Basic Information

Poland

Poland

Score

Poland | 5-10 years |

Poland | 5-10 years |https://bossa.pl

Website

Rating Index

Influence

A

Influence index NO.1

Poland8.51

Poland8.51 Forex License

Forex License No forex trading license found. Please be aware of the risks.

Poland

Poland  bossa.pl

bossa.pl  Poland

Poland | BOSSA.PL Review Summary | |

| Founded | 2000 |

| Registered Country/Region | Poland |

| Regulation | No regulation |

| Market Instruments | Stocks, bonds, ETFs, forex, funds |

| Demo Account | ✅ |

| Leverage | Up to 1:30 |

| Spread | From 1.1 pips (Standard Package) |

| Trading Platform | boss WebTrader, bossa Mobile, boss StaticaTrader, Amibroker Professional, MT4, MT5 |

| Minimum Deposit | 14 PLN, 4 EUR/USD/GBP |

| Customer Support | Contact form |

| Tel: +48 22 50 43 104 | |

| Email: makler@bossa.pl | |

| Address: DM BOŚ ul. Marszałkowska 78/80 00-517 Warszawa | |

| Facebook, X, Linkedin, YouTube | |

| Regional Restrictions | the USA, Australia, Canada or Japan |

BOSSA.PL is an unregulated broker, offering trading on stocks, bonds, ETFs, forex, and funds with leverage up to 1:30 and spread from 1.1 pips on boss WebTrader, bossa Mobile, boss StaticaTrader, Amibroker Professional, MT4 and MT5 platforms. The minimum deposit requirement is 14 PLN or 4 EUR/USD/GBP.

| Pros | Cons |

| Various trading markets | No regulation |

| Multiple account types | Regional restrictions |

| Demo accounts | |

| MT4 and MT5 platforms | |

| Low minimum deposit |

No. BOSSA.PL currently has no valid regulations. Please be aware of the risk!

BOSSA.PL offers trading on stocks, bonds, ETFs, forex, and funds.

| Tradable Instruments | Supported |

| Stocks | ✔ |

| Bonds | ✔ |

| ETFs | ✔ |

| Forex | ✔ |

| Funds | ✔ |

| Commodities | ❌ |

| Indices | ❌ |

| Cryptocurrencies | ❌ |

| Options | ❌ |

BOSSA.PL offers regular brokerage accounts, IKE accounts, IKZE accounts. Besides, demo accounts are also available.

| Account Type | Currency | Minimum Deposit |

| Regular brokerage account | PLN/EUR/USD/GBP | 14 PLN, 4 EUR/USD/GBP |

| IKE account | PLN | |

| IKZE account | PLN |

BOSSA.PL offers flexible leverage options, varying by product.

| Products | Maximum Leverage |

| Currencies CFDs | 1:30 |

| Indices CFDs | 1:20 |

| Cryptos CFDS | 1:2 |

| Bonds CFDs | 1:5 |

| Equity CFDs |

Note that the larger the trading volume the account is, the smaller the leverage will be applied to avoid exponential growth of possible losses.

The spread is from 1.1 pips. As for the commission, it varies on the trading product. You can find detailed fee info in the table below:

| Commission | Minimum Charge | |

| Stocks (Shares) | ||

| Commission on orders | 0.38% | 5 PLN |

| Day trading | 0.15% | |

| BETA ETF TBSP & 6M Bonds | 0.10% | 3 PLN |

| Other ETF Funds | 0.15% | |

| Derivatives | ||

| Index futures | 6.00 PLN per contract, 8.50 PLN per contract for ≥10 trades/month | / |

| Stock futures | 3.00 PLN per contract | |

| Currency futures | 0.2 PLN per contract | |

| Day trading - index contracts | 6 PLN | |

| Options | 2.00% of bonus value | Minimum: 1.5 PLN, Maximum: 9.9 PLN |

| Foreign Stocks & ETFs | ||

| USA, Germany, UK | From 0.29% | 14 PLN, 4 EUR/USD/GBP |

| France, Netherlands, Belgium | 19 PLN, 5 EUR/USD/GBP | |

| Switzerland | 76 PLN, 18 EUR, 20 USD, 16 GBP | |

| Canada | 152 PLN, 36 EUR, 40 USD, 32 GBP |

| Trading Platform | Supported | Available Devices | Suitable for |

| boss WebTrader | ✔ | Web, tablet | / |

| bossa Mobile | ✔ | Mobile | / |

| boss StaticaTrader | ✔ | Web, mobile | / |

| Amibroker Professional | ✔ | Web | / |

| MT4 | ✔ | Desktop, mobile, web | Beginners |

| MT5 | ✔ | Desktop, mobile, web | Experienced traders |

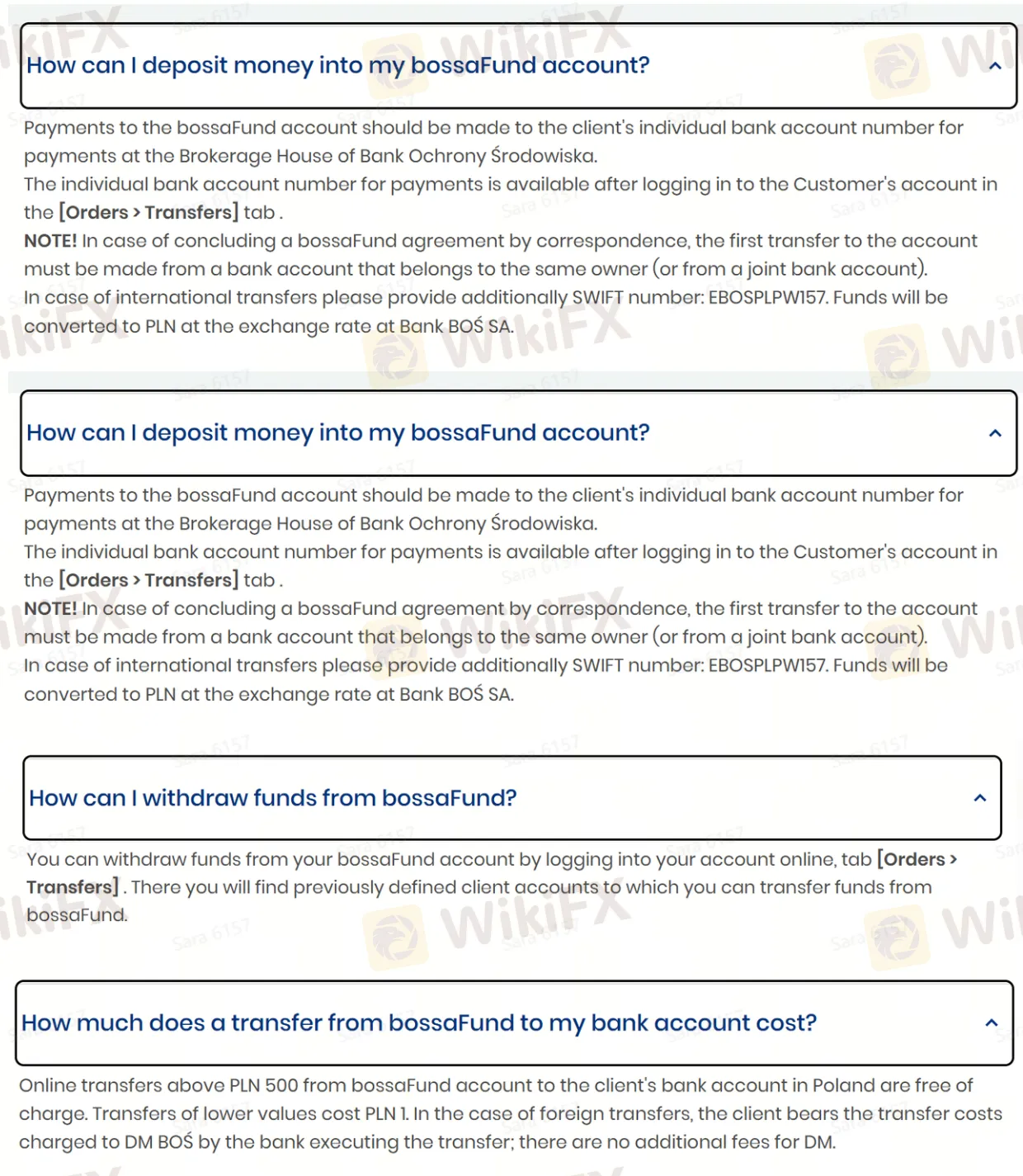

BOSSA.PL accepts payments via bank transfer.

| Transfer Type | Amount | Fee |

| Domestic Transfers (Poland) | ≥ 500 PLN | 0 |

| < 500 PLN | 1 PLN | |

| Foreign Transfers | Any amount | Client bears bank fees |

Please enter...

TOP

TOP

Chrome

Chrome extension

Global Forex Broker Regulatory Inquiry

Browse the forex broker websites and identify the legit and fraud brokers accurately

Install Now