OANDA to Transfer Prop Trading Business to FTMO Platform

After FTMO’s acquisition of OANDA, the transfer of the OANDA Prop Trader service to the FTMO platform begins.

简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Abstract:Before you invest your money with any forex or CFD broker, reading online reviews is a must. Why? Because reviews can expose hidden red flags and help you avoid falling into a scam. This article is a must-read SOHO Markets review

Before you invest your money with any forex or CFD broker, reading online reviews is a must. Why? Because reviews can expose hidden red flags and help you avoid falling into a scam. This article is a must-read SOHO Markets review whether you're still choosing a broker or have already signed up. Staying informed is one of the most powerful ways to protect yourself.

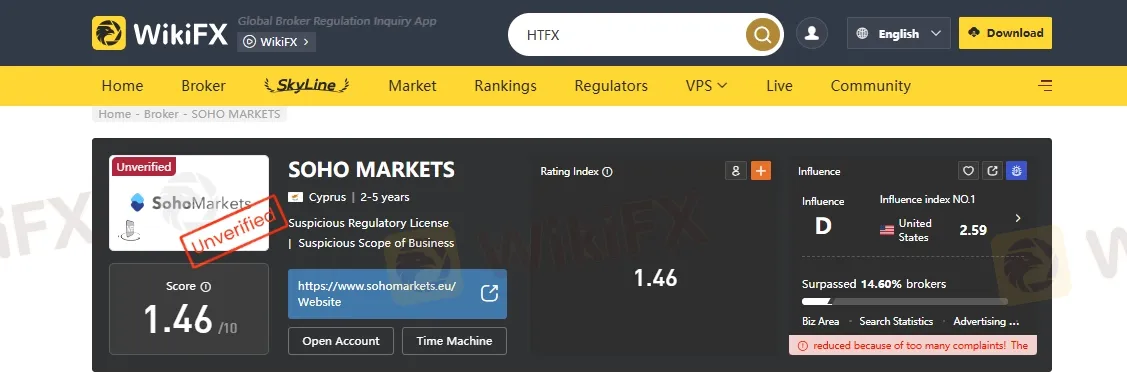

1. Poor Rating – 1.46/10 on WikiFX

SOHO Markets has a very low rating of just 1.46 out of 10 on WikiFX, a well-known platform that reviews brokers. This low score is a big warning sign. It suggests the broker might not have proper licenses, isnt fully transparent, and may not do enough to protect its users. In short, it may not follow important rules that keep traders safe.

2. Weak Regulation – Not Licensed by Trusted Authorities

One major red flag is that SOHO Markets is only regulated by CySEC (Cyprus), which isn't as strict or trusted as top regulators like the FCA (UK), ASIC (Australia), or FINMA (Switzerland). This means there‘s less oversight and fewer protections for your money. SOHO Markets is the trade name of Vstar & Soho Markets Limited. Brokers without strong regulation often work in legal grey areasand in the worst cases, they disappear with your funds. If a broker isn’t properly licensed, can you really trust them with your money?

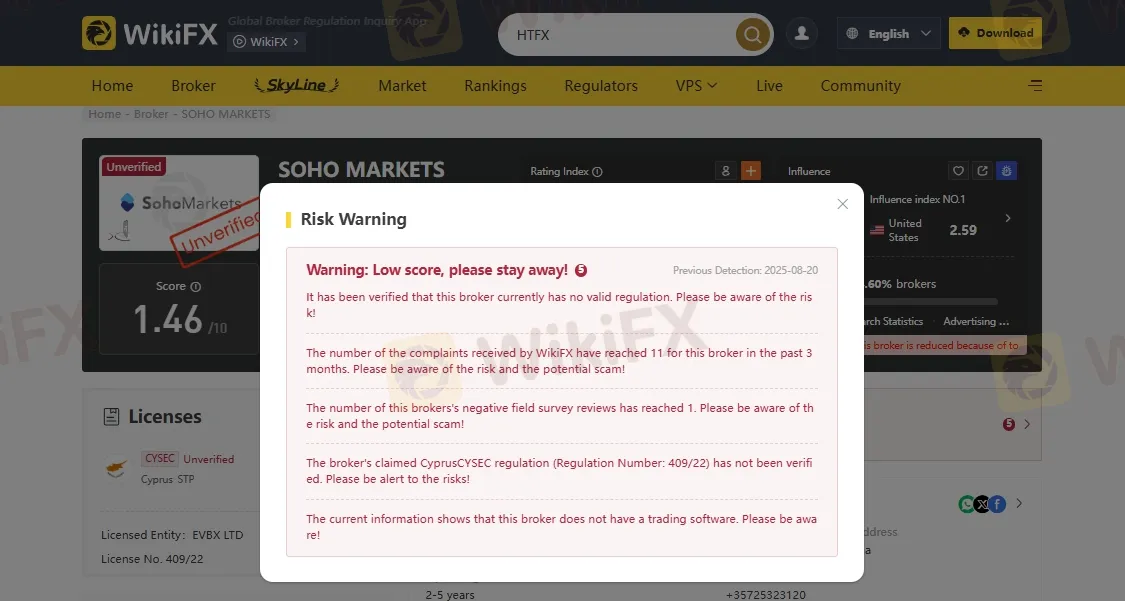

3. Warning Issued by WikiFX

SOHO Markets has been flagged by WikiFX, a well-known third-party platform that reviews and rates forex brokers. When a broker receives a warning from WikiFX, it's typically due to unverified regulation claims, poor user feedback, or suspicious activities. WikiFX issued warnng stating –

Warning: Low score, please stay away!

It has been verified that this broker currently has no valid regulation. Please be aware of the risk!

The number of the complaints received by WikiFX have reached 11 for this broker in the past 3 months. Please be aware of the risk and the potential scam!

The broker's claimed CyprusCYSEC regulation (Regulation Number: 409/22) has not been verified. Please be alert to the risks!

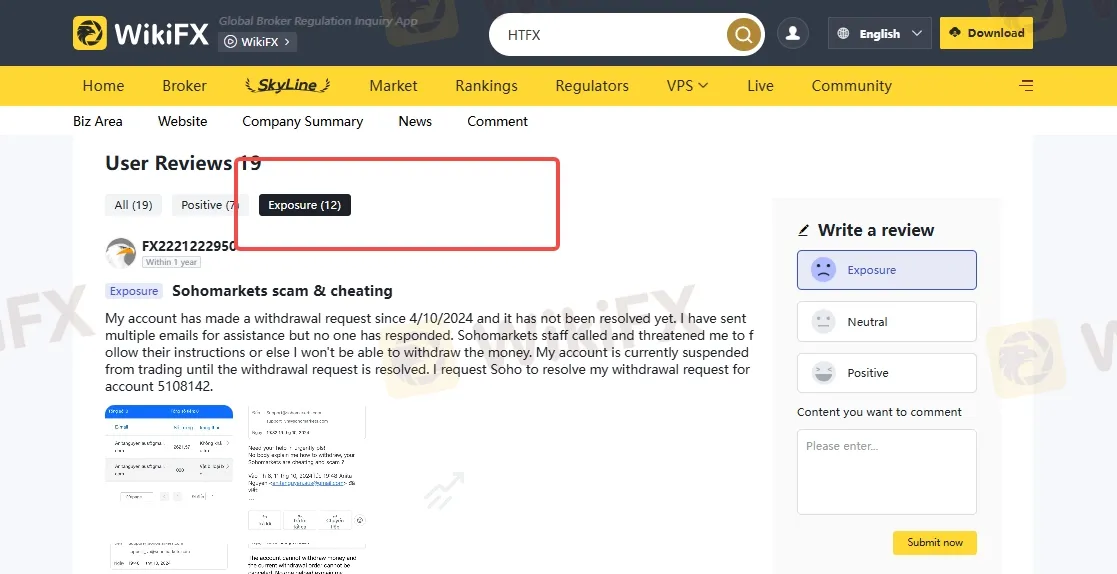

4. Unhappy Users Review

While searching for SOHO Markets, We found on WikiFX that many users are sharing negative experiences with SOHO Markets. The most common complaints include withdrawal issues, account restrictions, and wallet blocking. Some traders even claim that the broker is a scam, accusing it of cheating and manipulating trades. In some cases, users reported that their orders were canceled without their permission. With this many red flags from real customers, can you afford to take the risk?

Do not miss this article- www.wikifx.com/en/newsdetail/202508201164149430.html

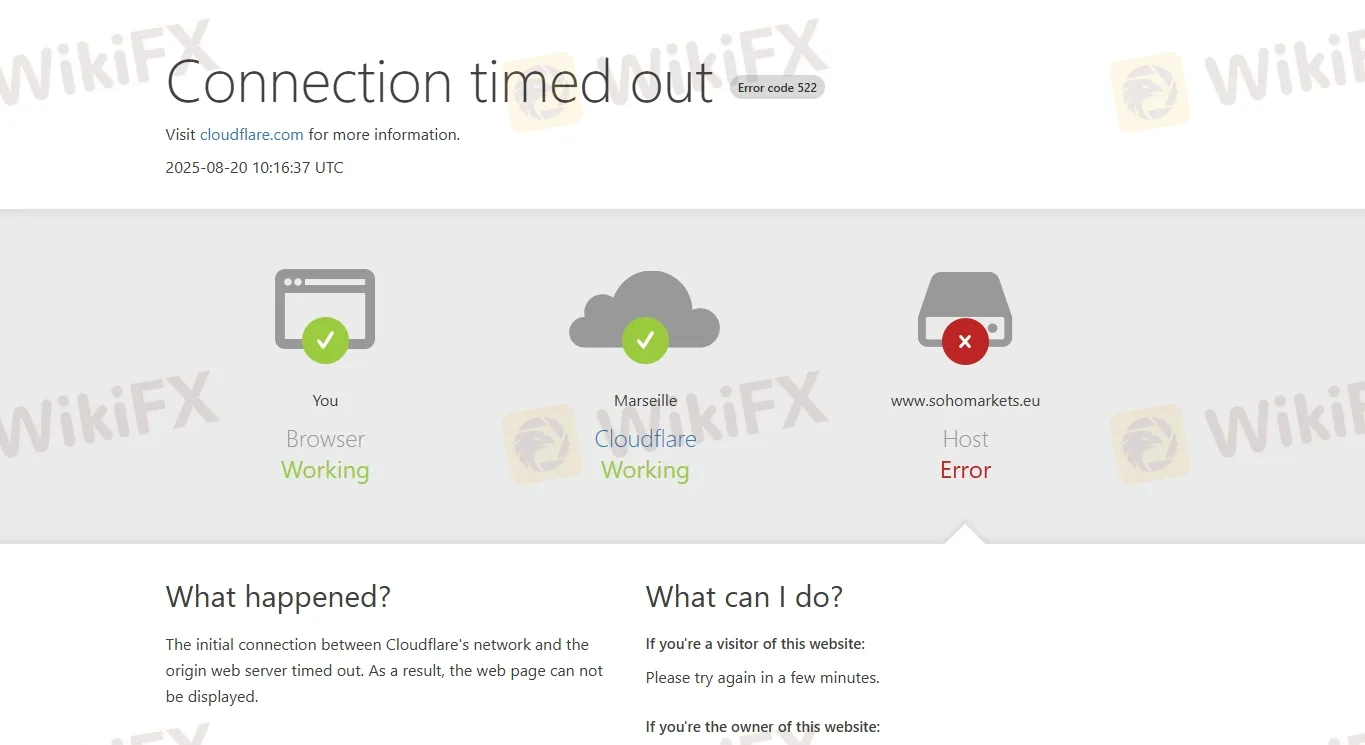

5. Frequent Error Codes

Technical issues and error codes are not just inconvenient — theyre dangerous in fast-moving financial markets. Users have reported system crashes, login failures, and platform errors while trading with SOHO Markets. Inadequate technical infrastructure not only impacts your trades but also signals poor platform management.

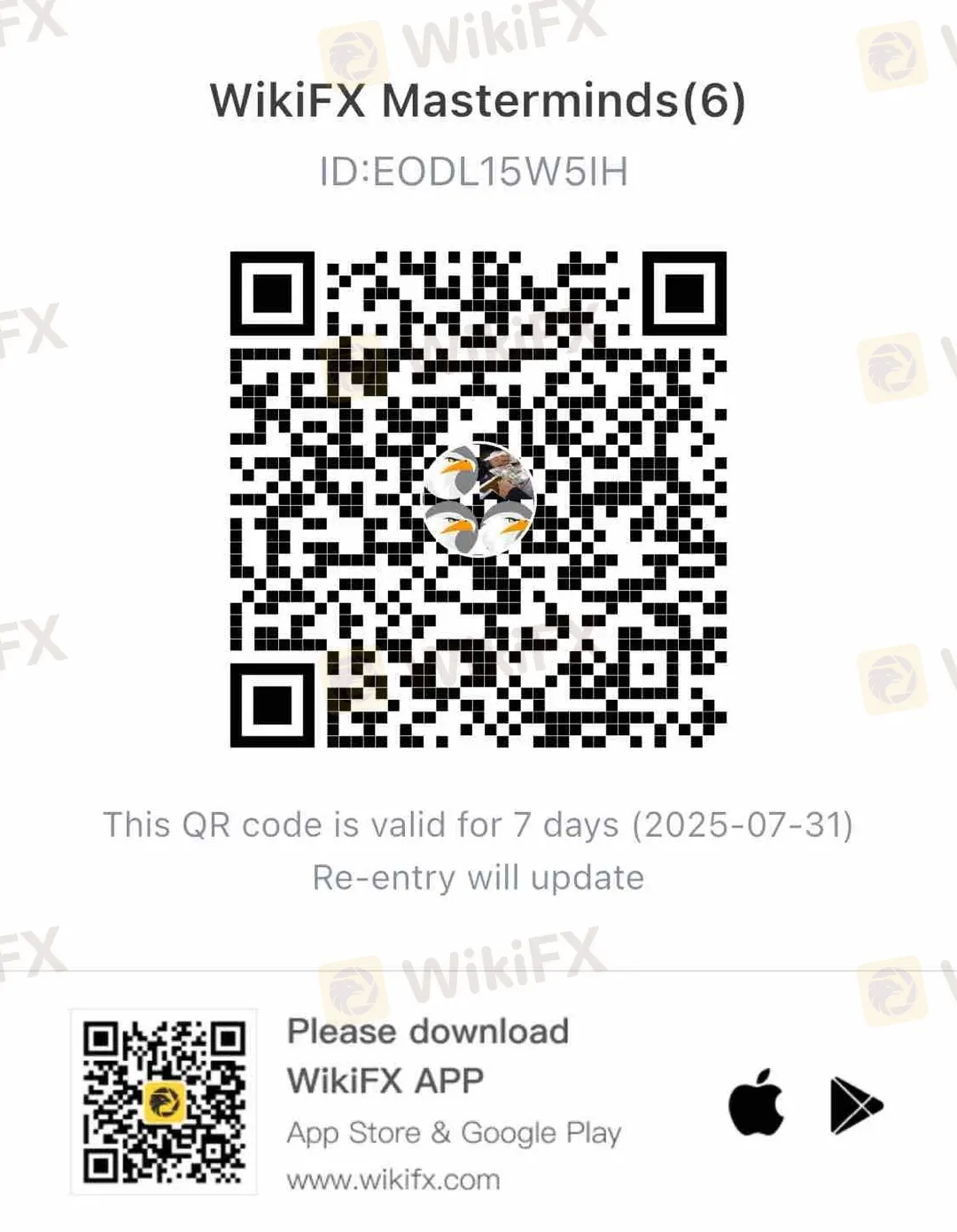

Join WikiFX Community

Be attentive and stay updated with WikiFX. You can get all the information you need to know about the Forex market, fraud alerts, and the latest news related to Forex trading — all in one place. Join the WikiFX Community by scanning the QR code at the bottom.

Steps to Join

1. Scan the QR code below

2. Download the WikiFX Pro app

3. After installing, tap the Scan icon at the top right corner

4. Scan the code again to complete the process

5. You have joined!

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

After FTMO’s acquisition of OANDA, the transfer of the OANDA Prop Trader service to the FTMO platform begins.

1x Trade scam: traders report that profits are being seized and withdrawals are being blocked. Review evidence and secure your funds now.

ACY Securities exposure: dozens of forex scam cases show withheld funds and account blocks; read reports, document losses, and stop deposits today.

FxPro, a United Kingdom-based forex broker, has been facing severe allegations concerning fund withdrawal issues, illegitimate account freezes, trade manipulation, and poor customer support. These allegations have been doing the rounds on several broker review platforms such as WikiFX. In this FXPro review article, we have examined these allegations for you to look at. Keep reading to learn how the broker allegedly worsened traders’ experiences.