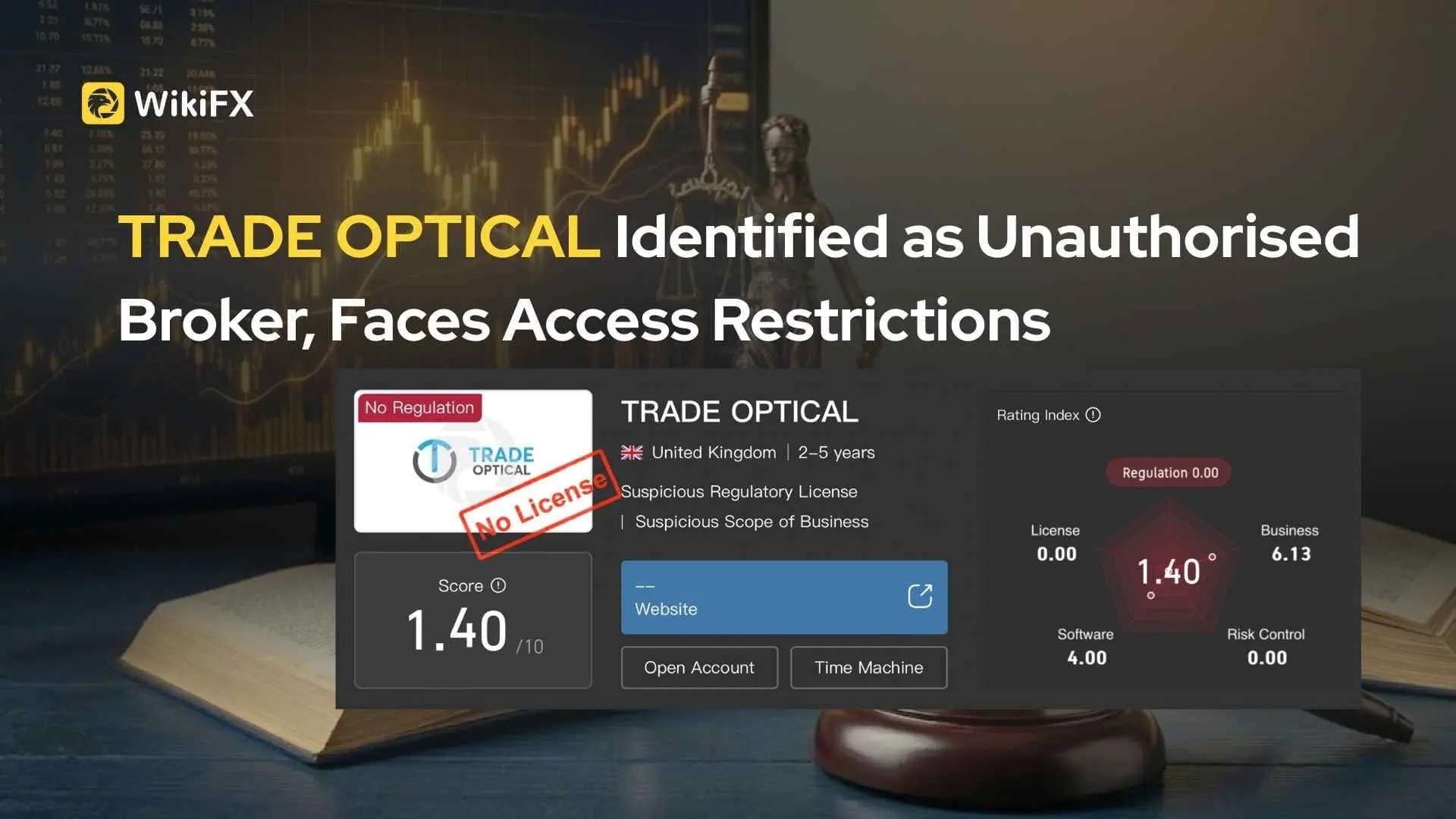

TRADE OPTICAL Identified as Unauthorised Broker, Faces Access Restrictions

WikiFX data shows that TRADE OPTICAL operates without a financial licence and lacks verified trading infrastructure, prompting regulatory actions and access restrictions.

简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

WikiFX data shows that TRADE OPTICAL operates without a financial licence and lacks verified trading infrastructure, prompting regulatory actions and access restrictions.

Why are most CFD brokers in Dubai opting for Category 5 licences? A closer look at capital requirements, speed to market, and regulatory structure.

The U.S. government in January ran up a smaller deficit than a year ago, while tariffs collections surged.

The January nonfarm payrolls report beat Wall Street expectations in both job creation and the unemployment rate.

Did you find a contrasting difference between Diago Finance’s deposit and withdrawal processes? Were deposits seamless, but withdrawals remained difficult? Did you fail to receive your funds despite paying extra fees? Did the Saint Lucia-based forex broker scam your hard-earned capital? You are not alone! Many traders have expressed concerns over the alleged illegitimate trading activities carried out by the broker. In this Diago Finance review article, we have investigated some complaints against the broker. Take a look!

Thinking about investing in FirewoodFX? Attracted by its no-deposit bonus offers? Stop for a while and evaluate many of the complaints concerning FirewoodFX bonus, verification, withdrawal denials, fund scams, etc. These alleged issues have grabbed significant traction on broker review platforms. In this FirewoodFX review article, we have investigated all of these allegations, shared bonus promotions claimed by the forex broker, and explained its regulatory status. Keep reading!

Has Wingo Markets deducted all your profits from the trading platform? Did it illegitimately close your forex trading account and burn all your hard-earned capital? Have you been denied withdrawals all the time? Maybe your issues align with many of its clients who have reported these incidents online. In this Wingo review article, we will check out the complaints, the broker’s regulation status, and some other events it is linked to. Keep reading!

If you are asking "Is Pemaxx Legit" or are worried about a possible "Pemaxx Scam," you are asking the right questions. Choosing where to put your trading capital is the most important decision you will make. In a market with many choices, telling the difference between trustworthy brokers and risky ones is crucial. Our complete review of available information, user experiences, and regulatory details shows major warning signs and high risk with Pemaxx. The evidence we found shows a clear pattern of problems that should make any potential investor very careful. This article will look at these concerns in detail, focusing on three important areas: questionable regulatory status, an extremely low safety score from independent reviewers, and a troubling number of user complaints about not being able to withdraw funds. Before trusting any broker, you must do your own research. This means looking beyond the broker's own advertising and checking its status using independent regulatory datab

Is Pemaxx a safe broker for your capital? This is the most important question for anyone thinking about trading, and the facts suggest this is a high-risk situation. On its website, Pemaxx looks like a worldwide trading company that offers many different investment options and good account deals. But when we look deeper into how it is regulated and what real users say, we find some very worrying problems. Information from independent checking websites and many user complaints show us a broker that doesn't live up to what it promises in its advertising. Government watchdog groups say its license looks fake, and checking services, such as WikiFX, give it a very low trust rating and tell people to stay away. Users report serious problems, especially not being able to take their capital out. These mixed signals—between what Pemaxx advertises and what users actually experience—make it absolutely necessary to do your own research before investing. Websites that collect this information, suc

If you're thinking about trading forex, you've probably heard of Alpari. This company has been around for a long time. But just because a company is old doesn't mean it's safe. The big question is: Is Alpari safe or scam? When we look at what real users say about their experiences, we find some very worrying problems. Many people have complained about this broker, and it has received very low safety ratings.

Is Jetafx a regulated broker? This is the main question for any trader thinking about using their services. When examining Jetafx Regulation, the findings raise serious concerns. Based on detailed information from the global broker research platform WikiFX, the answer is clear: Jetafx operates without a valid, recognized financial license. The platform gives the broker a very low score and marks it with serious warnings that potential users must understand.

When traders think about using a new trading platform, the most important question is always about safety. Is TransXmarket safe or scam? This question becomes even more important when looking at a broker that shows mixed signals. Some users have said good things about TransXmarket. However, these positive comments are overshadowed by serious warnings from regulators and major complaints from traders. Many potential investors keep asking, Is TransXmarket safe or scam? before committing their money. The goal of this review is not to make unfair accusations but to carefully examine all the available facts.

When people who trade want to know if a broker is safe, they want a straight answer. Based on many user reviews, GLOBAL GOLD & CURRENCY CORPORATION (GGCC) looks very risky for people thinking about using it. This company works as a broker without proper rules watching over it and has a very low trust score of 1.36 out of 10 on WikiFX, a website that checks brokers. This low score isn't random. It comes from many real user complaints and serious warning signs about how the company works. The biggest problems users report pertain to how trades work, including huge price differences from what they expected, and major trouble getting their capital back. These aren't small problems - they're big issues that can put a trader's capital at serious risk. This article will look at these problems closely, checking the facts and real experiences of traders who have used this platform.

Scam alert: FlipTrade Group stole $611 from a Nigerian trader on Feb 2nd via rigged trading contests, no withdrawals. Unregulated broker exposed on WikiFX—learn the case, report, and trade safely now!

Trive scam warning: clients in Mexico, India & Hong Kong report stolen funds and blocked withdrawals. Protect yourself—read exposure cases now.

Plus500 forex trading scam alert: multiple cases of blocked withdrawals. Read the warnings and safeguard your money!

South Africa's untapped mineral wealth, valued at $2.5 trillion, highlights a strategic economic shift beyond traditional gold mining that could underpin long-term demand for the Rand.

WikiFX Elite Club Focus is a monthly publication specially created by the WikiFX Elite Club for its members. It highlights the key figures, perspectives, and actions that are truly driving the forex industry toward greater transparency, professionalism, and sustainable development.

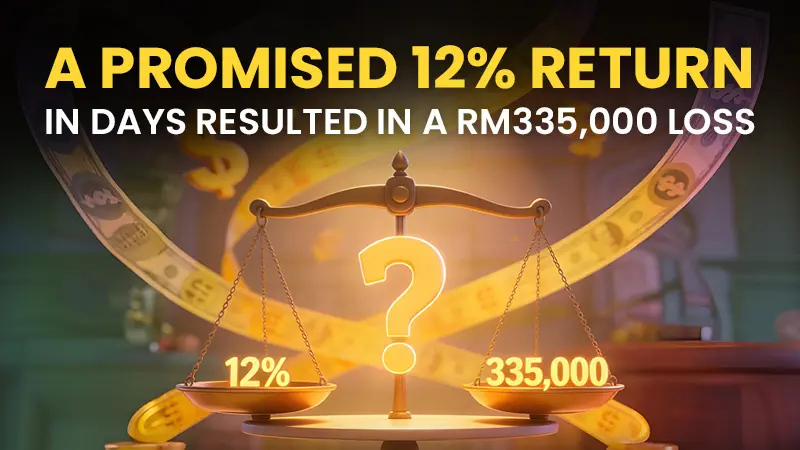

A 51-year-old trader in Pahang has lost more than RM335,000 after falling victim to an online investment scheme that promised a 12% return in just days!

OtetMarkets is a Forex broker established in 2023 and registered in St. Lucia. With a low WikiFX Score of 2.20 and no effective regulation, it presents significant risks. While it offers high leverage up to 1:1000 on MT5 and cTrader platforms, the broker is plagued by serious user complaints regarding withdrawal rejections, trade manipulation, and severe server issues.