WikiFX Spring Festival Message | Grounded in Transparency, Walking with Trust

As the Lunar New Year approaches, renewal is in the air. It is a moment to bid farewell to the old, welcome the new, and reflect while moving forward.

简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Abstract:Want to invest in forex trading options? You should first learn the concept of foreign exchange options. A lot of traders remain unaware of it. Forex options serve as a great tool for investment diversification and hedging of a spot position. They can also be used to predict short or long-term market views as opposed to trading in the currency spot market.

Want to invest in forex trading options? You should first learn the concept of foreign exchange options. A lot of traders remain unaware of it. Forex options serve as a great tool for investment diversification and hedging of a spot position. They can also be used to predict short or long-term market views as opposed to trading in the currency spot market.

Initiating currency options trades is similar to those in equity options. Both new and experienced traders use basic FX option setups.

Basic forex trading options strategies often commence with plain vanilla options wherein the trader purchases an outright call or put option to put forward a directional view of the foreign exchange trading.

Besides a plain vanilla option, traders can create a spread trade, which may seem complicated at the beginning. However, with more practice, traders can get accustomed to this practice. Debit spread, also called bull call or bear put, showcases a trader confident of the direction at which the exchange rate will move. However, the trader plays it slightly safer by taking relatively less risk.

The credit spread trade works similarly to a debit spread trade. However, the currency option trader, instead of making the premium payment, looks to earn profit from the spread premium while maintaining a trade direction. This strategy can also be known as a bear call spread or bull put.

If traders remain neutral against the currency but anticipate a change in price volatility over the short term, they will likely formulate an option straddle strategy to capture a potential breakout move. It is slightly simpler to set up compared to debit or credit spread trades. In a straddle strategy, the trader is aware of the imminent breakout scenario but is not clear about the direction.

Limited Risk Exposure

The maximum possible loss is limited to the option premium, making the risk more predictable.

While risk is capped, the potential profit can grow significantly with favorable currency movements.

Options allow traders to hedge existing spot or futures positions, protecting against sudden market volatility.

Traders can use diverse strategies, such as calls, puts, straddles, and spreads, to accommodate different market conditions.

Forex options make it possible to earn from both bullish and bearish trends.

Unlike leveraged spot trades, buying options does not require maintaining margin positions.

With a small premium, traders can control larger positions, maximizing efficiency.

Options add variety to trading approaches, helping spread risks across instruments.

Options can be customized with different expiries, aligning with short-term or long-term trading goals.

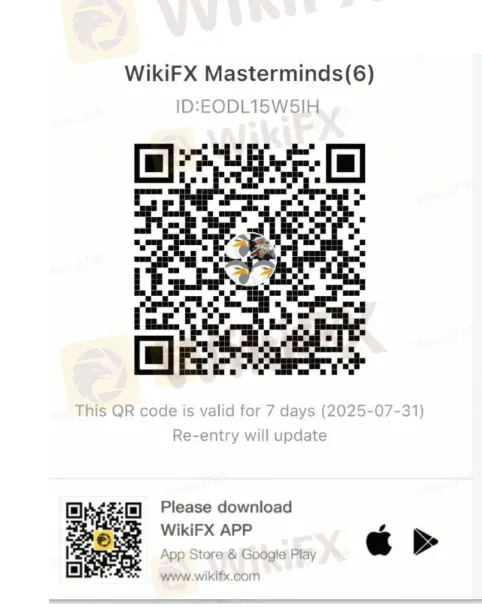

Want to Learn More About Forex? Connect with Our Experts on WikiFX Masterminds

Follow these steps to join the community.

1. Scan the QR code placed right at the bottom.

2. Download the WikiFX Pro app.

3. Afterward, tap the ‘Scan’ icon placed at the top right corner

4. Scan the code again.

5. Congrats, you have become a community member.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

As the Lunar New Year approaches, renewal is in the air. It is a moment to bid farewell to the old, welcome the new, and reflect while moving forward.

XSpot Wealth has found many negative comments from traders who have allegedly been deceived by the broker. Traders constantly accuse the broker of causing unnecessary withdrawal blocks and forcing them to continue depositing with it. Many user complaints emerged on WikiFX, a leading global forex regulation inquiry app. In this XSpot Wealth review article, we have investigated multiple complaints against the broker. Read on!

Did SEVEN STAR FX make unreasonable verification requests and block your forex trading account later? Did the broker prevent you from accessing fund withdrawals? Were you made to wait for a long time to receive a response from the broker’s customer support official? Have you had to seek legal assistance to recover your stuck funds? Well, these are some claims made by SEVEN STAR FX’s traders. In this SEVEN STAR FX review article, we have looked closely at the company’s operation, the list of complaints, and a take on its regulatory status. Keep reading to know the same.

When traders search for "Is ZarVista Safe or Scam," they want to know if their capital will be safe. Nice features and bonuses do not matter much if you can't trust the broker. This article skips the marketing talk and looks at real evidence about ZarVista's reputation. We want to examine actual user reviews, look into the many ZarVista Complaints, and check the broker's legal status to get a clear picture. The evidence we found shows serious warning signs and a pattern of major user problems, especially about the safety and access to funds. This report gives you the information you need to make a smart decision about this risky broker.