: Safety, Regulation & Forex Trading Details

Global Markets Rattle: Commodities and Crypto Slump as 'Trump Trade' Fades

Why Opofinance’s Dual Licensing Looks Weak, Not Reassuring

Is Toyar Carson Limited Legit? A 2026 Investigation into Scam Allegations

Wall Street Giants Pivot: The "Reflation Trade" Returns

Precious Metals Capitulation: Gold Plunges 12% to Break $5,000 Support

SARB Pauses Rate Cycle at 6.75% Amid Lingering Uncertainty

EZINVEST Review: The Financial Abattoir Behind the CySEC Mask

Currency Calculator