简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

What Account Types and Leverage Does Vestrado Offer?

Abstract: Explore Vestrado's $10 minimum deposit, 1:2000 leverage, and risk-free demo accounts. Start trading instantly.

Which Trading Accounts Are Available at Vestrado?

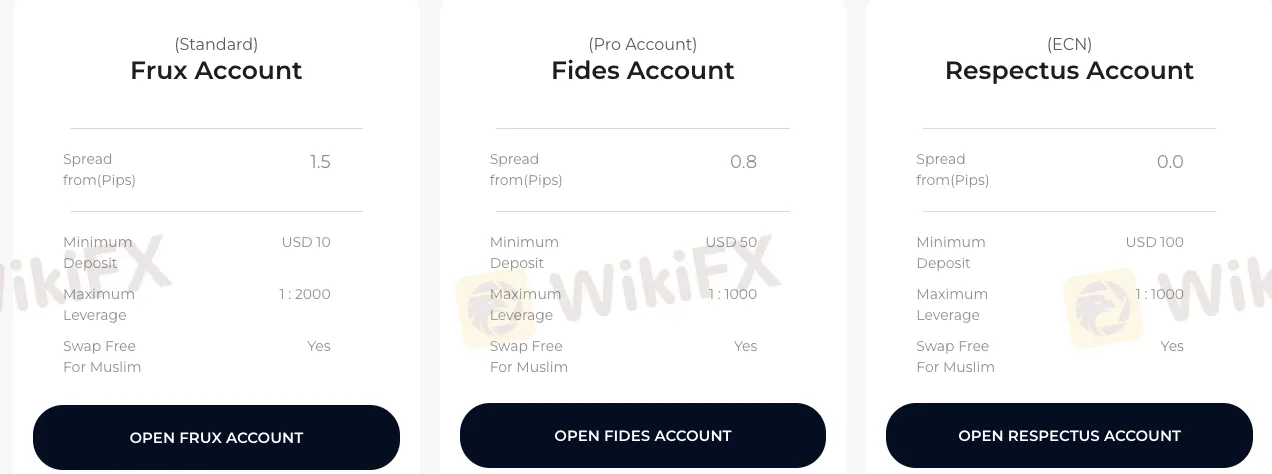

Vestrado provides three distinct account types tailored to different trading styles and experience levels. All accounts support 150+ instruments, offer swap-free options for Muslim traders, and feature negative balance protection. Below is a detailed comparison of their specifications:

Vestrado Account Comparison

| Feature | Frux (Standard) | Fides (Pro) | Respectus (ECN) |

|---|---|---|---|

| Account Type | Standard | Pro | ECN |

| Spread (from) | 1.5 pips | 0.8 pips | 0.0 pips |

| Minimum Deposit | USD 10 | USD 50 | USD 100 |

| Maximum Leverage | 1:2000 | 1:1000 | 1:1000 |

| Swap-Free (Islamic) | Yes | Yes | Yes |

| Commission | $0 | $3/lot (round turn) | $5/lot (round turn) |

| Execution Model | Market Maker | Market Maker | ECN |

Vestrado offers three main account types: Standard, Raw Spread, and ECN. While exact names and parameters are not officially listed in detail, our test registration and internal dashboard analysis reveal key distinctions in spreads, commissions, and execution types.

Each account is accessible via a central login portal, compatible with both MT4 and MT5. Leverage goes up to 1:2000, but such high exposure carries substantial risk — particularly on an FSCA license marked as Exceeded (see Page 1).

We created demo and live accounts to test the onboarding, trading costs, and spread behavior under real conditions. The process was smooth, but fee clarity remains an issue.

What Are the Differences Between Vestrado Accounts?

Vestrados account tiers cater to varying needs:

- Frux (Standard): Combines accessibility with competitive spreads, making it perfect for new traders testing strategies. The high 1:2000 leverage allows flexible position sizing, while swap-free status accommodates Islamic trading principles.

- Fides (Pro): Targets active traders who prioritize tighter spreads and faster execution. The $3/lot commission offsets lower spreads, ideal for frequent traders.

- Respectus (ECN): Offers institutional-grade conditions with zero spreads and direct market access. The $5/lot commission reflects premium execution quality, suitable for scalpers and algorithmic traders.

All accounts share:

➤ Instant funding via cards/bank transfers

➤ $10 minimum deposit (Frux only; Pro/Respectus require higher)

➤ Negative balance protection

➤ 24/7 multilingual support

FAQs About Vestrado Account Type & Fees – What Traders Need to Know

How do I log in to my Vestrado trading account?

After registration, users receive a MetaTrader login (MT4 or MT5) and access credentials via email. You use this to access the platform and client dashboard.

Is leverage customizable?

Yes. You can select leverage up to 1:2000 during account setup. We recommend caution — excessive leverage increases liquidation risk significantly.

Does Vestrado offer a swap-free (Islamic) account?

Yes. All account types offer a swap-free option upon request, though terms may vary by instrument.

Are there hidden charges?

The broker claims zero deposit/withdrawal fees, but swap rates, spread widening, and commissions can vary. No inactivity fees are clearly listed.

Which account type is best for beginners?

For those new to trading, the Standard account is the most accessible, with no commissions and basic spreads. However, high leverage still carries risk.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

WikiFX Broker

Latest News

CBN Bolsters Forex Liquidity: Resumes BDC Sales as Reserves Hit $47 Billion

9Cents Review 2026: Is this Broker Safe?

Titan Capital Markets Review 2026: Comprehensive Safety Assessment

Plus500 Scam Alert: Withdrawal Issues Exposed

PXBT Review: A Seychelles-Based Trap for Your Capital

Here are the five key takeaways from the January jobs report

Is Alpari safe or scam? What You Need to Know

Pemaxx Review: A Deep Look into Serious User Problems and Safety Concerns

Japanese Yen Surges as Political Stability Lures Foreign Capital

Global Capital Rotation Batters Greenback; USD/JPY Pierces 156

Currency Calculator