WikiFX Spring Festival Message | Grounded in Transparency, Walking with Trust

As the Lunar New Year approaches, renewal is in the air. It is a moment to bid farewell to the old, welcome the new, and reflect while moving forward.

简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Abstract:Wondering what does equity mean in forex trading? You are at the right place! It simply indicates the traders the capital they have currently to trade. Equity is arrived at after adding current profits to the trading balance. In case the trade witnesses losses, they will be subtracted from the trading balance. Upon the closure of all trades, your trading balance is your equity.

Wondering what equity means in forex trading? You are at the right place! It simply indicates to traders the capital they currently have to trade. Equity is arrived at after adding current profits to the trading balance. In case the trade witnesses losses, they will be subtracted from the trading balance. Upon the closure of all trades, your trading balance is your equity.

For instance, you are in a USD/JPY trade, and the platform shows a profit worth 500 Euros. Now the same thing also shows up in equity. The balance would demonstrate the amount you had while opening the trade. The equity would, however, show an adjusted amount.

For example, you begin the trade with $10,000 and currently have a profit of $500. Your trading account balance would be $10,000. However, the forex equity would be $10,500. As the system knows about your intent to close the trade at any time and further your balance, it calculates before you finally do it.

Equity number, which signifies the balance resulting from active trades, keeps varying with the change in currency pair prices. At the same time, equity includes additional fees. For example, by keeping an open position overnight, you allow the swap fee to get deducted from your equity.

The first deposit you make is placed on your trading balance. Upon opening a trade, equity indicates a change in the trading balance in real time. As the trade closes, the equity remains the trading balance. Forex trading runs on leverage, which allows traders to borrow funds from brokers to enhance their currency purchasing power. Here comes the concept of a margin. So, what is a margin? A margin allows traders to figure out the extent of additional trades traders can open.

You can find equity on the trading terminal you use, whether it is MT4, MT5 or any other. Usually, it is displayed at the bottom of trading platforms.

Several traders commit a mistake by focusing too much on equity numbers. Understand that markets dont bother about the capital you need. Raising the invested capital requires understanding price action, technical and fundamental analysis besides checking equity.

Several traders open single positions and keep looking at equity numbers, hoping that the price moves positively. Such actions are bound to negatively impact your trading balance. Do not make a single trade so significant that you concentrate solely on it. You witness the best trading experience by analyzing the markets, opening trades amid the emergence of great opportunities, and begin looking for other opportunities while still possessing active orders.

Most traders usually glance at their balance and equity. If equity is found to be lower than balance, they do not close orders until both become equal at least. These traders often refuse to accept losses and opine to move out of the trade once they are even. As a result, they move or remove stop loss orders or increase their trading positions. Adding to a losing position will likely draw you to more losses and blown-up accounts.

Summing Up

Equity in forex is more than just a number—it reflects your real-time trading strength and exposure. While it helps you track profits, losses, and available margin, it should never become the only factor driving your decisions. Smart traders understand that equity works hand in hand with balance, margin, and risk management. Instead of obsessing over fluctuations, focus on strategy, discipline, and market analysis. In the long run, managing equity wisely can be the difference between consistent profits and blown-up accounts.

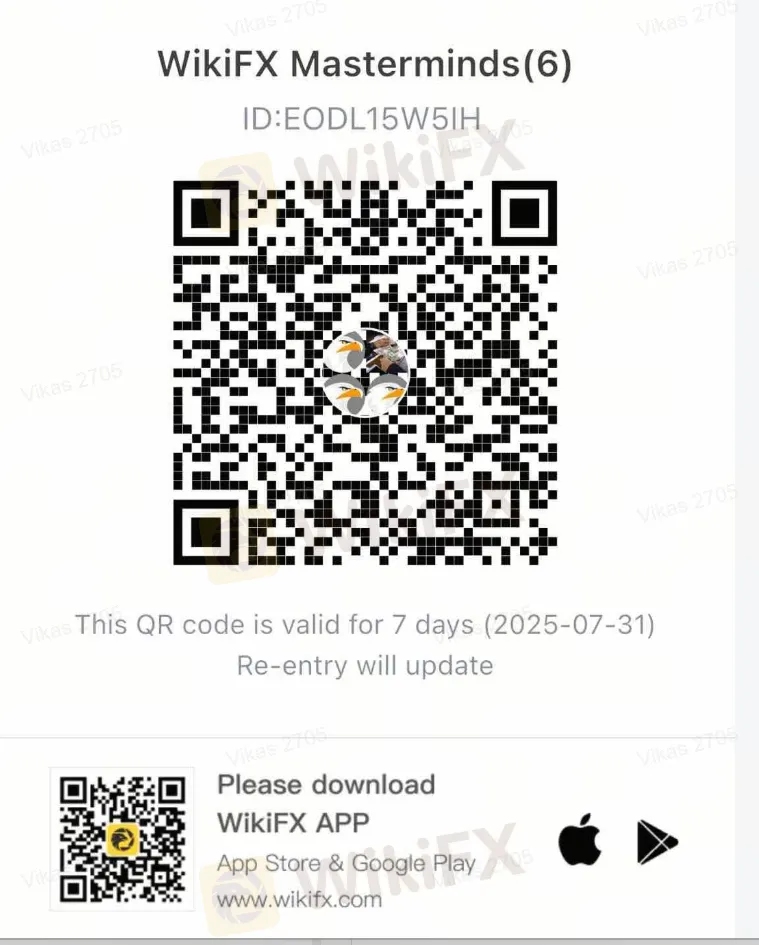

Join WikiFX Masterminds - Where Everything is Forex

Join it by following the steps shown below.

1. Scan the QR code placed right at the bottom.

2. Download the WikiFX Pro app.

3. Afterward, tap the ‘Scan’ icon placed at the top right corner

4. Scan the code again.

5. Congrats, you have become a community member.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

As the Lunar New Year approaches, renewal is in the air. It is a moment to bid farewell to the old, welcome the new, and reflect while moving forward.

XSpot Wealth has found many negative comments from traders who have allegedly been deceived by the broker. Traders constantly accuse the broker of causing unnecessary withdrawal blocks and forcing them to continue depositing with it. Many user complaints emerged on WikiFX, a leading global forex regulation inquiry app. In this XSpot Wealth review article, we have investigated multiple complaints against the broker. Read on!

Did SEVEN STAR FX make unreasonable verification requests and block your forex trading account later? Did the broker prevent you from accessing fund withdrawals? Were you made to wait for a long time to receive a response from the broker’s customer support official? Have you had to seek legal assistance to recover your stuck funds? Well, these are some claims made by SEVEN STAR FX’s traders. In this SEVEN STAR FX review article, we have looked closely at the company’s operation, the list of complaints, and a take on its regulatory status. Keep reading to know the same.

When traders search for "Is ZarVista Safe or Scam," they want to know if their capital will be safe. Nice features and bonuses do not matter much if you can't trust the broker. This article skips the marketing talk and looks at real evidence about ZarVista's reputation. We want to examine actual user reviews, look into the many ZarVista Complaints, and check the broker's legal status to get a clear picture. The evidence we found shows serious warning signs and a pattern of major user problems, especially about the safety and access to funds. This report gives you the information you need to make a smart decision about this risky broker.