简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

EZINVEST Review: The Financial Abattoir Behind the CySEC Mask

Abstract:EZINVEST is a masterclass in psychological manipulation, using a thin veil of CySEC regulation to bleed accounts dry via unauthorized trades and mandatory 'top-up' extortion. The data reveals a 2.46 rating burial ground where withdrawals go to die and aggressive account managers act as financial predators.

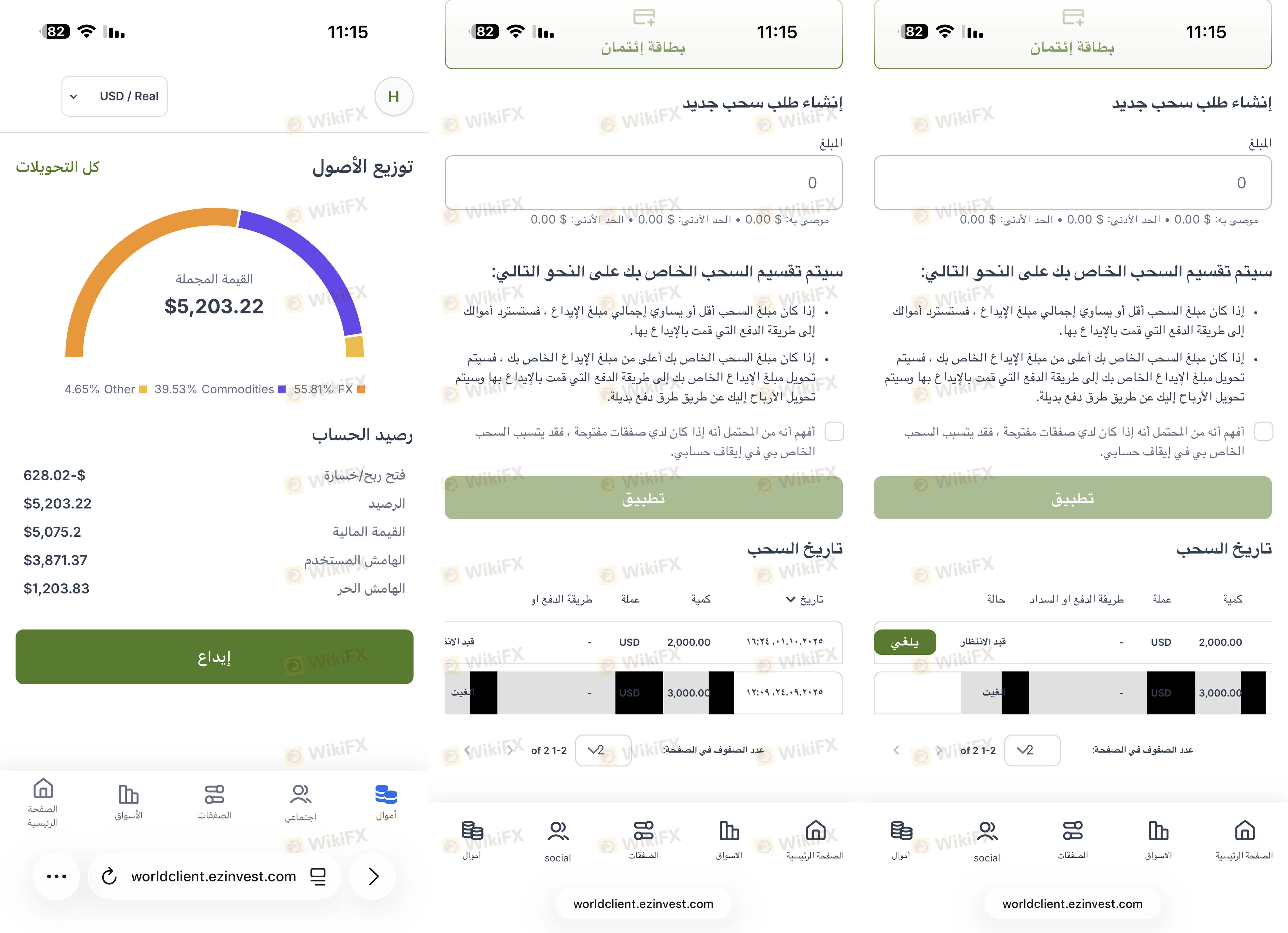

If you think a license from Cyprus is a bulletproof vest for your capital, the EZINVEST review data will leave you bleeding out in the streets of the retail market. With a pathetic WikiFX score of 2.46, this broker is not just failing; it is actively predatory. We are looking at a platform that has accumulated over 33 formal complaints in the last 90 days, ranging from systematic withdrawal blockages to blatant account manipulation.

The narrative is always the same: a friendly “account manager” lures you in with a modest $250 deposit, only to morph into a financial stalker once they smell more blood. From Lebanon to Bolivia, victims report the same soul-crushing pattern: unauthorized positions opened by the broker to intentionally create a “negative float,” followed by demands for thousands of dollars to “save” the account.

The Regulation Trap: A Paper Shield

The most dangerous thing about this broker is its veneer of legitimacy. It holds a CySEC license, but as the table below shows, a license is not a character reference—it is merely a piece of paper that EZINVEST uses to lure victims into a false sense of security.

| Regulator | License Type | Status |

|---|---|---|

| Cyprus Securities and Exchange Commission (CySEC) | WGM Services Ltd | Regulated (203/13) |

While the Forex regulation might exist on paper, the clinical reality on the ground is one of total anarchy. Being “Regulated” does not stop a broker from ghosting your emails or blocking your login portal when the time comes to pay out what is rightfully yours.

Psychological Warfare and Forced Liquidity

The Forex market is volatile enough without your own broker sabotaging you. Extensive case studies reveal that EZINVEST employees—specifically names like “Susana” and “Briggitte Casas”—engage in what can only be described as high-pressure extortion. One victim in Nicaragua reported that a broker opened unauthorized operations after a withdrawal request was made, effectively draining the account to zero within days.

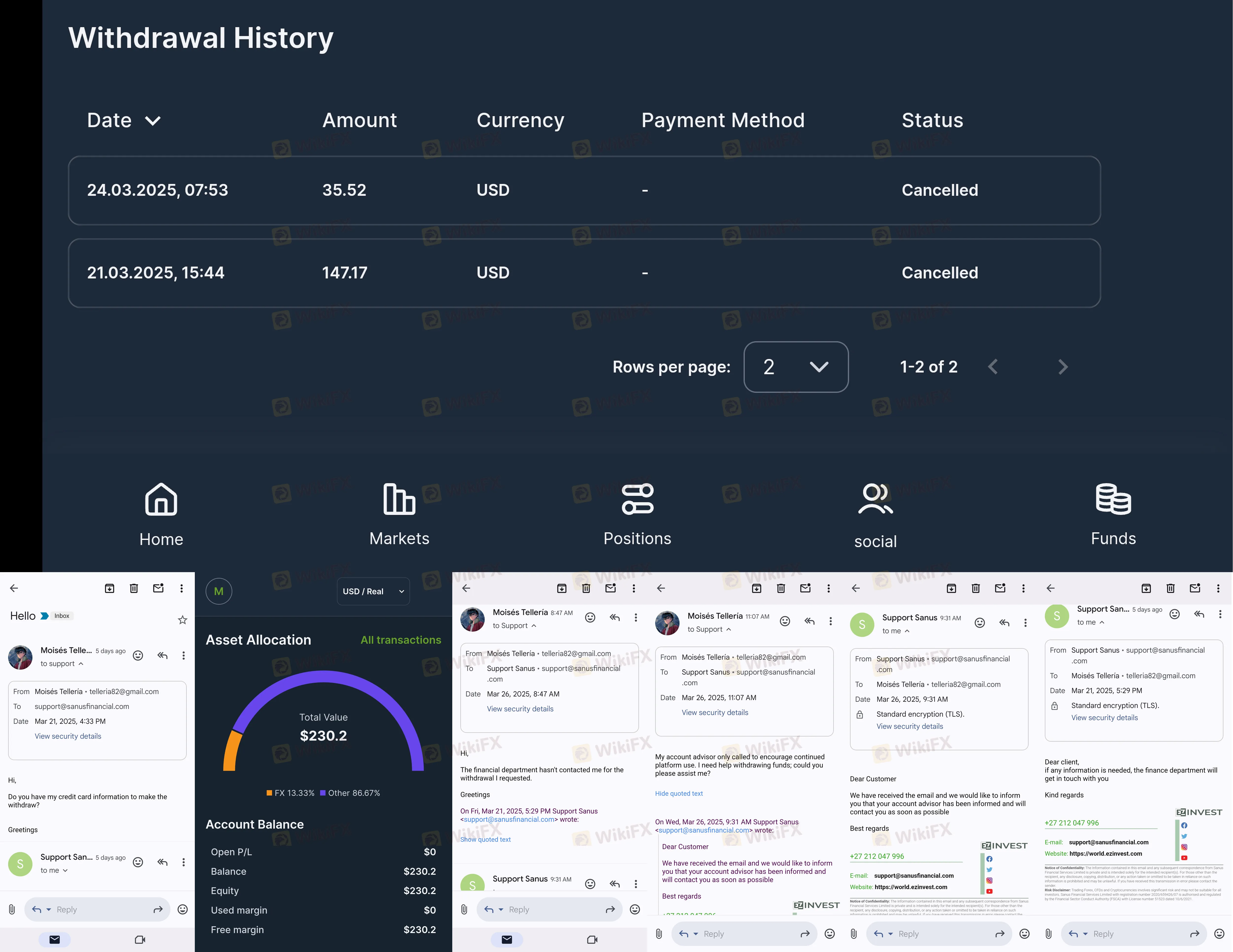

This isn't incompetent trading; it is a calculated liquidation of client assets. Another user from the Dominican Republic lost $34,800 after being promised a “risk-free” account, only to find their pleas for help met with evasive silence.

The “Withdrawal Impossible” Protocol

Before you even reach the login page, you should know that entering this ecosystem is easy, but leaving is a nightmare. The “Pain Points” identified in recent investigations include:

1. Mandatory Activity: Forcing users to trade for weeks after a withdrawal request is submitted.

2. The Insurance Scam: Demanding “insurance fees” or “security deposits” to release existing funds.

3. Unauthorized Trading: Closing winning positions too early or opening losing ones to destroy equity.

Technical Failures or Intentional Hurdles?

The software evaluation of the EZINVEST platform mentions a “smooth” experience, but the user cases tell a different story. If you cannot access your funds, “smoothness” is irrelevant. There are multiple reports of users being unable to reach their accounts after repeated attempts, suggesting that the login infrastructure might be selectively restrictive for those trying to pull their capital.

Furthermore, while they brag about MT4 and a “self-developed” platform, the lack of two-step authentication and biometric security is a red flag in a world where security should be regulation standard. This lack of security isn't a bug; it's a feature for a broker that wants total control over your entry and exit.

Final Verdict: A Toxic Influence

With an influence rank of 'C' and a primary footprint in India and Mexico, EZINVEST is hunting in emerging markets where investors might be less familiar with the aggressive tactics of “churn and burn” brokers. Their marketing strategy relies heavily on Google (83.20%), buying their way into your search results.

Don't be fooled by the CySEC stamp. The review is clear: EZINVEST is a graveyard for retail capital. From the $250,000 entry condition for “Platinum” accounts down to the “Bronze” entry-level traps, every tier is designed to funnel money into the broker's pockets, not the market.

Risk Warning: Trading with EZINVEST carries a high risk of total capital loss, not due to market movements, but due to internal broker conduct. If you have funds there, attempt a withdrawal immediately—but expect a fight.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

WikiFX Broker

Latest News

Precious Metals Capitulation: Gold Plunges 12% to Break $5,000 Support

EZINVEST Review: The Financial Abattoir Behind the CySEC Mask

SARB Pauses Rate Cycle at 6.75% Amid Lingering Uncertainty

Eurozone Resilience: Economy Defies Gloom as Germany Rebounds

Lured by a deepfake video, retiree lost over $4,000 in an investment scheme

Geopolitical Risk: Iran Accuses West of Inciting Domestic Unrest

Central Bank 'Super Week': ECB, BoE, and RBA to Test FX Volatility

Warsh Nomination Signals High-Stakes 'Regime Change' at Federal Reserve

Middle East Tensions: Aircraft Carriers vs. Diplomacy

War Clouds Over Persian Gulf: US Carrier Deployment Spikes Oil Volatility Risks

Currency Calculator