Company Summary

| Hirose Financial Review Summary | |

| Founded | 2010 |

| Registered Country/Region | United Kingdom |

| Regulation | FCA, LFSA, FSA |

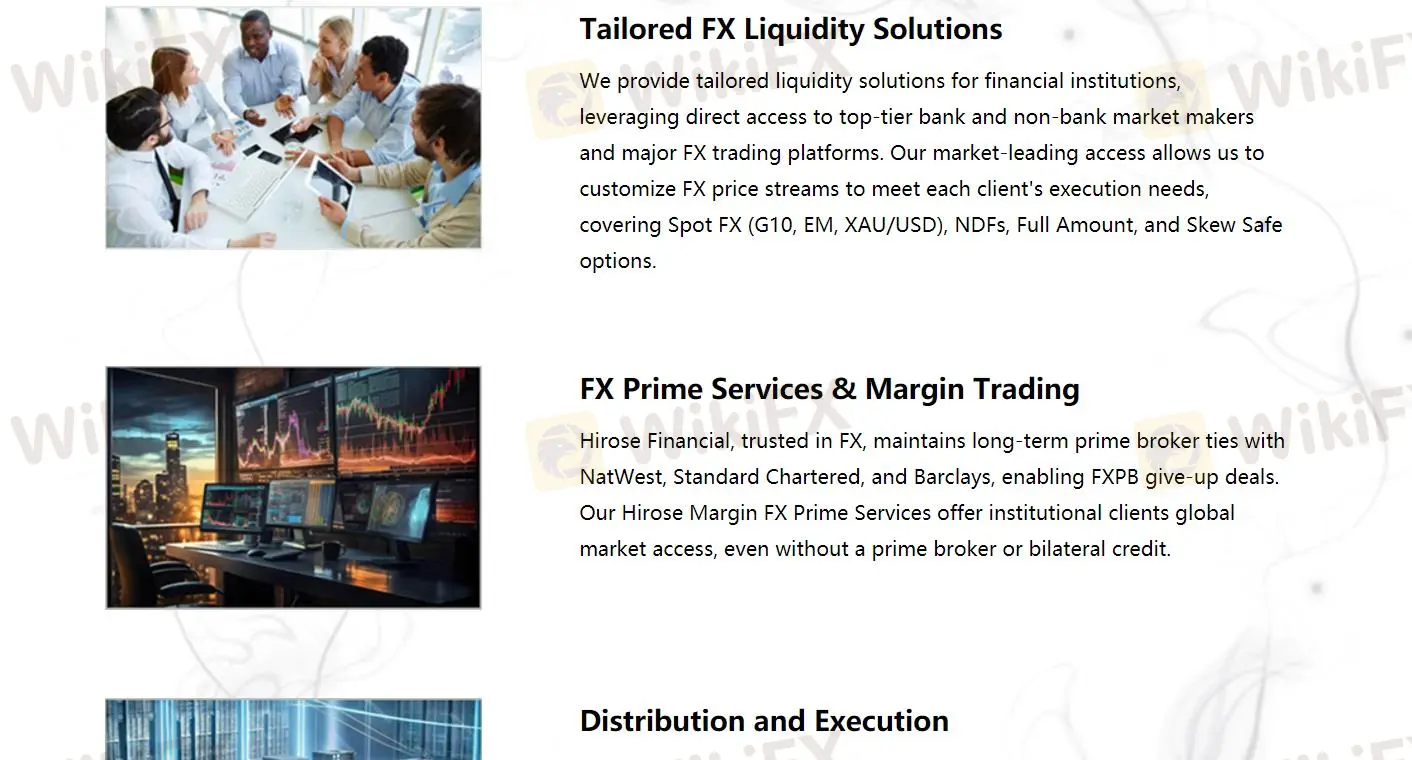

| Services | Tailored forex liquidity solutions, forex prime services and margin trading, distribution and execution |

| Customer Support | Email: support@hirose-financial.com |

| Physical Address: Japan: MG Building, 1-3-19 Shinmachi, Nishi-Ku, Osaka-Shi, Osaka, JapanEngland: mSalisbury House 29 Finsbury Circus London EC2M 5QQMalaysia: Level 2, Lot 19, Lazenda Commercial Centre, Phase 3, 87007 F.T. Labuan, Malaysia | |

Hirose Financial Information

Hirose Financial, founded in 2010, is a financial service company specialising in providing forex liquidity and credit solutions to institutional clients. The services it provides cover tailored forex liquidity solutions, forex prime services and margin trading, distribution and execution.

Pros and Cons

| Pros | Cons |

| Regulated | No commission information |

| Wide range of trading instruments | No clear information on the minimum deposit for each accounts |

| Generous leverage up to 1:500 | Limited account types offered |

| MT4 and MT5 supported | No Islamic account |

| Copy trading available | |

| Demo account available |

Is Hirose Financial Legit?

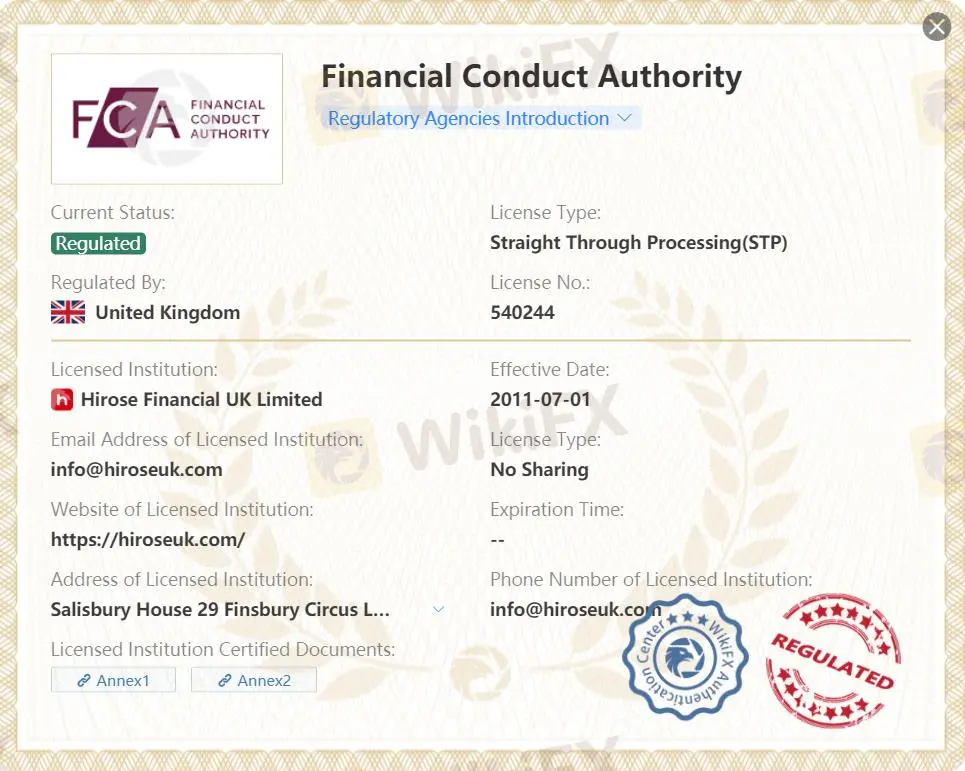

Hirose Financial is regulated by FCA, LFSA, and FSA. The current status of its FSA License is a suspicious clone.

| Regulated Country | Regulated Authority | Regulated Entity | License Type | License Number | Current Status |

| United Kingdom | FCA | Hirose Financial UK Limited | Straight Through Processing(STP) | 540244 | Regulated |

| Malaysia | LFSA | Hirose Financial MY Limited | Straight Through Processing(STP) | MB/15/0006 | Regulated |

| Japan | FSA | ヒロセ通商株式会社 | Retail Forex License | 近畿財務局長(金商)第41号 | Suspicious Clone |

Services

The services it provides cover tailored forex liquidity solutions, forex prime services and margin trading, distribution and execution.

A pos free

Hong Kong

I do not know if it is a clone or a fake. It just rejected the withdrawal. Fraud platform and hope to expose.

Exposure

werly

Spain

Hirose Financial's leverage is too low for my needs... Doesn't cut it. But the spreads are enticing, I'll still trade there.

Neutral

Jason30611

United Kingdom

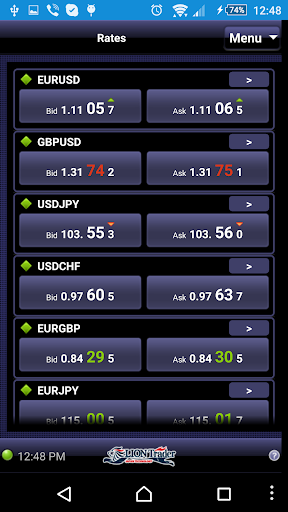

Hirose Financial has been my go-to for Forex trading. Really appreciate the tight spreads and the fact there are no hidden fees. It's regulated by the FCA, so I feel my money is safe. The mobile app is super handy for trading on the fly, and their step-by-step guide was a great help when I was starting out.

Positive

UG8YGTFH

New Zealand

I like their spreads and I really like the quality of execution. Customer service is also professional and knowledgeable. The live chat is always fast. Some more educational material would also be nice. 5 stars rating!

Positive

程安 -陶

Argentina

hirose is excellent as a forex trading platform. It requires a minimum deposit of only €50, which means that even a newbie like me can give it a try. The maximum leverage is only 1:30, which may be too low for some people, but it's enough for me.

Positive

DH55529

Hong Kong

This platform reliable to trade with somehow. I asked some details about the minimum deposits, spreads, deposits and withdrawal, their customer support team quickly answered me. Spreads on major forex pairs are quite competitive and the MT4 trading platform seems quite smooth…

Positive

陳厚甫

Hong Kong

I've been trading for the past few week. Everything gonna be okay! I'm going to love it!

Positive

FX1014859862

Hong Kong

I used this broker to trade forex pairs once, and its spreads are pretty competitive. Trading platform easy to use. You can only trade forex and gold with this broker, limited products. Well, you can find some free educational resources to use.

Positive