Company Summary

| Access Bank Review Summary | |

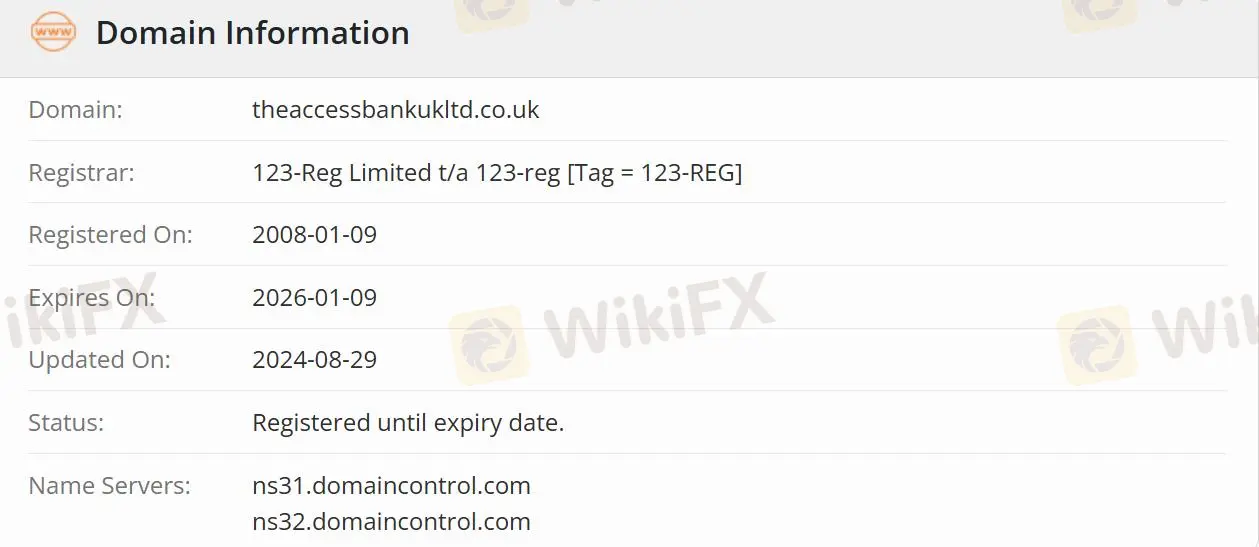

| Founded | 2008-01-19 |

| Registered Country/Region | United Kingdom |

| Regulation | Regulated |

| Services | Trade Finance/Commercial Banking/Asset Management/Investment |

| Customer Support | Email: ccontactaaccessprivatebank.com |

| Telephone: 0333 222 4516 (UK)/+44 1606 813020 | |

Access Bank Information

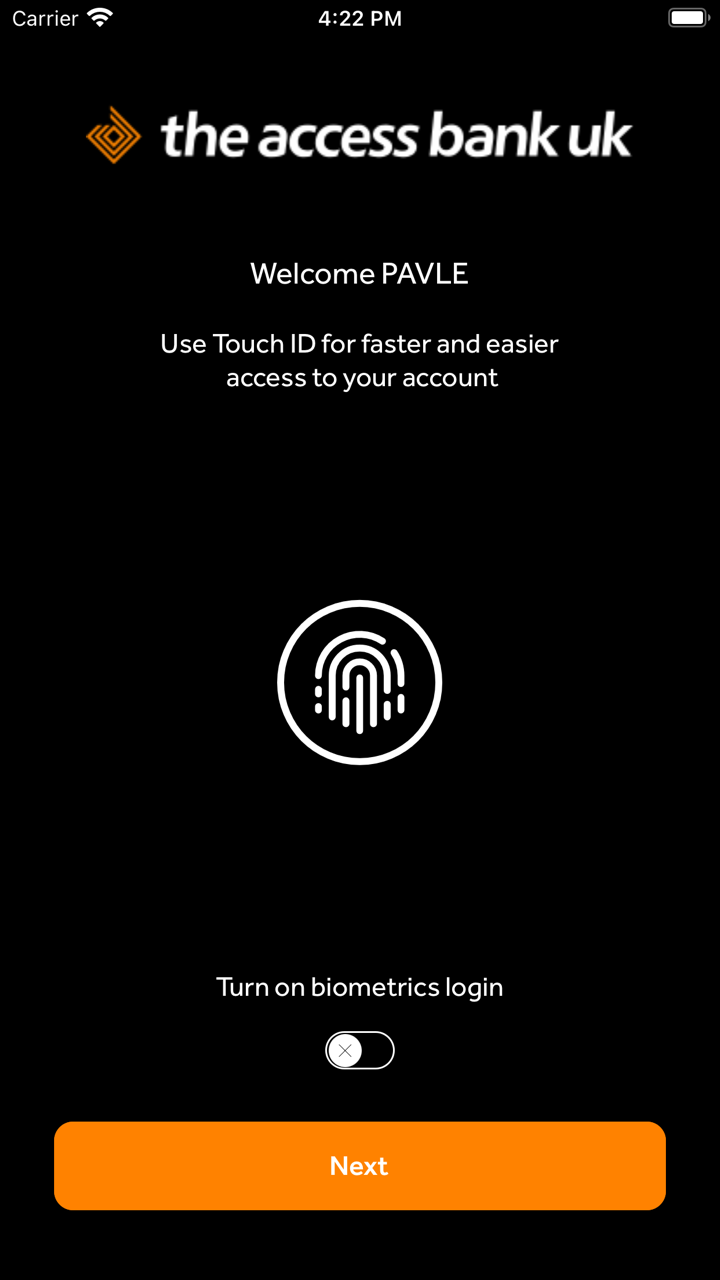

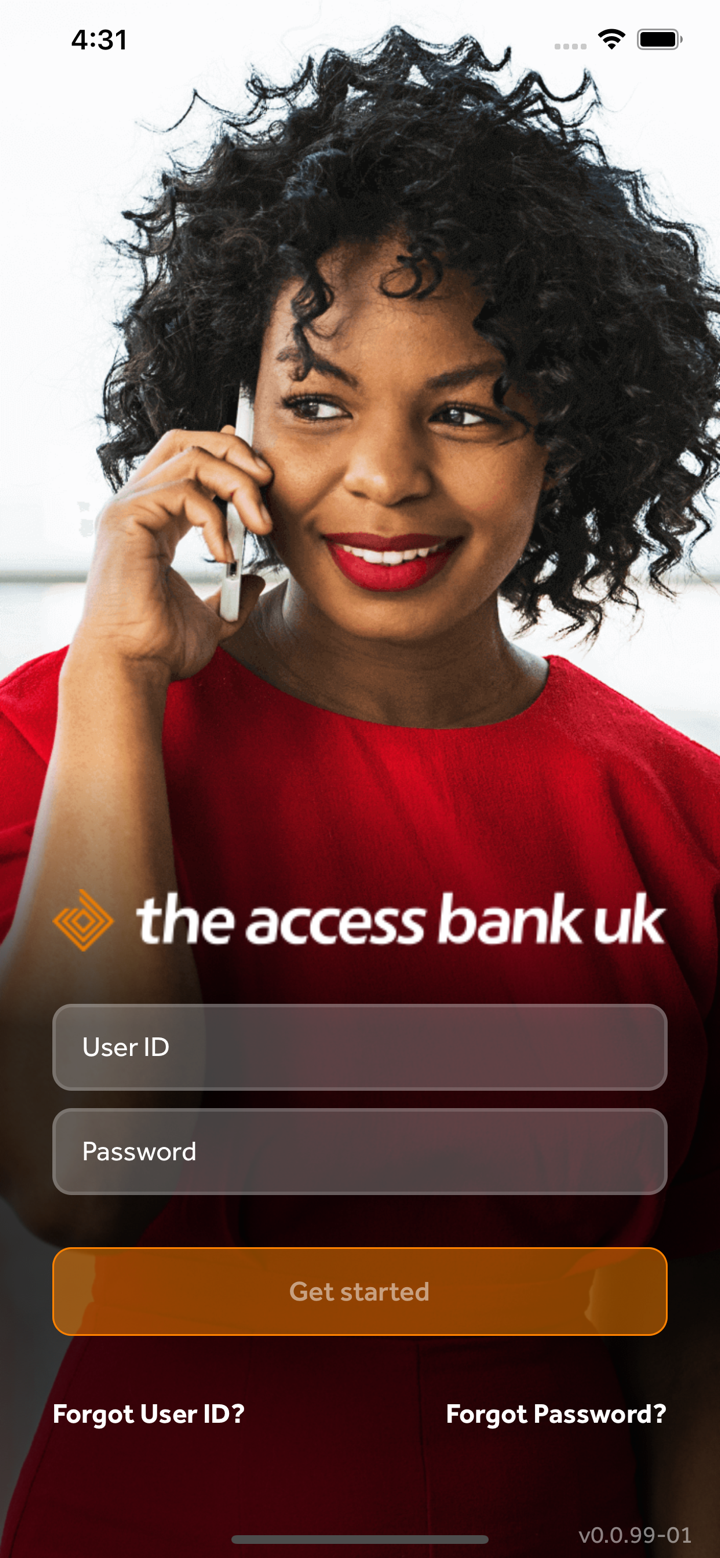

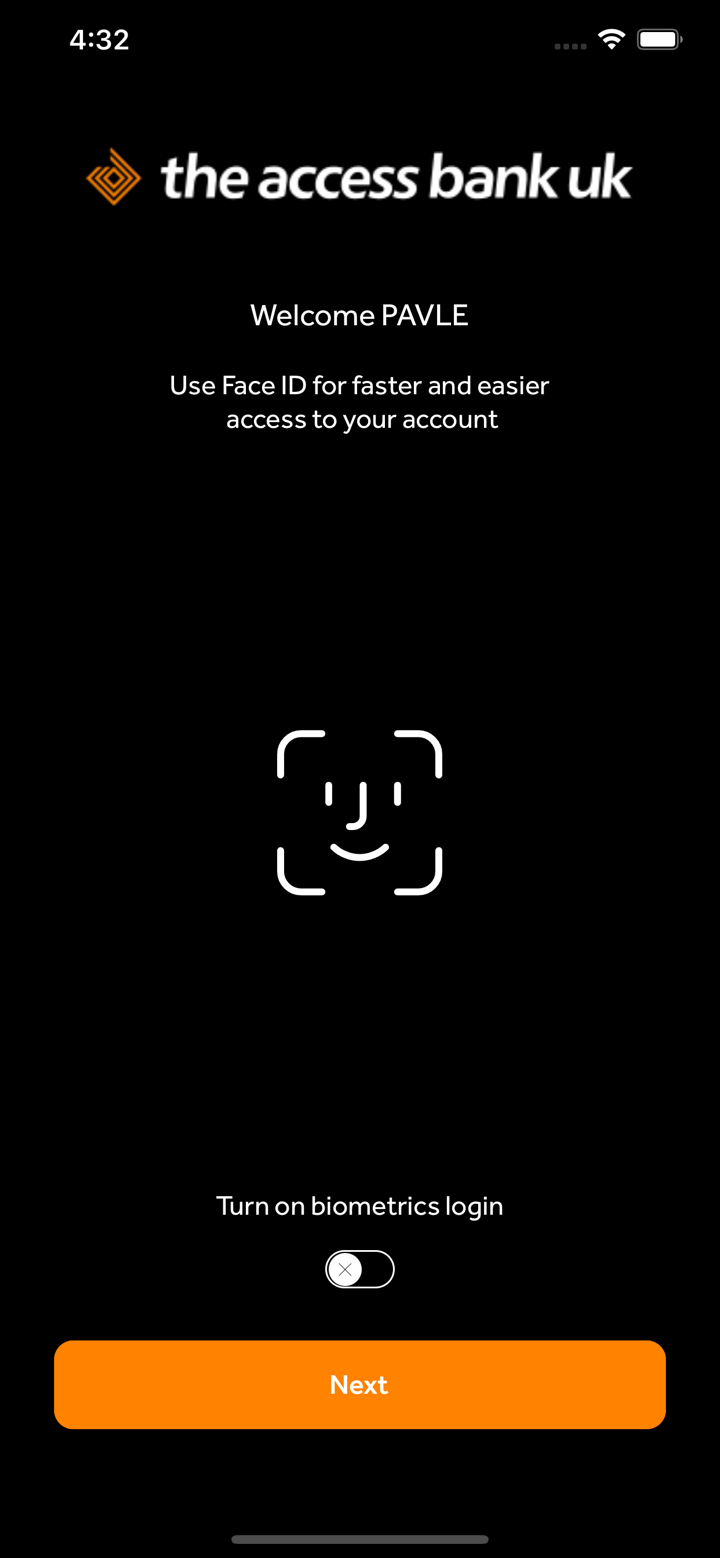

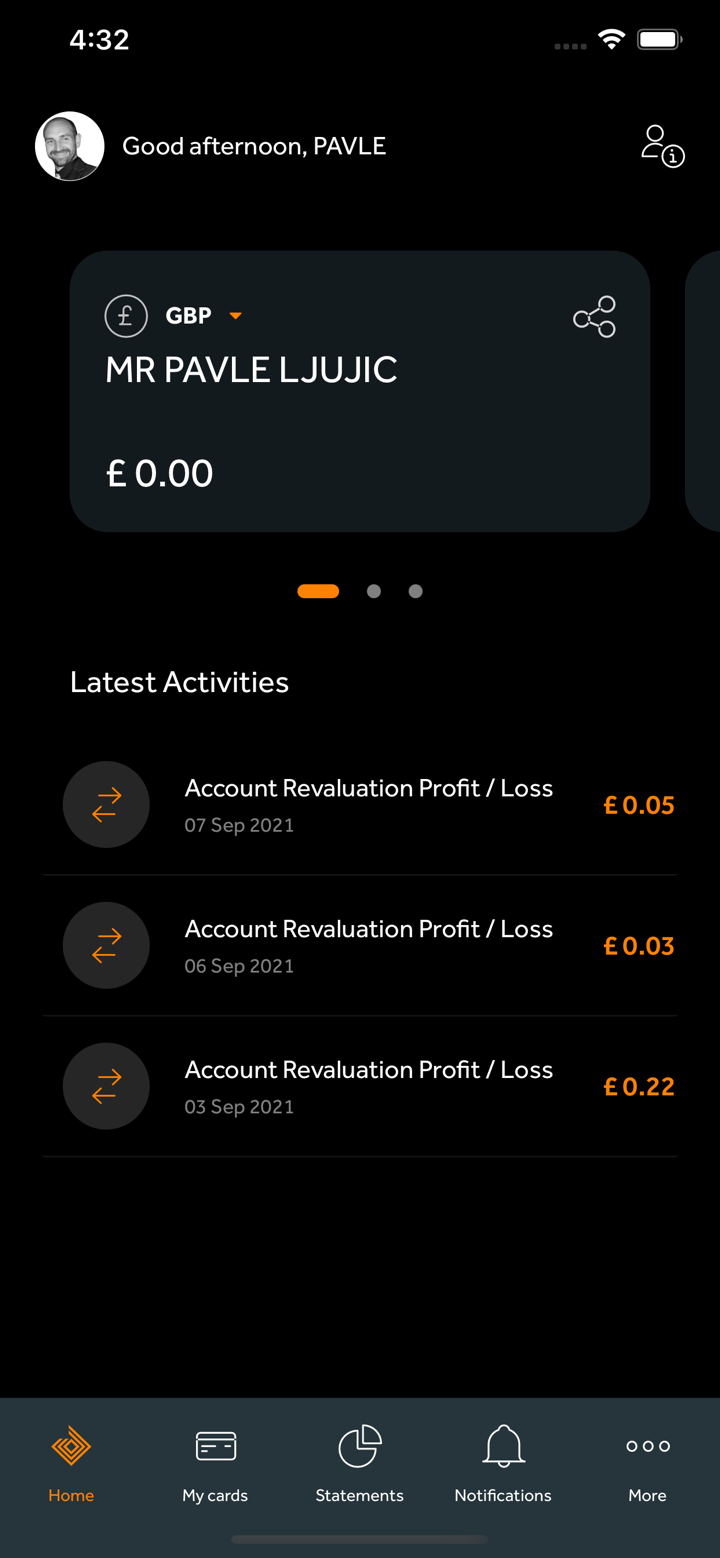

Access Bank registered in the United Kingdom offers a broad range of innovative products and services including trade finance, commercial banking, and asset management, as well as supports the flow of investment into markets in Nigeria, Africa, and the MENA region. The bank's objective is to grow the international business of the Access Bank Group through customer service and innovative solutions in Trade Finance, Commercial Banking, and Asset Management

Is Access Bank Legit?

Access Bank is authorized and regulated by the Financial Conduct Authority(FCA) with license No. 478415. A regulated company is safer than an unregulated one.

What services does Access Bank provide?

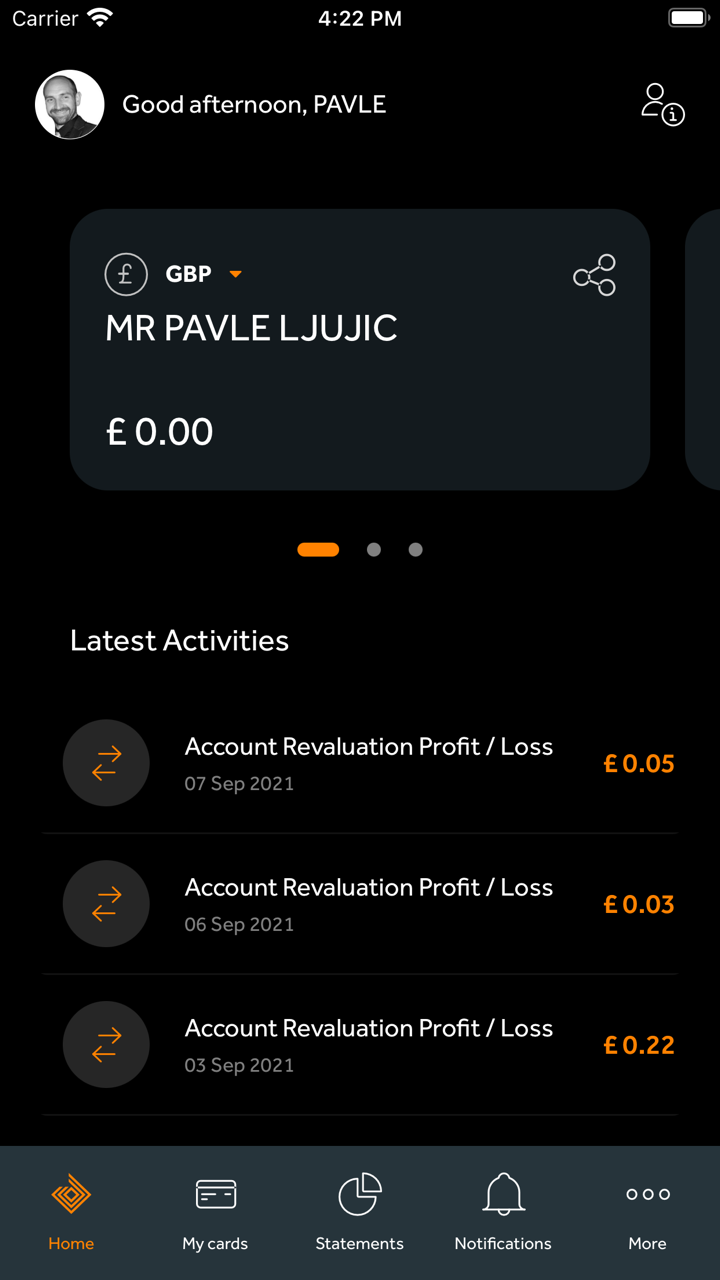

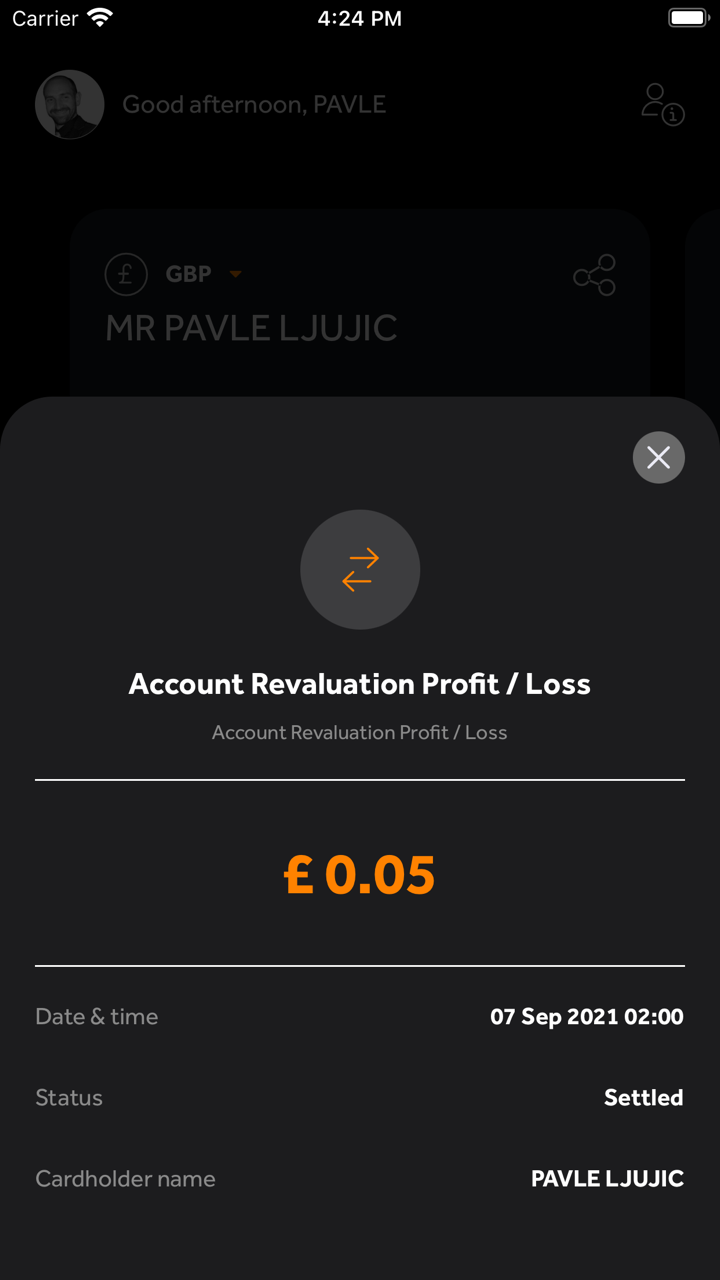

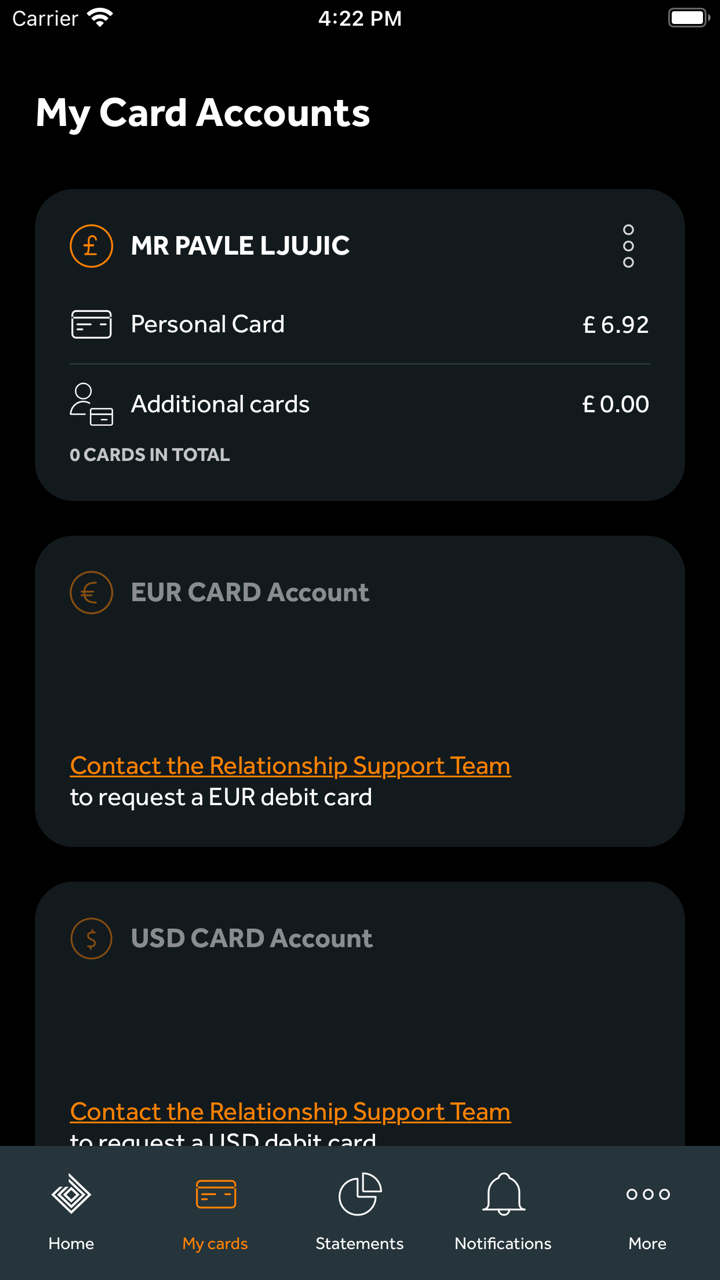

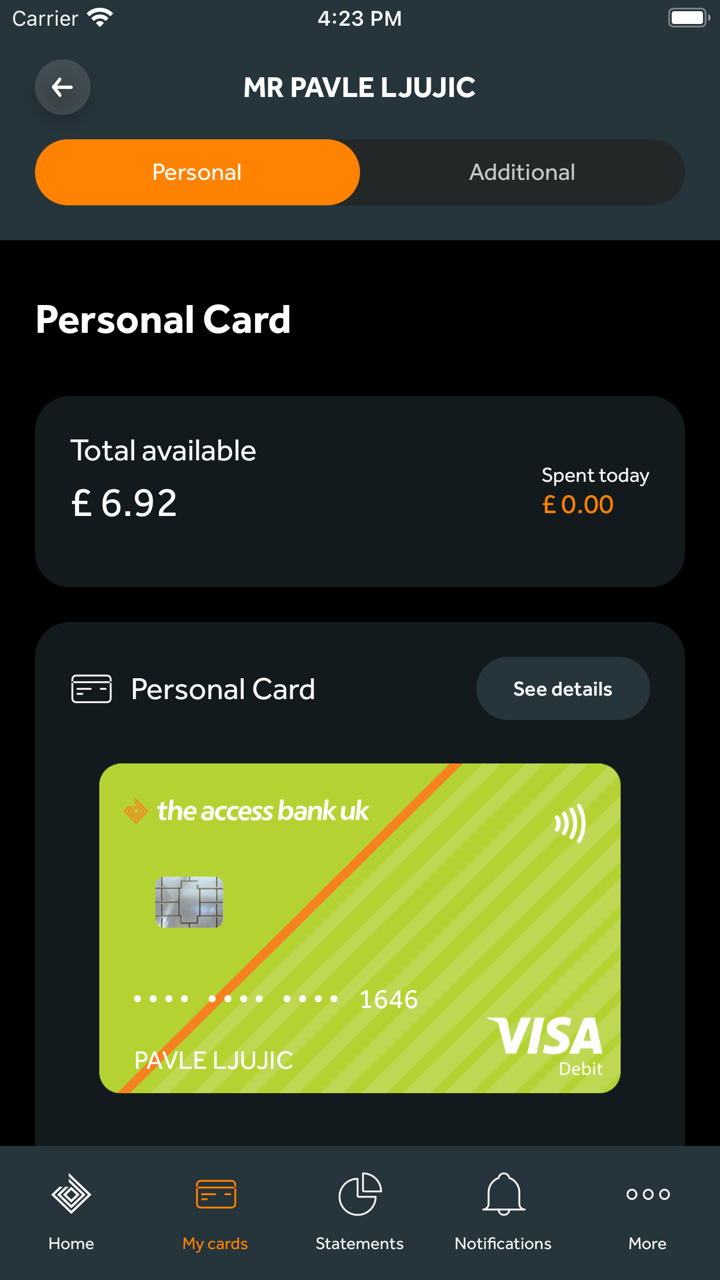

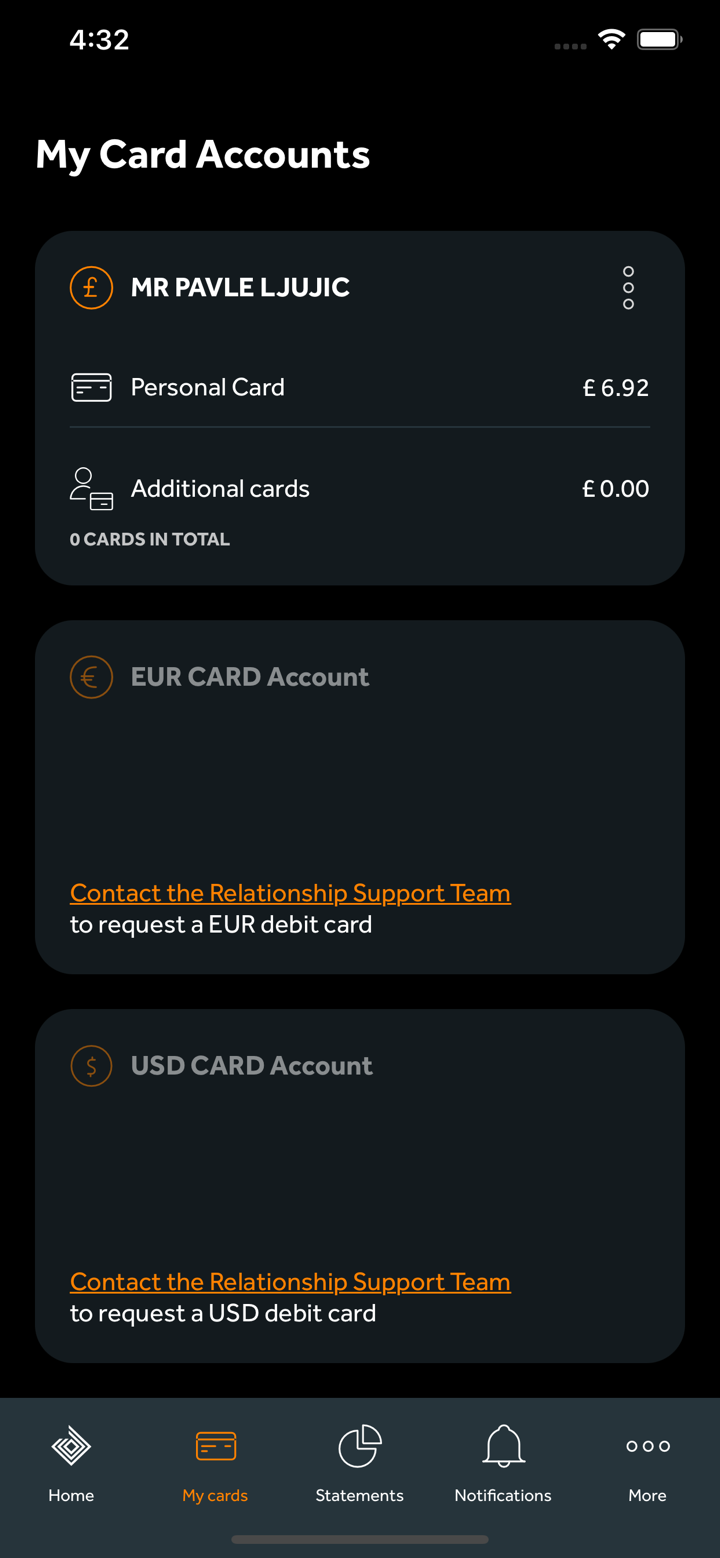

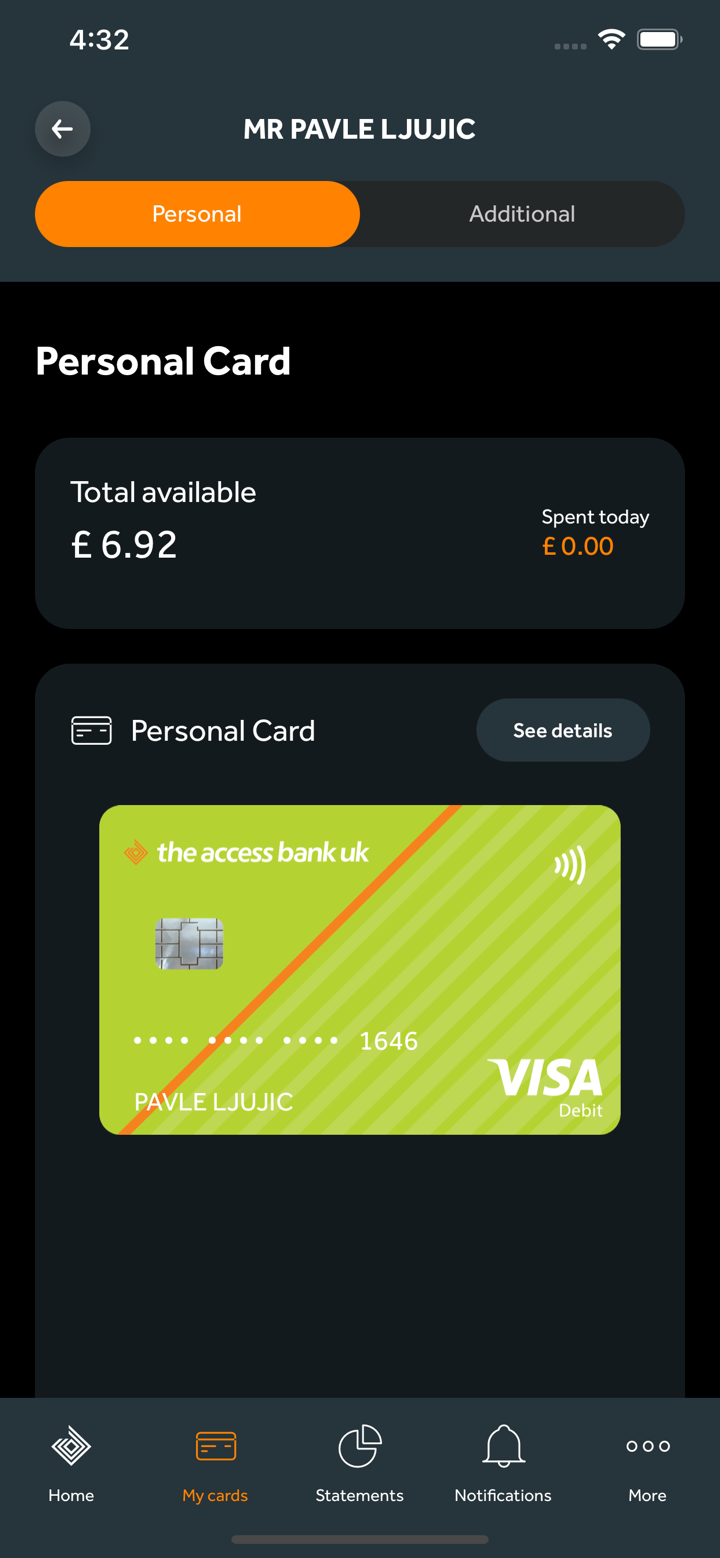

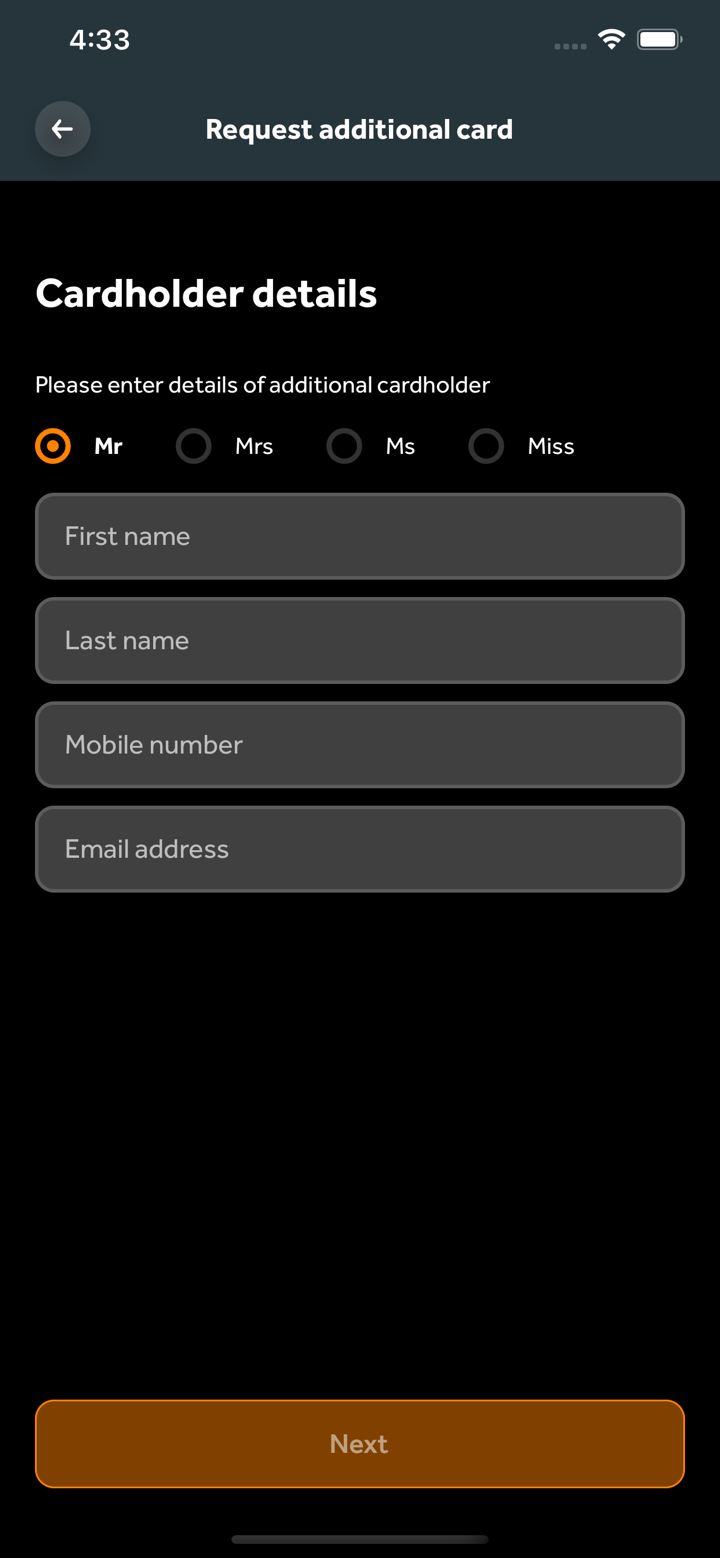

Access Bank provides various financial services to individuals, businesses, and private individuals in the UK. Other international users can enjoy services such as commercial banking and trade financing.

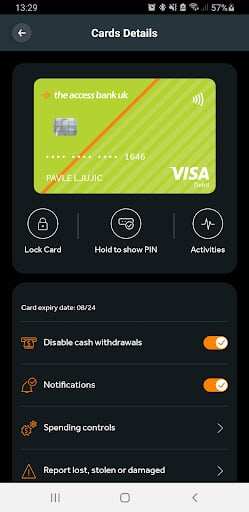

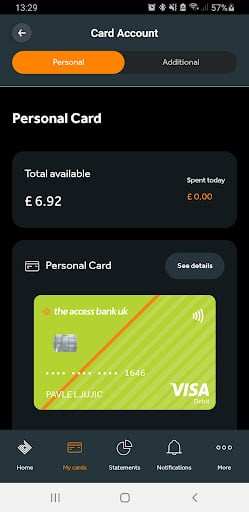

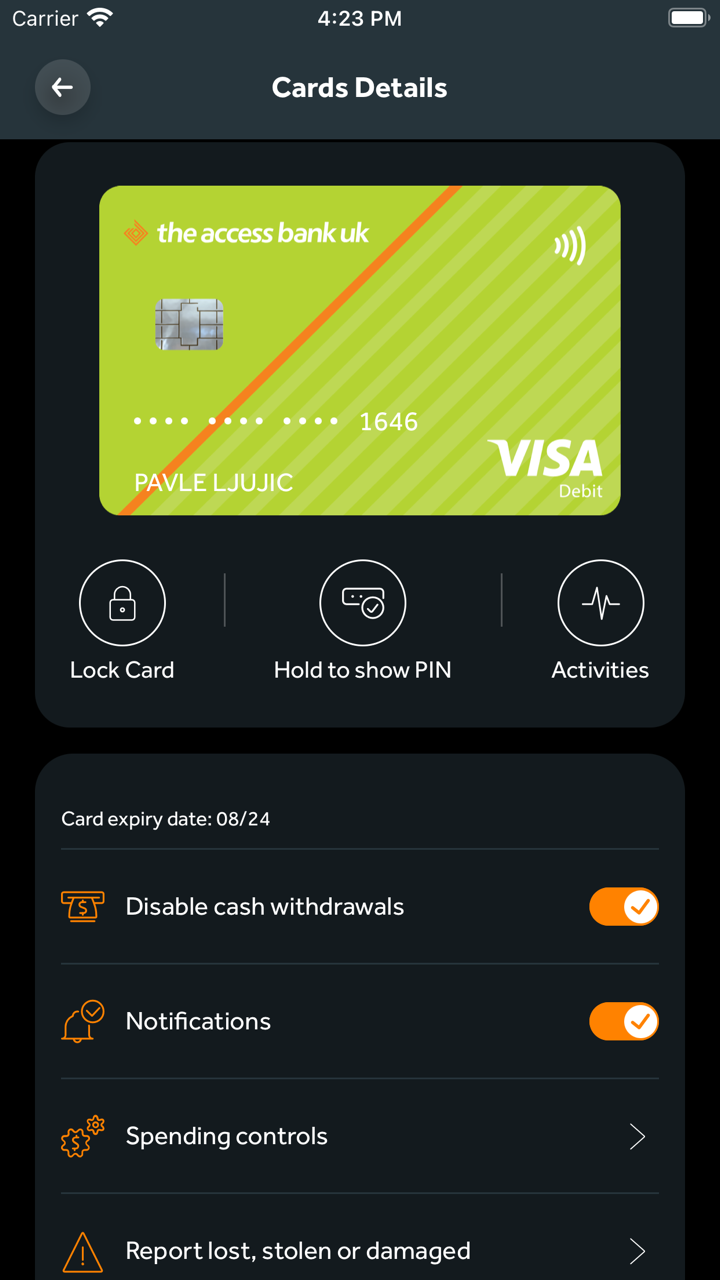

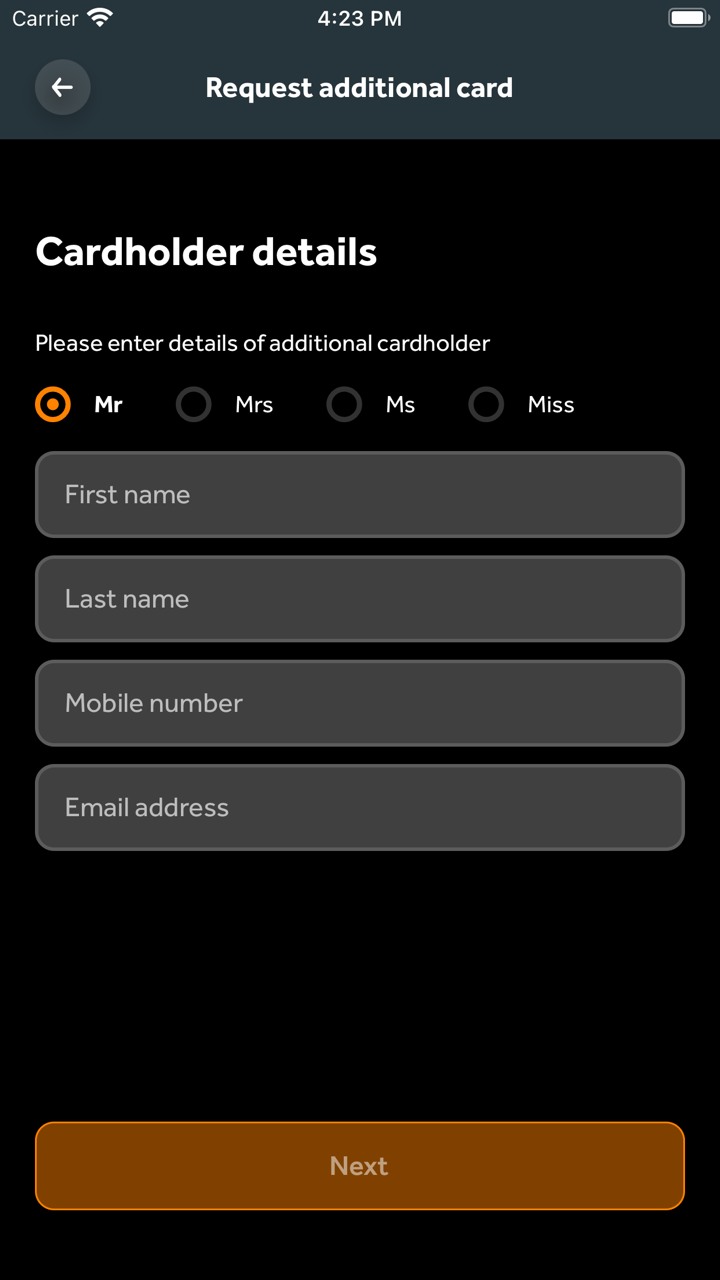

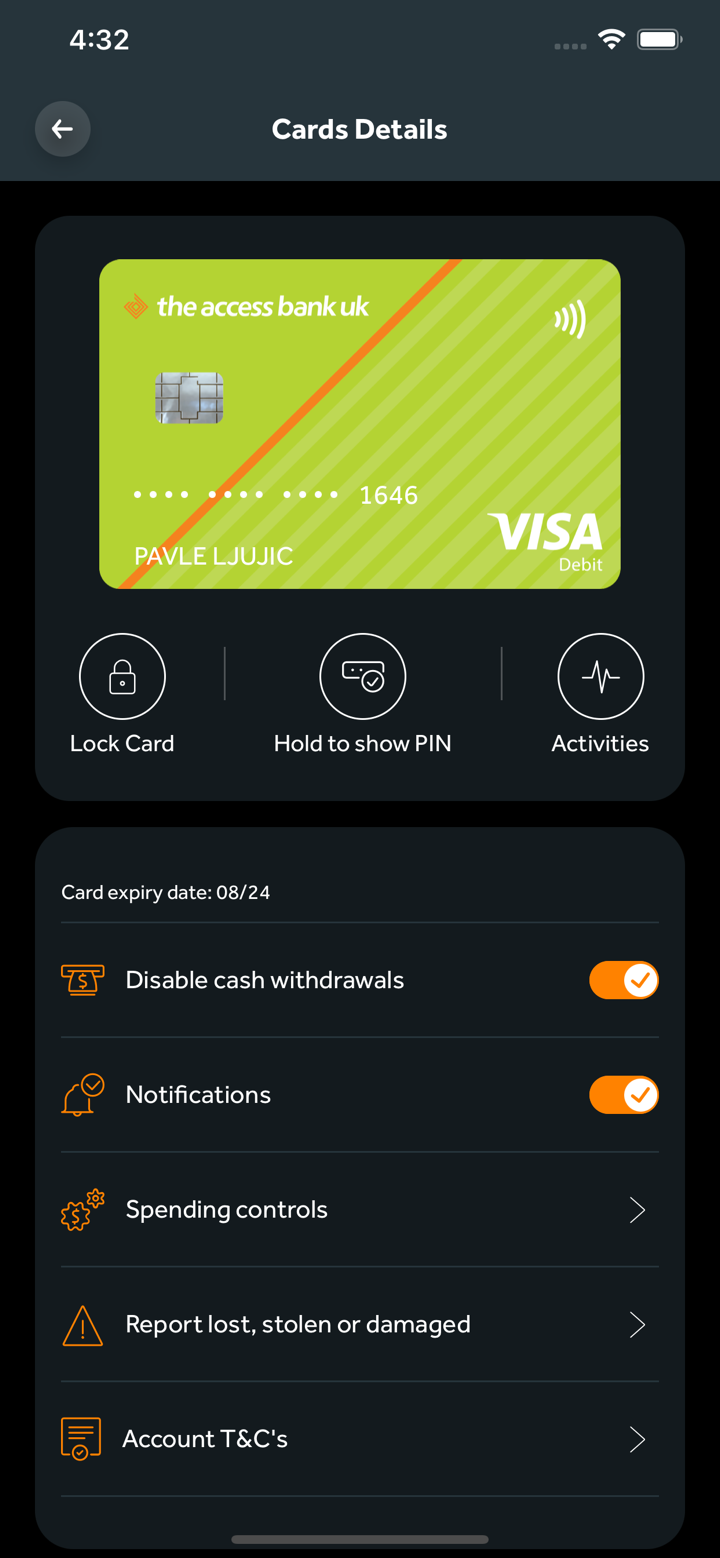

UK personal customers can choose personal banking, current accounts, property loans, foreign exchange services, faster payments, frequently asked questions, and notice deposit accounts.

The bank provides UK business customers with business banking, business accounts, trade finance, property loans, notice deposit accounts, direct lending, faster payments, and frequently asked questions.

UK private customers exclusive private banking, discretionary portfolios, execution-only portfolios, property loans, notice deposit accounts, faster payments, and portfolio-secured lending.

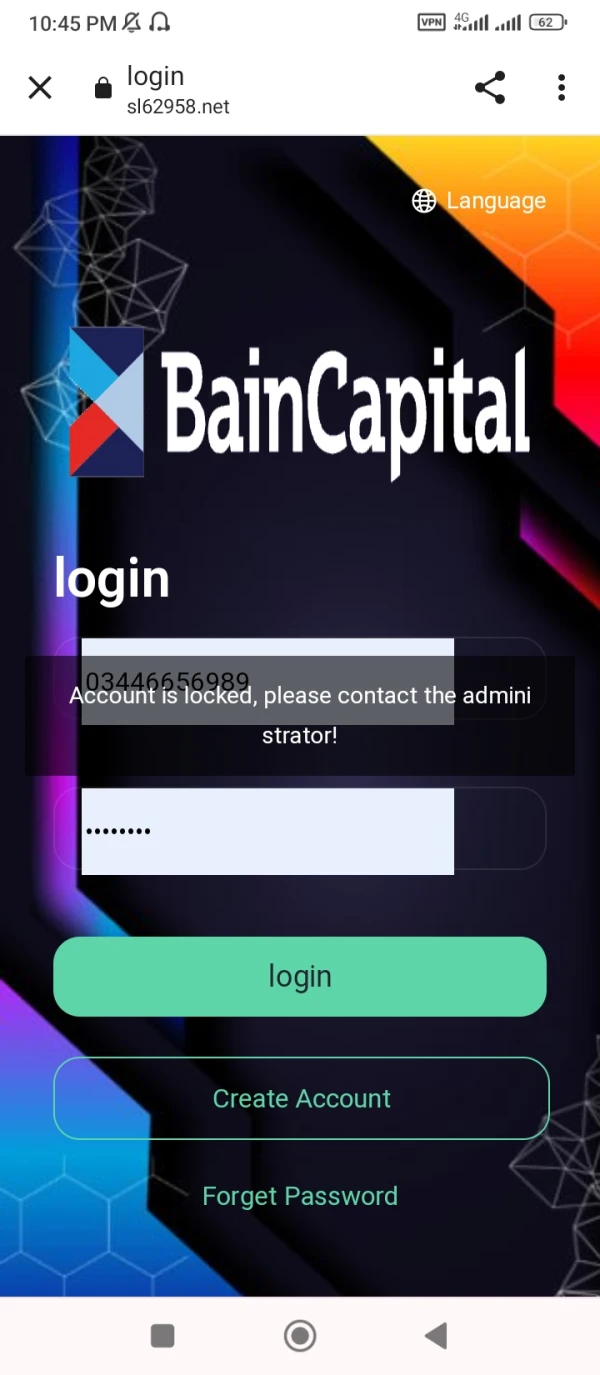

Ghazi6612

Pakistan

Now my account has locked

Exposure

sunny91

Turkey

Banking with Access Bank UK feels genuinely personal. They really prioritize understanding and meeting my needs. Their online banking is straightforward and efficient.

Positive

拳

Singapore

Trustworthy and reliable! Top-notch banking service!

Positive

KASLAS

Nigeria

the main problem of brokers is bad network but the Access Bank broker is very good in network is simple for trading and making profit withdrawal process was successful

Positive

程安 -陶

Argentina

The customer service of this company is very good. I received a response within an hour of sending the email, and customer service patiently and meticulously helped me resolve the issue.

Positive

Rith Rith

Hong Kong

I've tried a lot of this kind of stuff, in a sense, I want to try it, but in my subconscious I think, yes, yes, I want to try!! Can someone tell me it works.

Positive