简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Libertex Review: Safety, Regulation & Forex Trading Details

Abstract:Libertex holds a valid CySEC license but currently faces a regulatory warning from Indonesian authorities and a high volume of user complaints. Recent WikiFX data indicates persistent risks regarding withdrawal delays, aggressive account managers, and platform login instability.

Key Takeaways

- Regulatory Status:Libertex is regulated by CySEC in Cyprus but has been Blacklisted by BAPPEBTI in Indonesia for unauthorized operations.

- User Complaints: A high volume of reports (over 40 recently) cite difficulties with withdrawals and aggressive sales pressure.

- Platform Issues: Some users have reported technical errors, including Libertex login failures and website access issues.

- Risk Level: Despite a decent influence score, the operational risks and user feedback suggest caution is necessary.

Libertex Broker Summary

Libertex is a well-known broker established in 2014, headquartered in St. Vincent and the Grenadines. It holds a WikiFX Score of 6.49, which reflects a mix of valid regulation and significant user complaints. While the broker has a high influence rank (A) and supports popular platforms like MT4 and MT5, its reputation is impacted by negative enforcement actions in Southeast Asia and serious client grievances regarding fund safety.

The broker primarily serves markets in Latin America (Mexico, Chile, Colombia) and Europe, but investors should be aware of the gap between its regulatory status on paper and the practical experience reported by users.

Regulation: Is the License Real?

One of the most critical aspects of any Libertex review is verifying its legal standing. Libertex operates under the company name Indication Investments Ltd and holds a license from the Cyprus Securities and Exchange Commission (CySEC). However, it also has a negative record with Indonesian regulators.

| Regulator | License Type | Status |

|---|---|---|

| Cyprus CYSEC | Regulatory License | Regulated |

| Indonesia BAPPEBTI | Regulatory Disclosure | Blacklisted |

Regulatory Warning

While the CySEC license provides a layer of safety for European clients, Libertex has been flagged by BAPPEBTI (Indonesia's Commodity Futures Trading Regulatory Agency). The regulator placed Libertex on a blacklist, citing it as an illegal commodity futures trading entity. This creates a complex safety profile: the broker is legal in one jurisdiction but considered high-risk or unauthorized in another.

User Reviews: Libertex Login & Withdrawal Complaints

Deep analysis of WikiFX records reveals a troubling pattern in user feedback. While some users trade normally, a significant number of case reports from 2024 and into 2025 highlight three specific risks:

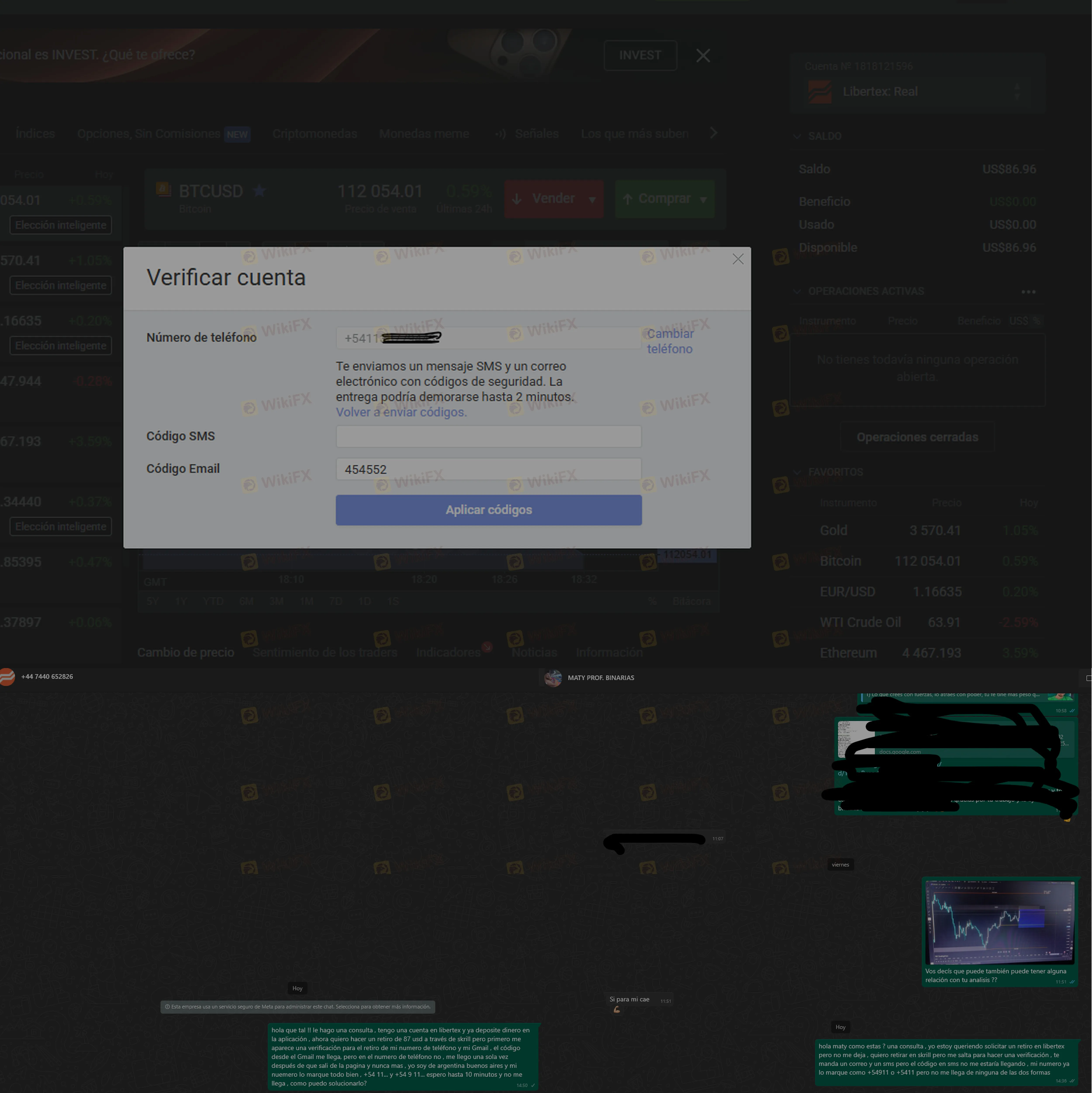

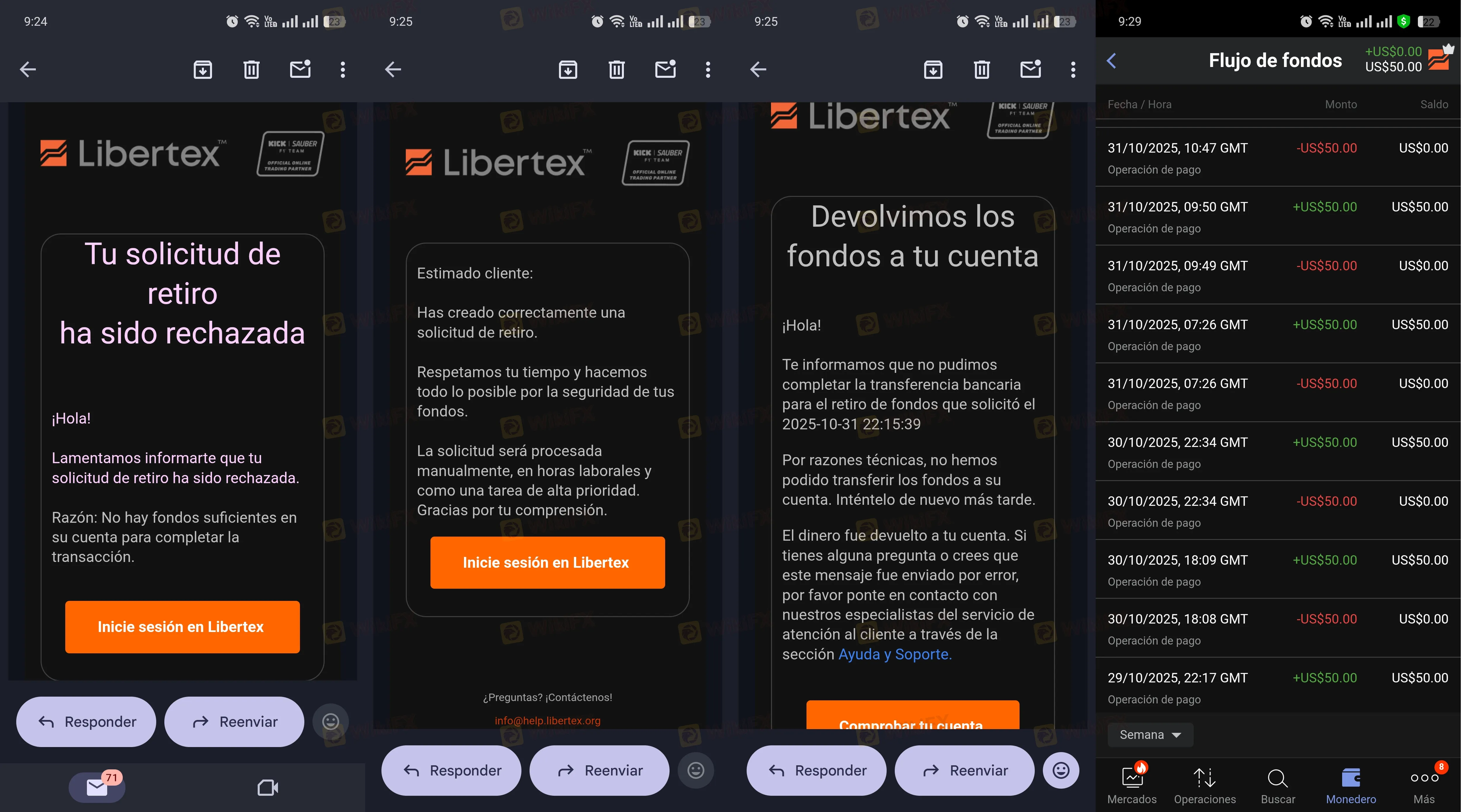

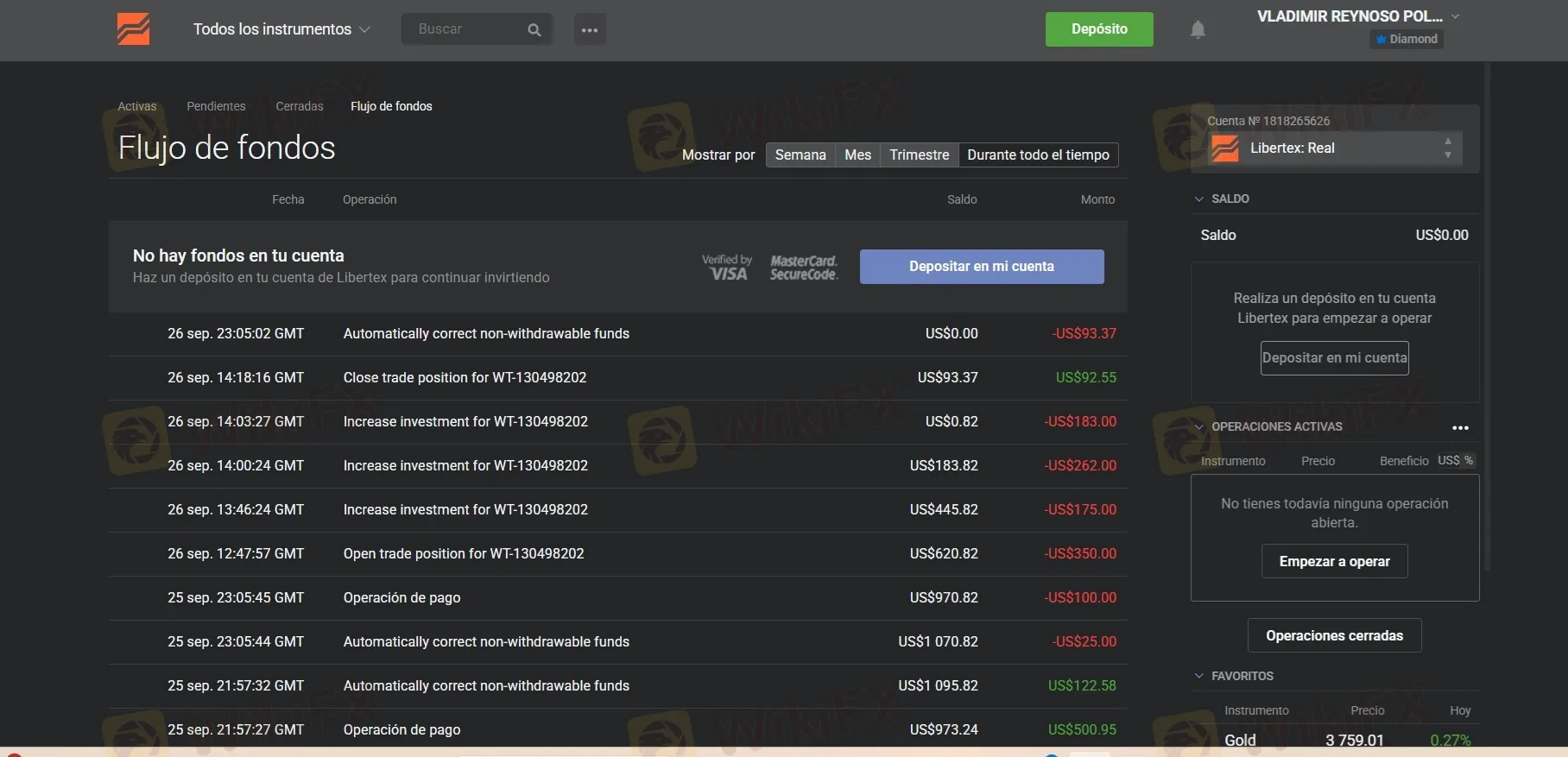

1. Withdrawal Delays and Verification Loops

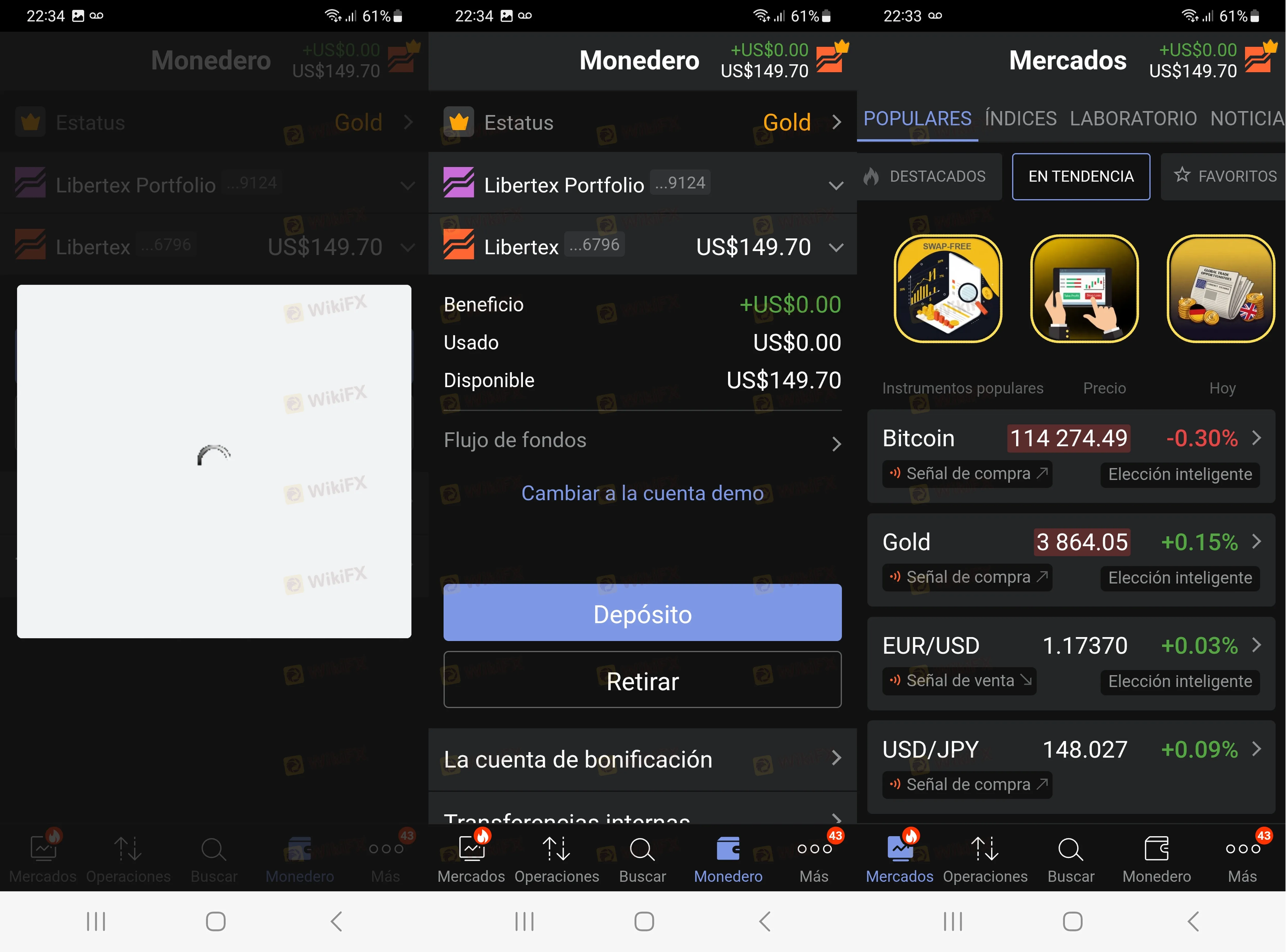

The most common complaint involves the inability to withdraw funds. Users from Colombia, Argentina, and Mexico have reported that Libertex often processes deposits instantly but stalls withdrawals.

- The “Verification” Trap: Traders report that when they request a withdrawal (e.g., $87 USD or larger amounts like $3141 USD), the broker demands excessive verification documents. Even after submission, requests are often ignored or rejected.

- Case Evidence: A report from Argentina described the process as “impossible,” with the withdrawal button simply failing to work.

Another user noted that after depositing $50 USD, they could not retrieve their funds due to technical “errors.”

2. Aggressive “Financial Advisors”

Multiple reports describe a pattern where Libertex agents contact clients via phone to encourage larger deposits.

- Misleading Guidance: Users claim these “advisors” pressure them to open high-risk trades (e.g., in Crude Oil or Natural Gas) with high leverage.

- Resulting Losses: In several cases, following this advice led to the total loss of the account balance. One user reported losing $3,400 USD in a single operation guided by an advisor who promised safety.

- Important:Forex brokers generally should not offer direct investment advice that disadvantages the client. This behavior is a major red flag for investors.

3. Login and Technical Failures

For traders asking about Libertex login stability, recent data is concerning.

- Access Denied: Reports from Malaysia indicate instances where users could not access the login page at all, receiving “Error 404” messages after registering.

- Platform Latency: Other users mentioned that account balances would decrease without explanation or that trades would move in the exact opposite direction of the market instantly upon execution, raising concerns about platform fairness.

Conclusion

This Libertex review finds a broker with a split personality. On one hand, Libertex is a long-standing entity with a valid CySEC license and popular trading software. On the other hand, the high volume of validated complaints regarding withdrawals, the blacklisting by BAPPEBTI, and reports of aggressive sales tactics paint a picture of high risk for the average retail trader.

Recommendation: Investors should prioritize brokers with cleaner regulatory records and fewer complaints about fund access. If you choose to trade here, test Libertex login stability and withdrawal procedures with small amounts before committing significant capital.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

WikiFX Broker

Latest News

Is Forex Still Worth It in 2026? Global Central Banks Are Splitting

JPY Volatility Ahead: PM Takaichi Calls Snap Election Amid Rate Hike Speculation

China Holds Rates Steady After Hitting 5% Growth Target, Easing Expected in Q1

The Fed on Trial: Markets Brace for Supreme Court Showdown Over Central Bank Independence

Trade War 2.0: Trump’s Greenland Ultimatum Rattles Transatlantic Alliance

Euro Stabilizes as France Forces 2026 Budget; Bond Spreads Narrow

JPY Volatility Spikes as PM Takaichi Calls Snap Election and Fiscal Gamble

AI in Medicine: Diagnostics, Privacy, and Ethical Challenges

TSMC Earnings Confirm AI "Supercycle," But Capacity Wall Looms

China Macro: Liquidity Trap Signals Persist Despite Credit Bump

Currency Calculator