Company Summary

| Aspect | Information |

| Company Name | AI GOLD |

| Registered Country/Area | Japan |

| Founded Year | 2019 |

| Regulation | FSA |

| Products | Forex, CFDs, Click 365 |

| Tax | Average 20% (20.315% from Heisei 25 to Heisei 49) |

| Fees | FX course fees:1100 JPY |

| Trading Tools | e-profitFX,E-mail,newsletter,yukiko V Chart |

| Demo Account | Available |

| Customer Support | Phone: 03-6861-8181 |

| Educational Resources | FX and CFD seminars,Markets knowledge:Economic calendar,comments of FX,CFD,Stock index market;Technical reports:markets forecast report;Transaction guideline and rules |

Overview of AI GOLD

AI GOLD, established in Japan in 2019, operates under the regulation of the Financial Services Agency (FSA) and offers a range of financial products and services including Forex, CFDs, and Click 365.

The company, offering an average tax rate of 20% (20.315% from Heisei 25 to Heisei 49), provides trading tools such as e-profitFX, email newsletters, and the Yukiko V Chart. AI GOLD also offers a demo account for practice trading. Customers can access support via phone at 03-6861-8181.

Additionally, the company emphasizes education in trading, providing resources like an economic calendar, FX, CFD, and stock index market commentary, technical reports including market forecasts, and transaction guidelines and rules.

Is AI GOLD Futures Limited Legit or a Scam?

AI GOLD Securities Co., Ltd., regulated by the Financial Services Agency (FSA) in Japan, holds a Retail Forex License with the license number Kanto Local Financial Bureau (Kin-sho) No. 282.

This license became effective on September 30, 2007, indicating that AI GOLD operates in compliance with the stringent financial regulations and standards set forth by the FSA in Japan.

Pros and Cons

| Pros | Cons |

| Regulated by FSA | Limited Global Reach |

| Various Financial Products | Language Barrier |

| Trading Tools Availability | Limited products of only forex and CFDs |

Products

AI GOLD offers a range of financial products and services, some of which include:

- Forex (Foreign Exchange): This involves trading in global currencies, allowing traders to speculate on the changes in currency values against each other.

- CFDs (Contracts for Difference): These are derivative products that enable traders to speculate on the rising or falling prices of fast-moving global financial markets (such as commodities, indices, shares, and treasuries).

- Click 365: This is a specific product related to exchange-traded FX Daily Futures contracts, offering a unique blend of features that may include leverage and ease of online trading.

Products

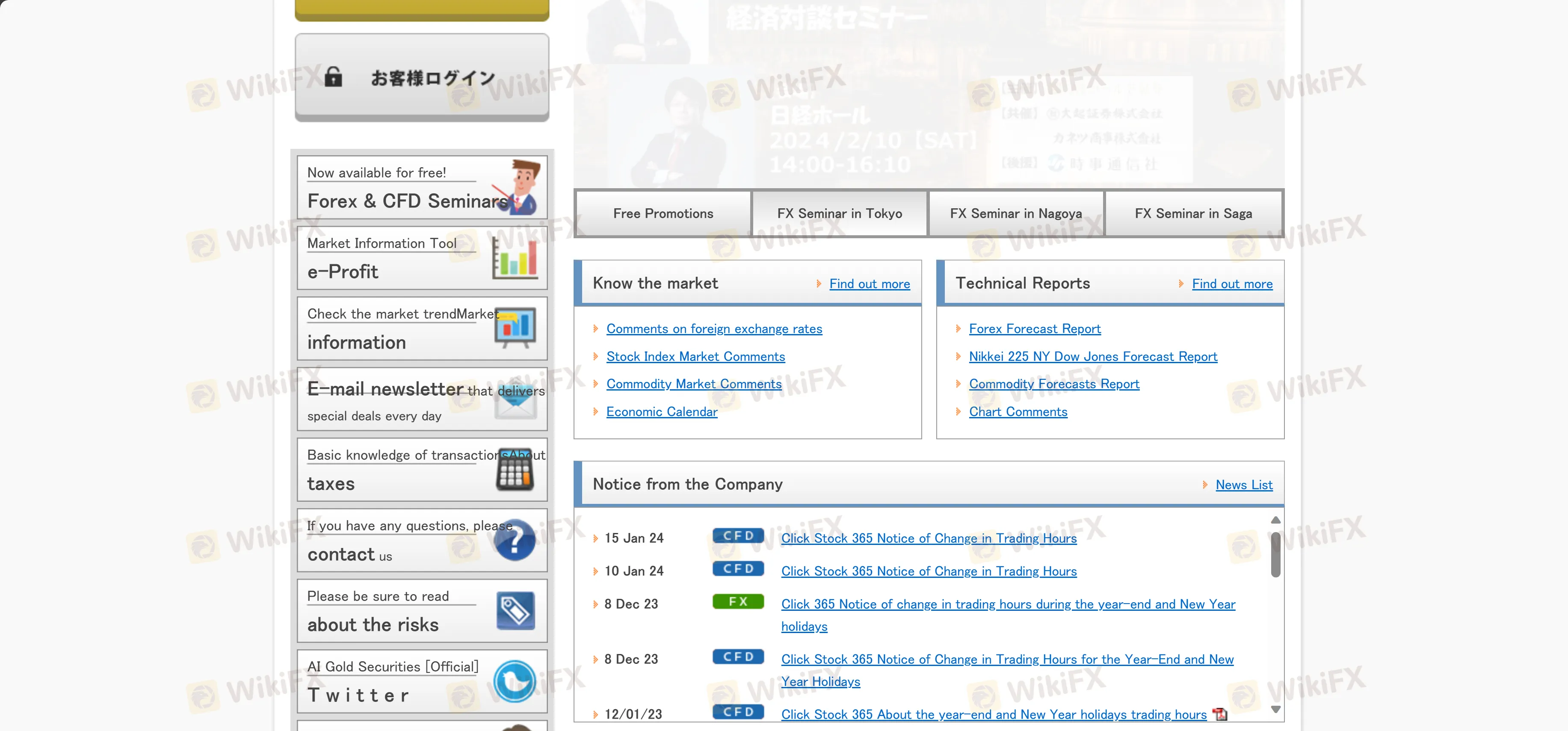

AI Gold Securities Co., Ltd. provides a range of trading tools and resources to assist their clients in making informed trading decisions. Here's an overview of the key tools available:

- e-profit: Developed by Minkabu Co., Ltd., e-profit is a market information tool that allows users to view real-time price information, market news, and charts for Click365 (FX) and Click365 (CFD) stocks. It offers high customization for charts, enabling traders to create their own technical charts.

e-profit Web Version: This version can be used directly in a web browser without the need for installation, offering convenience for those who prefer online accessibility.

e-profit Download Version: For those who prefer a more personalized layout, the downloadable version of e-profit allows users to customize their trading interface. It's important to note that this software is designed for Windows and is not compatible with smartphones or tablets.

- YukikoV Chart: This tool, which requires a certain minimum deposit for access, is tailored for more advanced users. It's a popular choice among traders and includes various analytical features.

- Email Newsletter: AI Gold Securities provides an email newsletter that includes:

- Original forecast range derived using unique calculation methods.

- Schedule of main economic indicators for fundamental analysis.

- Pivot Analysis for day trading, featuring pivot figures for major currency pairs and indexes.

- Information on seminars and campaigns, offering insights and learning opportunities for various levels of traders.

These tools, along with the educational resources and support provided by AI Gold Securities, are designed to attract both novice and experienced traders, offering them comprehensive solutions for their trading needs.

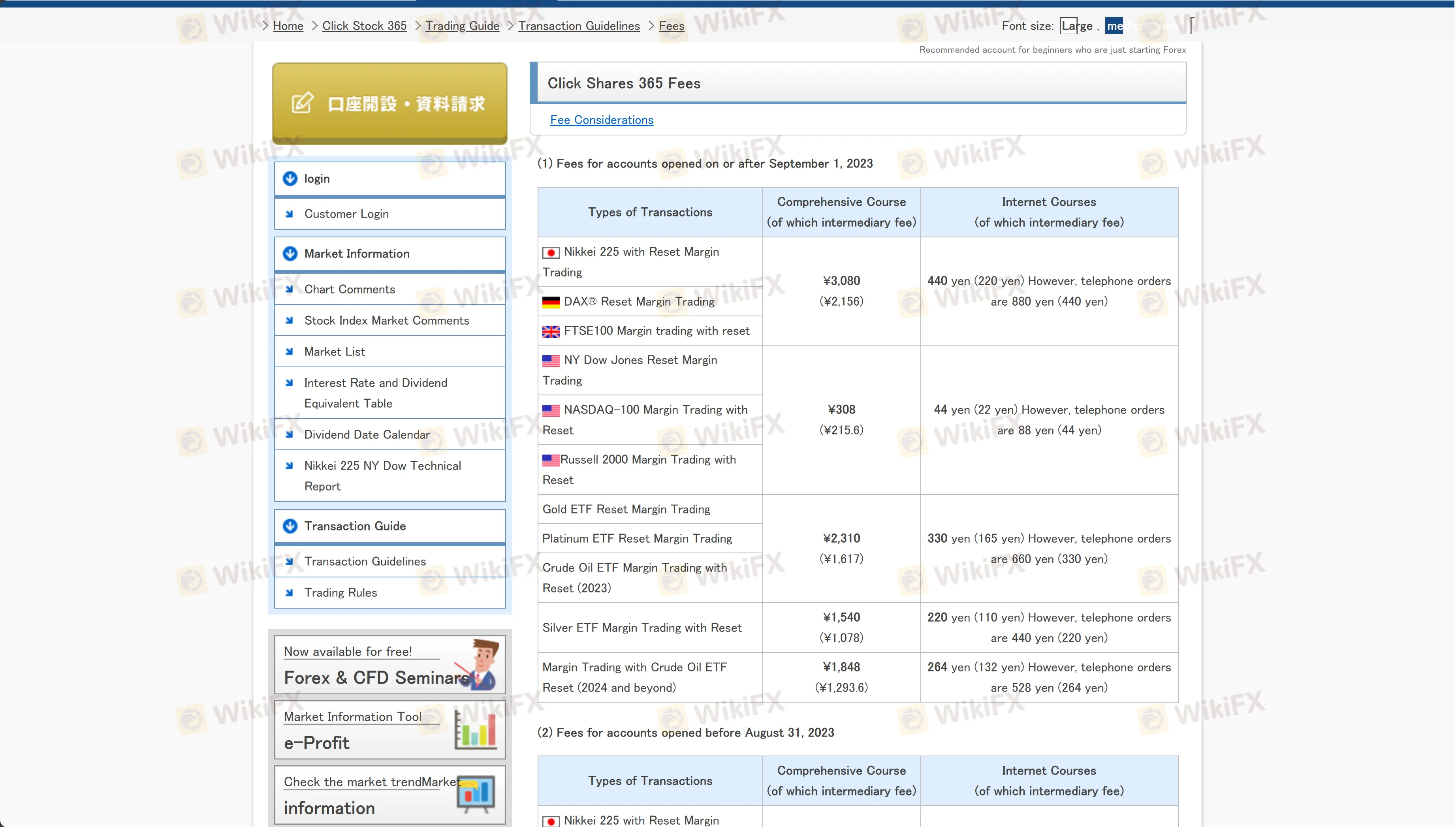

Fees

AI GOLD offers various fee structures for its financial products and services, including Forex, CFDs, and other trading options. The fee details are as follows:

General Fees

- One-way Fee per Ticket for Telephone Orders: JPY 1,100. This fee is charged for each transaction, with deductions from the deposit margin reflected on the delivery date (usually the second trading day after the transaction date). For daily trading, there's no settlement fee charged.

- One-way Fee per Ticket for Internet Transactions: JPY 220. Similar to telephone orders, this fee is charged per transaction. In case of computer failure and phone orders are made, the fee is JPY 440.

- Intermediary Account Fees: For telephone orders, JPY 770 out of JPY 1,100 and for internet transactions, JPY 110 out of JPY 220 are the fees paid to the financial instruments intermediary.

- Account Related Fees: Free account setup, maintenance, and report preparation.

CFDs Trading Fees

- Nikkei 225, DAX®, FTSE100, NY Dow Jones, NASDAQ-100, Russell 2000, Gold ETF, Platinum ETF, Silver ETF, Crude Oil ETF (2023 onwards): Fees vary based on the type of transaction and whether it's through the Comprehensive Course or Internet Courses. Telephone order fees are generally double the internet order fees.

CFDs Trading Fees for Accounts Opened

- Similar to the fees effective from September 1, 2023, but with slightly different rates for different transactions like Nikkei 225, DAX®, FTSE100, NY Dow Jones, NASDAQ-100, Russell 2000, Gold ETF, Platinum ETF, Silver ETF, and Crude Oil ETF.

Additional Information:

- Telephone Reception Hours: Monday to Friday 8:30 AM to 5:00 PM.

- Reports: Delivered electronically except for the annual profit and loss report, which is mailed.

Tax

AI Gold Securities Co., Ltd. applies a separate taxation method for income earned through Click 365 and Stock 365 trading, categorized as miscellaneous income. Here's a concise overview:

- Fixed Tax Rate: A consistent tax rate of 20% (20.315% from Heisei 25 to Heisei 49 due to special income tax for reconstruction) is applied, irrespective of the amount of profit. This contrasts with the comprehensive taxation method, where higher profits could lead to a higher tax rate.

- Combining Profits and Losses: Profits and losses from Click 365, Stock 365, and commodity futures can be combined with those from other futures contracts for tax purposes.

- Three-Year Loss Carry-Forward: If losses occur, they can be carried forward and deducted from profits over the next three years, potentially reducing taxable income.

- Annual Tax Filing Requirement: Filing a tax return is necessary every year to benefit from the loss carry-forward deduction, even in years with no transactions.

- Consultation Recommended: Due to the complexity of tax laws, consulting with a tax office or accountant is advised for accurate tax filing.

Customer Support

AI Gold Securities Co., Ltd., located at 12-8 Hisamatsucho, Nihonbashi, Chuo-ku, Tokyo, offers customer support for its clients. If you need assistance or have any inquiries related to their services, you can contact their customer support team directly by phone at 03-6861-8181.

This line serves as a primary point of contact for any support or information you may require regarding their financial products and services.

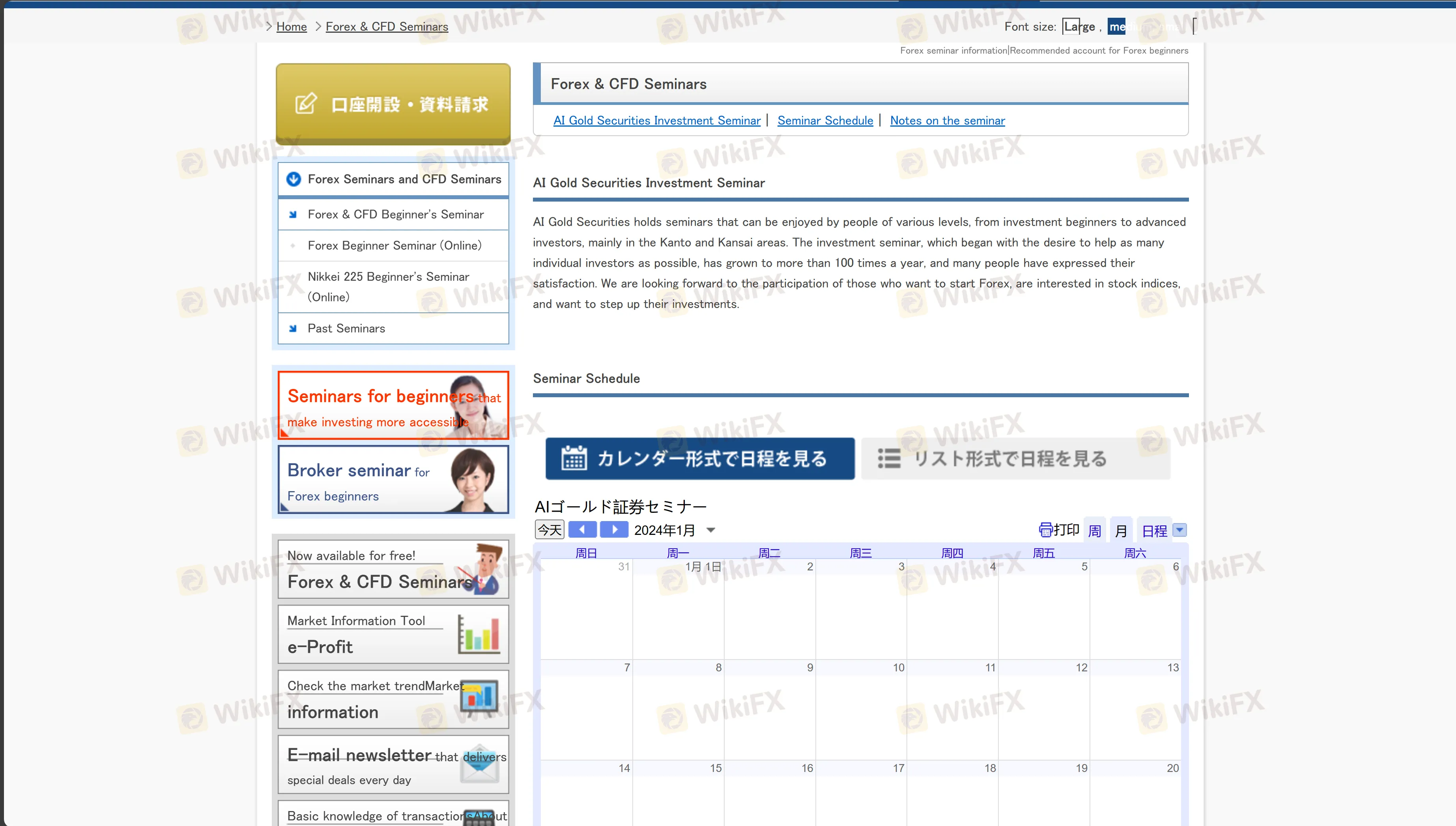

Educational Resources

AI Gold Securities Co., Ltd. provides a comprehensive suite of educational resources aimed at enhancing the trading knowledge and skills of its clients. These resources include:

- Economic Calendar: This tool offers insights into key economic events and indicators that can impact the Forex, CFD, and stock index markets. It's essential for traders who rely on fundamental analysis.

- Market Commentary: AI Gold offers commentary on FX, CFD, and stock index markets, providing traders with expert insights and analysis of current market trends and potential future movements.

- Technical Reports: These include market forecast reports which are valuable for traders who use technical analysis as part of their trading strategy. The reports can help in identifying potential market opportunities and risks.

- Transaction Guidelines and Rules: To assist traders in understanding the operational aspects of trading, AI Gold provides guidelines and rules that cover transaction procedures, risk management, and best practices in trading.

- Newsletters and Email Updates: Subscribers receive regular newsletters and email updates that contain market analysis, trading tips, and updates on upcoming economic events.

- Seminars and Webinars: AI Gold occasionally organizes seminars and webinars, satisfying various levels of traders, from beginners to advanced. These sessions are often conducted by experienced traders or financial experts.

- Pivot Analysis Tutorials: For clients interested in technical analysis, specifically pivot analysis, AI Gold provides educational content that explains how to use this technique effectively in day trading.

Conclusion

AI Gold Securities Co., Ltd., based in Tokyo, Japan, offers a large range of financial products and services, including Forex, CFDs, and Click 365.

They operate under strict regulation by the Financial Services Agency (FSA) and provide unique trading tools like e-profit and the Yukiko V Chart. AI Gold supports its clients with a comprehensive customer service phone line and maintains a transparent fee structure for various trading activities. Additionally, they offer specialized tax guidance for traders, emphasizing the separate taxation system for trading income.

FAQs

What financial products does AI Gold Securities Co., Ltd offer?

AI Gold Securities offers a range of financial products including Forex trading, Contracts for Difference (CFDs), and Click 365, which is related to exchange-traded FX Daily Futures contracts.

Is AI Gold Securities Co., Ltd. regulated?

Yes, AI Gold Securities is regulated by the Financial Services Agency (FSA) in Japan.

What are the trading tools available at AI Gold Securities?

AI Gold Securities provides several trading tools such as e-profit for real-time market information, the Yukiko V Chart for technical analysis, and a customizable e-profit download version.