NFP Preview: Inflation Fears and War Jitters Cloud Rate Cut Path

The US Dollar and safe-haven assets hold gains as traders await critical US employment data, with rising geopolitical tensions dimming hopes for aggressive Federal Reserve rate cuts.

简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

The US Dollar and safe-haven assets hold gains as traders await critical US employment data, with rising geopolitical tensions dimming hopes for aggressive Federal Reserve rate cuts.

JP Morgan warns that Middle East oil producers face a critical storage crisis within 72 hours, potentially forcing a 3.3 million barrel-per-day production cut as the Strait of Hormuz risk premium escalates.

The US is drafting regulations to expand AI chip export licencing globally, potentially requiring sovereign investment commitments in exchange for Nvidia and AMD hardware.

Gold prices plummeted below $5,100 despite geopolitical chaos, driven by Poland's liquidation of reserves for defense funding and a rampant US Dollar.

China sets an aggressive 2026 growth target of roughly 5% backed by a 4% fiscal deficit, signaling a definitive shift toward central government leveraging to combat demand weakness.

OmegaPro is a UK-based entity established in 2018 with a dangerously low WikiFX Score of 1.58. It is unregulated and has received official warnings from multiple financial authorities, including the CNMV (Spain), FSC (Mauritius), and AMF (France). The broker currently faces a massive volume of complaints regarding withdrawal refusals and forced account migrations.

Geopolitical friction in the Caspian region escalates as Azerbaijan vows retaliation following an alleged Iranian drone strike, raising potential supply risks for global energy markets.

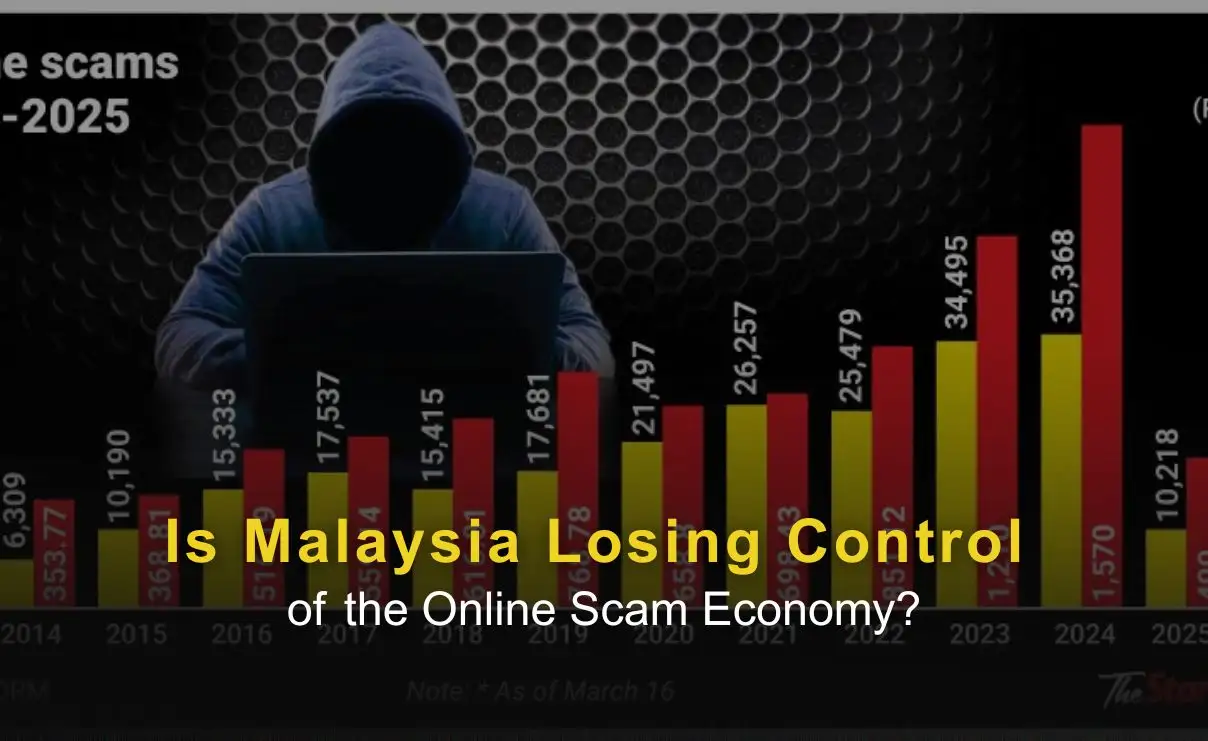

In a parliamentary written reply reported in January 2026, the Home Ministry indicated that Malaysia recorded RM2.77 billion in losses from financial scams in 2025 alone. Over the three year period between 2023 and 2025, total losses linked to online and financial fraud reportedly reached RM5.62 billion.

A coalition of 24 US states has launched a legal challenge against President Trump's latest global tariff measures, citing recent Supreme Court rulings. The lawsuit introduces political and legislative uncertainty that could dampen the 'Trump Trade' momentum in currency markets.

Taiwanese prosecutors have charged 62 individuals and 13 companies for their alleged involvement in a large cyber-fraud network linked to the Prince Group, a conglomerate accused of operating scam operations across Asia.

Iran has officially denied reports of closing the Strait of Hormuz, a critical oil shipping chokepoint, amidst escalating military conflict involving the US, Israel, and Iran. The geopolitical uncertainty continues to underpin volatility in crude oil markets and safe-haven demand.

InvesaCapital receives a critical rating of 1.45/10 due to unauthorized regulatory status and multiple investor warnings. This review highlights severe safety concerns, including withdrawal denials and high-leverage risks associated with its unverified operations.

A coalition including the US, China, and mining firms is pressuring Ghana to abandon a proposed hike in gold royalties, citing risks to investment and production costs.

Morgan Stanley forecasts the ECB will hold rates steady, while intra-Western trade tensions surface as Germany backs Spain in a dispute with the US.

HEADWAY Rebate Service holds a critical WikiFX score of 1.32 and lacks verified regulation from the South African FSCA. With multiple trader reports citing profit deductions and massive spread manipulation, this broker presents a high risk to client funds.

Escalating conflict in the Gulf, marked by fresh attacks on tankers and Iranian strikes, is rattling global energy markets while prompting European nations like Italy to pledge support.

Economists surveyed by Dow Jones expect payroll growth of 50,000, following January's surprisingly high 130,000.

When choosing a forex broker, few things matter more than how easy it is to make investments and withdraw them. Looking into the Dbinvesting Deposit and Dbinvesting Withdrawal processes is an important part of researching this broker. At first glance, this broker offers normal payment options. However, many users have reported serious problems that show a big difference between what the company promises and what actually happens to real traders. This article aims to give you the complete, honest truth. We will look at both the official procedures that Dbinvesting advertises and the real risks that every trader needs to know about. Here's some important background: as of early 2026, WikiFX (a global financial review website) gives Dbinvesting a very low score of 2.14 out of 10 and warns users to "Low score, please stay away!" This creates a dangerous situation where traders need to be extremely careful. This guide will first explain the payment methods the company claims to offer, then

When checking for a broker, the most important question is always about safety. Is my capital secure? Can I take out my profits? For Dbinvesting, the evidence we have gathered points to a conclusion that should make any trader think twice. Based on a thorough review of user feedback, regulatory status, and how transparent they are, Dbinvesting presents a high potential risk to its clients. We don't make this claim lightly; it's based on facts we can verify and a clear pattern of user-reported problems that can't be ignored.

When looking at a broker, the first question is always about safety. Is Dbinvesting a safe platform for your investments? The immediate answer is complicated and requires extreme caution. While Dbinvesting is officially a regulated company, its license comes from the Seychelles Financial Services Authority (FSA), which is classified as an offshore regulator. This difference is important and forms the basis of the high-risk status connected to this broker. This initial concern is made worse by objective, third-party data. As of our 2026 review, Dbinvesting holds an extremely low WikiFX safety score of just 2.14 out of 10. This score is not random; it is a data-based reflection of the broker's weak regulation, lack of transparency, and most importantly, its track record with clients. The platform has been flagged for a large number of serious user complaints, which show a disturbing pattern of issues, especially concerning withdrawing funds and the random cancellation of profits. The pu