1x Trade Review Exposed: Withdrawal and Bonus Tricks

1x Trade scam: traders report that profits are being seized and withdrawals are being blocked. Review evidence and secure your funds now.

简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Abstract:Is your forex trading experience at KOT4X filled with trade losses, deposit lure, withdrawal denials, and account blowups due to injudicious use of margin? We empathize with you and many other traders who face these issues with this scam forex broker. Some of you got so disappointed that you rightfully criticized the broker on several review platforms. In this article, we have shared such painful experiences. Take a look!

Is your forex trading experience at KOT4X filled with trade losses, deposit lure, withdrawal denials, and account blowups due to injudicious use of margin? We empathize with you and many other traders who face these issues with this scam forex broker. Some of you got so disappointed that you rightfully criticized the broker on several review platforms. In this article, we have shared such painful experiences. Take a look!

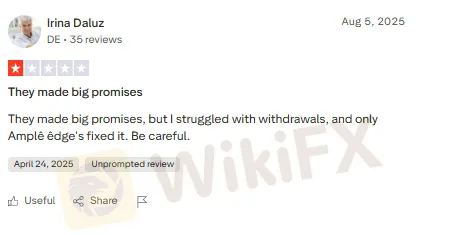

KOT4X promises so much about the impeccable service it has for traders. However, that does not turn out in real time. It is alleged to have fooled traders into depositing before scamming them. Here is one screenshot where a trader has made such a claim. Besides, there is one trader who admitted to having lost everything. However, the recovery happened eventually.

Traders are usually lured into depositing funds by KOT4X executives who use fake means to convince them. However, all these are a well-thought-out strategy to deceive traders by blocking their withdrawals. The screenshot below conveys this problem.

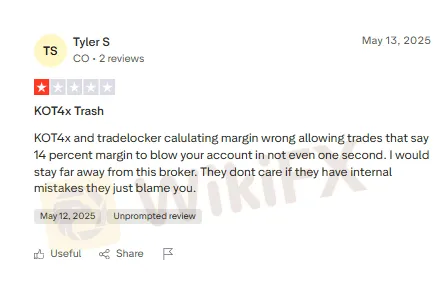

Trade manipulation, which runs deep at KOT4X, often makes investors suffer losses. However, not owning their mistakes and rather blaming traders has become so normal here. A trader, whose screenshot is placed below, has admitted that the account was wiped out in no time due to the wrong margin calculation.

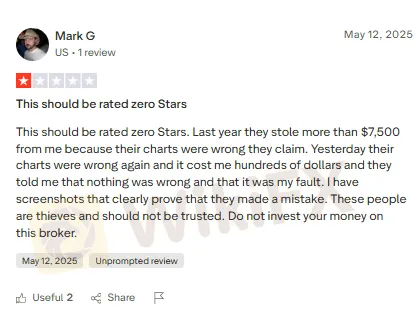

Now, this is a massive allegation and not called for! A trader complained that he was allegedly defrauded for around $7,500 by KOT4X last year. The company gave an excuse of a wrong chart in defence. The trader had to bear further losses a year later because of the same wrong chart excuse. Here are the words of the trader.

The problem lies in the lack of transparency that is expected from an unregulated broker such as KOT4X. The Saint Vincent and the Grenadines-based forex broker has failed to gain a forex broker license despite being in this landscape for more than five years. Imagine the numerous traders who would have been duped by it during this period. As a result, the WikiFX team could not give KOT4X any more than 1.56 out of 10. Time for this broker to improve its operations.

Coming to the growing WikiFX Masterminds community, where forex updates take centre stage

Want to join it? Follow these steps -

1. Scan the QR code placed right at the bottom.

2. Download the WikiFX Pro app.

3. Afterward, tap the ‘Scan’ icon placed at the top right corner

4. Scan the code again.

5. Great, you have become a community member.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

1x Trade scam: traders report that profits are being seized and withdrawals are being blocked. Review evidence and secure your funds now.

ACY Securities exposure: dozens of forex scam cases show withheld funds and account blocks; read reports, document losses, and stop deposits today.

FxPro, a United Kingdom-based forex broker, has been facing severe allegations concerning fund withdrawal issues, illegitimate account freezes, trade manipulation, and poor customer support. These allegations have been doing the rounds on several broker review platforms such as WikiFX. In this FXPro review article, we have examined these allegations for you to look at. Keep reading to learn how the broker allegedly worsened traders’ experiences.

Exclusive Markets review highlights weak offshore regulation and rising scams, including unpaid withdrawals. Multiple exposures demand caution—verify before trading.