Abstract:Forex broker comparison tools, like WikiFX, offer users reliable, in-depth information on various brokers, evaluating them based on factors such as regulation, trading conditions, and platform features. These tools aim to help traders make informed decisions, ensuring a safer and more efficient trading experience when selecting a forex broker.

Introduction

With daily trading amounts surpassing $6 trillion, the foreign exchange (FX) market is the biggest and most active financial market in the world. It's essential for dealers to work with reputable and trustworthy forex firms due to the size and complexity of the market. Enter WikiFX, a thorough tool for comparing forex firms that provides insightful analysis and knowledge to assist traders in making knowledgeable choices. We will examine WikiFX's complete features in this piece and how it can help buyers discover the ideal forex dealer for their requirements.

What is WikiFX?

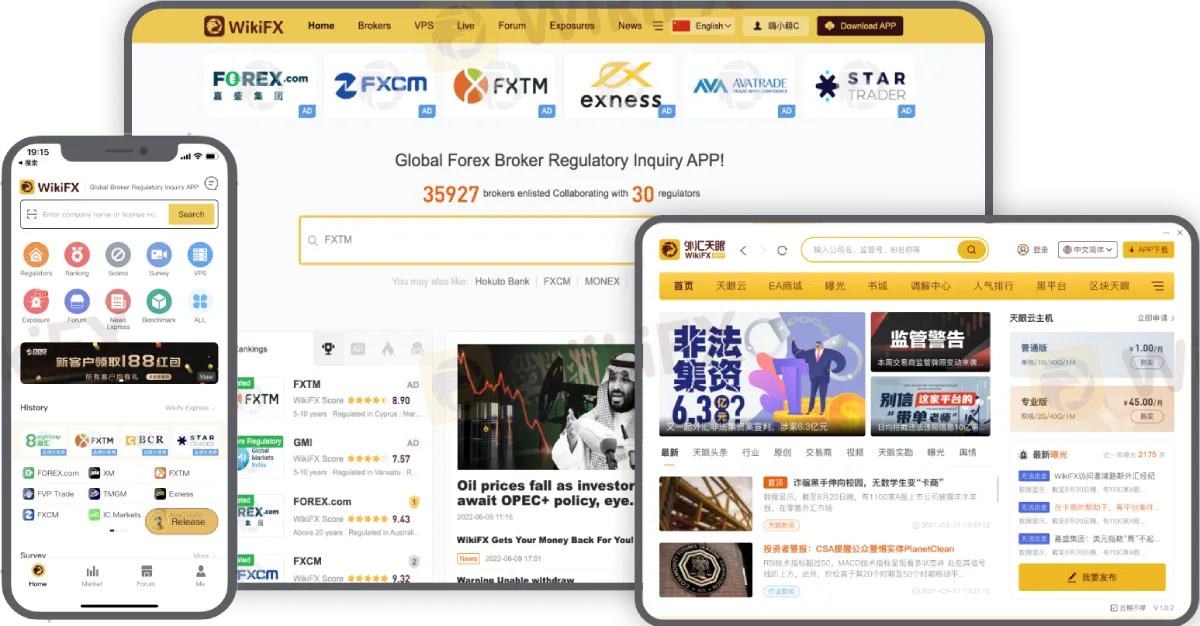

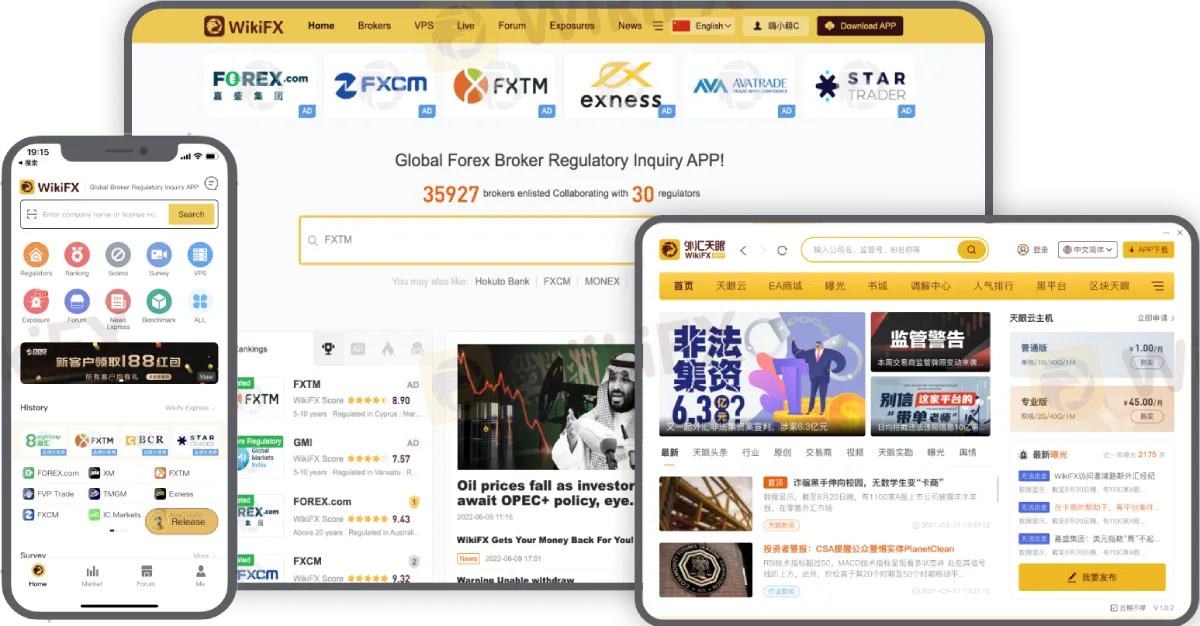

WikiFX is a cutting-edge forex broker comparison tool created to help users assess and choose the top forex firms in the sector. WikiFX provides extensive information on each broker's legal status, dealing terms, client testimonials, and other factors in its directory of over 40,000 brokers. WikiFX enables buyers to choose a forex dealer with confidence by offering an open and impartial platform.

Key Features of WikiFX

1. Regulatory information for brokers The legal standing of a currency dealer is one of the most important things to take into account. WikiFX offers comprehensive details on the licensing, regulating bodies, and conformance records of each dealer. With the help of this information, buyers can evaluate a broker's reliability and dependability to make sure they are working with a respectable and well-respected organization.

2. Market Situations Spreads, leverage, trading platforms, and account kinds are just a few of the trading conditions that are thoroughly compared on WikiFX. The best dealer for a trader's selling tastes and tactics can be found by analyzing these variables.

3. User evaluations and rankings WikiFX has a sizable database of user evaluations and scores that offer insightful information about other dealers' interactions with various brokers. These evaluations can provide important details about a broker's client support, platform dependability, and image as a whole.

4. Broker History and Background WikiFX provide comprehensive historical data on each trader, including the date of creation, location of the corporate offices, and size of the business. By using this information, buyers can evaluate a broker's security and dependability and make an informed decision about a respectable, well-established broker.

5. Risk Alert For traders who may have regulatory problems, financial dangers, or other issues that could affect a trader's experience, WikiFX issues risk alerts. These cautions assist dealers in avoiding working with possibly hazardous agents and safeguarding their assets.

WikiFX: How to Use It

WikiFX usage is a simple procedure. Visit the WikiFX website or download the iOS or Android app to get started. Users can utilize the following functions after logging in:

1. Search: Type a forex broker's name into the search field to view a comprehensive description of that broker that includes regulation data, trading terms, client feedback, and more.

2. Compare: Choose several brokers and contrast their features side by side to help buyers find the best broker for their requirements.

3. Evaluate: Users can rate and evaluate dealers themselves, providing the WikiFX community with insightful feedback.

4. News and Analysis: WikiFX keeps traders updated and up to current on market events by providing the most recent forex news, market analysis, and trading advice.

5. Education: To assist traders in enhancing their trading abilities and information, WikiFX offers a plethora of instructional tools, including papers, videos, and seminars.

Conclusion

For currency dealers looking for a dependable and trustworthy exchange, WikiFX is a priceless resource. WikiFX makes it easier to compare and choose forex dealers thanks to its extensive library, open information, and user-friendly layout. dealing professionals can make educated choices and boldly traverse the complicated world of forex dealing by utilizing the power of WikiFX.

Download the WikiFX App on your smartphone to stay updated on the latest news.