简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

PRCBroker Review 2026: Comprehensive Safety Assessment

Abstract:PRCBroker holds regulatory licenses from CySEC and VFSC, achieving a WikiFX score of 5.97, though recent data highlights significant withdrawal friction. This review weighs its safety protocols against reported operational risks to determine its viability for 2026.

Executive Summary

In this in-depth review, we analyze the key metrics defining PRCBroker's current market standing. The broker PRCBroker was established in 2014 and maintains a headquarters in Cyprus. While the firm commands a WikiFX score of 5.97, indicating a moderate level of credibility, its high entry requirements and recent influx of user complaints present a complex picture for potential investors. As a financial broker operating for over a decade, PRCBroker offers access to global markets via standard industry platforms, yet its service quality requires a granular audit.

Our analysis aims to provide a transparent review of the broker's regulatory framework, trading environment, and client feedback to assess whether it remains a safe harbor for capital in 2026.

1. Regulation & Safety Protocols

The most critical aspect of our audit is the regulation PRCBroker operates under. The entity is dual-regulated, holding licenses from the Cyprus Securities and Exchange Commission (CySEC) and the Vanuatu Financial Services Commission (VFSC).

- CySEC (Cyprus): This is a Tier-2 regulator that ensures compliance with European standards, including the Markets in Financial Instruments Directive (MiFID). It mandates negative balance protection and segregated client accounts.

- VFSC (Vanuatu): This represents an offshore license, which generally offers lower regulatory oversight compared to European authorities.

While the framework of regulation suggests a baseline of safety, traders should note that the entity has received a generic warning regarding unregulated domains associated with the industry, although PRCBroker's specific authorized domains retain legal status. The primary concern is not the lack of licensure, but the disparity between its regulatory status and the operational issues reported by clients.

2. Forex Trading Conditions

For traders focusing on Forex instruments, PRCBroker provides a trading environment built on the MetaTrader 4 (MT4) and MetaTrader 5 (MT5) platforms. The broker offers a maximum leverage of 1:100, which aligns with standard risk management practices but may feel restrictive to aggressive traders used to offshore leverage caps.

A notable drawback is the high barrier to entry. The “Premium” account requires a minimum deposit of $10,000, and the “VIP” account demands $100,000. For a retail Forex trader, these requirements are significantly higher than the industry average, which is typically around $100-$500. This pricing structure suggests the broker is targeting high-net-worth individuals, yet the service delivery must be scrutinized to see if it justifies such a premium.

3. User Feedback & Complaints

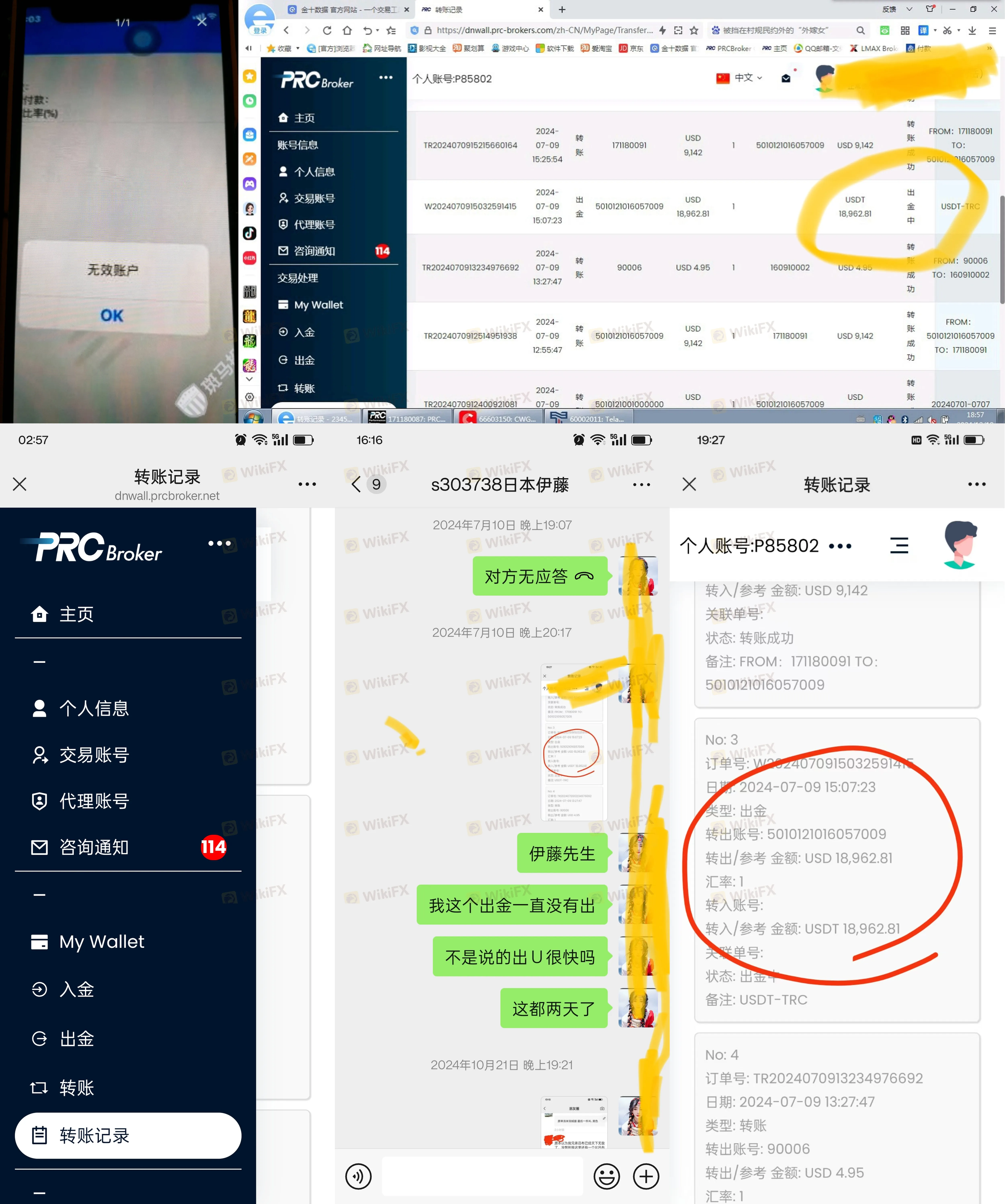

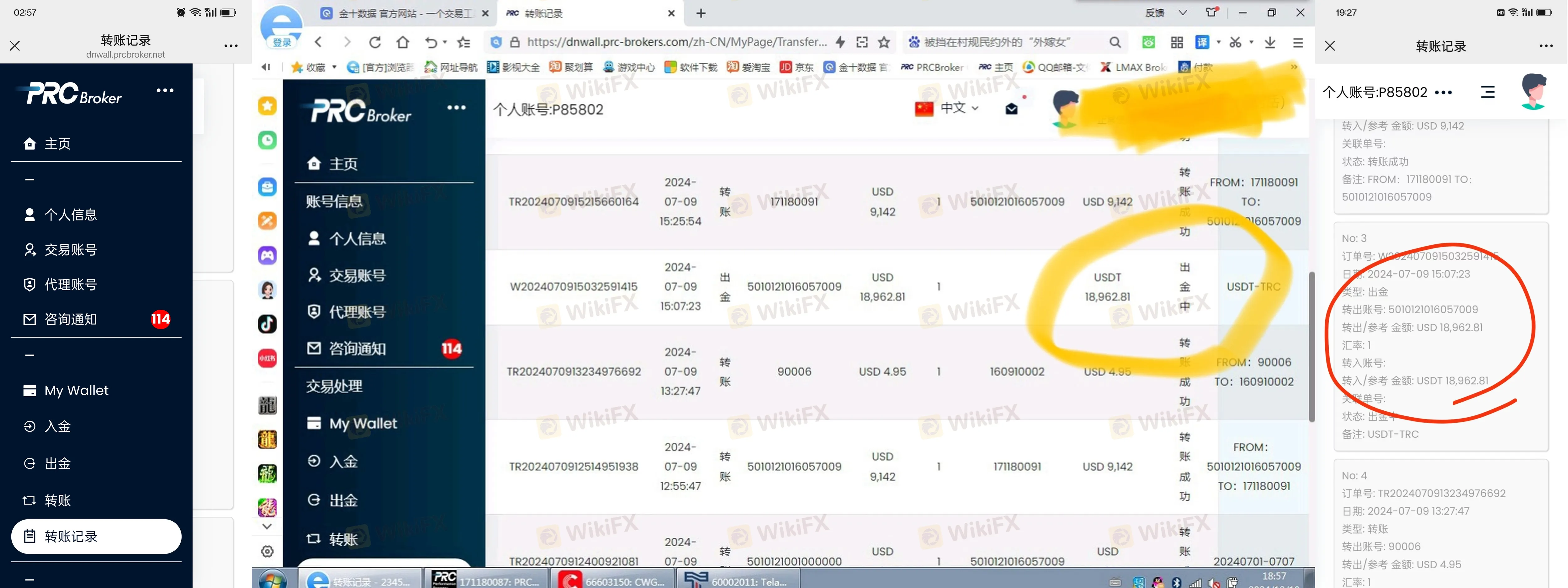

Operational risks become apparent when analyzing recent user feedback. In the last three months alone, WikiFX has received 19 complaints against PRCBroker. These cases highlight severe issues, primarily concerning the refusal of withdrawals and the freezing of accounts after profits are generated.

Specific allegations include:

- Withdrawal Denials: Multiple users (Cases 1, 2, 8, 9) reported that the broker refused to process withdrawals for amounts ranging from thousands to over a million dollars, often citing “violations” without clear evidence.

- Account Access: Several complaints (Case 16, 17) mention that the broker froze their accounts abruptly. Users have reported difficulties with their login stability, stating that after profitable trades, the software was closed or disabled, preventing them from accessing their funds.

- Support Unresponsiveness: Traders allege that customer service channels, including WeChat and QQ, often block clients (Case 2, 3) once disputes over funds arise.

4. Software & Access

PRCBroker utilizes the industry-standard MT4 and MT5 platforms, which are generally renowned for their reliability and charting capabilities. However, based on the complaints mentioned above, the technical infrastructure appears to be weaponized in some dispute scenarios.

Under normal circumstances, to access the platform, traders must complete the login security steps. The platform reportedly lacks advanced two-step verification (2FA) or biometric authentication, which are becoming standard for securing your login credentials in 2026. While the software itself is robust, the reported inability of some profitable traders to log in casts a shadow over the platform's independent reliability.

Final Verdict

PRCBroker occupies a precarious position in the market. While it holds a valid CySEC license and offers established trading platforms, the high deposit requirements and the severity of recent client complaints regarding fund safety cannot be ignored. The reported issues with withdrawals and login access for profitable accounts suggest significant operational risks.

Traders are advised to exercise extreme caution. For real-time updates on regulation status or to verify the official login page, consult the WikiFX App.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

WikiFX Broker

Latest News

ECB and BoE Set to Hold Rates Amid Inflation Jitters

Gold Reclaims $4,800 After Historic Rout; Volatility Persists

Binary.com Review — Missing Trades & Reporting Issues Investigated

OpoFinance Withdrawal Issues: Traders Warn Others

Macro Strategy: Hard Assets Favored Over Consumption in Inflationary Environments

Central Bank 'Super Week': ECB, BoE, and RBA to Test FX Volatility

Precious Metals Capitulation: Gold Plunges 12% to Break $5,000 Support

EZINVEST Review: The Financial Abattoir Behind the CySEC Mask

SARB Pauses Rate Cycle at 6.75% Amid Lingering Uncertainty

Eurozone Resilience: Economy Defies Gloom as Germany Rebounds

Currency Calculator