Mazi Finance Scam Exposure: A Warning to Indian Traders

Latest India Mazi Finance scam: Failed XAUUSD execution despite margin, costing $675—fake “insufficient balance” excuse. Protect funds, read the full report now!

简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Abstract:When selecting a broker, understanding its regulatory standing is an important part of assessing overall reliability. For traders seeking to protect their capital, ensuring that a platform operates under recognised and stringent oversight can make all the difference. Keep reading to learn more about Juno Markets and its licenses.

When choosing a broker, regulation is often the first line of defense for any trader. In the case of Juno Markets, what may appear at first to be a well-established trading company reveals a number of concerning facts upon closer inspection. Although the broker holds some regulatory credentials, several red flags regarding its licensing status and offshore presence should not be overlooked.

While it does hold an Institution Forex Licence (STP) from the Australian Securities and Investments Commission (ASIC) under licence number 540205, this specific authorisation is restricted to institutional business only. This means that the broker cannot legally open accounts for individual retail traders under this licence, limiting the direct consumer protection benefits that ASIC regulation is known for.

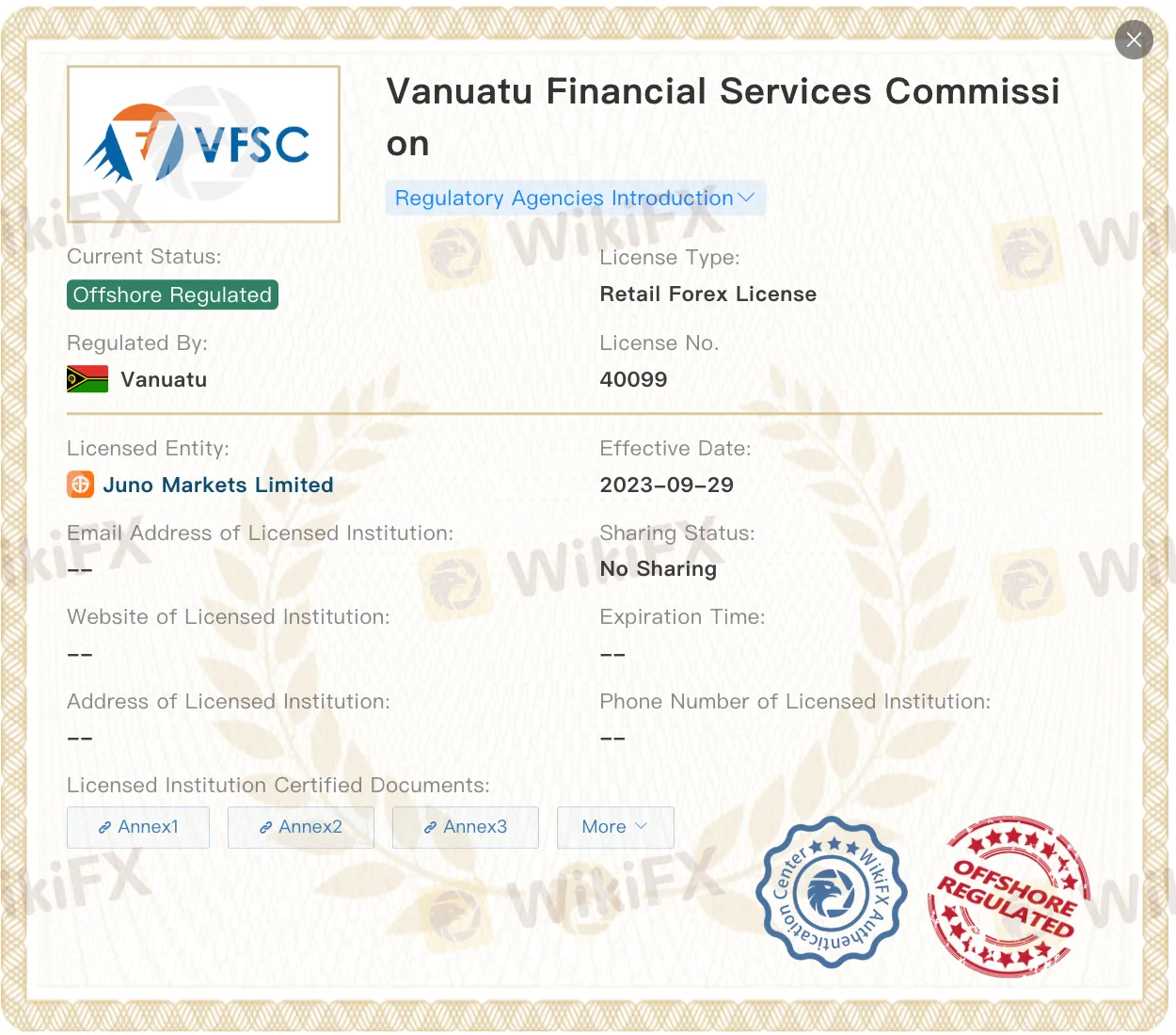

For retail accounts, Juno Markets possesses a licence from the Vanuatu Financial Services Commission (VFSC), number 40099. While this is a legal licence, the VFSC is an offshore regulator with lighter rules than ASIC or other top-tier authorities. Offshore regulation often has weaker investor protection, leaving traders with fewer options if disputes or problems arise.

Further complicating the picture is the fact that Juno Markets has been publicly disclosed by the Securities Commission Malaysia, an indication that Malaysian authorities have flagged its activities. Such disclosures often serve as cautionary notices, advising investors to proceed carefully due to potential compliance or authorisation concerns.

According to WikiFX, a platform that reviews brokers based on their regulatory background, platform operations, and user safety, Juno Markets scores just 5.94 out of 10. While this does not confirm that the broker is a scam, it certainly places it in a relatively riskier category that traders should approach with caution.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Latest India Mazi Finance scam: Failed XAUUSD execution despite margin, costing $675—fake “insufficient balance” excuse. Protect funds, read the full report now!

Does Pemaxx prevent you from withdrawing funds once you make profits? Has the Mauritius-based forex broker disabled your trading account upon your withdrawal request? Do you fail to withdraw funds despite meeting the trading lot requirements? These scam-like trading activities have allegedly become a part of the broker’s operation, as many traders have complained about them online. In this Pemaxx review article, we have highlighted their comments against the forex broker. Keep reading!

Did Fortune Prime Global deduct all your profits by accusing you of market manipulation? Are you struggling to access withdrawals for months? Has the forex broker disabled your forex trading account upon the withdrawal application? Does the broker stipulate tax payments as a condition for fund withdrawals? You are not alone! In this Fortune Prime Global review article, we have highlighted these complaints. Read on!

WikiFX is launching the "Safe Trade with WikiFX" exclusive interview series, featuring members of the WikiFX Elite Club. This series delivers in-depth industry insights on trading safety, the establishment of industry standards, and regional market dynamics, aiming to foster deeper understanding of local markets and jointly advance transparency across the industry.