No Global Recession In 2026, But Period Of Poor Growth Continues

The IMF estimates for 2026 show no signs of recession. However, the global economy remains in a peri

简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

The IMF estimates for 2026 show no signs of recession. However, the global economy remains in a peri

If you're looking up information on Toyar Carson Limited Regulation, you probably want to know if they're safe and legitimate. Let's get straight to the point. Our detailed research shows that Toyar Carson Limited works without any supervision from trusted financial regulators. This lack of regulation is the biggest warning sign any trader can see. Public records show they have a business rating of only 1.46 out of 10, which means they have serious problems with how they operate and keep clients safe. In this article, we'll share facts based on evidence from public business records, visits to their location, and feedback from users. Our aim is to give you the clear facts you need to understand the major risks of working with this company and help you make a smart decision to protect your money.

Eight years after the collapse of the MBI pyramid scheme, newly disclosed asset seizures reveal the vast scale of the fraud.

Has your MY MAA MARKETS forex trading experience been nothing short of a financial misery? Do you fail to gain the forex broker’s approval for fund withdrawals? Were you denied withdrawals on the grounds of fake accusations concerning system abuse and hedging? Does the broker deliberately cause you unwarranted slippage as you start executing winning trades? Do you feel the broker is unregulated? Your concerns seem genuine, as many traders have accused the broker of serious financial misconduct. In this MY MAA MARKETS review article, we have investigated some trader complaints. Take a look!

AssetsFX exposure reveals 5 scam‑like warning signs: unregulated operations, shaky fund safety, and alarming trader complaints you can’t afford to ignore.

For any trader thinking about TradeFxP, the most important question is about safety and TradeFxP Regulation. The answer to this question decides whether your money is protected or at dangerous levels of risk. Our research shows that TradeFxP does not have any valid, high-quality financial regulation, putting it in a high-risk category for investors. This conclusion is based on facts and data, not just opinions, and comes from studying how the broker operates.

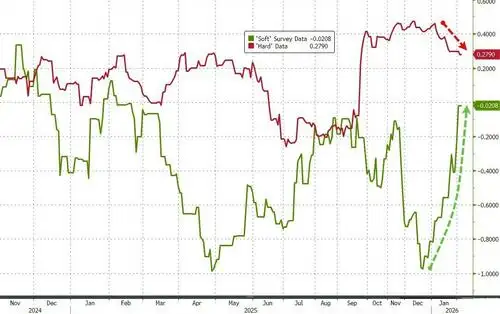

Following the dramatic rebound in US Manufacturing survey data - driven by a surge in new orders - '

PRCBroker is accused of withholding $1.13M in profits and freezing withdrawals. Read the details and decide if this broker is right for you.

Kudotrade’s flashy promises hide real risks for new traders. Learn why this unregulated broker isn’t safe before you invest—protect your funds today.

Join forex expert Tom as he shares his journey, trading wisdom, and thoughts on AI and the future of forex in WikiFX’s inspiring “Inside the Elite” interview.

Eight unlicensed forex websites share identical layouts, wording, and short-term domains. WikiFX analysis reveals a mass-produced scam pattern traders should avoid.

Selangor police arrested 20 suspects after dismantling three online scam syndicates operating fake job and investment scams across Kajang, Seri Kembangan and Puchong, with multiple devices seized and investigations ongoing.

This guide will examine all available information to give you a clear and honest assessment of the risks involved. We will look at the company structure, study the details of the STMARKET Regulation , STMARKET License, and compare what the broker claims online with what can actually be verified. Our goal is not to make trading decisions for you, but to provide the facts you need to protect your money. Understanding a broker's real legal and regulatory status is the most important step when checking if they are trustworthy.

Citadel Securities warns Dollar bears as resilience in US nominal GDP and a potential hawkish pivot under nominee Kevin Warsh could freeze Fed rate cuts for the coming year. Meanwhile, market structure concerns arise regarding Warsh's aggressive balance sheet reduction goals.

**coinbase** (associated with the domain coindfa.com) currently holds a minimal WikiFX score of 1.36 due to its lack of valid regulation. Recent user reports from 2024 highlight severe risks, specifically concerning withdrawal refusals and demands for substantial upfront fees.

Market analysis suggests the Federal Reserve is quietly moderating its aggressive tightening stance as financial stability concerns impose a ceiling on restrictive policy measures.

Bitcoin has erased all gains made since the US election, plummeting nearly 8% to break below $73,000 as risk assets face intense liquidation. Analysts warn the 'Trump Trade' premium has evaporated, with the crypto market potentially entering a renewed bearish cycle.

A wave of panic selling swept through US equity markets as AI disruption fears battered software stocks, dragging the Nasdaq down 2.4%. While Nvidia's CEO calmed fears regarding OpenAI relations, the broader 'SaaS-pocalypse' has ignited concerns over credit stability and deepened risk-off sentiment globally.

TR外汇 (TR Forex) is an unregulated broker established in 2018 with a critically low WikiFX score of 1.57. Identified as a suspected Ponzi scheme, the platform operates without financial licensing and utilizes multiple suspicious domain names. Due to a high volume of complaints and lack of safety measures, this broker is considered high-risk.

The Japanese Yen experienced whipsaw trading at the start of 2026, while Euro fundamentals show faint signs of long-term recovery. Separately, India and the US appear close to a significant tariff reduction deal.