Company Summary

| Match Securities Review Summary | |

| Founded | 2021 |

| Registered Country/Region | Mauritius |

| Regulation | No Regulation |

| Market Instruments | FX, CFDs, ETFs, Futures, Metals, and Indices |

| Demo Account | ❌ |

| Leverage | / |

| Spread | / |

| Trading Platforms | ML Trader, Meta Trader 5 (MT5), and IRESS Pro Trader |

| Min Deposit | / |

| Customer Support | 24/5 live chat |

| Phone: +230 454 3200 | |

| Email: support@matchsecurities.com | |

| Address: 4th Floor, Iconebene, Rue de LInstitut, Ebene, Mauritius, 80817 | |

Founded in 2021, Match Securities is an unregulated brokerage company based in Mauritius. It provides FX, CFDS, ETFS, Futures, Metals, and Indices via trading platforms like ML Trader, Meta Trader 5 (MT5), and IRESS Pro Trader.

Pros and Cons

| Pros | Cons |

| Various trading options | Unregulated status |

| Multiple customer support channels | Limited info on accounts |

| MT5 platform provided | Limited info on trading fees |

| No demo account | |

| Complexity for beginners |

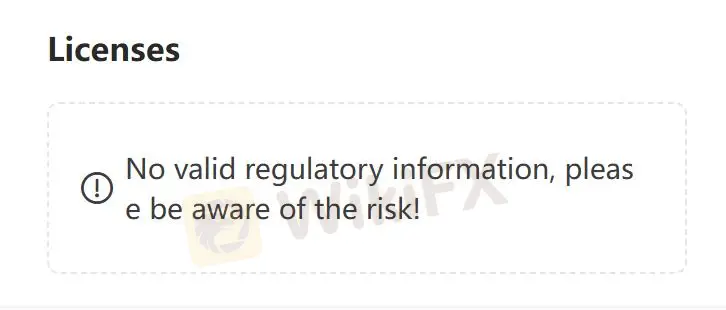

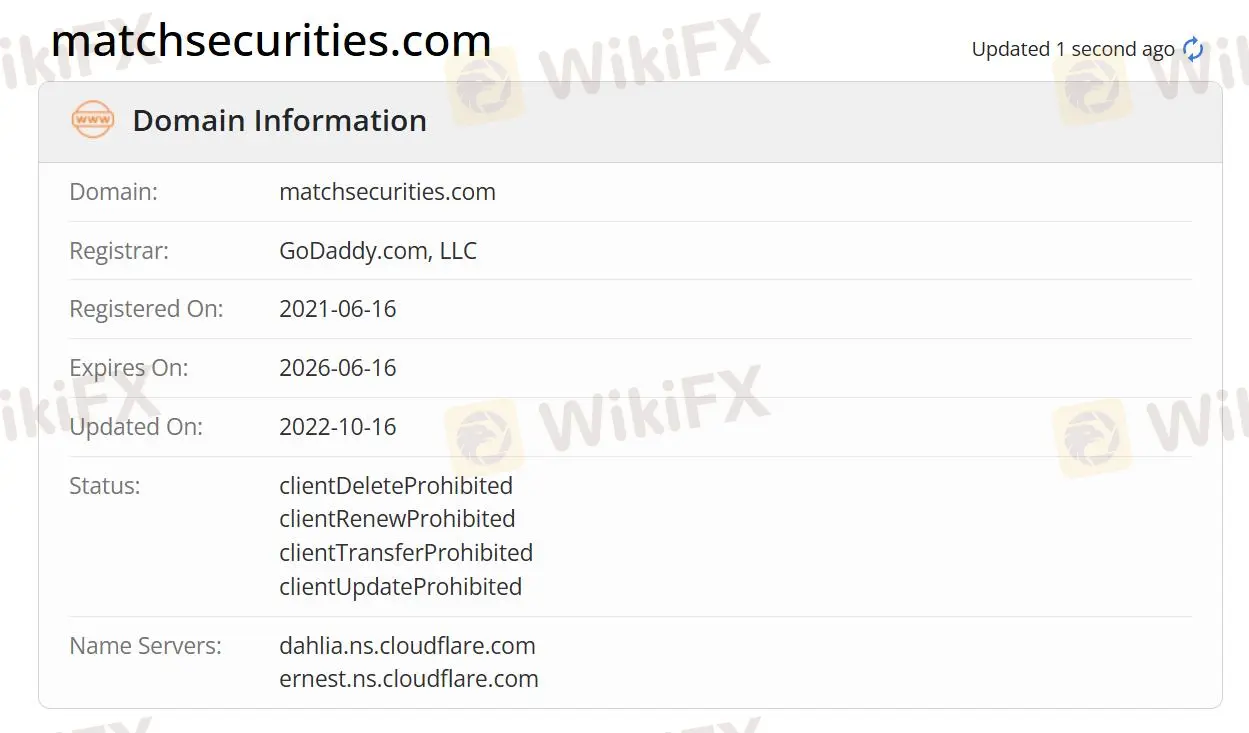

Is Match Securities Legit?

At present, Match Securities lacks valid regulation. Its domain was registered on June 16, 2021, and the current status is “client Delete Prohibited, client Renew Prohibited, client Transfer Prohibited, client Update Prohibited”. Please pay high attention to the safety of your funds if you choose this broker.

What Can I Trade on Match Securities?

On Match Securities, you can trade with FX, CFDs, ETFs, Futures, Metals, and Indices.

Forex: They can access the world's most liquid market. They can trade 200+ FX pairs with low commissions and competitive spreads. The company offers powerful trading platforms, superior tools and 24/5 expert support.

Commodities: Commodity investments hold value long-term. Match Securities offers low trading costs, deep liquidity and a hedge against inflation. They can trade derivatives on energies like crude oil and natural gas for fast execution and best pricing.

Equities CFDs: They can trade derivatives on shares of top companies with low margin requirements. They can access equities CFDs on Apple, Amazon, Facebook. Match Securities offers strong liquidity, fast execution, low spreads.

Indices: They can go long or short on major stock indices. They can access USA500, Germany 30, UK100. It is offered on MT4, MT5, ML Trader. They can trade with tight spreads and leading pricing.

Futures: They can trade on award-winning platforms. They can access 300+ futures from 16 exchanges. Advantages include competitive pricing, orders and depth trader tools, 24/5 expert support and dedicated account managers.

| Tradable Instruments | Supported |

| Forex | ✔ |

| CFDs | ✔ |

| Metals | ✔ |

| Indices | ✔ |

| Futures | ✔ |

| ETFs | ✔ |

| Stocks | ❌ |

| Commodities | ❌ |

| Cryptocurrencies | ❌ |

Trading Platform

Match Securities offers ML Trader, Meta Trader 5 (MT5), and IRESS Pro Trader.

ML Trader: Fast and efficient execution, integrating extensive and profound global liquidity from Tier 1 banks and institutions, offering a high-speed and high-performance trading journey.

Meta Trader 5 (MT5): Industry-standard multi-asset trading technology for foreign exchange, stocks, and futures. Rich in features and intuitive, equipped with tools for price analysis, algorithmic trading, and copy trading.

IRESS Pro Trader: A web-based online trading platform that integrates dynamic, multi-asset, multi-channel market data streaming with sophisticated trading and portfolio management.