Company Summary

| Santander Review Summary | |

| Founded | 2003 |

| Registered Country/Region | United Kingdom |

| Regulation | Exceeded |

| Products and Services | Mortgages, Credit Cards, Savings and ISAs, Investments, Insurance, Personal Loans, Current Accounts |

| Trading Platform | Online Banking, Mobile Banking app |

| Min Deposit | Not mentioned |

| Customer Support | 24/7 Live chat |

Santander Information

Santander, founded in 2003 and registered in the UK, is an online trading platform that offers many financial services accessible through online and mobile banking. While the Investment Advisory License is now exceeded, this platform provides diverse products including mortgages, credit cards, savings, ISAs, investments, insurance, and personal loans, alongside various current account options.

Pros and Cons

| Pros | Cons |

|

|

|

|

Is Santander Legit?

Santander once had an Investment Advisory License regulated by the Financial Conduct Authority (FCA) in the United Kingdom with a license number of 106054, but now it is exceeded. The WHOIS search shows the domain santander.co.uk was registered on August 14, 2003.

Products and Services

- Mortgages: Santander offers mortgage services for first-time buyers, home movers, and remortgagers, including options for switching lenders, borrowing more, and managing existing mortgages.

- Credit Cards: Santander offers credit cards to suit different needs, including the All in One, Long Term Balance Transfer, Everyday No Balance Transfer Fee, and Santander World Elite™ Mastercard®.

- Savings and ISAs: Santander provides various savings and ISA options for different financial goals, such as the Easy Access Saver, Regular Saver, Santander Edge Saver, Easy Access ISA, Fixed Rate ISAs, Fixed Term Bonds, Junior ISA, and Inheritance ISA.

- Investments: Santander offers investment options with cashback, an online Investment Hub for advice and fund selection, and readily available investment advice and resources.

- Insurance: Santander offers a comprehensive range of insurance products, including home, life (with critical illness), health, mortgage life, family/lifestyle, over 50s life, car (including EV), travel, business, and landlord insurance.

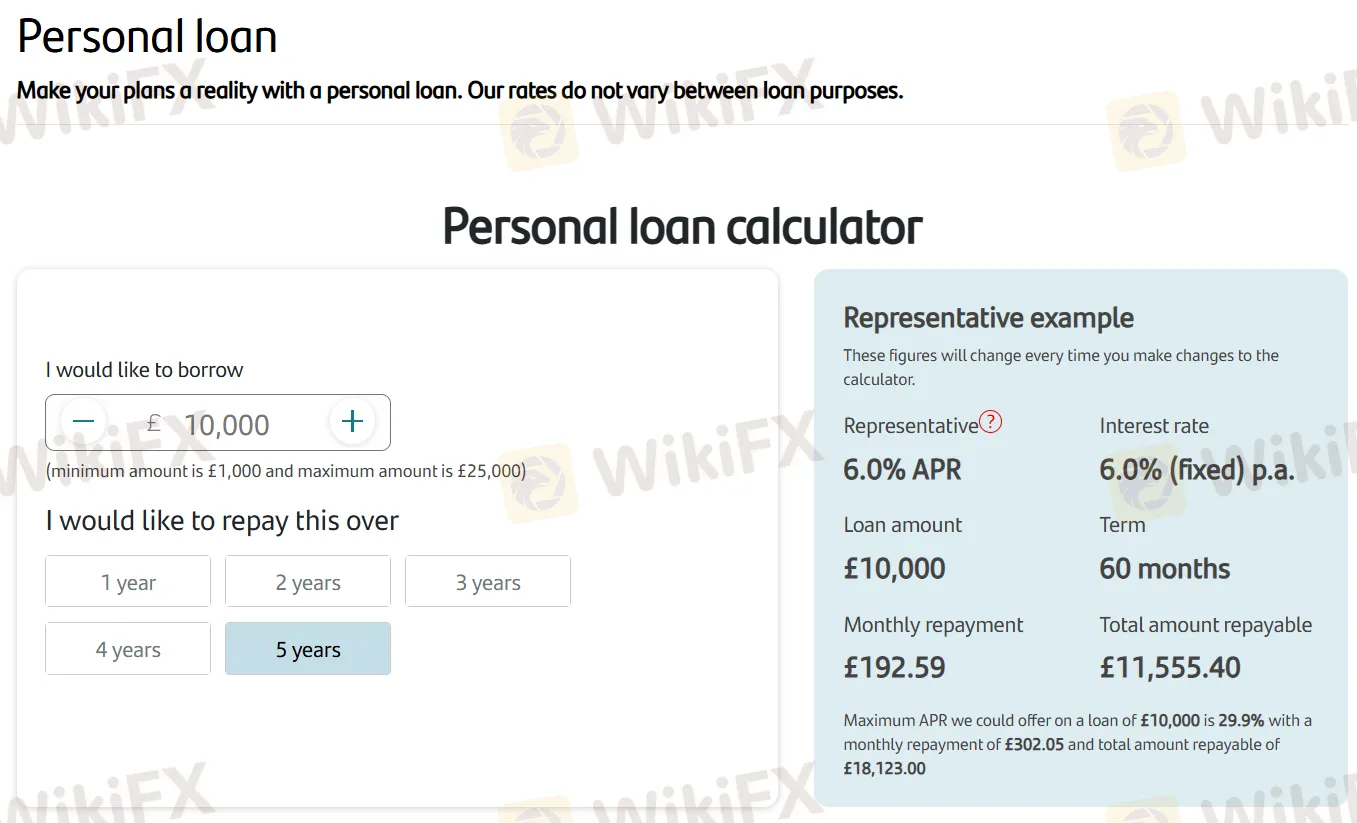

- Personal loan: Santander offers personal loans with fixed interest rates, ranging from £1,000 to £25,000, with flexible repayment terms, subject to eligibility.

Current Accounts

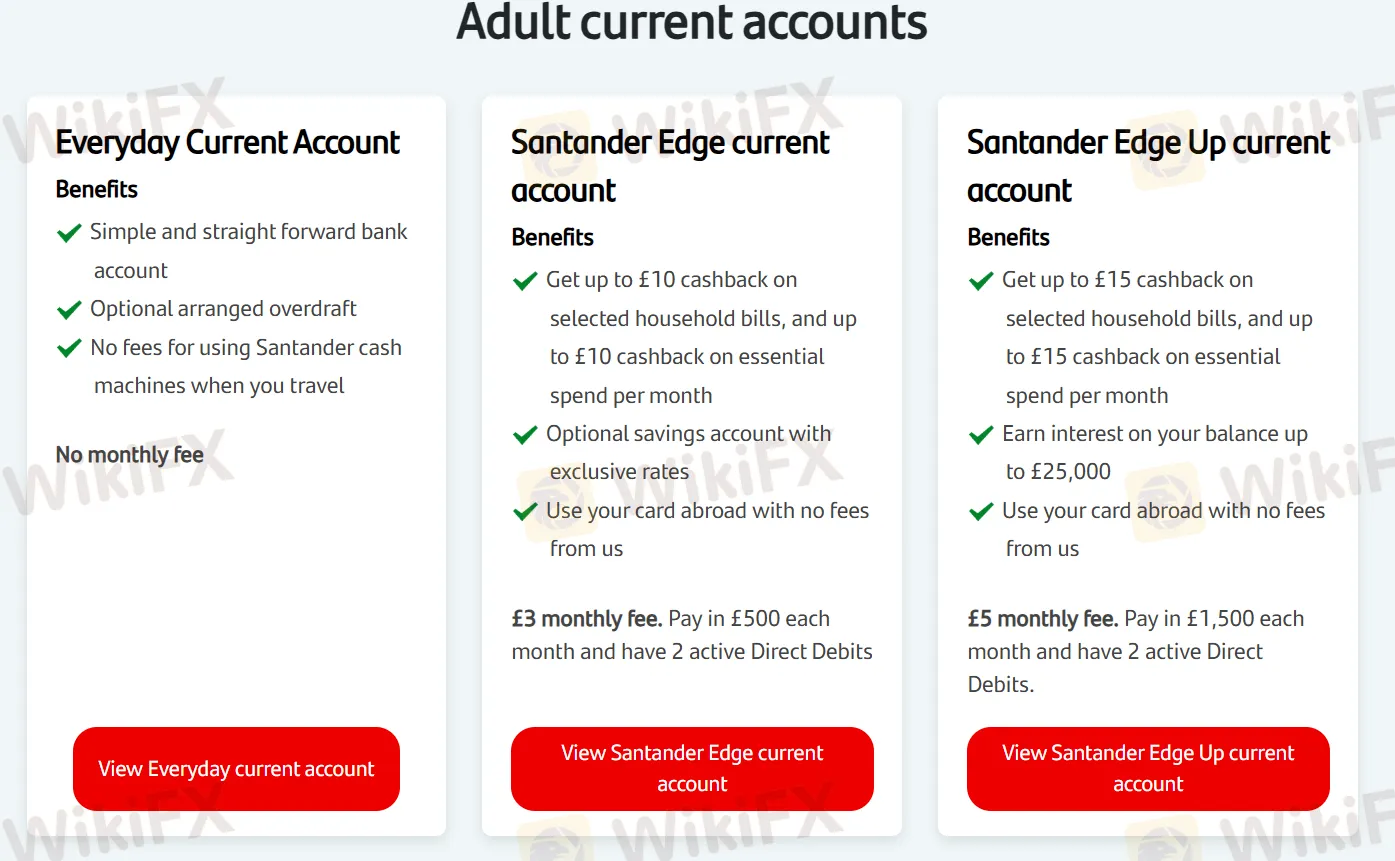

Adult current accounts:

Account Name Benefits Monthly Fee Key Requirements Everyday Current Account Simple bank account, optional overdraft, no fees at Santander ATMs abroad. No fee None explicitly stated. Santander Edge current account Up to £10 cashback on bills & essential spend, optional savings account with exclusive rates, no card usage fees abroad from Santander. £3 Pay in £500/month and have 2 active Direct Debits. Santander Edge Up current account Up to £15 cashback on bills & essential spend, earn interest on balances up to £25,000, no card usage fees abroad from Santander. £5 Pay in £1,500/month and have 2 active Direct Debits.

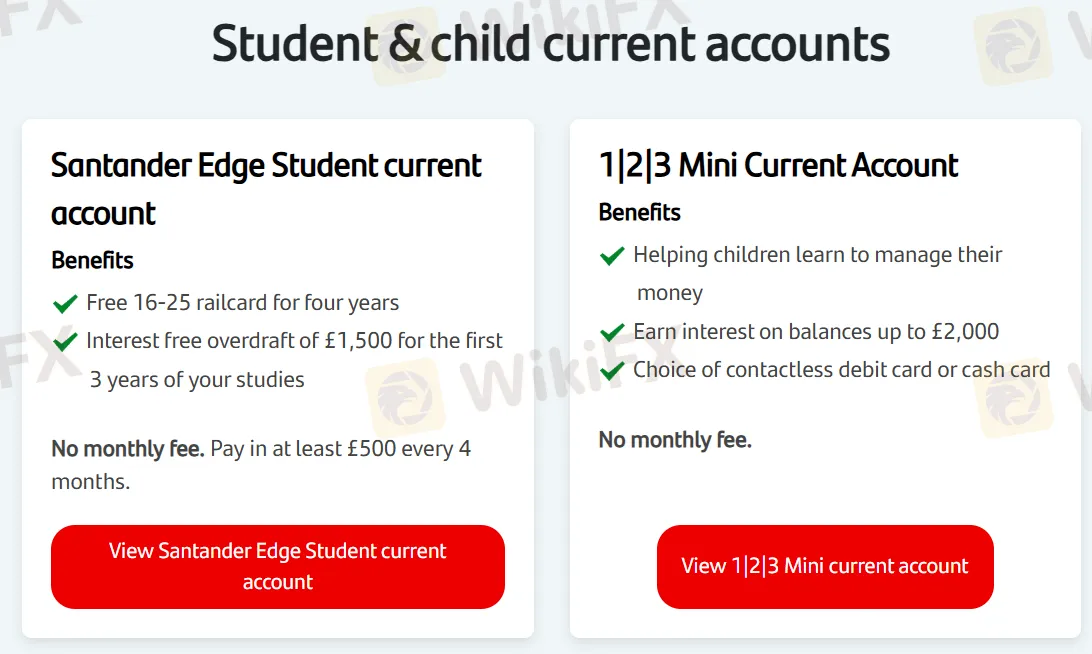

Student & child current accounts

Other current accounts

- Basic Current Account: Suitable for those with poor credit history or new to the UK for work/study, no monthly fee.

- Carer's Card account: Allows giving debit cards to up to 2 carers, money transferred from your other accounts, carers can withdraw cash or shop for you, no monthly fee.

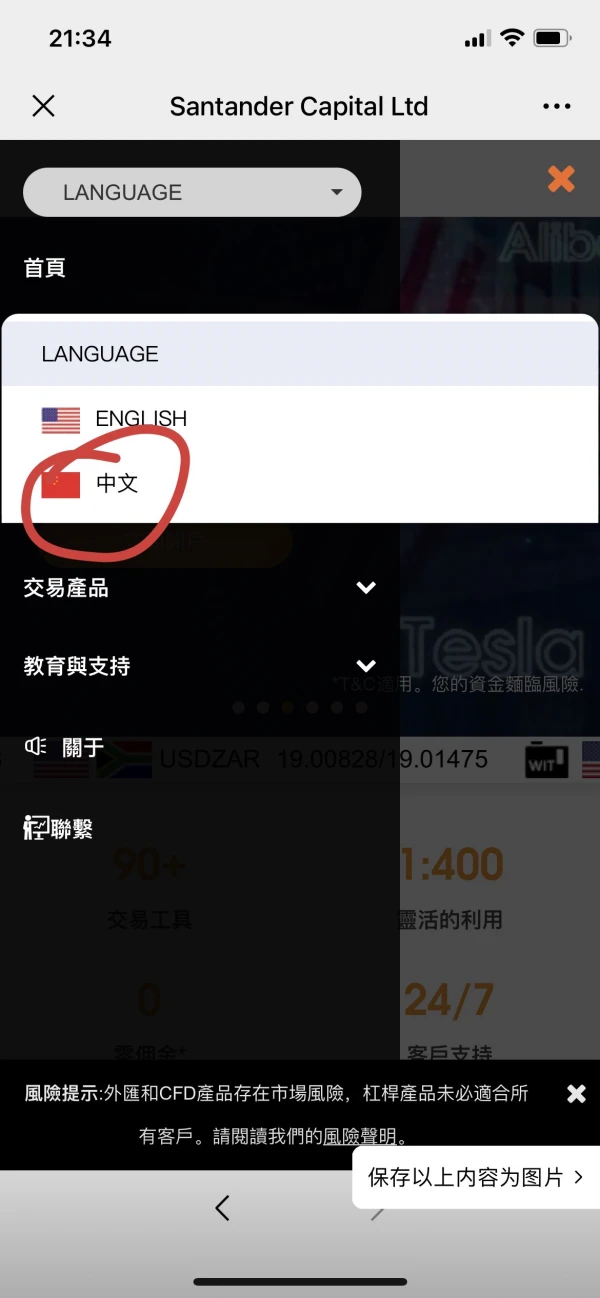

Trading Platform

| Trading Platform | Supported | Available Devices | Suitable for |

| Online Banking | ✔ | PC and Mobile | Investors of all experience levels |

| Mobile Banking app | ✔ | IOS and Android | Investors of all experience levels |

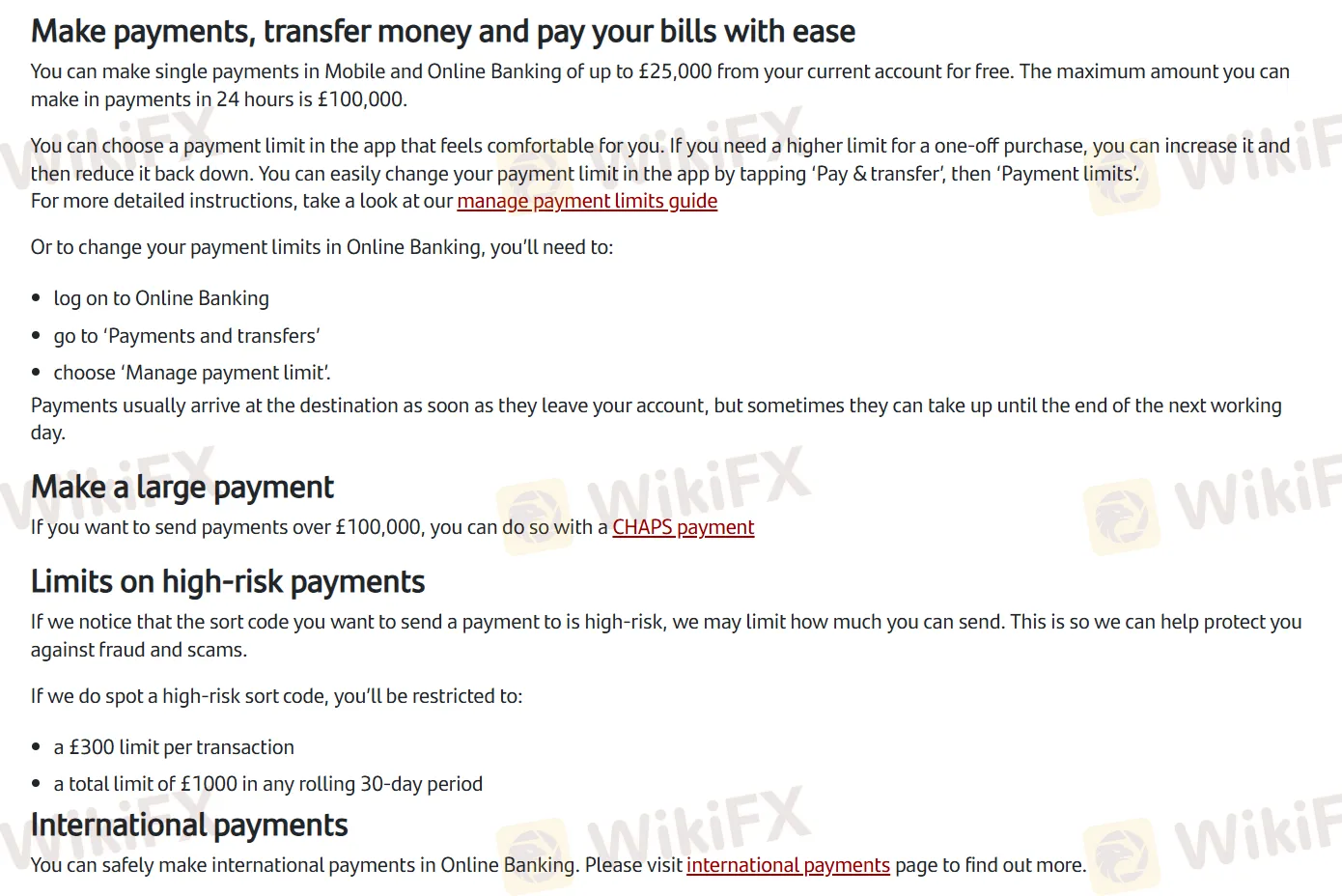

Payments and Transfers

Deposit/Withdrawal Fees and Minimum Deposit are not mentioned on the website. But you should pay attention to:

- Free Transfers: Up to £25,000 per transaction online/mobile (daily limit £100,000).

- Adjustable Limits: Easily manage your payment limits in the app.

- Large Payments: Use CHAPS for amounts over £100,000.

- High-Risk Limits: Transactions to risky accounts capped at £300 (single) and £1,000 (30-day total).

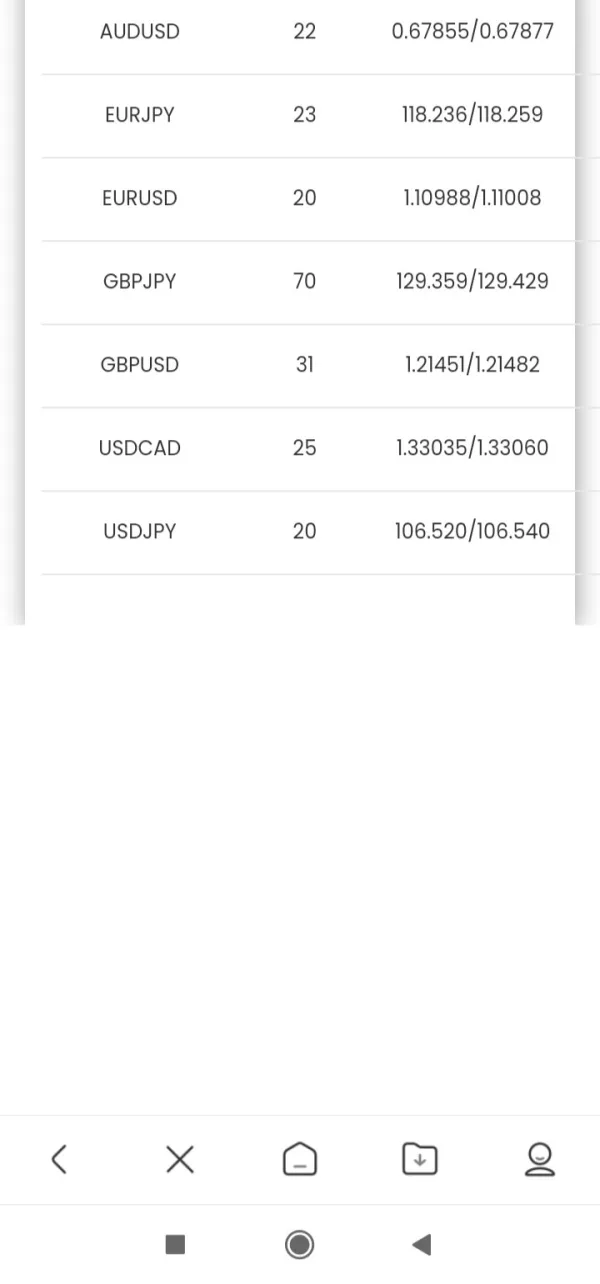

FX4981129072

Chile

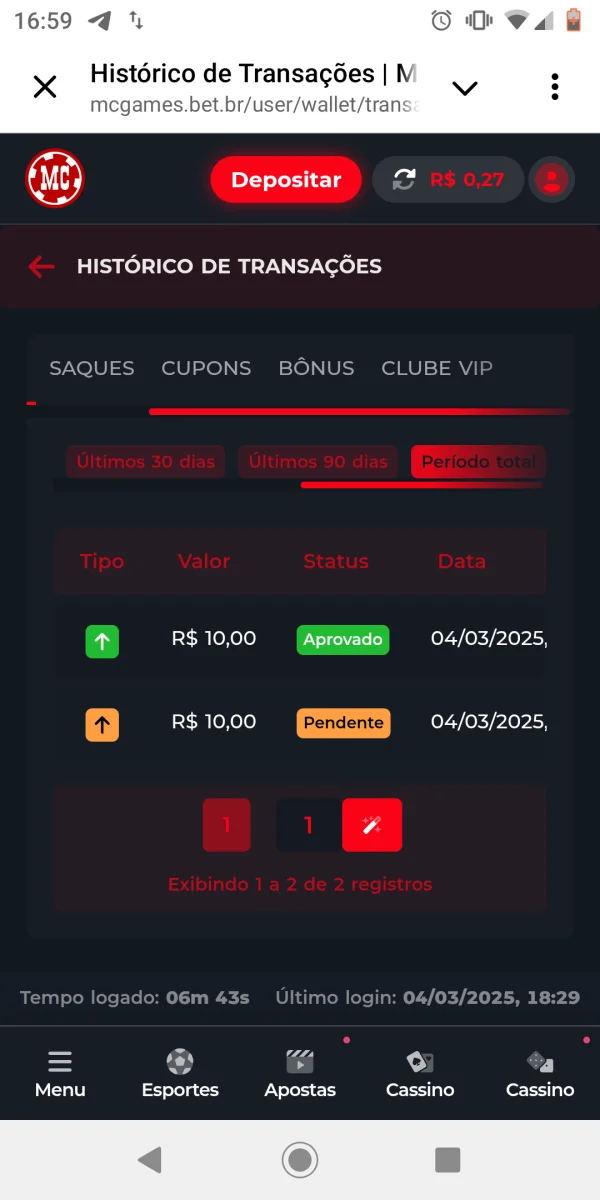

I deposited $146 on this platform and transferred $4030 from suouesta. But my account was blocked.

Exposure

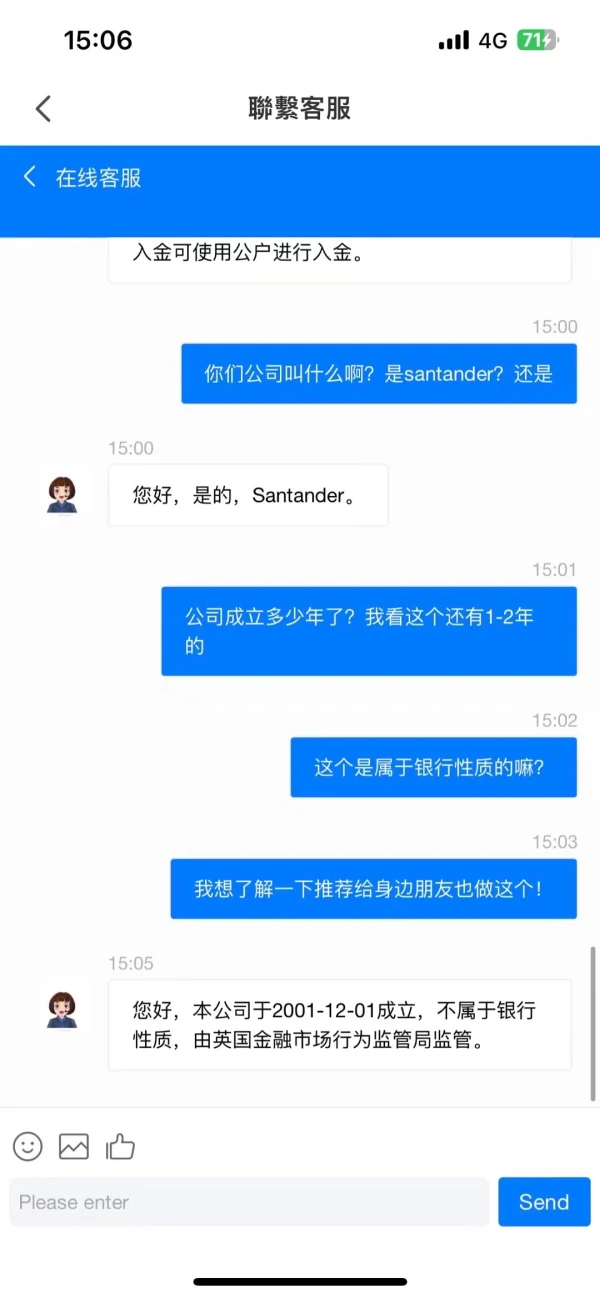

8618

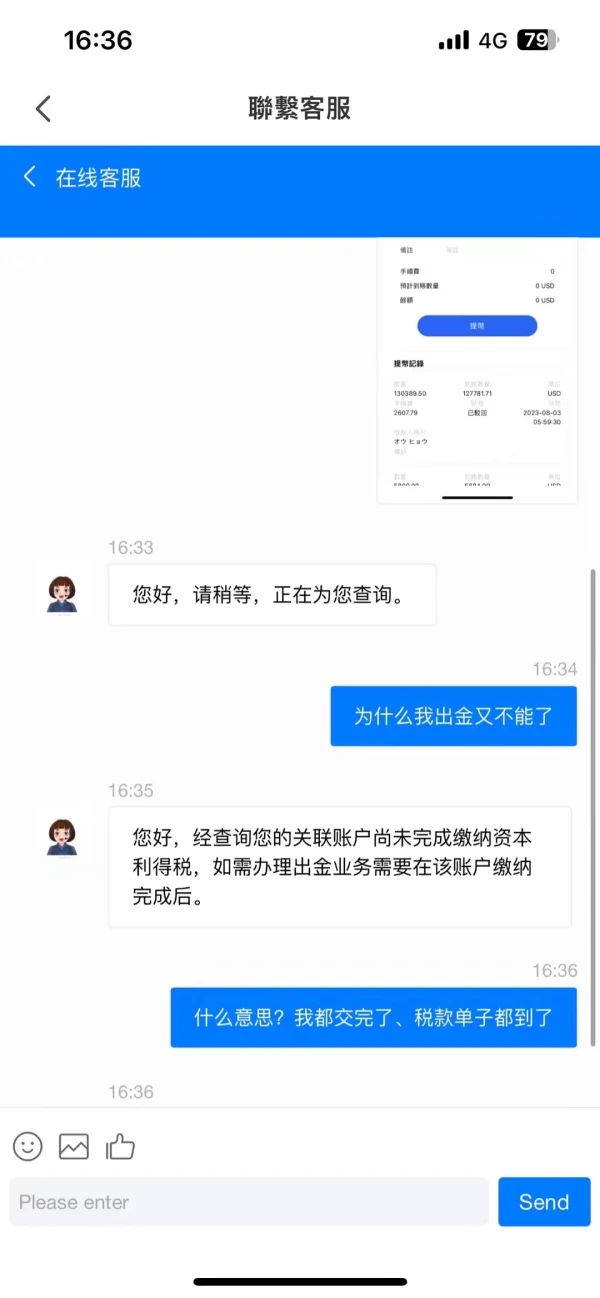

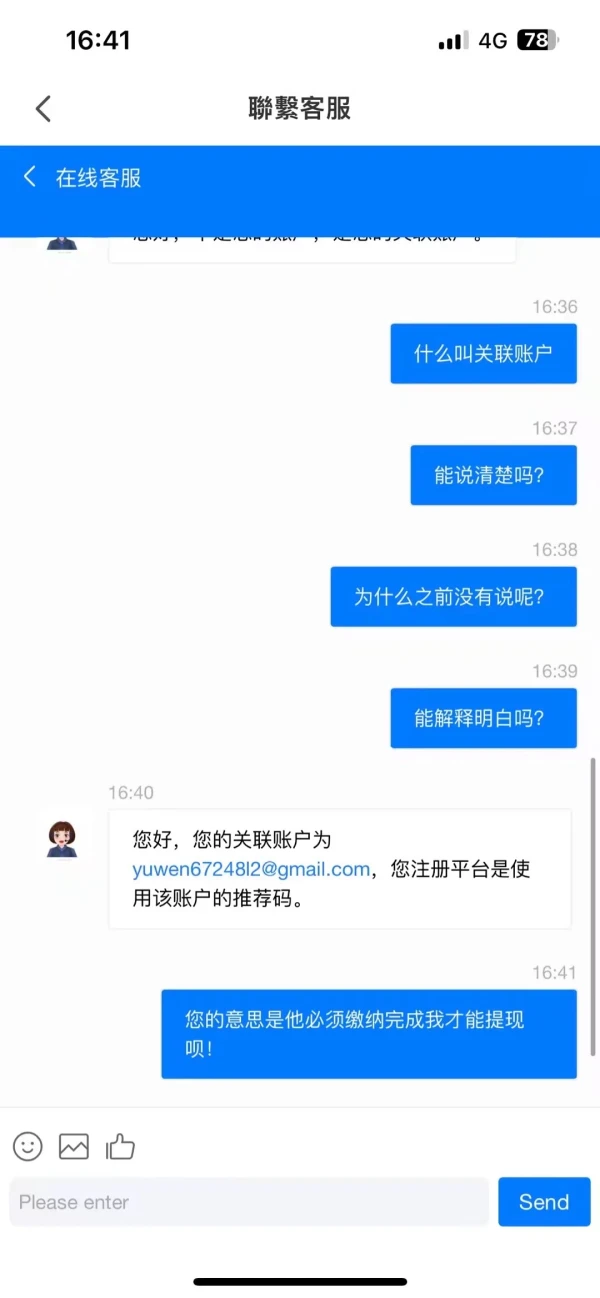

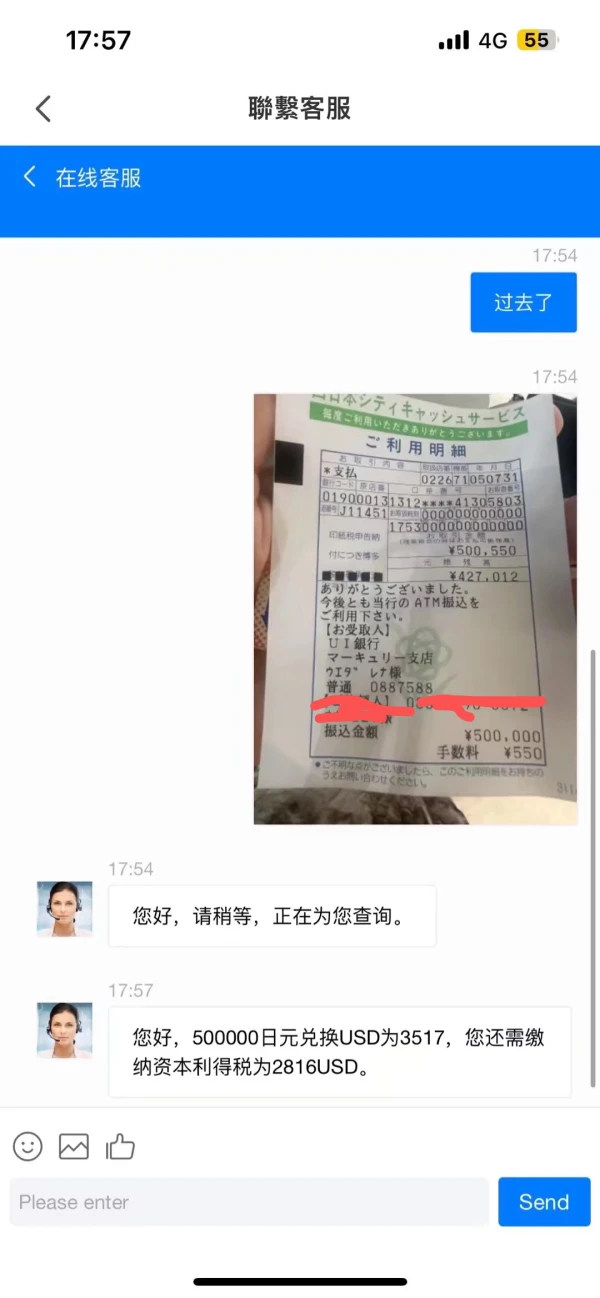

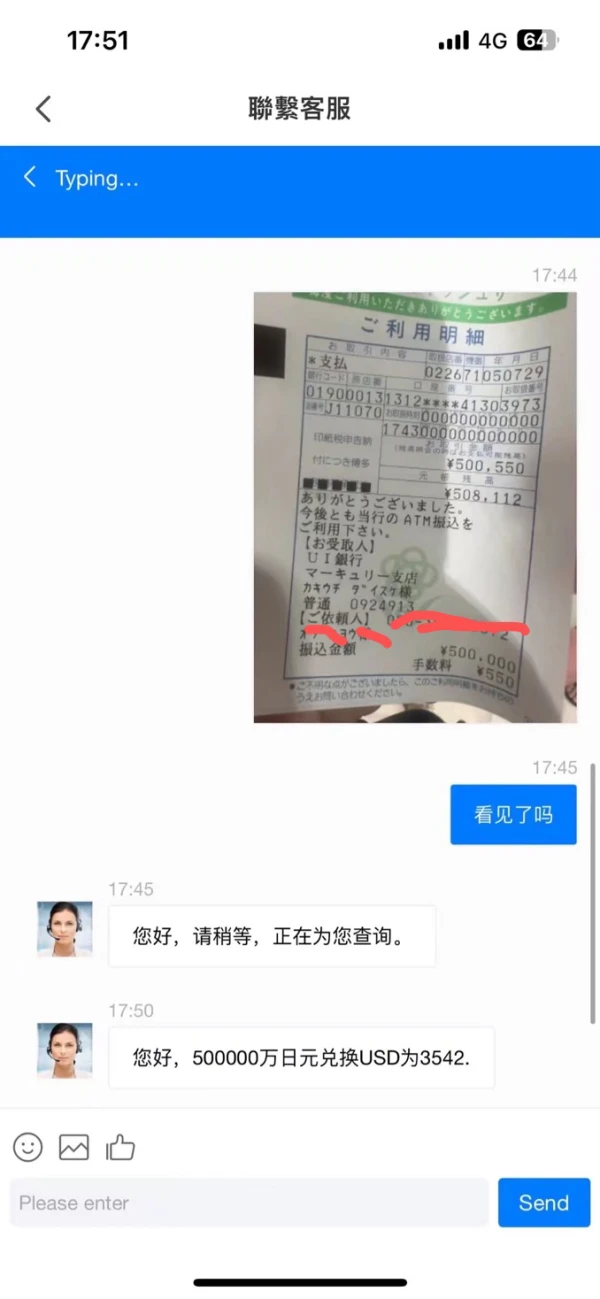

Japan

I registered this account using the code given to me by the recommender. Now I don't know if it's the platform policy or what. Originally, the reason why I couldn't withdraw money was because I hadn't paid taxes on my profits. I need to pay 20% of the profit to withdraw money. But I still can't withdraw money after paying the taxes. The platform also said that the money associated with the account was not paid. What kind of policy is this? My own taxes and my account have been paid, but I cannot withdraw funds yet. I can't understand. The person who recommended me now is always saying that he has no money to pay and has been out of contact. I couldn't withdraw my principal, and I paid another 20563 usd in taxes!

Exposure

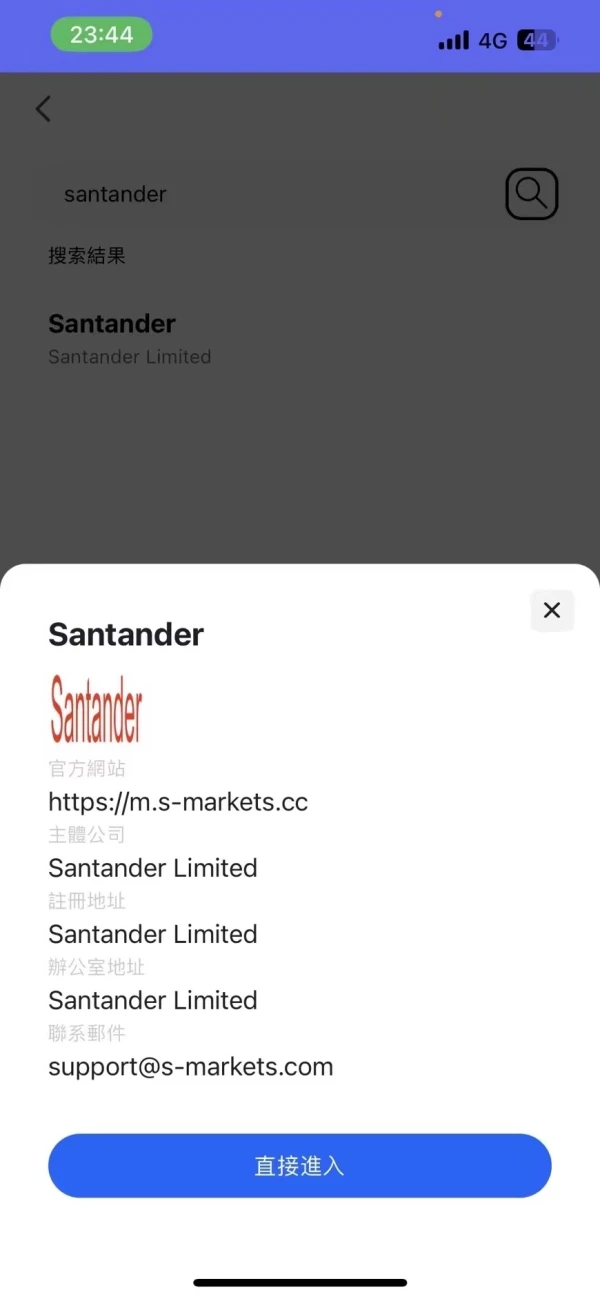

FX4184815529

Hong Kong

I can only post the exposure information under the official ones. The ones marked below are official. The platform I deposited is fake. The address of the fraudulent and fake platform: is https://www.santanderfx.com It has been liquidated to obtain the user's assets. I am now unable to withdraw funds.

Exposure

FX1208880192

Brazil

Too good

Positive

VX-DCEP8888

Hong Kong

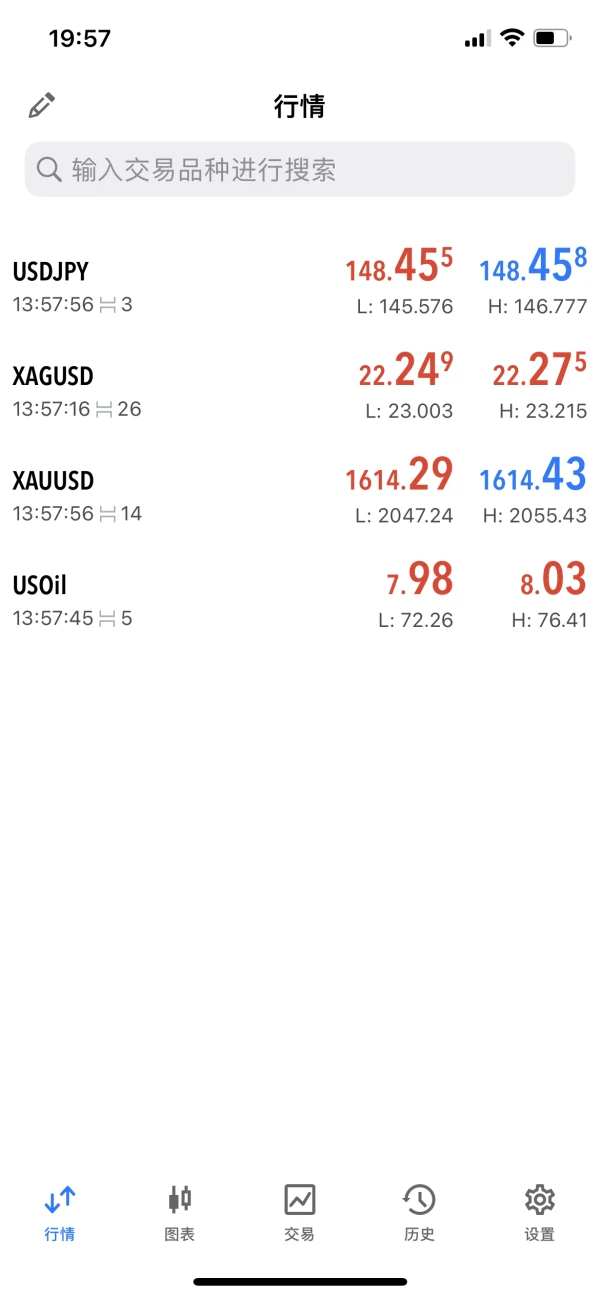

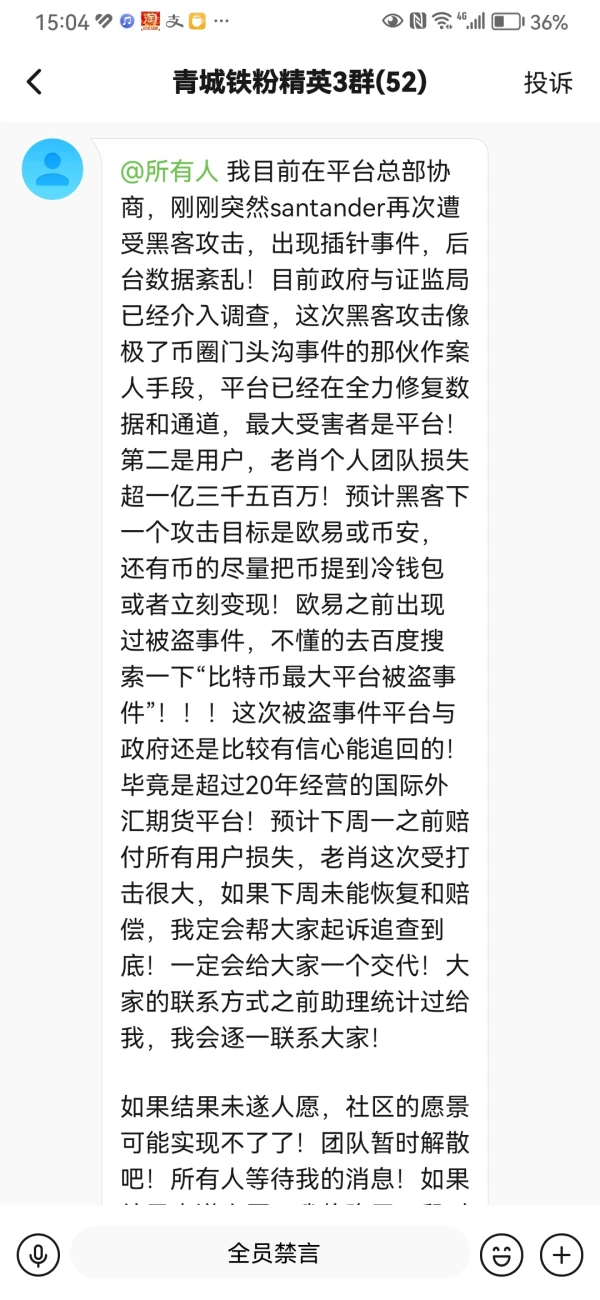

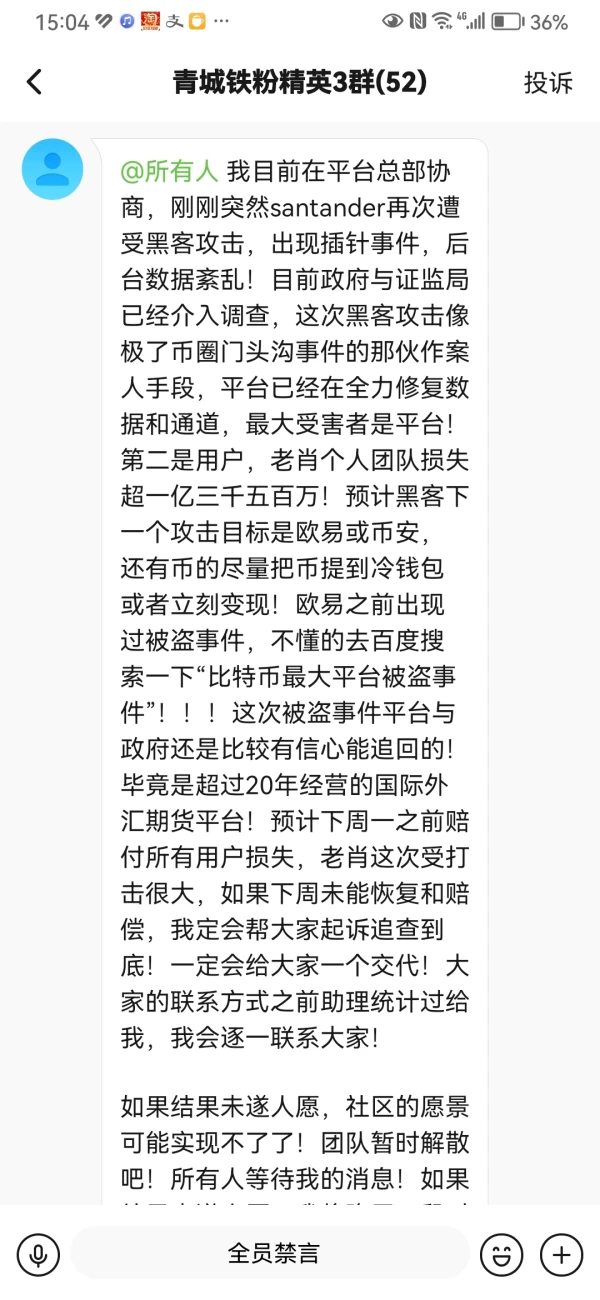

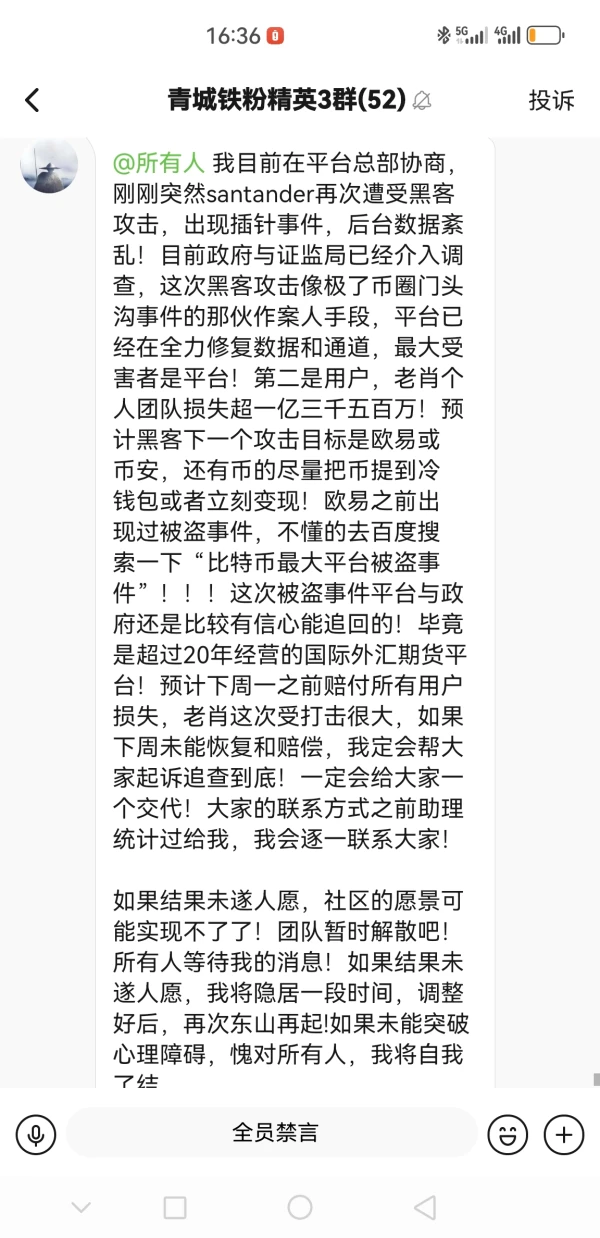

Xiao Peng began to gain the trust of members through lectures, and step by step induced everyone to register for the fake Santander website: https://www.santanderfx.com. Starting from depositing money, he induced everyone to buy gold and crude oil, and finally directly controlled the platform to liquidate their positions! They lied about a hacker attack and no one can withdraw money. The website is currently unavailable! This is pure fraud. Please be sure to unite and contact me on WeChat to wipe out the Xiao Peng gang together to prevent more people from being deceived!

Exposure

幸福3324

Hong Kong

Xiao Peng's fraud team uses lectures to deceive our trust and induces us to download the mt5 platform. He persuades us to choose the Santander trader and conduct copy trading! The malicious marking caused us to liquidate our positions. The trading platform was hacked last Thursday and we were unable to withdraw cash. Furthermore, the chat group was suddenly disbanded and blacklisted! Withdrawal is currently unavailable! I have called the police. The police has accepted the case and has been sorting out relevant information.

Exposure

幸福3324

Hong Kong

I was defrauded by Xiao Peng's team. The telecom network used the fake meta5 platform. It is the trader Santander. My position is currently liquidated and I am unable to withdraw money. I have reported the case! The police are sorting it out!

Exposure

布鲁斯李7022

Hong Kong

I was also deceived by Xiao Peng, fake Santander, now has a burst position, has been unable to withdraw funds, Santander has been unable to log in.

Exposure

谁来救我

Hong Kong

Can only find the genuine to send exposure information, this site is fake, can not withdraw. Has burst the position to obtain the user's assets, now can not withdraw, everyone should keep our own rights, join the following group, more people power big rights, do not let go of the Xiao Peng, this gang.

Exposure

布鲁斯李7022

Hong Kong

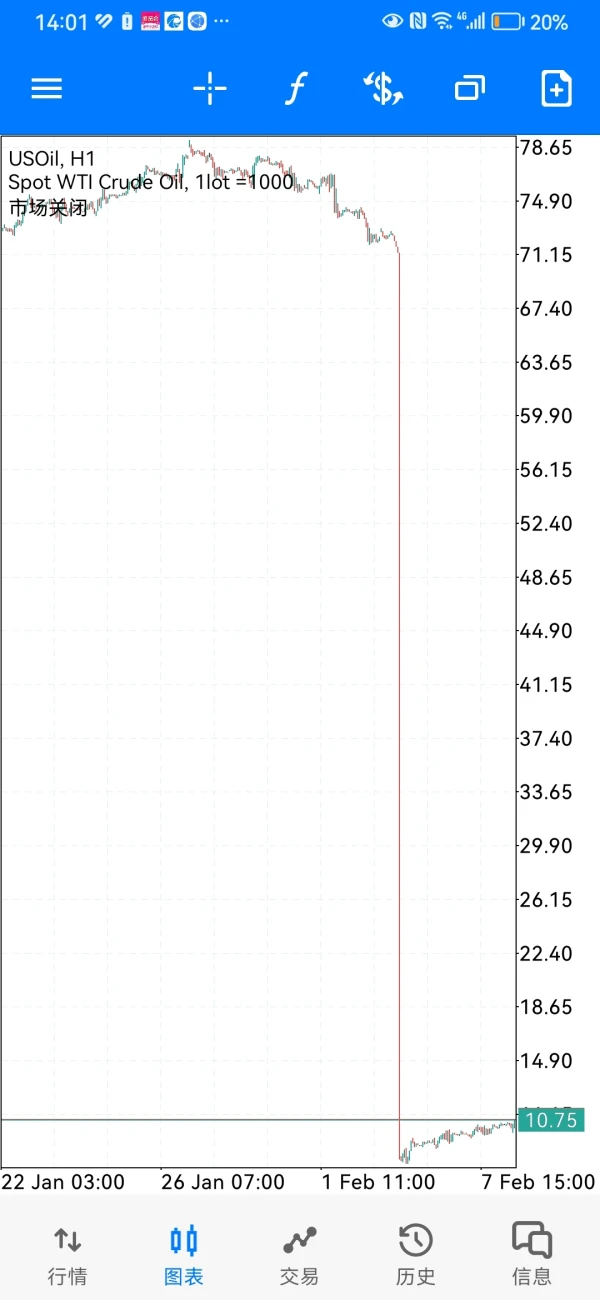

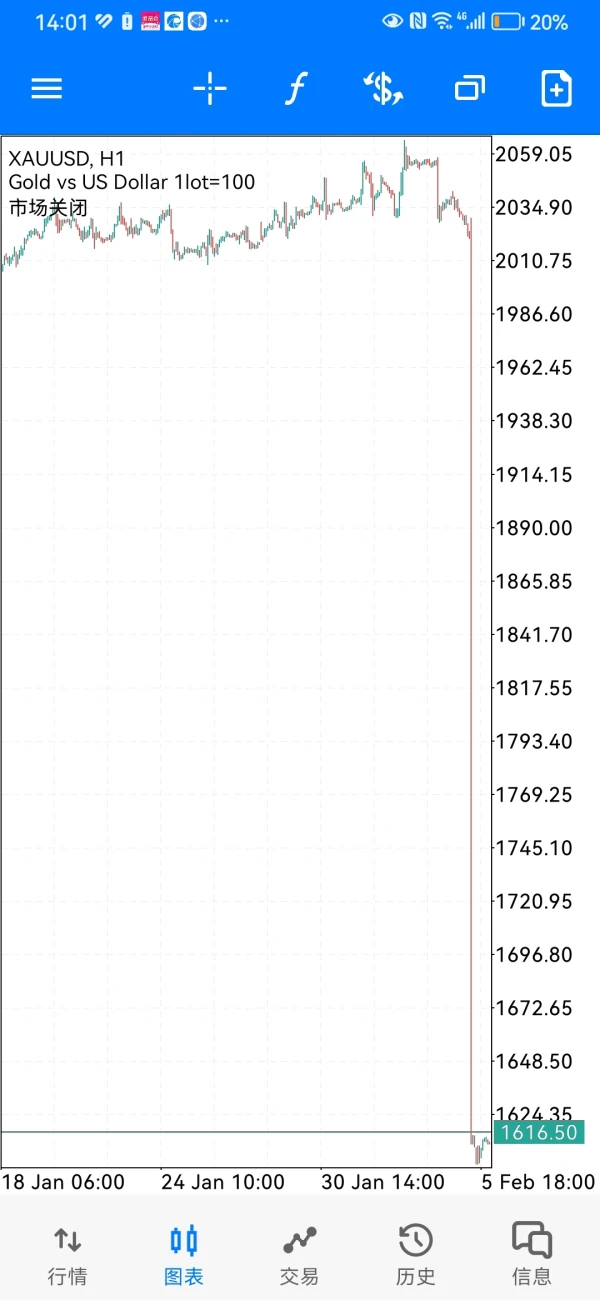

I first deposited money into this broker and made some money at the beginning. I tried to withdraw 200u, I was still able to withdraw money smoothly. Later, they operated the K-line, I lost money directly, leaving only a little bit of principal. Then they induced me to deposit money again until I ran out of money, and directly controlled the K-line. Crude oil fell directly from 72 to single digits, and gold was cut in half. I hope no one will be scammed again.

Exposure