Abstract:This article gives you a complete, fair look at ZarVista (now called Zarvista Capital Markets as of September 2024). We'll examine what users say, check the company's legal status, and investigate the biggest problems users report. Our goal is to give you clear, factual information so you can make a smart decision based on evidence, not just marketing promises. We'll look at both the good services they offer and the serious issues you need to think about carefully.

What Traders Are Saying

People who trade foreign currencies (forex) are hearing more about ZarVista these days. Many are looking for honest reviews from real users. This is especially important because the company recently changed its name from ZaraFX. If you're looking for honest ZarVista opinions or want to learn about ZarVista problems, you're in the right place! Online discussions about this broker show both praise and serious complaints, which can be confusing for people thinking about using its services.

This article gives you a complete, fair look at ZarVista (now called Zarvista Capital Markets as of September 2024). We'll examine what users say, check the company's legal status, and investigate the biggest problems users report. Our goal is to give you clear, factual information so you can make a smart decision based on evidence, not just marketing promises. We'll look at both the good services they offer and the serious issues you need to think about carefully.

Major Warning Signs

When choosing a broker, the most important things are keeping your capital safe, proper government oversight, and honest business practices. In our study of ZarVista, we found major warning signs in these areas. This section brings together the most serious problems reported by users and found in public records. These aren't small annoyances but big risks that any potential trader must consider before investing. The following points show the main ZarVista problems discussed in the trading community.

Major Problem #1: Trouble Getting Your Capital Out

The most common and worrying complaint we found in ZarVista opinions is about difficulties withdrawing capital. This seems to happen regularly, not just occasionally. Traders report long delays and arguments when trying to get their capital and profits back, which is a major warning sign. We studied many user reports and found a clear pattern.

Based on community feedback, here are specific examples of withdrawal problems:

· Case Study 1: A user couldn't withdraw about $9,000 from their account. According to the report, the platform blocked the withdrawal, claiming the user used an Expert Advisor (EA), which the user said wasn't true. This suggests the company might make up reasons to keep your capital.

· Case Study 2: Many traders have documented their withdrawal requests staying “pending check” for long periods, with some waiting over 5 to 12 days without progress or clear communication.

· Case Study 3: When users contact customer service about delays, they often get unhelpful responses like “the relevant team is processing it.” This usually leads nowhere, leaving traders without their capital or a clear timeline.

The fact that these complaints appear on different platforms suggests a serious ongoing problem with how the broker handles withdrawals, which should worry any investor.

Major Problem #2: Weak Government Oversight

A broker's government license is the foundation of whether you can trust them and your main protection as a trader. ZarVista operates under licenses from offshore locations, which are widely known to offer weak protection for investors compared to top regulators like the FCA (UK) or ASIC (Australia).

We checked ZarVista's licenses and their risks:

· Comoros (MISA): The company has license T2023293 / HY00623401 from the Mwali International Services Authority. This is a weak offshore regulator with little international recognition, easy rules, and poor enforcement.

· Mauritius (FSC): Under the name Zara Trading Limited, the company is licensed by the Financial Services Commission of Mauritius (License GB23202450). A major warning with this regulator is that the FSC doesn't publicly list the website addresses of its licensed companies. This creates a serious risk because it's hard for traders to independently check if the website they're using is really run by the licensed company.

The direct results for traders under this system are serious. There's no investor protection fund to help clients if the broker goes bankrupt. Also, trying to get legal help in a dispute is extremely difficult and expensive because of the offshore location.

Given these regulatory concerns, traders must research using independent checking platforms, such as WikiFX, to verify a broker's regulatory status and complaint history before investing.

Major Problem #3: Government Investigations

Beyond user complaints and regulatory concerns, ZarVista, under its old name ZaraFX, has faced serious legal challenges. These events raise major questions about the company's compliance and legal operation in certain regions.

The most notable incident involves Indian authorities:

· Date: In August 2025, a significant enforcement action occurred.

· Action: India's Enforcement Directorate (ED) raided four office locations connected to ZaraFX. As a result, bank accounts containing about ₹39 million (around $445,000 USD) were frozen.

· Allegation: The investigation focused on claims of illegal forex trading platform operations and violations of India's strict currency regulations.

· Target: The ED's investigation specifically named the company's CEO, Jamsheer Thazhe Veettil.

In response, the company issued a statement denying it had any offices, subsidiaries, or operations in India and claimed it didn't market services to Indian residents. While this is the company's official position, the public record of an official investigation and asset freeze by a national enforcement agency remains a major red flag about the broker's trustworthiness and compliance.

Understanding ZarVista's Services

For a complete picture, we need to look at the services ZarVista offers on paper. An objective review of its account types, trading conditions, and platform technology gives context to user feedback. This helps traders weigh the broker's advertised features against the operational risks we've highlighted. ZarVista aims to serve different types of traders through various account levels and the standard MetaTrader platforms.

Account Types Overview

ZarVista offers four main account types, each designed for different levels of trading experience and capital. The broker also provides Swap-Free (Islamic) versions of these accounts and Demo accounts for practice.

Trading Conditions and Platforms

The trading environment is a key part of any broker's offering. ZarVista provides access to various instruments with a hybrid execution model.

Here's a summary of their trading conditions:

· Leverage: Up to 1:500 is available for forex pairs. This level is much lower for other assets like commodities (up to 1:100) and cryptocurrencies (1:10).

· Instruments: The platform offers over 350 tradable assets. This includes forex pairs, metals, indices, energies, and some cryptocurrencies. Notably, Stock CFDs are not available for trading.

· Execution: ZarVista uses a Market Execution model. This typically means a hybrid system that can work as a Market Maker, STP, or ECN broker, depending on the trade and account type.

· Spreads: All accounts operate on a floating spread basis, meaning trading costs change with market volatility.

For its trading interface, ZarVista relies on established third-party software and a proprietary social trading system:

· MetaTrader 5 (MT5): This is positioned as the main platform. It's known for advanced features, including 21 timeframes, 38 built-in indicators, and a better strategy tester for EAs.

· Social Trading: The broker has developed its own PAMM/MAM system for copy trading, allowing users to follow and copy other traders' strategies on the platform.

· Mobile App: ZarVista offers a mobile application for both Android and iOS. It's important to note that this app is for account management—monitoring statistics, transferring funds, and contacting support—and doesn't support direct trading.

A Range of User Opinions

The heart of our investigation lies in analyzing the wide range of ZarVista opinions. Community feedback is deeply divided, which itself can be a warning sign. While some users report satisfactory experiences, a significant and vocal group of traders reports severe problems. This sharp contrast requires careful examination, as it highlights an inconsistent and potentially unreliable user experience, especially regarding the most critical aspect of trading: accessing your funds.

The Positive Feedback

To present a balanced view, we must acknowledge the positive feedback some users have shared. These comments typically focus on the front-end aspects of the trading experience—the platform's usability and initial interactions with the company.

Users who have left positive reviews often appreciate the following:

· Platform Stability: Some traders praise the user-friendly nature and stability of the MT4 and MT5 platforms provided by ZarVista, reporting a smooth trading experience without technical problems.

· Responsive Support (Initial Contact): In some cases, users have noted that the customer support team is quick to respond to initial questions via live chat or email.

· Localized Services: The broker has received positive mentions for its localized support, particularly in the MENA region, where local deposit methods and dedicated support teams are available.

· Fast Withdrawals (for some): A small number of users report having successful and fast withdrawal experiences. This conflicting feedback creates a confusing and unpredictable picture regarding getting your capital back.

The Overwhelming Negative Feedback

Despite the positive comments, the negative feedback is more numerous, more detailed, and focuses on more critical issues. These aren't minor complaints about spreads or platform features; they are serious claims about fund safety and the broker's integrity.

The main themes in negative ZarVista opinions include:

· “This is a scam”: This extreme feeling is expressed by many users who feel they've been cheated. This label comes from experiences where they could not withdraw funds, especially after making profits.

· Withdrawal Obstruction: This is, by far, the most common and serious complaint. Users describe a pattern of delays, excuses, and ultimately, being unable to access their capital.

· Profit Issues: There are multiple reports of traders having their profits canceled or their accounts restricted or disabled shortly after earning, with the broker citing vague rule violations.

· Ineffective Customer Service: While some praise initial contact, many users complain that when faced with a critical issue like a stuck withdrawal, customer service becomes repetitive, unhelpful, and unable to provide any real solution.

· High Spreads: Some traders note that the actual trading spreads are not as competitive as advertised, especially compared to more established, top-tier brokers.

The sharp contrast between positive and negative opinions, especially about withdrawals, is a significant concern. To gauge current sentiment and see the latest complaints, prospective users should review real-time feedback on platforms like WikiFX.

Conclusion: Weighing the Evidence

After a thorough analysis of ZarVista's services, regulatory status, and the extensive body of community feedback, a high-risk profile emerges. While the broker presents a functional trading platform with various account types and features on paper, this is overshadowed by fundamental weaknesses in areas crucial for trader security. The decision to trade with any broker is ultimately personal, but it must be informed by a clear assessment of the risks involved.

Summary of High-Risk Factors

To conclude our findings, we've summarized the most critical disadvantages and risks associated with ZarVista. These points should be at the forefront of any trader's decision-making process.

· Weak Offshore Regulation: The broker's licenses from Comoros and Mauritius offer minimal investor protection and little to no practical legal help in the case of a dispute.

· Severe Withdrawal Complaints: The high number and consistent nature of user complaints about withdrawal delays and denials represent the most significant operational red flag.

· Official Legal Investigation: The 2025 asset freeze and investigation by India's Enforcement Directorate raise serious questions about the company's legality and compliance practices.

· No Investor Compensation Fund: If the company fails financially, client funds are not protected by a compensation scheme, meaning your entire investment is at risk.

· Low Trust Scores: Independent rating platforms reflect these risks. For instance, Traders Union has assigned ZarVista a low safety score of 4.86 out of 10, indicating a high-risk environment.

Our Final Perspective

The evidence suggests that while ZarVista may provide a usable trading interface for some, the operational and regulatory risks are substantial. The recurring, serious complaints about fund withdrawals cannot be ignored, as the ability to access your capital is the most basic requirement of a trustworthy broker. The combination of weak regulation and a history of legal scrutiny further increases these risks.

Before considering opening an account or depositing funds with any broker, especially one with the red flags discussed in this analysis, we cannot stress this enough: conduct your own independent verification. Visit a trusted third-party regulatory checker like WikiFX. There, you can examine their licenses, read unfiltered user reviews, and check for any new warnings. This is not just a recommendation; it is an essential step in protecting your capital.

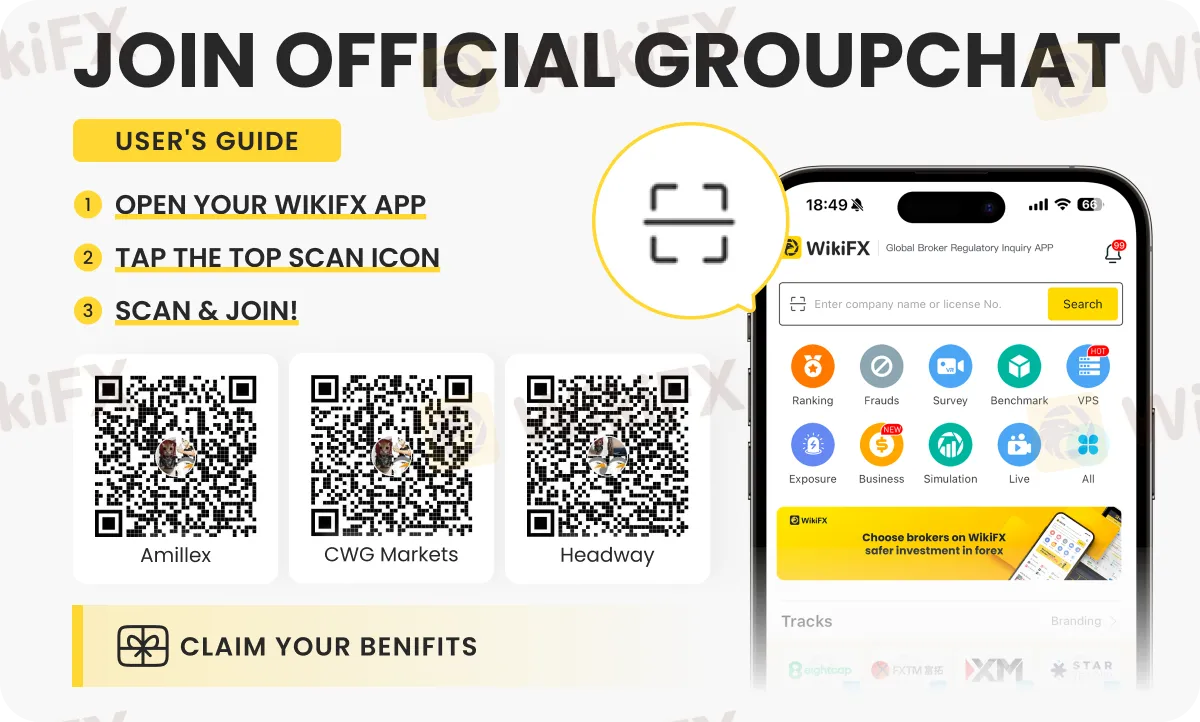

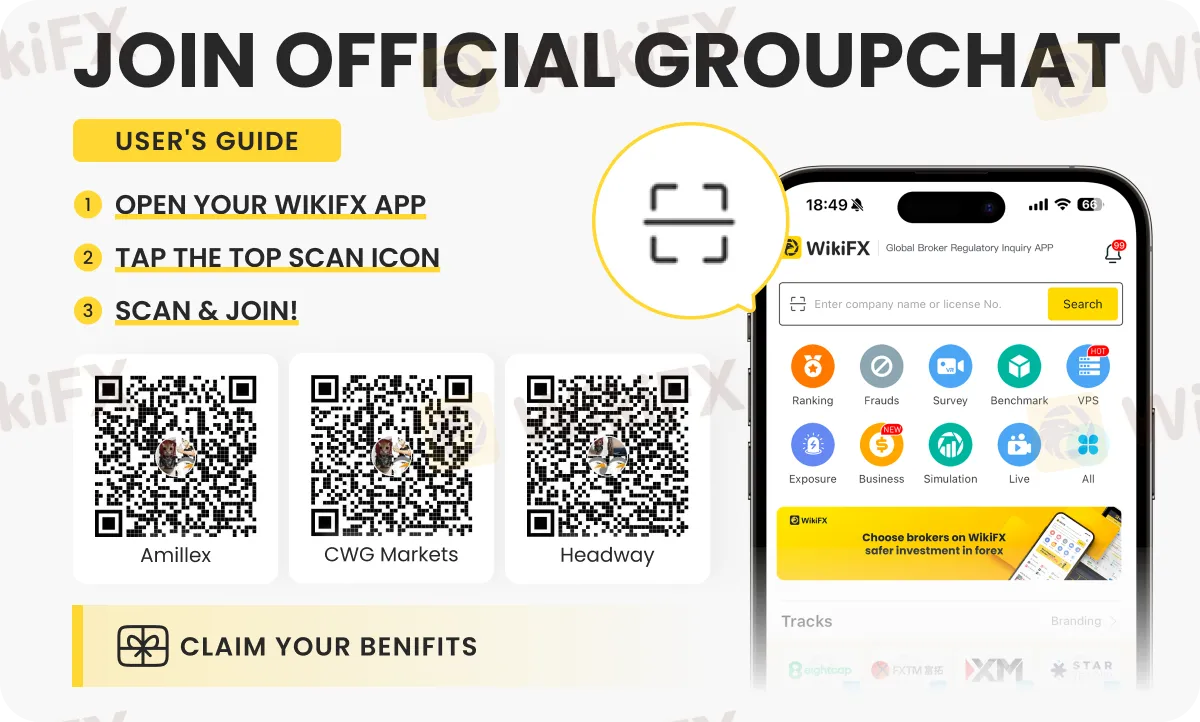

Want to be part of the group/s where everything is forex? Join these special chat groups (OIFSYYXKC3, 403M82PDMX or W2LRJZXB7G) by following the instructions shown below.