Company Summary

| NOMURA Review Summary | |

| Founded | 1994 |

| Registered Country/Region | Japan |

| Regulation | FSA |

| Market Instruments | Domestic Stocks, Foreign Stocks, Investment Trusts, Bonds, FX, Real Estate ST |

| Demo Account | / |

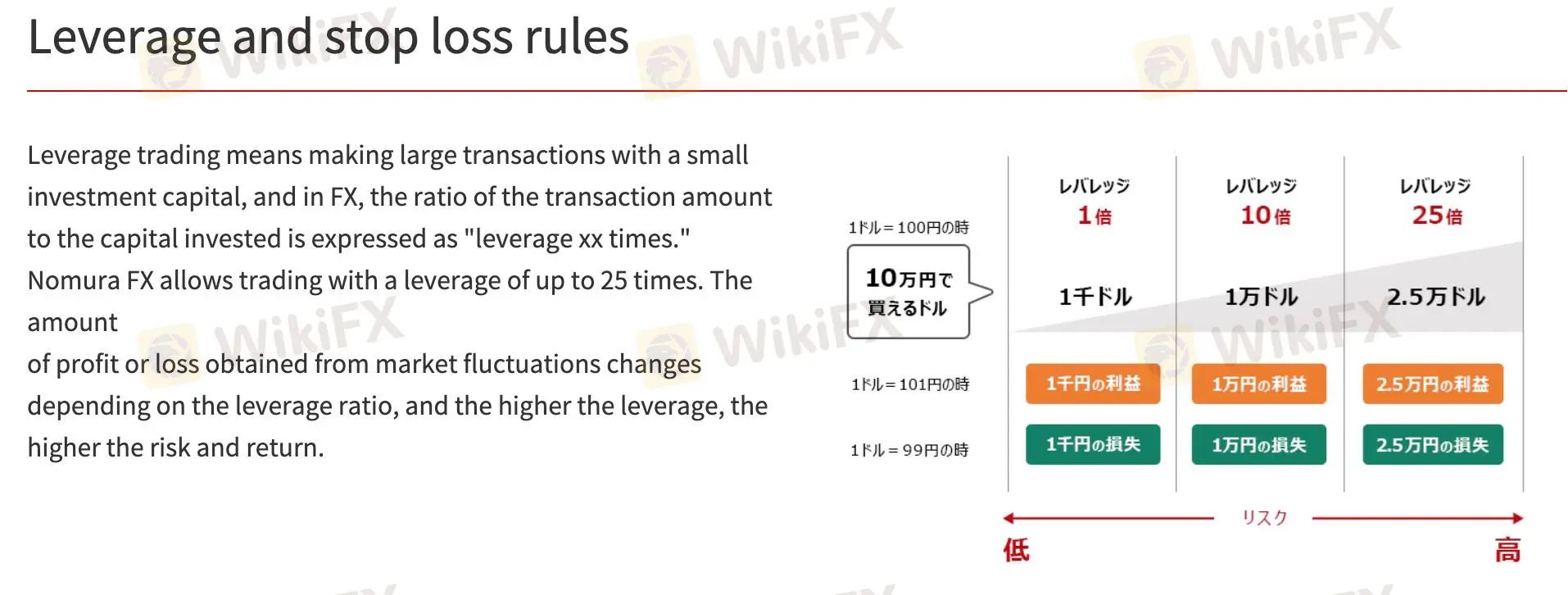

| Leverage | 1:25 |

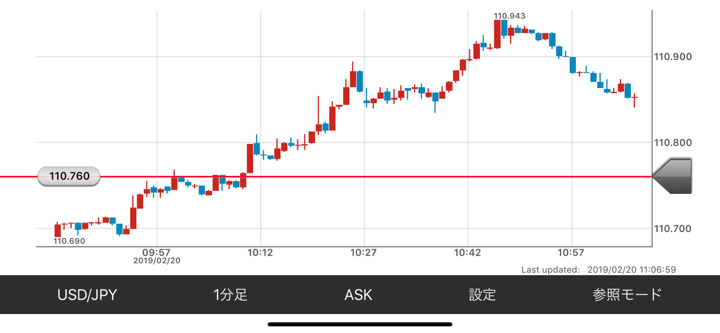

| Spread | USD/JPY: 2.8pips |

| Trading Platform | Nomura Asset Management App (“NOMURA”), Asset Management App (“OneStock”), Nomura FX App |

| Min Deposit | / |

| Customer Support | - General Dial: 0570-077-000 |

| - Alternate: 042-303-8100 | |

NOMURA Information

Nomura Securities offers equities, investment trusts, FX trading, and structured real estate. Its sophisticated trading systems and rigorous regulatory control serve retail and institutional clients. The firm's cost structure varies by service channel, with in-branch rates far greater than online ones.

Pros and Cons

| Pros | Cons |

| Regulated by the FSA | Higher fees for branch-based transactions |

| All-inclusive trading apps and platforms | Limited leverage compared to competitors |

| Numerous tradable instruments | No demo account available |

Is NOMURA Legit?

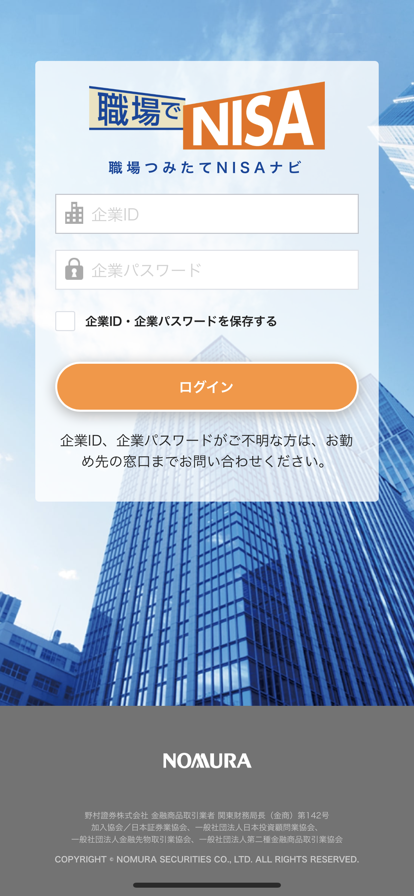

Yes, Nomura is regulated. The FSA of Japan oversees it under a Retail Forex License. The license number is 関東財務局長(金商)第142号, with an effective date of 2007-09-30.

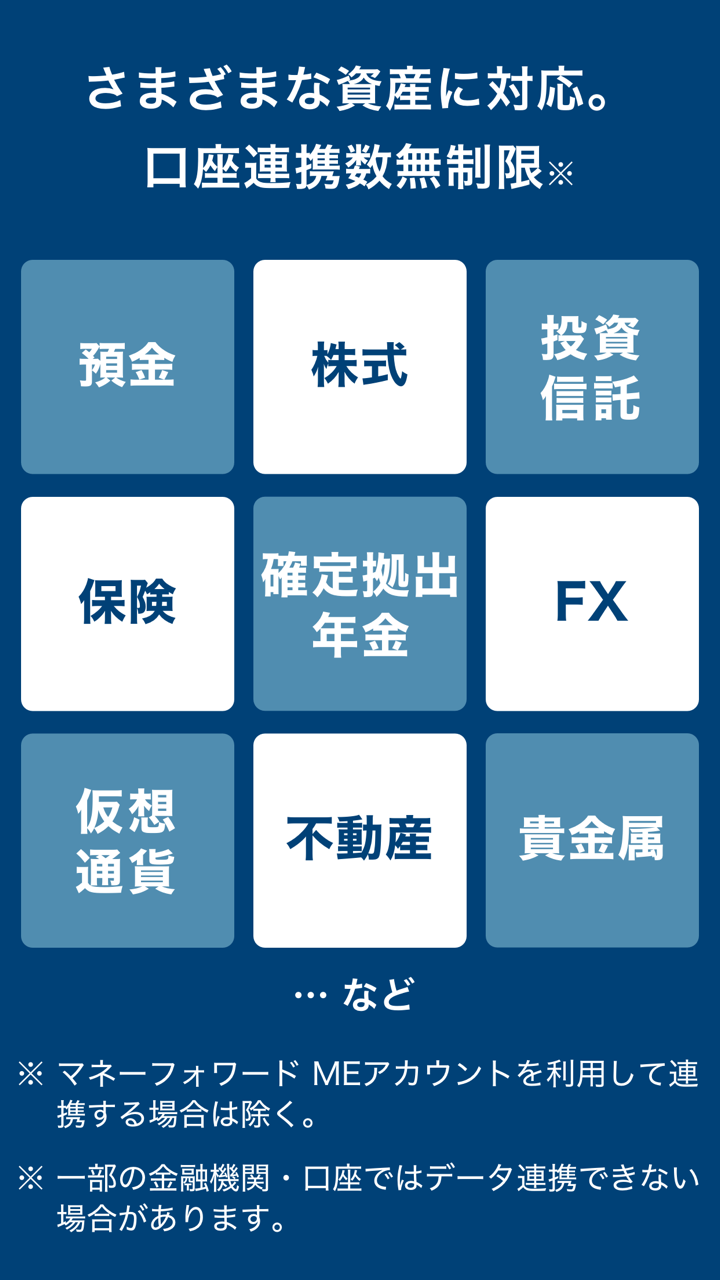

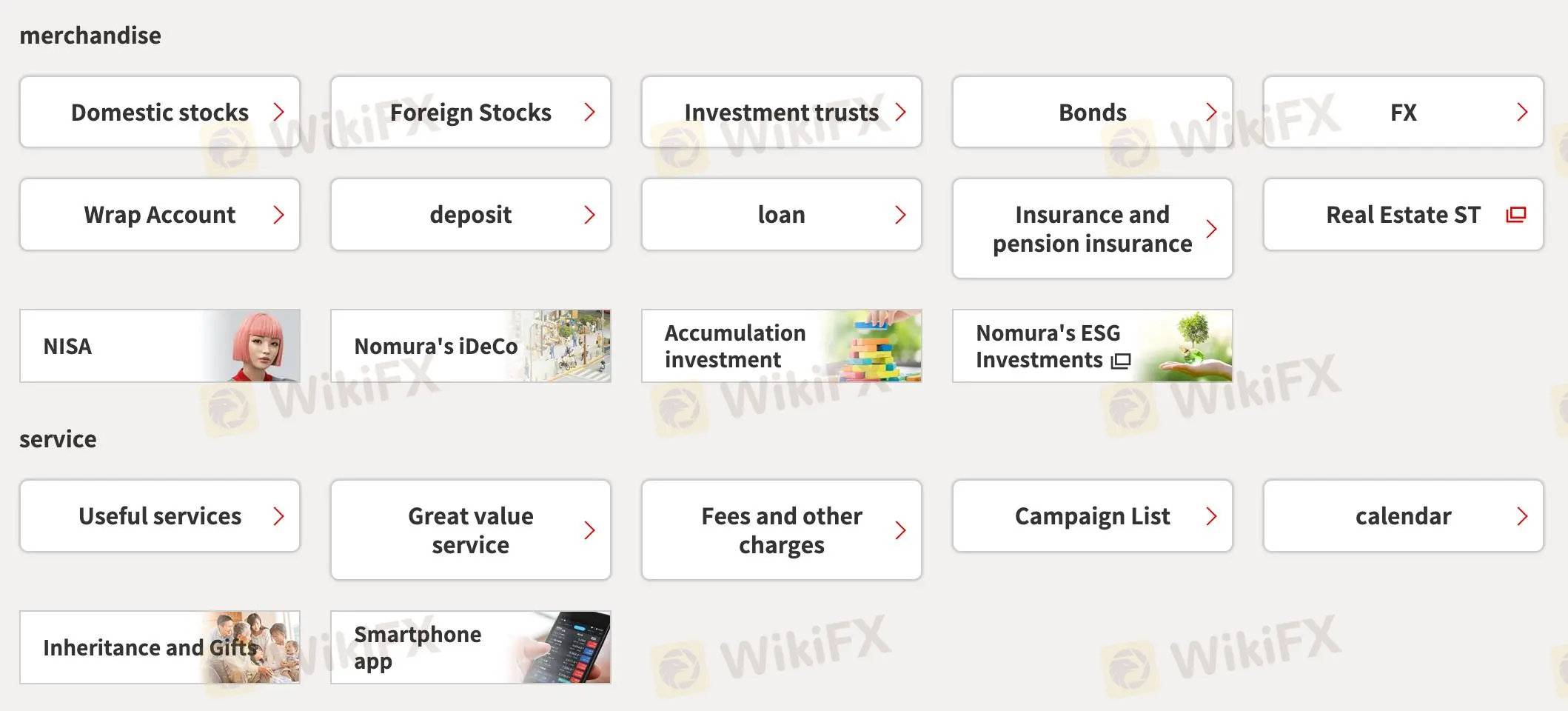

Services and products

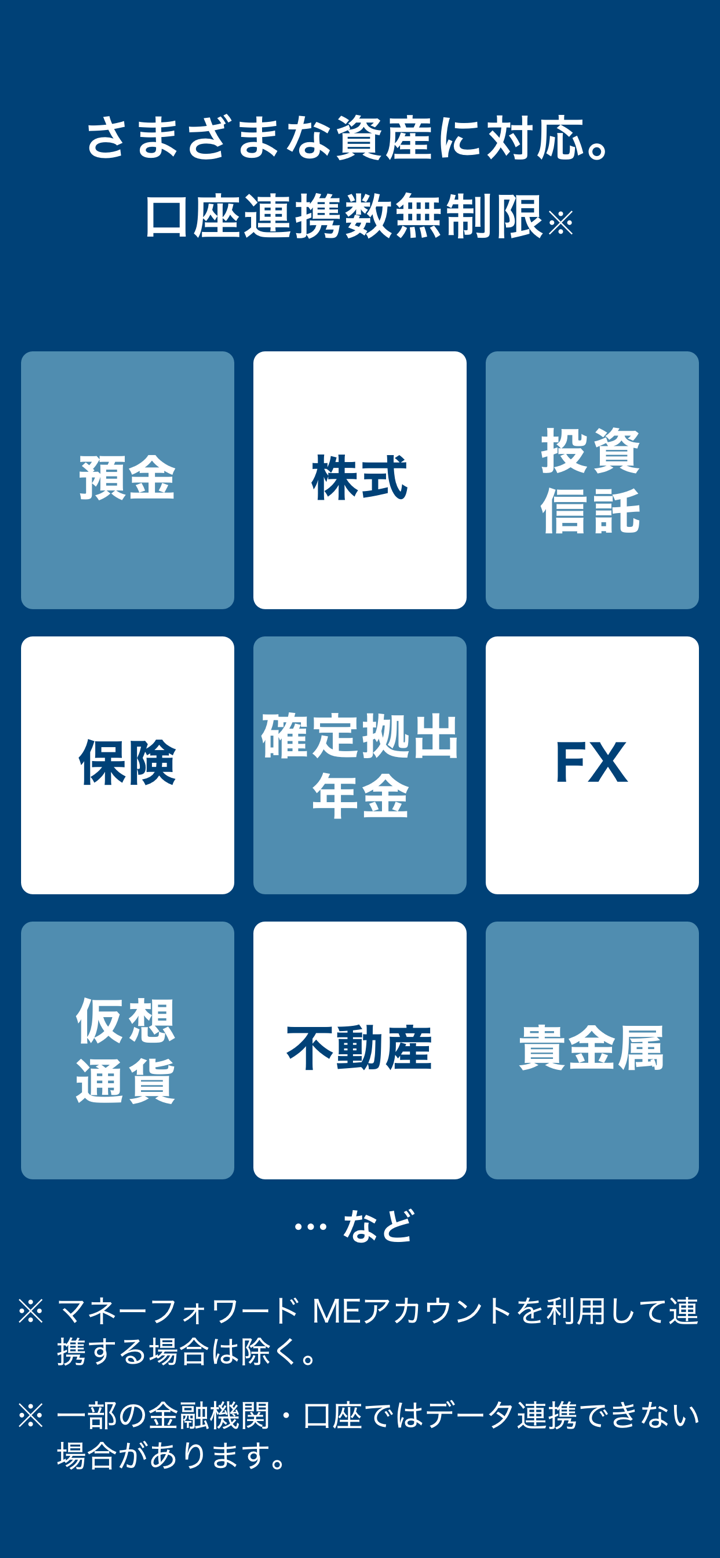

The broker provides local and foreign stocks, investment trusts, bonds, FX trading, and insurance products among a broad spectrum of financial products and services. They provide support services including campaign promotions, inheritance preparation, and a smartphone app.

| Tradable Instruments | Supported |

| Domestic Stocks | ✔ |

| Foreign Stocks | ✔ |

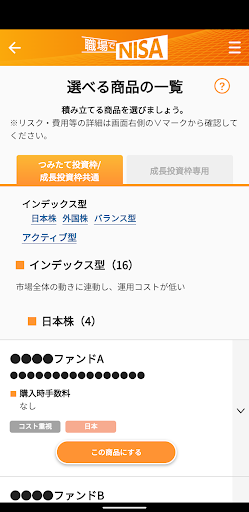

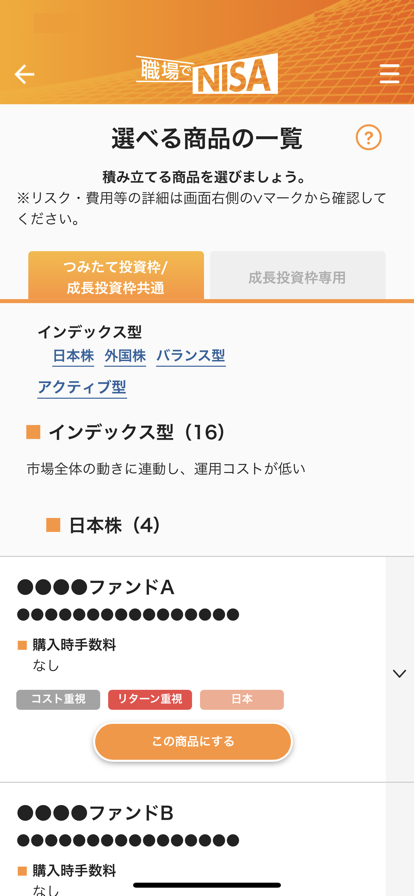

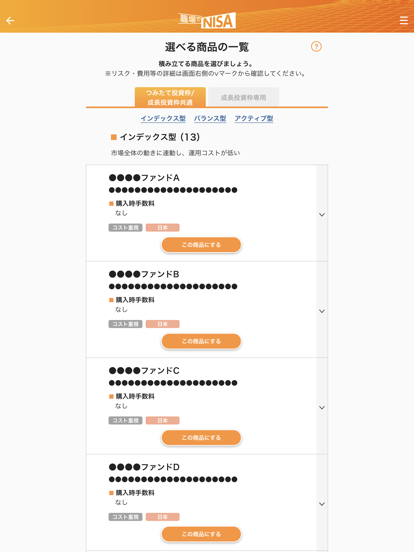

| Investment Trusts | ✔ |

| Bonds | ✔ |

| FX | ✔ |

| Real Estate Structured Products (ST) | ✔ |

| Commodities | ❌ |

| Crypto | ❌ |

| ETFs | ❌ |

Leverage

Nomura FX allows traders to do larger trades with less cash with 25x leverage. High leverage boosts profits but also raises losses. A “loss cut rule,” which automatically closes positions when the “margin maintenance rate” drops below 100%, reduces risk at Nomura FX. Traders should be cautious because sudden market changes can cause losses greater than deposited cash, even with stop-losses.

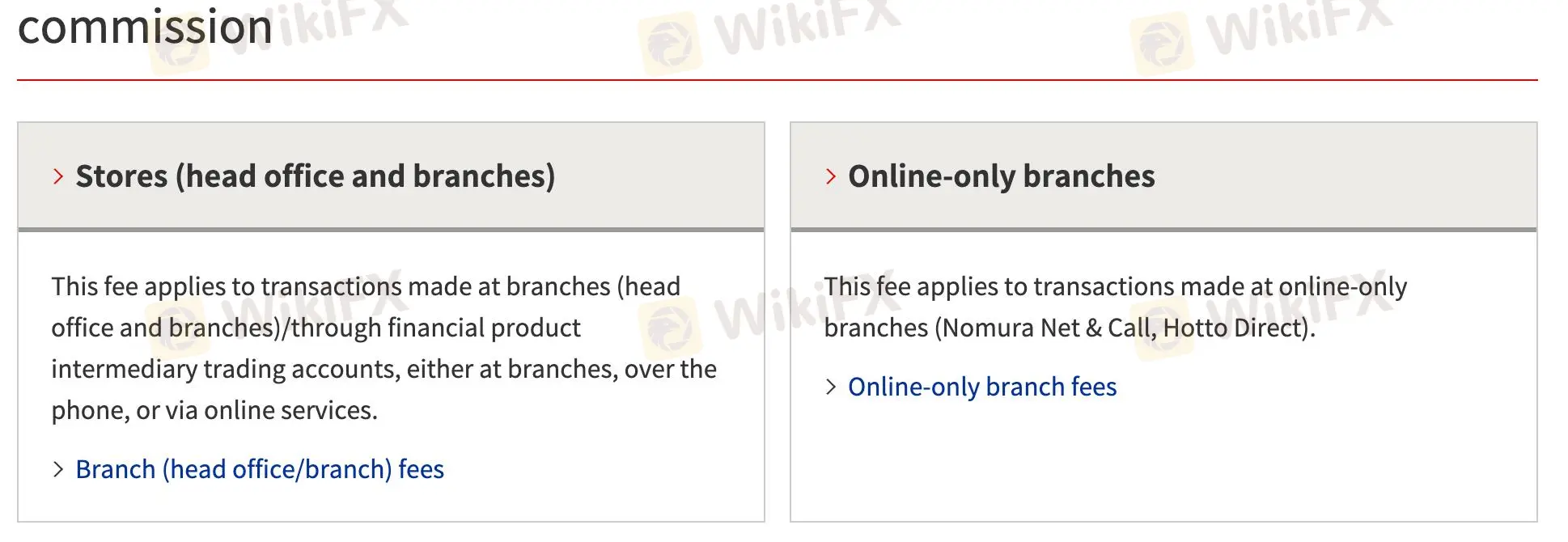

NOMURA Fees

Nomura's rates vary by service, with in-branch and online-only transactions having different fees. Physical branches charge far more for domestic stock trading than internet accounts.

| Fee Type | Charge |

| Transfer of shares to another company (<20 units) | Basic fee: 550 yen + 550 yen/unit (minimum 1,100 yen). |

| Transfer of shares to another company (>20 units) | Uniform fee: 11,000 yen. |

| Additional purchase of shares | 330 yen per stock. |

| Balance or transaction certificate | Free for individual transactions; 1,000 yen for multiple transactions per account. |

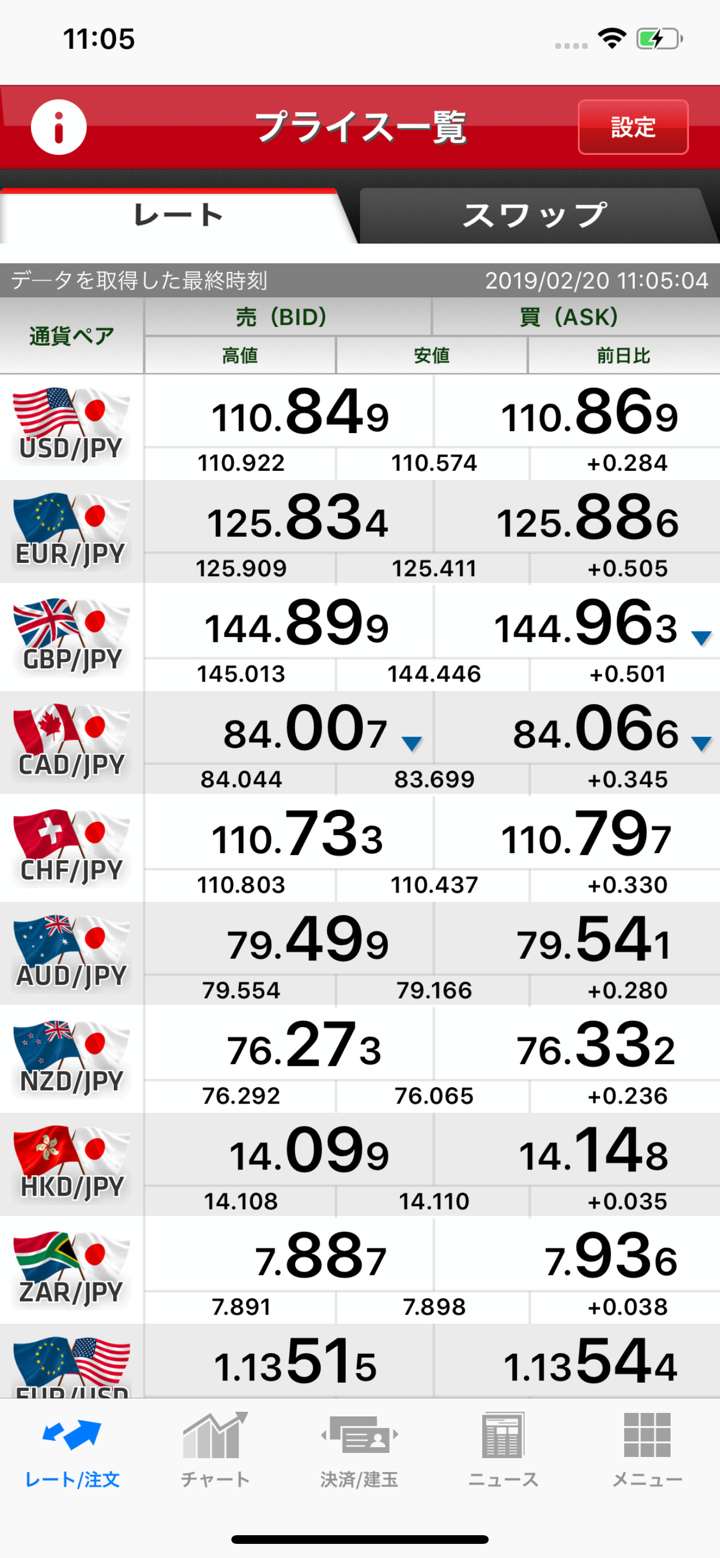

No Transaction Fees: Nomura FX does not charge explicit transaction fees but derives income from spreads.

Swap Rates: Traders may earn or pay swap points depending on the interest rate differential between the traded currencies. Swap points fluctuate based on market conditions.

Currency Conversion: For non-yen currency trades, additional spreads for yen conversion may apply.

| Currency Pair | Spread (pips) |

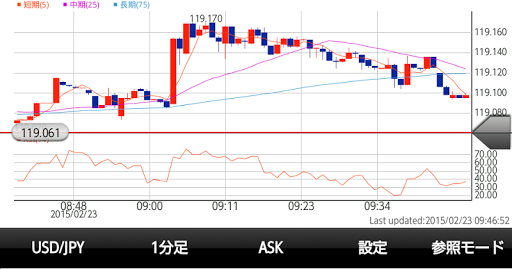

| USD/JPY | 2.8 |

| EUR/JPY | 5.3 |

| GBP/JPY | 6.9 |

| AUD/JPY | 4.9 |

| EUR/USD | 2.9 |

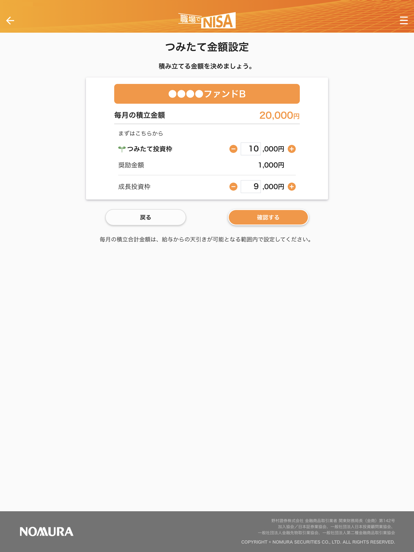

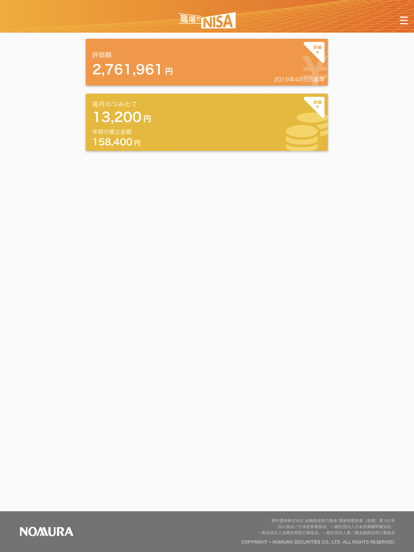

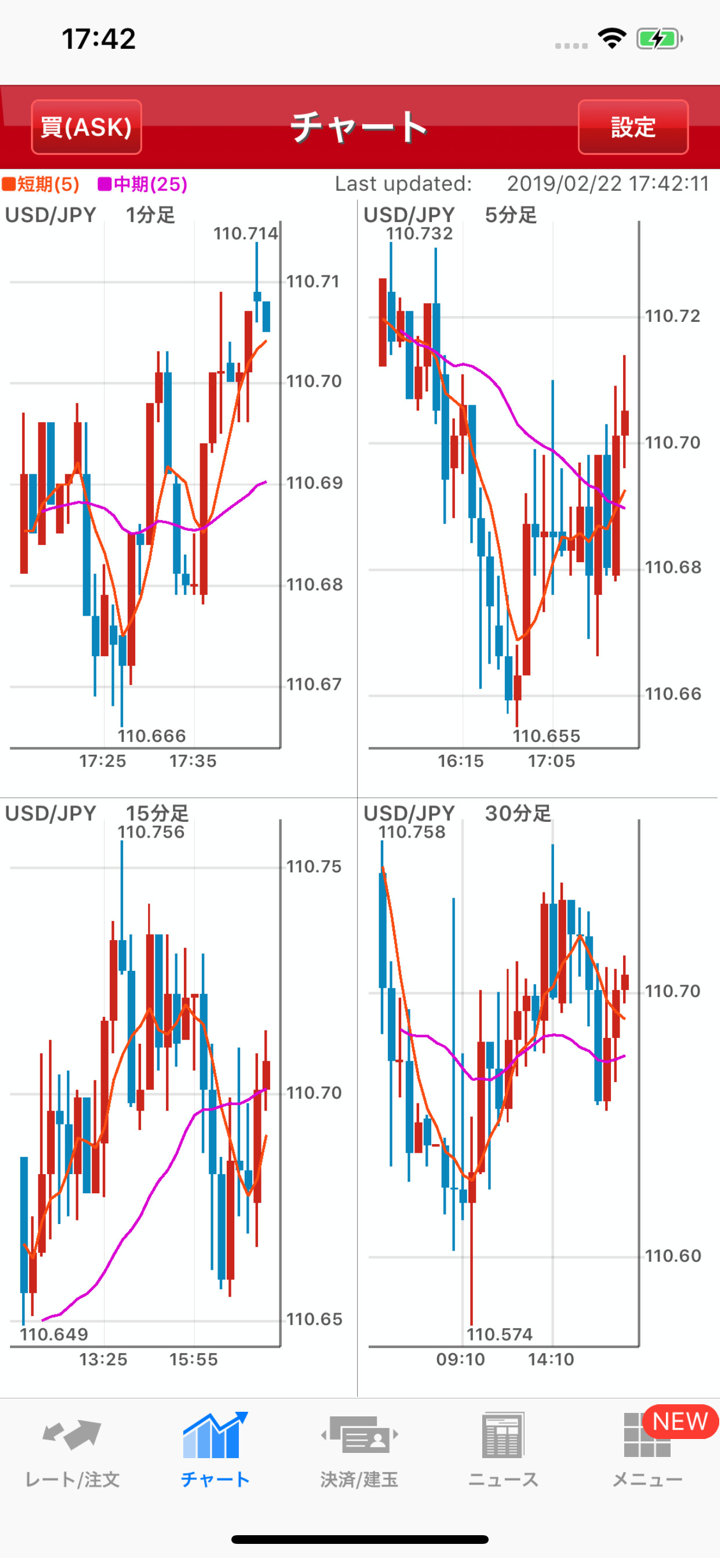

Trading Platform

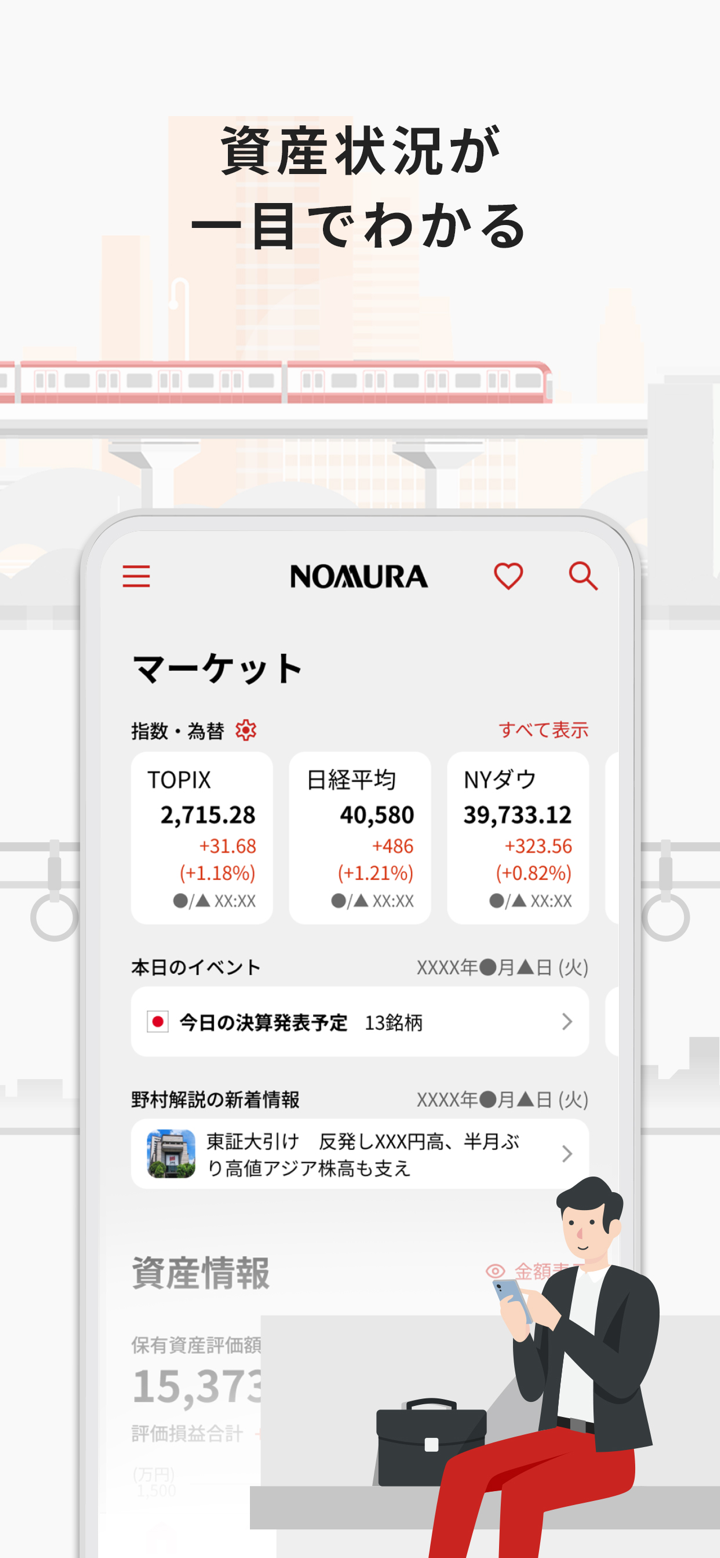

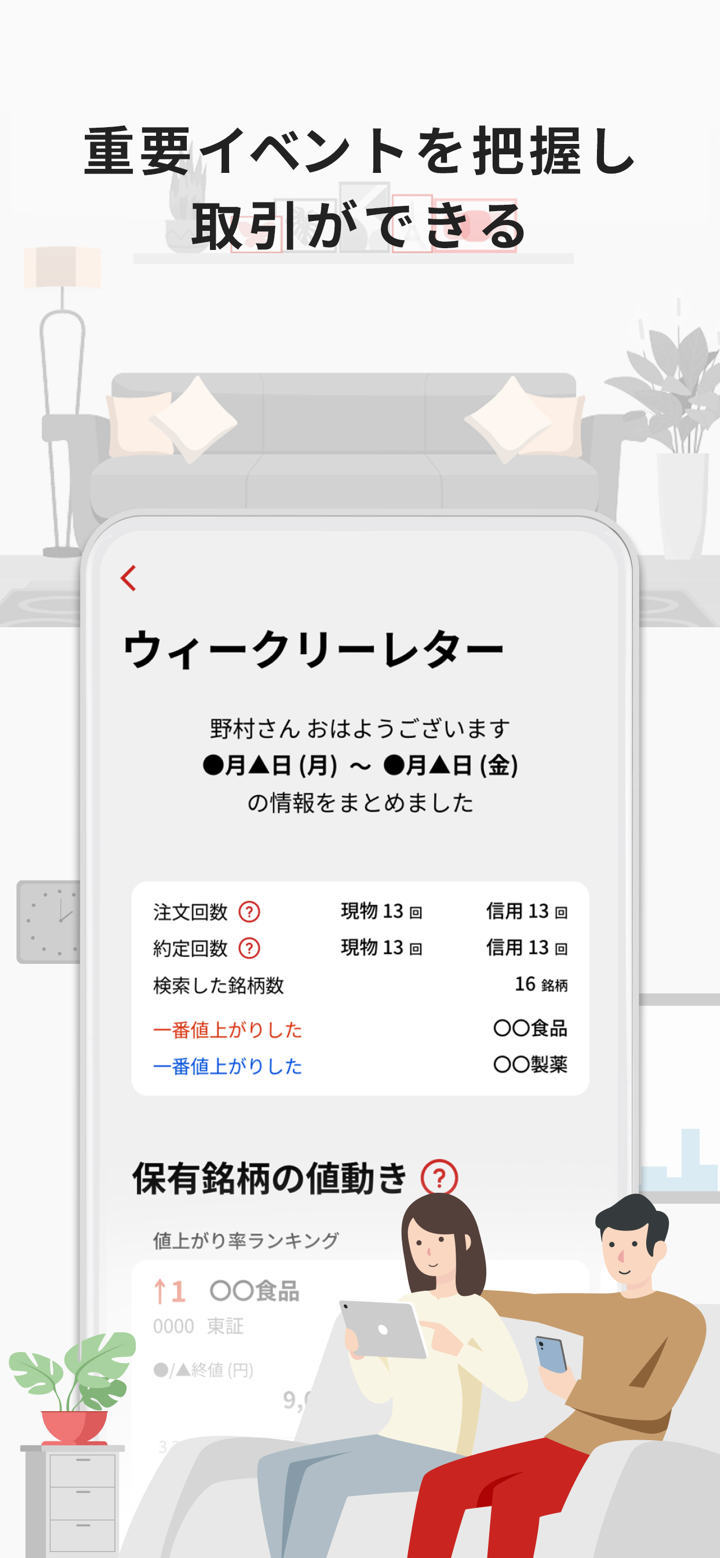

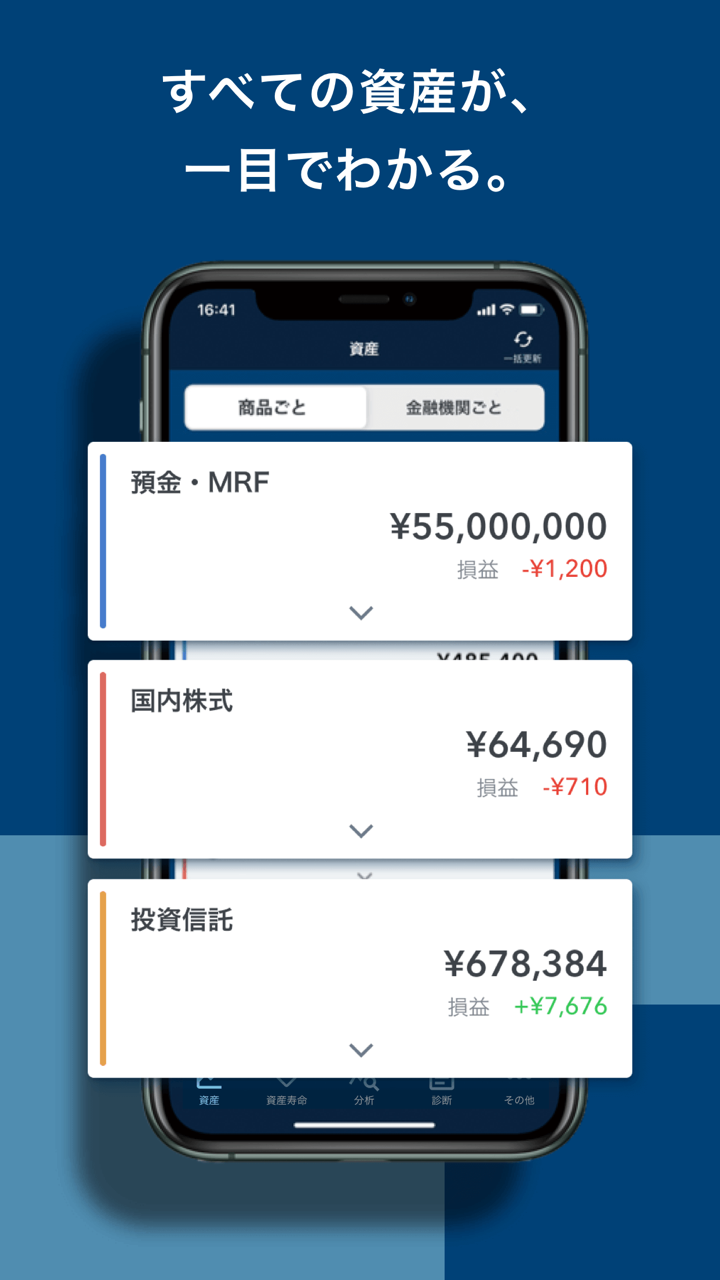

| Trading Platform | Supported | Available Devices | Suitable for What Kind of Traders |

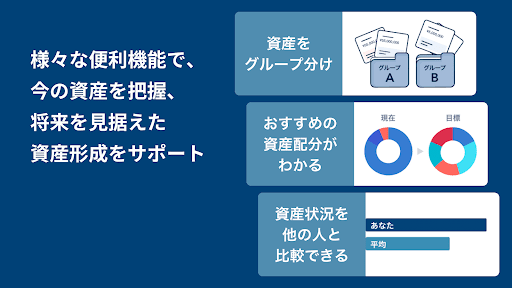

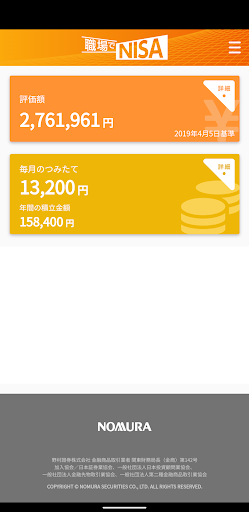

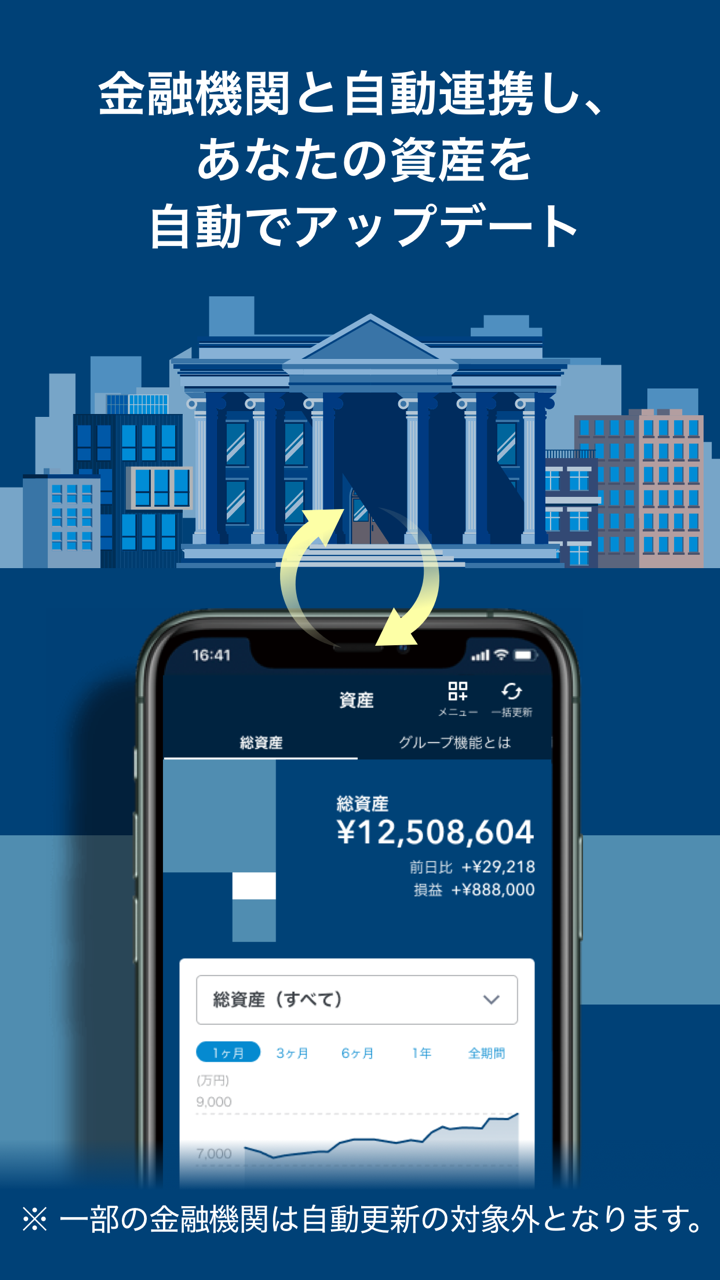

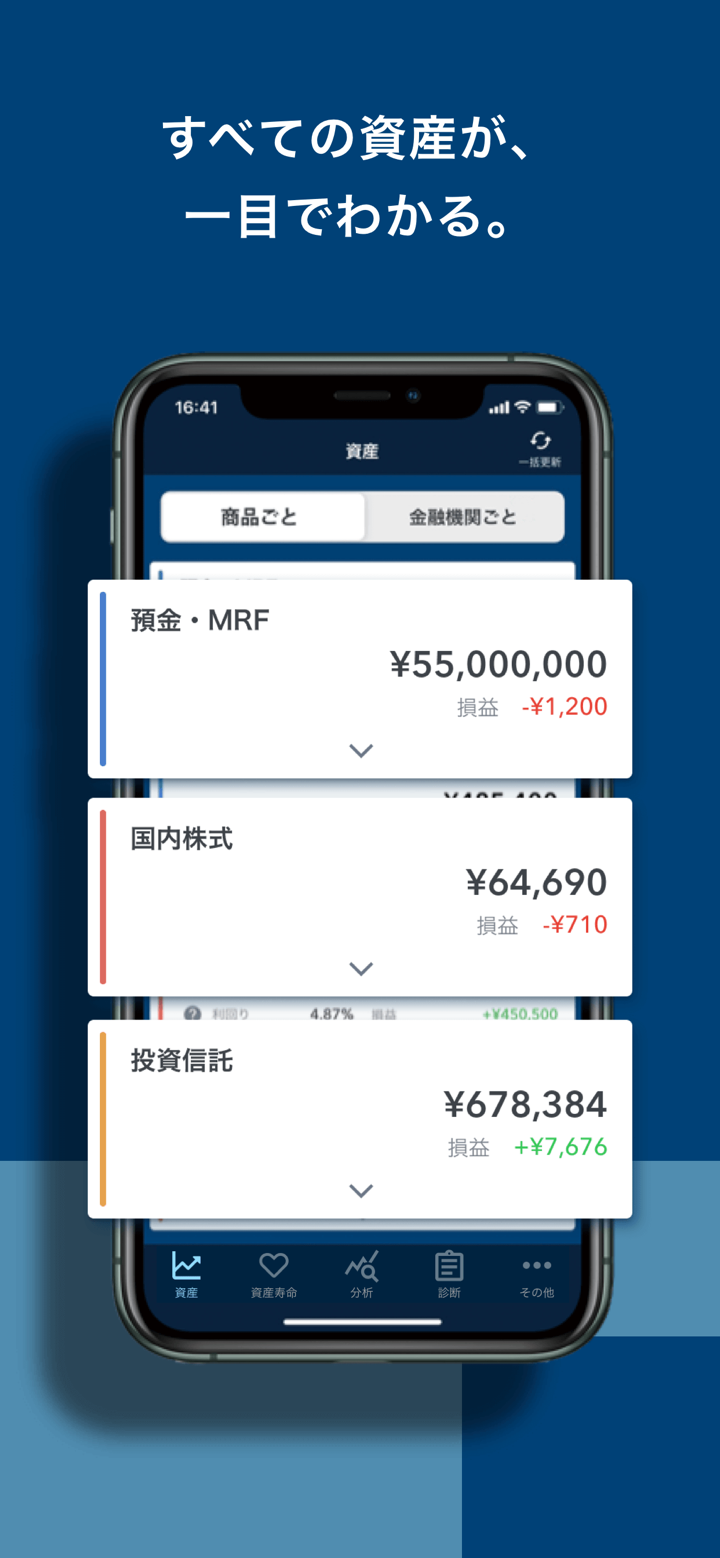

| Nomura Asset Management App “NOMURA” | ✔ | iPhone, Android | Traders and investors managing multiple financial assets and seeking personalized trading tools. |

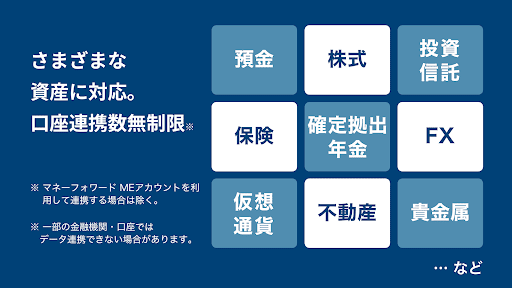

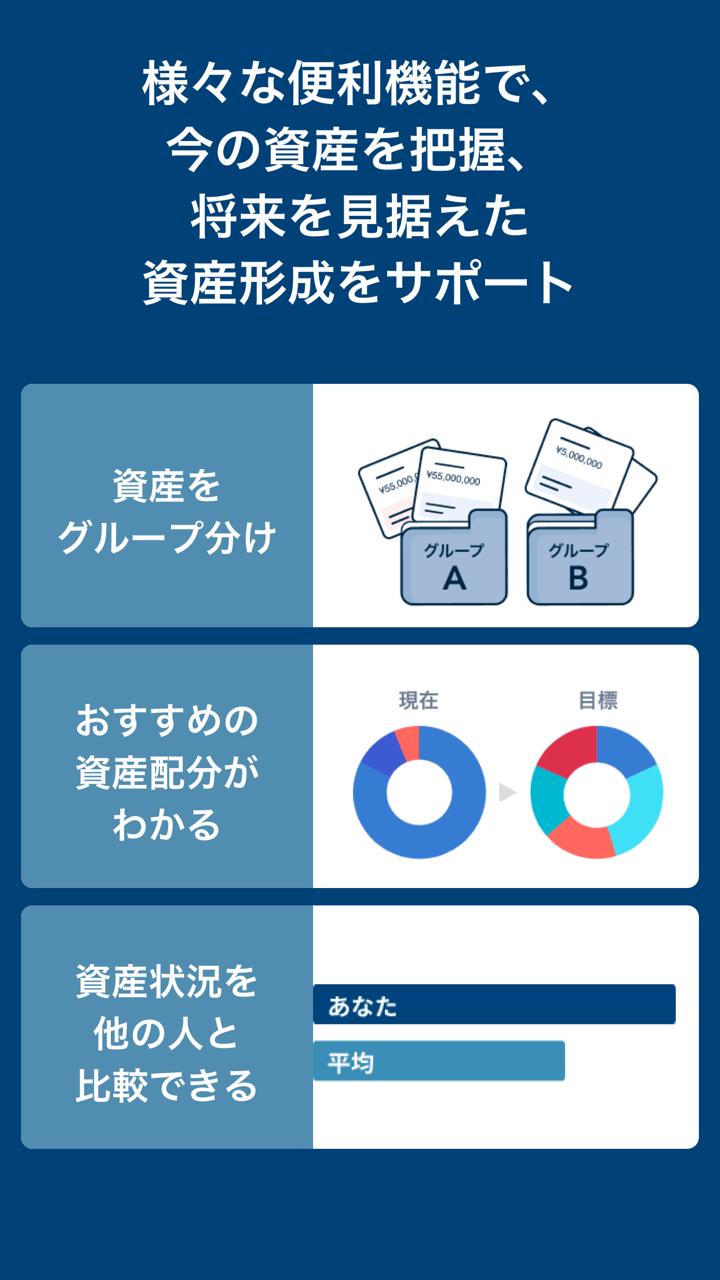

| Asset Management App “OneStock” | ✔ | iPhone, Android | Investors who want an overview of their assets, with additional features like asset diagnosis. |

| Nomura FX App | ✔ | iPhone, Android | FX traders who prefer trading on mobile devices with intuitive and focused operations. |