Basic Information

United States

United States

Score

United States

|

5-10 years

|

United States

|

5-10 years

| https://www.geneva-trading.com

Website

Rating Index

Influence

D

Influence index NO.1

Greece 2.47

Greece 2.47 Licenses

LicensesNo valid regulatory information, please be aware of the risk!

United States

United States geneva-trading.com

geneva-trading.com United States

United States

FREYTAG, THOMAS

Manager

Start date

Status

Employed

GENEVA TRADING USA, LLC(Illinois (United States))

BRERETON, H. ARTHUR

Manager

Start date

Status

Employed

GENEVA TRADING USA, LLC(Illinois (United States))

CREAMER, ROBERT S

Manager

Start date

Status

Employed

GENEVA TRADING USA, LLC(Illinois (United States))

| Aspect | Information |

| Registered Country | Ireland (Dublin) and USA (Chicago) |

| Founded year | 1999 |

| Company Name | Geneva Trading |

| Regulation | No regulatory oversight |

| Services | Market trading in various asset classes |

| Customer Support | Offices in Chicago and Dublin, phone and in-person support available |

GENEVA TRADING was launched in 1999 in Dublin, Ireland by two founders named Art Brereton and Thomas Freytag respectively. In 2000, GENEVA TRADING opened its office in Chicago to facilitate its expansion into other markets. As a part of its growth strategy, GENEVA TRADING began making markets on Eurex, and in 2005, this broker get access to diversified financial markets, entering into the Future market in 2006, further expanding its energy presence with a dedicated oil trading desk in 2008. GENEVA TRADING acquired market-making technology platform in 2010, and in 2016, it acquired the options trading platform and intellectual property of Toji International, LLC, a firm focusing on the Asian-Pacific markets.

GENEVA TRADING operates without regulatory oversight as a broker, potentially exposing clients to risks associated with unregulated financial activities. Investors should exercise caution when considering engaging with unregulated brokers like GENEVA TRADING, as they may lack the safeguards and protections provided by regulatory bodies. It's advisable for investors to prioritize platforms regulated by reputable financial authorities to mitigate potential risks and ensure a safer trading environment.

Geneva Trading offers a range of advantages and disadvantages for potential clients to consider. On the positive side, the company provides a comprehensive selection of market instruments across various asset classes, allowing traders to diversify their portfolios and engage in multiple trading strategies. Additionally, Geneva fosters a culture of innovation and entrepreneurship, empowering traders to leverage advanced technology and drive profitability. However, a notable drawback is the absence of regulatory oversight, which exposes clients to risks associated with unregulated financial activities. Prospective clients should carefully weigh these factors when considering Geneva Trading as a trading platform.

| Pros | Cons |

|

|

|

|

|

|

|

|

|

|

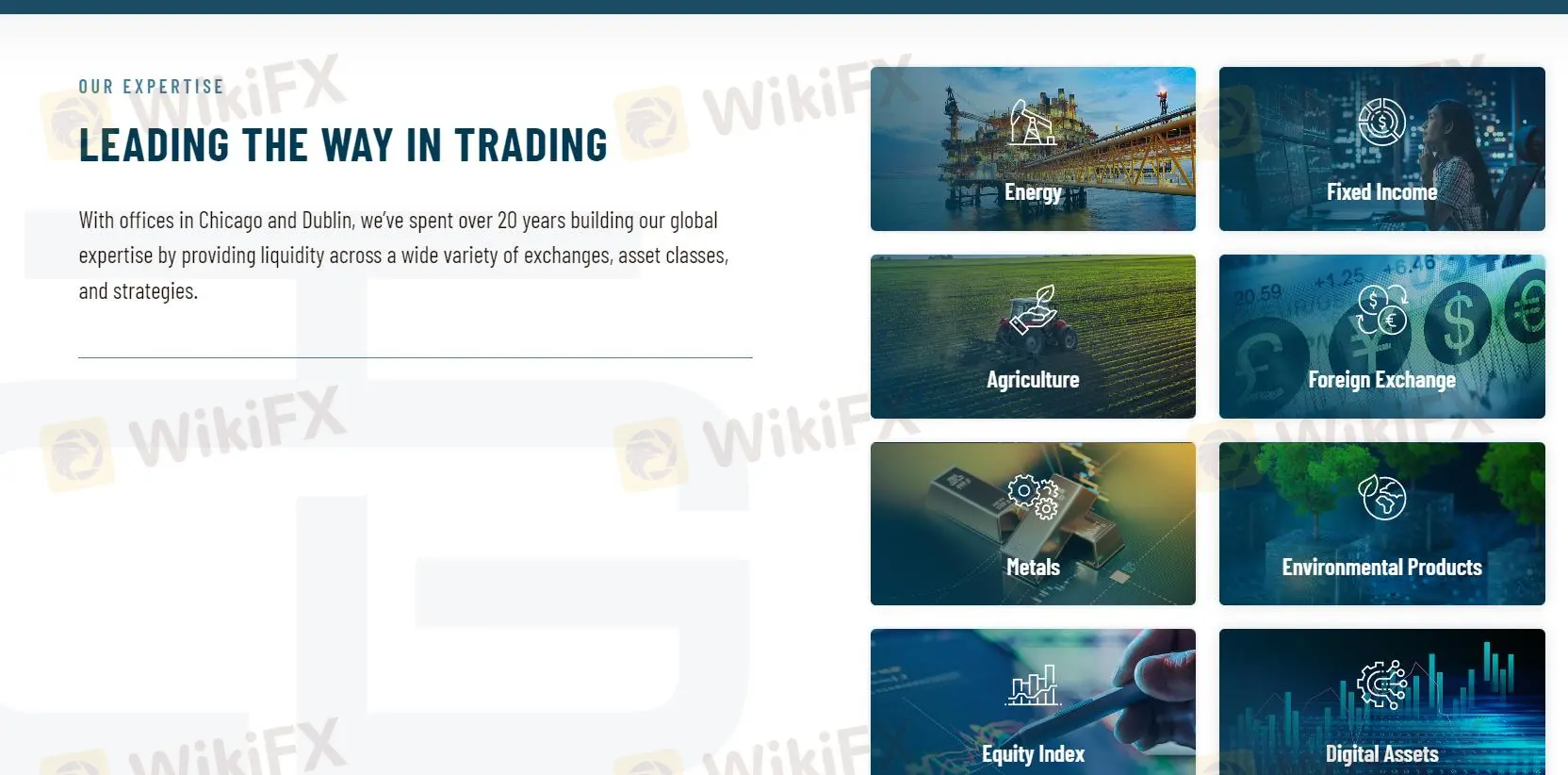

GENEVA TRADING provides a comprehensive selection of market instruments across distinct asset classes:

Energy: Including crude oil, natural gas, and other energy commodities.

Fixed Income: Offering government bonds, corporate debt securities, and other fixed-income products.

Agriculture: Encompassing grains, livestock, and other agricultural commodities.

Foreign Exchange: Featuring major and minor currency pairs for forex trading.

Metals: Covering precious metals like gold, silver, as well as industrial metals like copper.

Environmental Products: Such as carbon credits and renewable energy certificates.

Equity Index: Derivatives linked to major stock market indices, allowing exposure to broader market movements.

Digital Assets: Including cryptocurrencies like Bitcoin and Ethereum, catering to the growing demand for digital asset trading opportunities.

This organized array of market instruments enables traders to diversify their portfolios and engage in a wide range of trading strategies across multiple asset classes.

There is four core segments comprising of GENEVA TRADINGs full business line, which includes the following:

Technology-Develop an advanced proprietary trading platform comprised of fast execution, visualization, and analytical tools.

Trade Support-Provide developers, analysts, and traders with the resources and mentorship.

Data Science

Risk Management-This company says it has a team of professionals dedicated to risk monitoring and educating traders about best practices in risk management.

GENEVA TRADING provides customer support through its offices in Chicago and Dublin, offering multiple avenues for assistance:

Chicago Office:

Address: 190 South LaSalle Street, Suite 1800, Chicago, IL 60603

Phone: 312-471-6100

Dublin Office:

Address: La Touche House, 2nd Floor, International Financial Services Center, Dublin 1, Ireland

Phone: +353 1 618-1000

Clients can contact either office for assistance regarding account management, trading inquiries, or technical support. These direct channels ensure prompt and efficient assistance, complemented by email and online support options for added convenience.

In conclusion, while Geneva Trading offers a wide range of market instruments across various asset classes and fosters a culture of innovation and entrepreneurship, potential clients should exercise caution due to the lack of regulatory oversight. Despite the innovative approach and comprehensive customer support, the absence of regulation poses inherent risks for investors. Therefore, individuals considering Geneva Trading should carefully weigh the benefits against the potential drawbacks and prioritize platforms regulated by reputable financial authorities to ensure a safer trading environment. Additionally, further information regarding trading specifics such as leverage, spreads, and platform features would provide a more complete picture for prospective clients to make informed decisions.

Q1: Is Geneva Trading regulated?

A1: No, Geneva Trading operates without regulatory oversight as a broker.

Q2: What market instruments does Geneva Trading offer?

A2: Geneva Trading provides a diverse selection of market instruments, including energy commodities, fixed income securities, agricultural products, foreign exchange pairs, metals, environmental products, equity index derivatives, and digital assets.

Q3: Where are Geneva Trading's offices located?

A3: Geneva Trading has offices in Chicago, Illinois, and Dublin, Ireland.

Q4: How can I contact Geneva Trading for customer support?

A4: You can contact Geneva Trading's offices in Chicago and Dublin directly via phone or visit their respective addresses.

Q5: Does Geneva Trading offer leverage and spread information?

A5: Specific details about leverage, spreads, and other trading features are not provided in the available information.

Online trading carries substantial risk, potentially leading to the total loss of invested funds. It may not be appropriate for all traders or investors. It's crucial to fully comprehend the associated risks before engaging in trading activities. Additionally, the content of this review is subject to change, reflecting updates in the company's services and policies. The review's creation date is also relevant, as information could have become outdated. Readers should confirm the latest information with the company prior to making any investment decisions. The responsibility for utilizing the information provided herein lies exclusively with the reader.

Please enter...

TOP

TOP

Chrome

Chrome extension

Global Forex Broker Regulatory Inquiry

Browse the forex broker websites and identify the legit and fraud brokers accurately

Install Now