Basic Information

Bangladesh

Bangladesh

Score

Bangladesh

|

5-10 years

|

Bangladesh

|

5-10 years

| http://padmasecurities.com.bd/

Website

Rating Index

Influence

D

Influence index NO.1

Bangladesh 2.31

Bangladesh 2.31 Licenses

LicensesNo valid regulatory information, please be aware of the risk!

Bangladesh

Bangladesh padmasecurities.com.bd

padmasecurities.com.bd Germany

Germany| Padma Bank Securities Review Summary | |

| Founded | / |

| Registered Country/Region | Bangladesh |

| Regulation | No Regulation |

| Trading Products | Stocks, derivatives |

| Services | Online trading, Depository Services, and BEFTN-based Fund Transfer Services |

| Trading Platform | / |

| Minimum Deposit | / |

| Customer Support | Phone: +8801534004480; +8801550063882 |

| Email: info@padmasecurities.com.bd | |

| Address: DSE Tower, Room-137, Level-08, plot-46, Road-21, Nikunjo-02, Dhaka-1229 | |

Padma Bank Securities is a Bangladesh-based financial services company that provides online trading, custody services, and BEFTN-based fund transfer solutions. The company was founded without disclosing specific details and operating without regulatory oversight, which could raise doubts about its legitimacy.

Padma Bank Securities provides real-time market data and chart analysis tools to help clients make informed trading decisions and securely manage securities through Depository Participant (DP) services. Due to the lack of regulation and opaque information, traders should be cautious when considering working with the company.

| Pros | Cons |

| Various financial services offered | No regulation |

| Limited info on account features |

Padma Bank Securities is not regulated, traders should be aware of the potential risks and exercise caution before trading.

Besides, Padma Bank Securities domain name cannot be found.

| Trading Products | Supprted |

| Stocks | ✔ |

| Derivatives | ✔ |

| Forex | ❌ |

| Commodities | ❌ |

| Indices | ❌ |

| Cryptocurrencies | ❌ |

| Bonds | ❌ |

| Options | ❌ |

| ETFs | ❌ |

Padma Bank Securities offers BO accounts for traders.

A B/O or Beneficiary Owner Account facilitates trading (buy or sell) of securities. Securities are electronically deposited to or withdrawn from BO accounts. B/O accounts are opened with Central Depository Bangladesh Limited (CDBL) through a Depository Participant (DP), i.e., brokerage house.

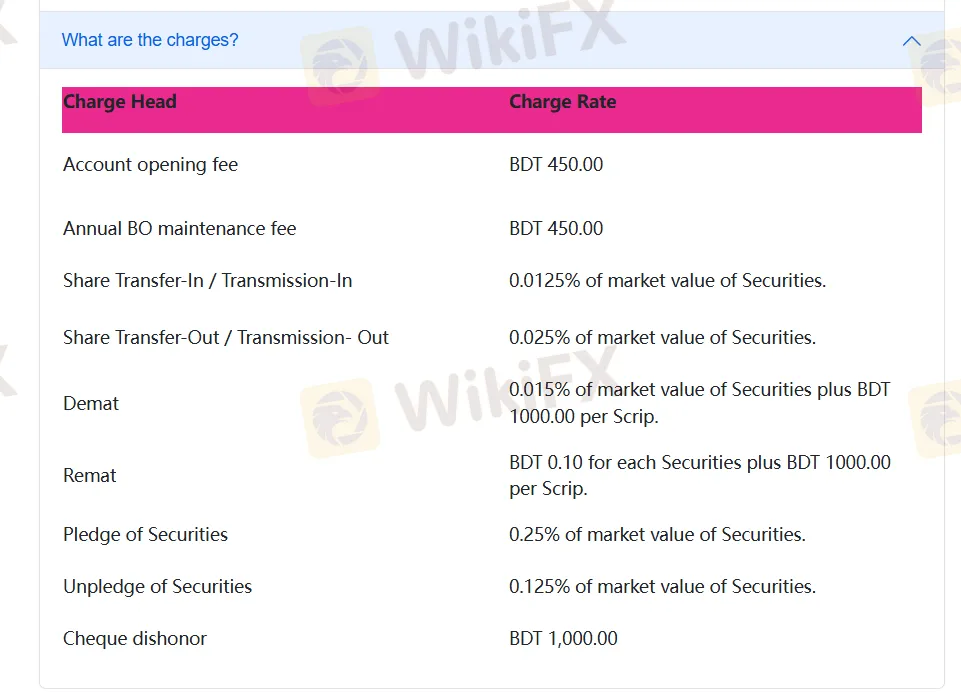

Fixed Fee: Both the account opening fee and the annual B/O maintenance fee are BDT 450.

Mark-to-market fees: Transfer-in, transfer-out, Demat, Remat, pledge, and unpledge are charged as a percentage of the market value of securities.

Additional fees:DEMAT and REMAT are also subject to an additional BDT 1,000 per security and a check bounce fee of BDT 1,000.

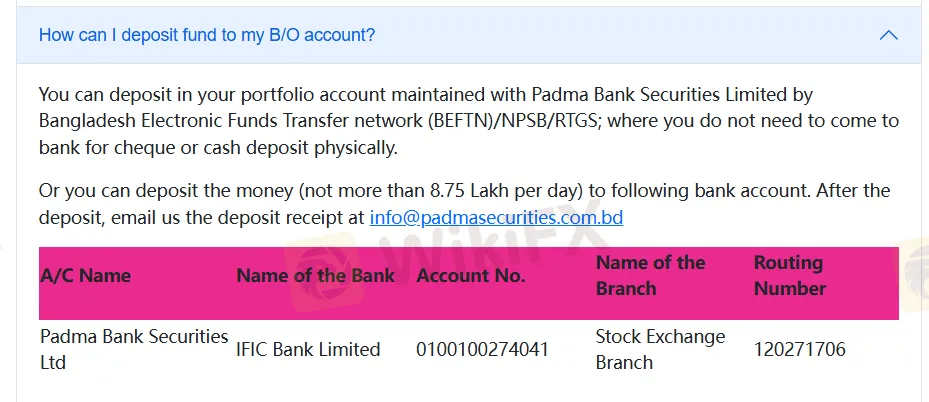

Padma Bank Securities provides customers with a diverse and convenient payment option to easily manage their B/O (Buy for Own) accounts.

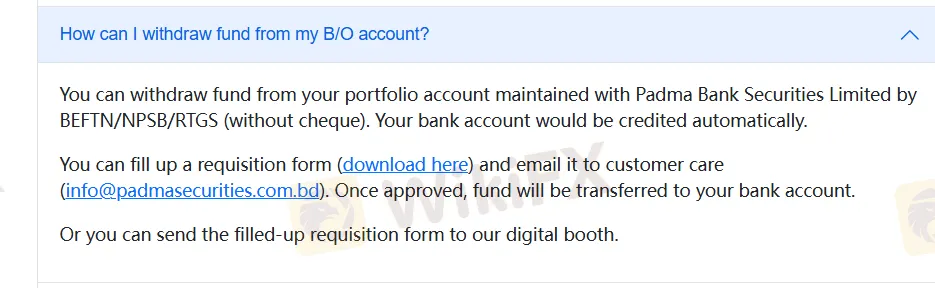

Clients can deposit or withdraw funds through the Bangladesh Electronic Funds Transfer Network (BEFTN), the National Payment System (NPSB) or the Real Time Full Settlement System (RTGS) without having to visit the bank in person.

In addition, clients can also choose to deposit up to $87,500 per day into the designated account of IFIC Bank Limited and send the deposit voucher to the “info@padmasecurities.com.bd” by email.

Please enter...

TOP

TOP

Chrome

Chrome extension

Global Forex Broker Regulatory Inquiry

Browse the forex broker websites and identify the legit and fraud brokers accurately

Install Now