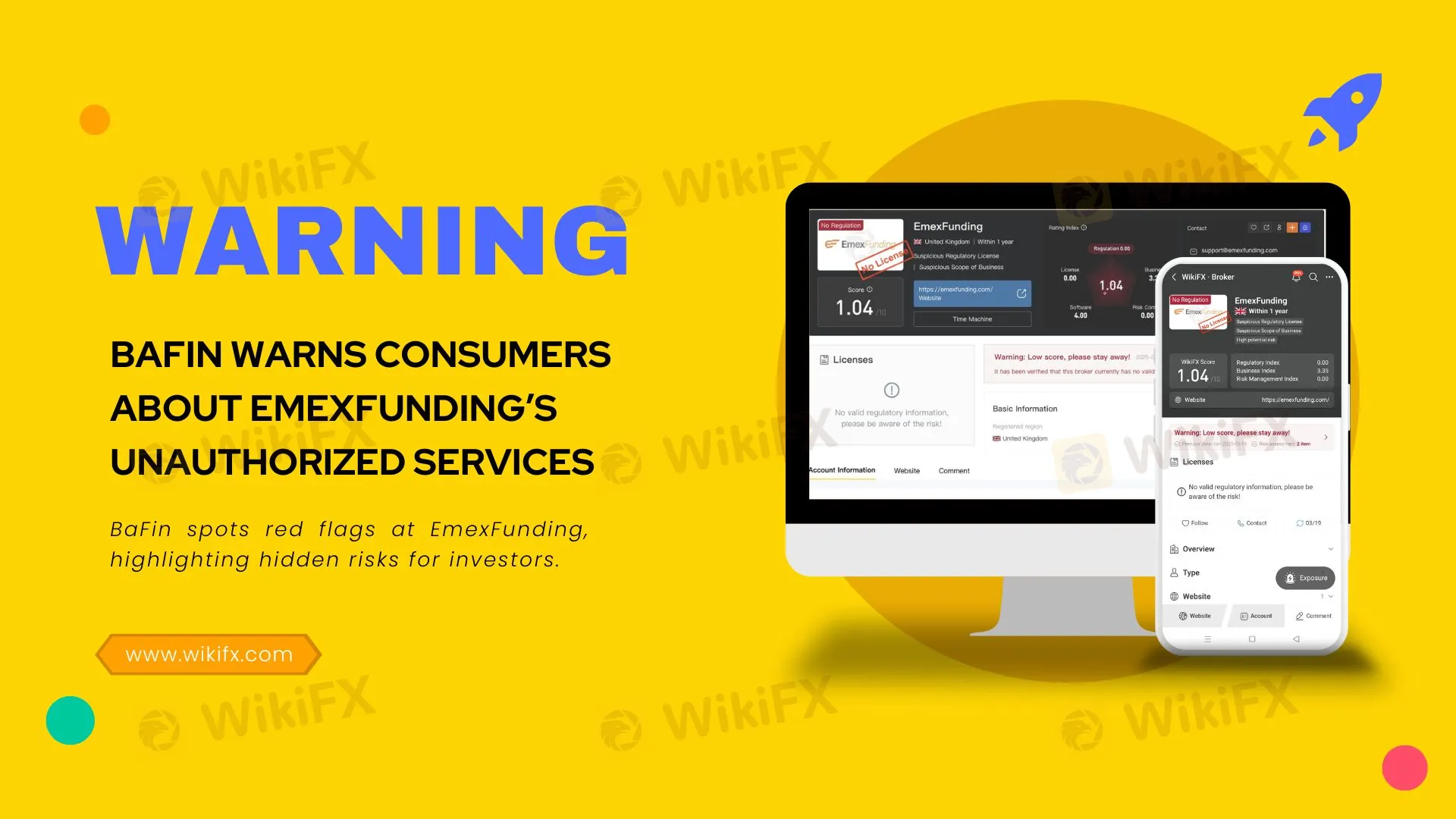

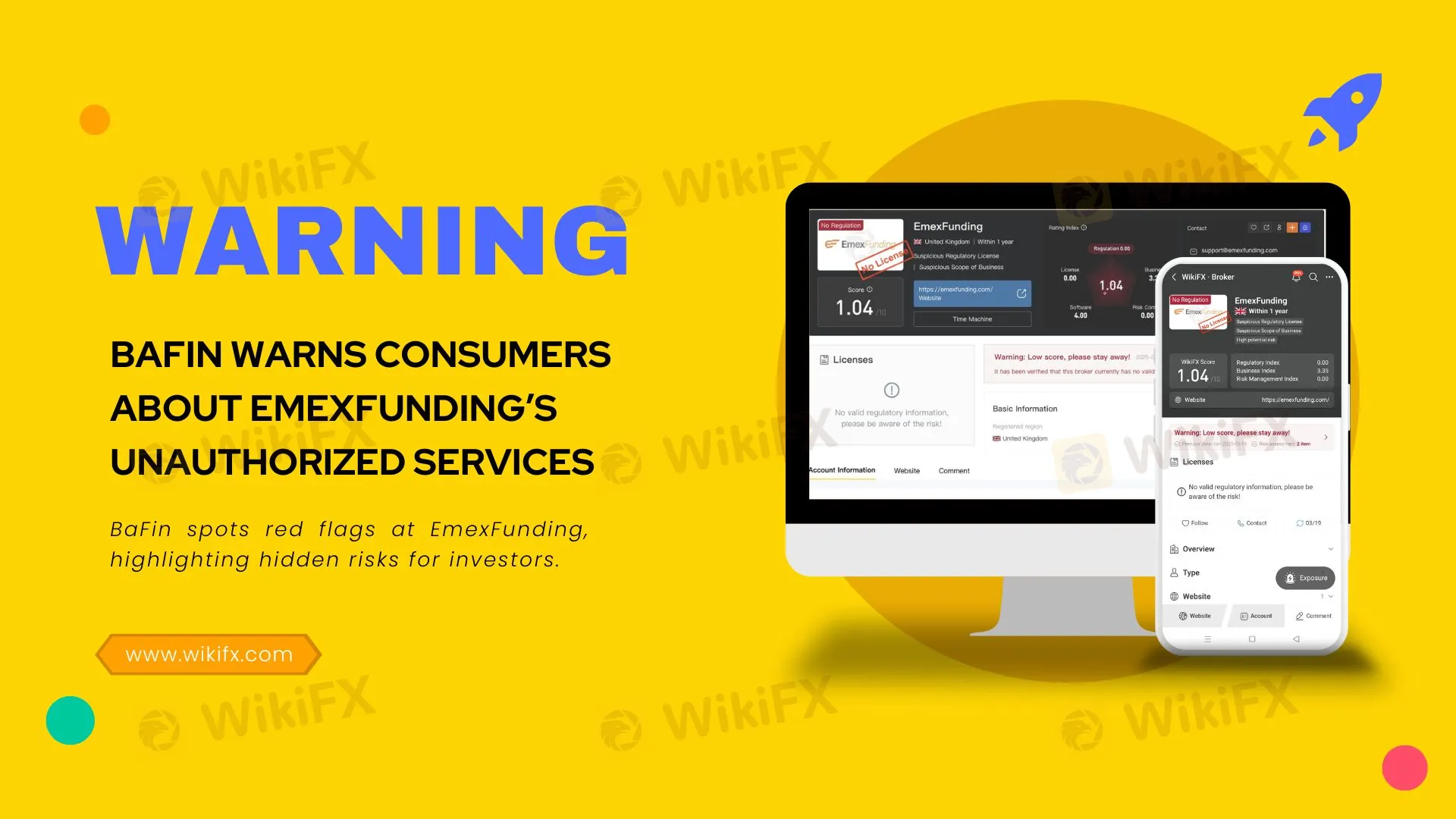

Abstract:BaFin spots red flags at EmexFunding, highlighting hidden risks for investors.

The German Federal Financial Supervisory Authority (BaFin) has issued a critical consumer alert about the activities of EmexFunding, an unauthorized financial services provider operating through the website emexfunding.com.

BaFin's investigation revealed that EmexFunding, whose operators remain unidentified, is offering financial, investment, and cryptocurrency services without the necessary regulatory permissions. The company falsely operates under the business name “EmexFunding GmbH,” claiming its registered office is in Corby, United Kingdom. However, official records verify that such a company does not exist, indicating a clear attempt to mislead potential customers.

A significant concern raised by BaFin involves EmexFunding's promotion of a so-called “Handelskreditvertrag” (trading credit agreement). Through this misleading document, the firm encourages consumers to secure loans specifically for trading financial products and cryptoassets on its platform. Such tactics pose considerable risks, potentially leading consumers into substantial financial losses and debt.

Under German legislation—including the German Banking Act (Kreditwesengesetz - KWG) and the German Cryptomarkets Supervision Act (Kryptomärkteaufsichtsgesetz)—entities must obtain explicit authorization from BaFin to offer financial or investment-related services. EmexFunding lacks such authorization, rendering its operations unlawful and exposing investors to significant risks.

Additionally, a search conducted through the regulatory verification platform WikiFX corroborates BaFin's concerns. WikiFX reports EmexFunding as having no valid regulatory licenses and assigns it a notably low reliability rating, further emphasizing the dangers of engaging with this unauthorized provider.

BaFin strongly advises investors to perform thorough due diligence by consulting official regulatory databases and trusted platforms such as WikiFX before committing funds to any financial service providers. Engaging with unauthorized companies such as EmexFunding can result in limited legal protections and the inability to recover invested funds.