Company Summary

| Meiji Yasuda Review Summary | |

| Founded | 1986 |

| Registered Country/Region | Japan |

| Regulation | FSA |

| Product & Service | Asset management, services under investment advisory agreements and discretionary investment contracts |

| Customer Support | Phone: +81-3-6700-4058 |

| Address: OTEMACHI PLACE EAST TOWER, 2-3-2 Otemachi,Chiyoda-ku, Tokyo, 100-0004 Japan | |

Founded in 1986 and registered in Japan, Meiji Yasuda is a regulated financial firm overseen by the Financial Services Agency (FSA). Specializing in asset management, it offers services under investment advisory agreements and discretionary investment contracts.

Pros and Cons

| Pros | Cons |

| Regulated by FSA | Various fees charged |

| Good customer support |

Is Meiji Yasuda Legit?

Yes, Meiji Yasuda is regulated by FSA currently.

| Regulated Country | Regulated Authority | Regulated Entity | Current Status | License Type | License Number |

| Financial Services Agency (FSA) | 明治安田アセットマネジメント株式会社 | Regulated | Retail Forex License | 関東財務局長 (金商) 第405号 |

Products and Services

Meiji Yasuda provides clients with asset management products and services under investment advisory agreements and discretionary investment contracts.

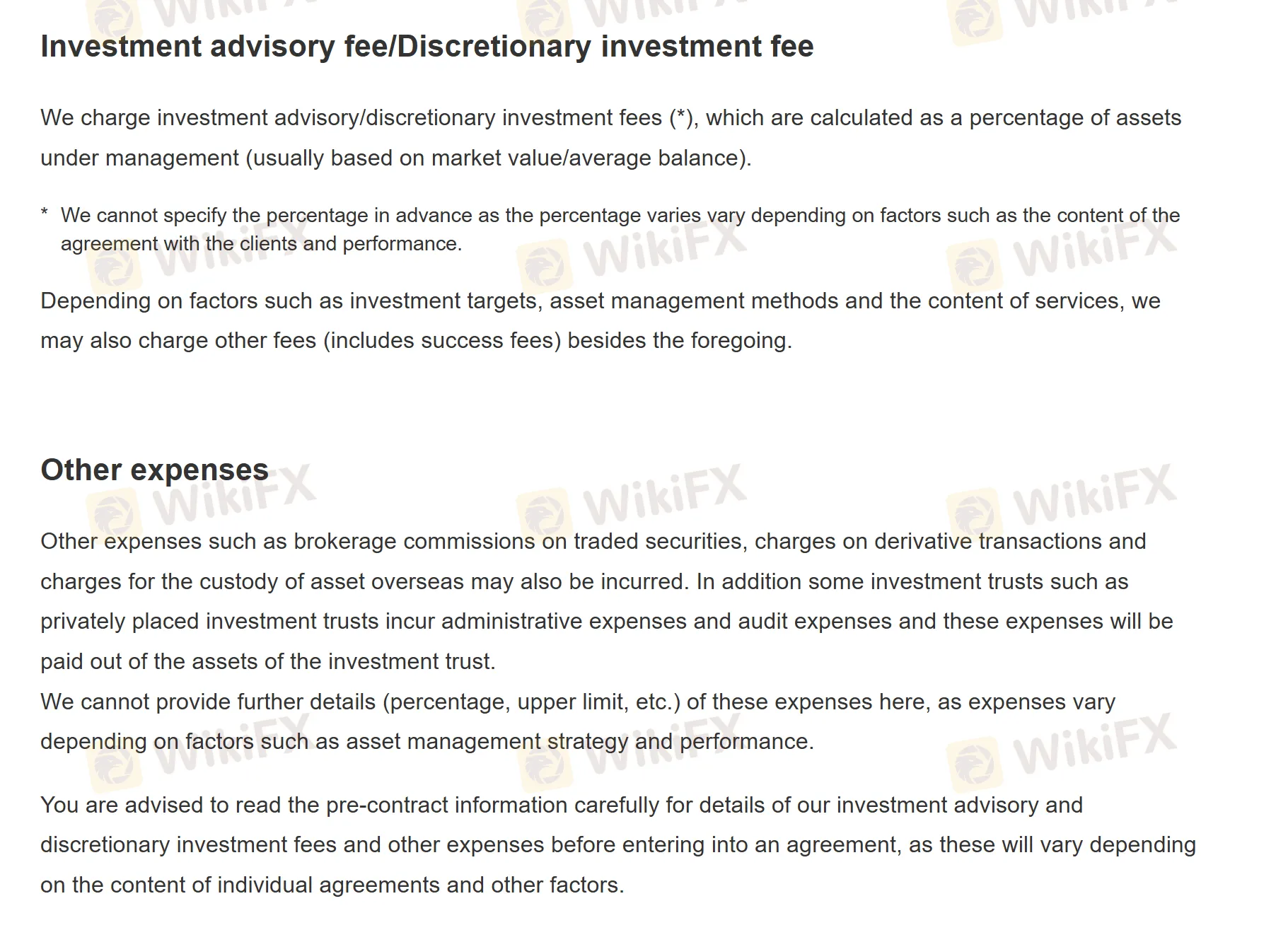

Fees

On Meiji Yasuda's website, we can only find descriptions about the types of fees but no exact figures. Details are as follows:

| Investment Advisory/Discretionary Investment Fees | Calculated as a percentage of assets under management (market value/average balance). |

| Percentage varies based on client agreement, performance, investment targets, asset - management methods, and service content. | |

| May include additional fees (e.g., success fees) | |

| Other Expenses | Includes brokerage commissions, derivative transaction charges, overseas asset custody charges. |

| Privately placed investment trusts may have administrative and audit expenses paid from trust assets. | |

| Specifics (percentage, upper limit) vary with asset - management strategy and performance. |

สมพง พระประแดง

Thailand

There was an invitation to trade foreign exchange. I checked it and found it had no license.

Exposure

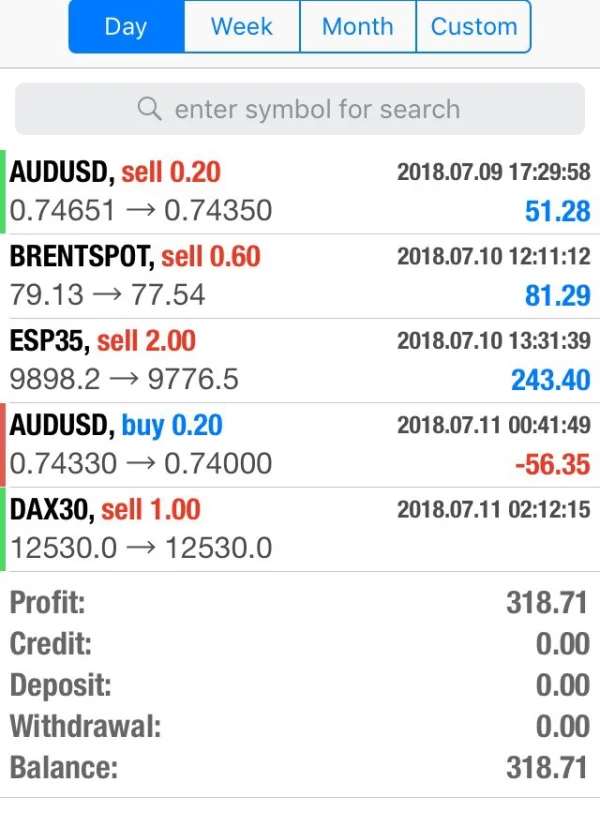

FX1478979502

Malaysia

Meiji Yasuda is a legit brokerage firm, no doubt about it. They've been around for ages, so you know they're doing something right. Their trading conditions are pretty good too - I don't feel like I'm getting ripped off every time I make a trade. But the downside is that their customer service is a bit of a mystery. There's not much info about it on their site, which can be frustrating. But overall, I'm happy with Meiji Yasuda and would recommend them to anyone looking for a solid broker.

Positive

kinder

Tunisia

Been trading with Meiji Yasuda for a while now and I gotta say, I'm impressed! They've got years of experience, so you know they've seen it all. Plus, they're regulated by the FSA, which gives me a lot of confidence in their reliability. The best part? Their fees are competitive, so I'm not losing money left and right. The only downside is that their website construction is a bit backward. But hey, if you want a solid broker that knows what they're doing, Meiji Yasuda is a great choice.

Positive

AA资治通鉴

Morocco

I am very impressed with this company! It has a long history, rich trading products, and is strictly regulated by the FSA... After all, safety is the most important thing.

Positive

Miguel Pinesela

Hong Kong

8 months into live trading and i dont see anything out of the ordinary, broker keeps up as advertised, good trading instruments, good process... Over all they are really good.

Positive