WikiFX Spring Festival Message | Grounded in Transparency, Walking with Trust

As the Lunar New Year approaches, renewal is in the air. It is a moment to bid farewell to the old, welcome the new, and reflect while moving forward.

简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Abstract:If you have invested or are planning to invest in Multibank Group, you must read this. Founded in California in 2005, the broker has grown into a global financial player. But alongside its two-decade history of expansion, it continues to grab headlines for operational flaws, scam allegations, and executive exits. In this article, we uncover its journey with a special focus on the South Asia market, including India and Pakistan.

If you have invested or are planning to invest in Multibank Group, you must read this. Founded in California in 2005, the broker has grown into a global financial player. But alongside its two-decade history of expansion, it continues to grab headlines for operational flaws, scam allegations, and executive exits. In this article, we uncover its journey with a special focus on the South Asia market, including India and Pakistan.

The group operates across 25 regions worldwide with different entities, serving its clients a host of financial products comprising forex, stocks, indices, commodities, cryptocurrencies, etc. The broker is regulated across five continents, including South East Asia, South Asia, and the Middle East. The entities by which Multibank Group operates across these regions are -

Multibank Group forayed into the Indian market with MEXD Worldwide Private Limited on August 30, 2024. Its official address in India is - 5/588, Vikas Khand, Gomti Nagar, Gomtinagar, Lucknow, Lucknow, Uttar Pradesh, India, 226010. The India operation is headed by Courtney Fitzsimmons (Executive Director, MEXD Worldwide) and Santhosh Kumar Kollipara (Head of Operations, MEXD Worldwide).

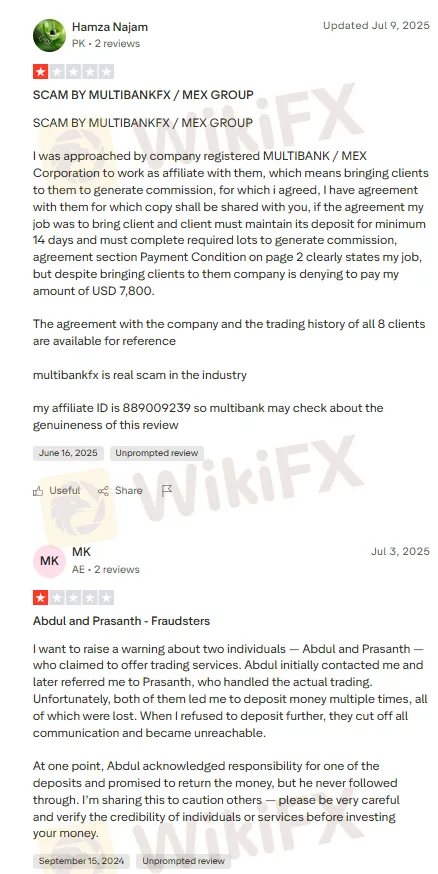

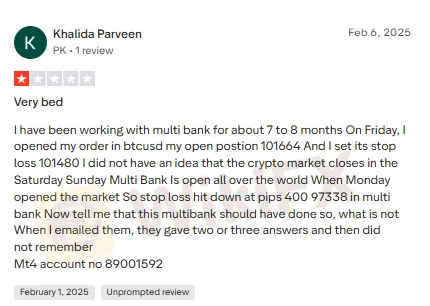

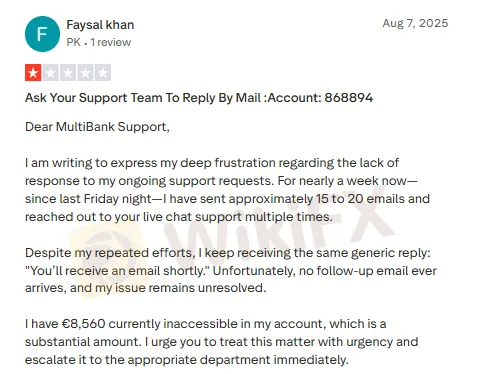

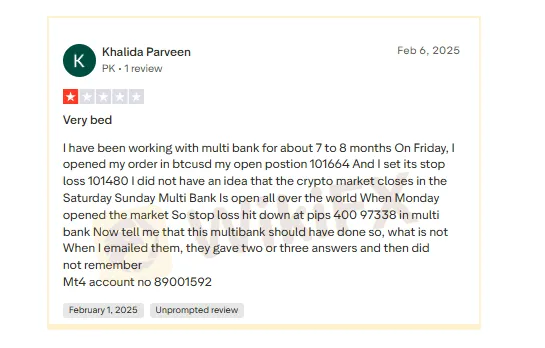

Although it does not have any office in Pakistan, people here are not so cool about Multibank Group. Some of them have alleged the group to have piled losses for them using manipulative forex trading tricks. Here are some who have expressed their utter frustration over the trading fiasco at Multibank Group.

Multibank Group posted a revenue of $209 million during the first half of 2025, registering a 20% growth compared to 2024. On the other hand, the India operation, as of now, has an authorized and paid-up capital of INR 1 lakh each. Through India, Multibank Group has been operating a global crypto exchange, regulated by the Financial Intelligence Unit (FIU) - India, since August 2024.

The group intends to establish a strong local presence in India, navigate its banking and compliance frameworks, and leverage its expertise in computer programming for related technology and consulting services, including AI integration.

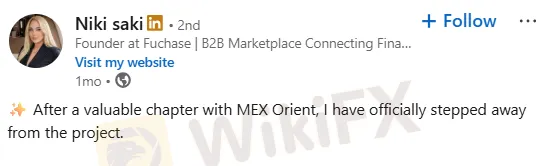

The group has witnessed the departure of top executives holding critical positions over the last couple of years. The worst part is that they departed way sooner than expected. Sharing some of the quick departures the group witnessed recently.

Niki Saki resigned as Chief Executive Officer, MEX Orient, just six months after she joined the Dubai-based venture, through a LinkedIn post.

Roman Krutyanskiy quit as the Chief Business Development Officer, Multibank Group, just 11 months after he joined it. Interestingly, his previous journey with Admirals, an Industry-leading currency pair and CFD broker, as Chief Sales and Service Officer lasted 11 years.

Multibank Chief Data Officer Mahmoud Hammoud quit within two years of the companys Dubai-based office.

These departures indicate that not all is RIGHT at Multibank Group.

Multibank Group faces investor ire for the misdoings committed by its executives on several products. However, their predominant manipulations in forex trading grab more eyeballs.

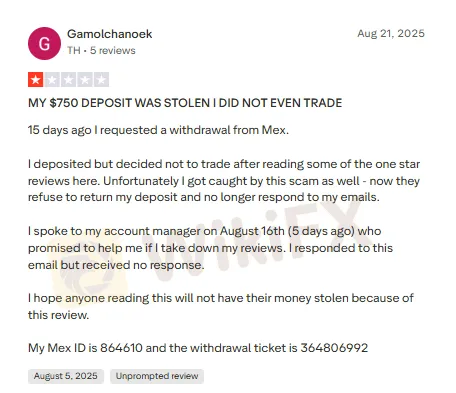

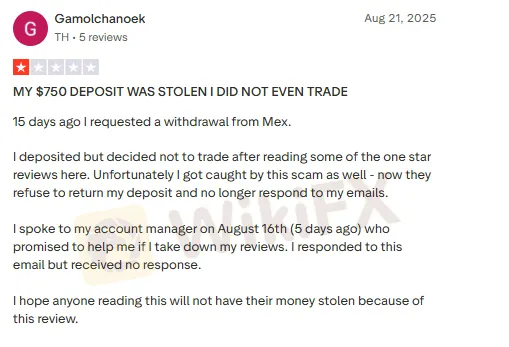

Multibank Group has committed countless scams on forex. These include scamming an investor who deposited $750. As per his claims, he did not trade after watching several 1-star reviews. However, the fund was utilized by MEX for an illicit purpose, resulting in the investor losing it. MEX refused to return the deposit amount to the investor. The screenshot below showcases the pain the investor underwent.

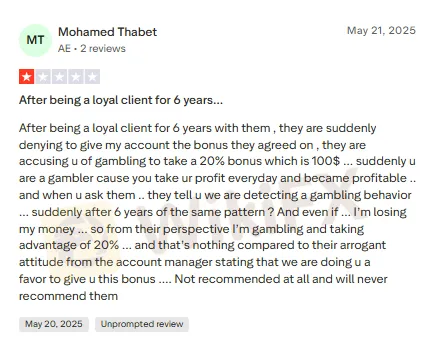

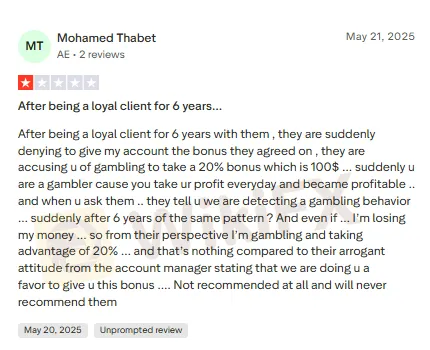

Retaining loyal clients does not seem to be on the brokers agenda. Recently, one of its clients, who has been trading with it for six years, accused Multibank Group of denying the bonus it agreed to share. Here is what the trader claimed.

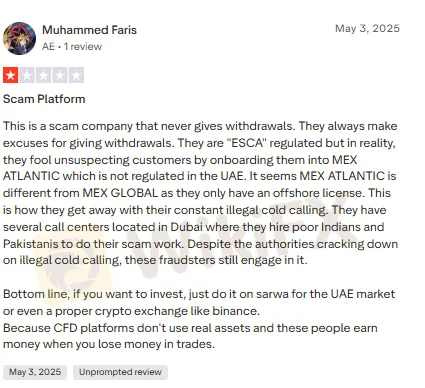

Clients, especially in the Middle East, have been the most affected by Multibank Group. It often denies them withdrawal access by giving plenty of excuses. Frustrated by long pending withdrawal requests, one client labelled it a Scam Platform and wrote a long, negative review of the broker. Take a look!

Recently, it is found that some fake recruiters are scamming applicants using a malicious crypto poker linked to Multibank Group. The poker contains remote code execution, broker authentication, and wallet harvesting. Applicants are asked to deploy this code as part of a job test. The code hacks credentials and wallet data, leaving applicants shocked.

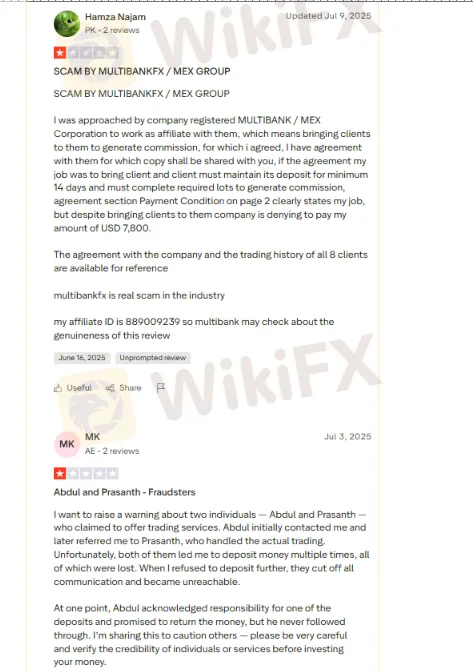

While searching for the latest updates on the MultiBank Group, we came across several recent negative reviews that raise serious concerns. A growing number of users are strongly criticizing the broker for delayed withdrawals, poor customer support, and a variety of unresolved issues. If you're considering trading with MultiBank, you must read these user experiences to stay cautious.

We found a recent user review that highlights serious concerns about the brokers withdrawal practices and customer support. On August 21, 2025, a user reported requesting a withdrawal 15 days earlier after deciding not to proceed with trading. When the user asked the account manager for assistance. The manager asked the user first remove negative comments he had posted. After complying, the user received no further support and still did not receive their funds.

Another, two user experiences paint a troubling picture of MultiBanks customer service and withdrawal practices. In both cases, users report persistent delays, lack of meaningful support, and serious difficulties accessing their own funds — one citing over €8,560 being held without resolution, and the other alleging manipulative tactics and excessive withdrawal fees.

Multiple user reviews raise serious concerns about MultiBank Groups operations. Common issues include delayed withdrawals, poor customer support, and unresponsiveness. One user reported that while deposits are processed instantly, withdrawals take 7–14 days. Another experienced unexpected losses due to unclear trading conditions and received limited assistance afterward. A third, an affiliate, claims the company refused to pay a $7,800 commission despite a valid agreement and meeting all terms.

Another review raises serious questions about the credibility of MultiBank Group‘s representatives. Users warned about individuals named Abdul and Prasanth, who encouraged multiple deposits that were ultimately lost. After refusing to deposit further, the user was cut off, and a promised refund was never delivered raising concerns about the credibility of these individuals. Another user criticized the broker’s poor customer service and lack of withdrawal options, urging others to stay away.

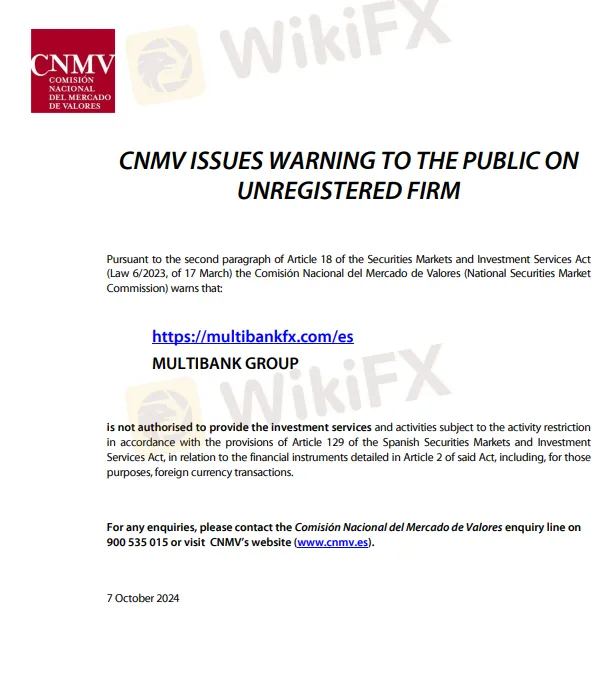

In 2022, the Spanish financial regulator CNMV (Comisión Nacional del Mercado de Valores) cancelled the license of MultiBank Group (MBG). Previously, the company was listed as “Supervised” by the CNMV, meaning it was authorized to offer investment services in Spain. However, its status was changed to “No Longer Authorised,” which means the firm either lost its license or chose to stop offering financial services in the Spanish market.

Yes, MultiBank Group, the parent company of MEXD Worldwide, is currently active in India. It operates a local branch in Gomti Nagar, Lucknow, Uttar Pradesh, under the Corporate Identification Number (CIN) U62099UP2024FTC208582. The company was incorporated with the Ministry of Corporate Affairs (MCA) on August 30, 2024, making it 11 months and 30 days old as of today. However, as of now, it has no local branch in Pakistan.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

As the Lunar New Year approaches, renewal is in the air. It is a moment to bid farewell to the old, welcome the new, and reflect while moving forward.

XSpot Wealth has found many negative comments from traders who have allegedly been deceived by the broker. Traders constantly accuse the broker of causing unnecessary withdrawal blocks and forcing them to continue depositing with it. Many user complaints emerged on WikiFX, a leading global forex regulation inquiry app. In this XSpot Wealth review article, we have investigated multiple complaints against the broker. Read on!

Did SEVEN STAR FX make unreasonable verification requests and block your forex trading account later? Did the broker prevent you from accessing fund withdrawals? Were you made to wait for a long time to receive a response from the broker’s customer support official? Have you had to seek legal assistance to recover your stuck funds? Well, these are some claims made by SEVEN STAR FX’s traders. In this SEVEN STAR FX review article, we have looked closely at the company’s operation, the list of complaints, and a take on its regulatory status. Keep reading to know the same.

When traders search for "Is ZarVista Safe or Scam," they want to know if their capital will be safe. Nice features and bonuses do not matter much if you can't trust the broker. This article skips the marketing talk and looks at real evidence about ZarVista's reputation. We want to examine actual user reviews, look into the many ZarVista Complaints, and check the broker's legal status to get a clear picture. The evidence we found shows serious warning signs and a pattern of major user problems, especially about the safety and access to funds. This report gives you the information you need to make a smart decision about this risky broker.