Company Summary

| Invast Global Review Summary | |

| Founded | 2021 |

| Registered Country/Region | Australia |

| Regulation | ASIC |

| Market Instruments | Forex, Metals, Equities, Indexes, Commodities, ETFs, CFDs, Futures |

| Demo Account | / |

| Leverage | / |

| Spread | / |

| Trading Platform | / |

| Minimum Deposit | / |

| Customer Support | Tel: +61 2 9083 1333 |

| Email: support@26degreesglobalmarkets.com | |

Invast Global Information

Invast Global, regulated by ASIC, is a financial services business based in Australia. It provides diverse market instruments, including various CFDs (FX, Metals, Equity Index, Commodity, ETF, Pairs) and Synthetic Futures, alongside advanced trading and prime brokerage solutions for both Broker Dealers and Hedge Funds. The platform offers flexible multi-currency deposit options but does not accept third-party, card, PayPal, or cash deposits.

Pros and Cons

| Pros | Cons |

|

|

|

|

Is Invast Global Legit?

Invast Global has a Market Maker (MM) license regulatedby the Australian Securities and Investments Commission (ASIC) with a license number of 438283.

What Can I Trade on Invast Global?

- For Broker Dealers, Invast Global offers an extensive multi-asset product range including FX and Metals CFDs, 40 proprietary Equity Index and Commodity CFDs, Equity and ETF CFDs from over 35 global stock exchanges, and Pairs CFDs, along with Algo Execution solutions.

- For Hedge Funds, Invast Global offers a suite of asset classes including Equity and ETF Synthetics (with DMA to 39 exchanges), FX and Precious Metals, Index and Commodity with transparent pricing, Synthetic Futures across 17 global exchanges, and an Equity Algorithm Suite.

Solutions

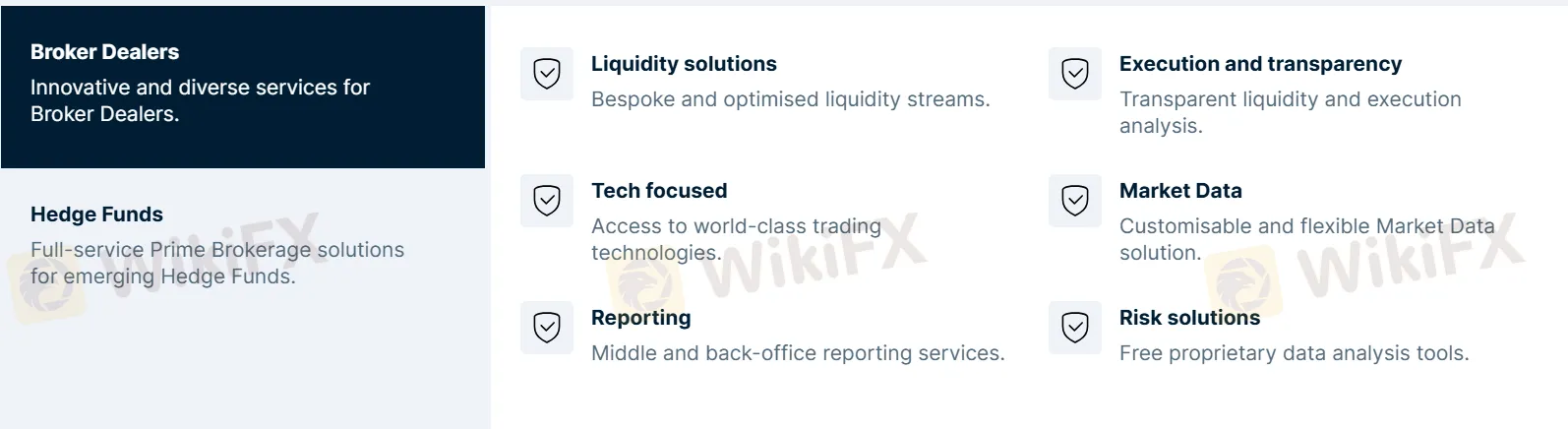

- For Broker Dealers, Invast Global offers innovative and diverse services including bespoke Liquidity solutions, transparent Execution and transparency analysis, Tech-focused access to world-class trading technologies, customisable Market Data solutions, Middle and back-office Reporting, and proprietary Risk solutions.

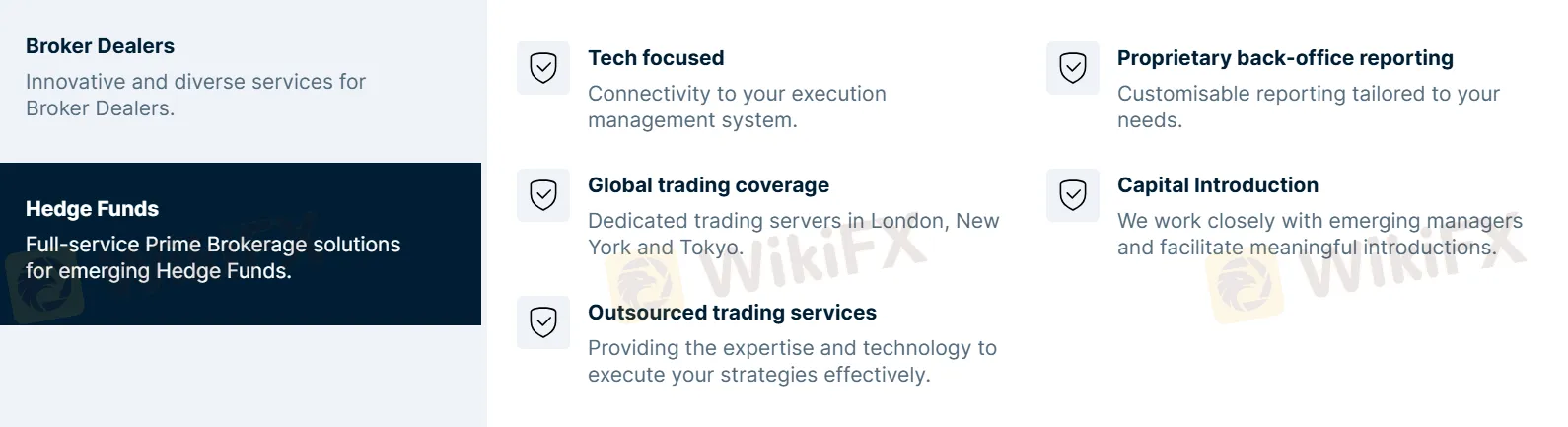

- For Hedge Funds, Invast Global provides full-service Prime Brokerage solutions tailored, combining global trading coverage (with dedicated servers in London, New York, and Tokyo) and seamless EMS connectivity. Their outsourced trading services and proprietary reporting tools empower funds to execute strategies efficiently while accessing capital introduction support.

Deposit and Withdrawal

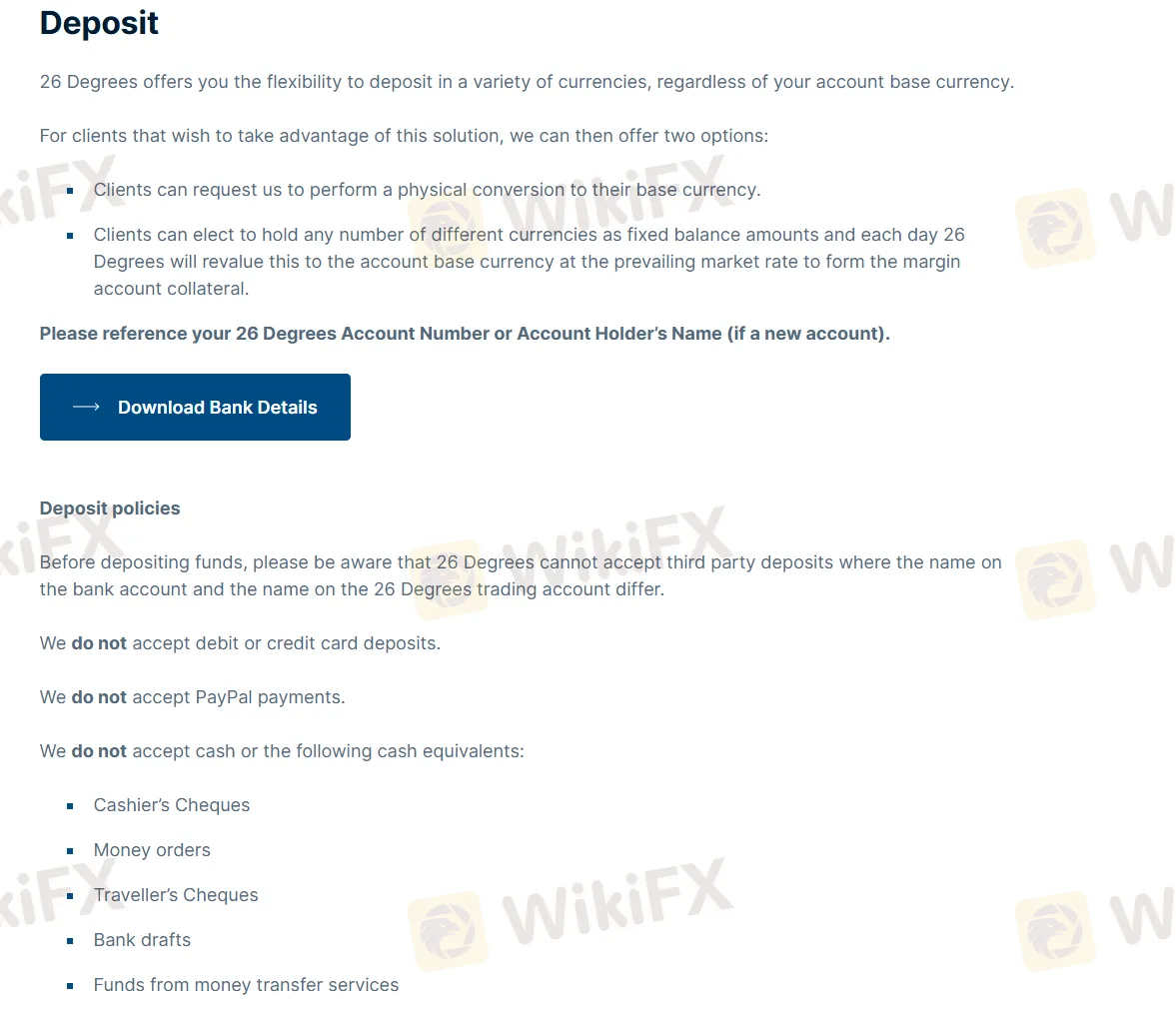

Invast Global offers flexible multi-currency deposit solutions, allowing clients to fund accounts in various currencies. Clients can choose to either convert deposits to their base currency or maintain balances in multiple currencies. Third-party deposits, cards, PayPal, and cash equivalents are not accepted.

FX2815803623

Australia

Scammer and Fraudulent Company WingOn Global Markets https://www.wingon-global.com/ Cheaters involved to avoid 1. David Chan CEO liar, dishonorable ethics no licence. No integrity act in a perfunctory manner hide deceit 2. Choy Hoi Yee Financial Planner not uphold customer contract trades for personal/company interests 3. Directors Bu Baicheng Yu Ka Yeung Thomas BOC NG Ka Fat

Exposure

FX2413743082

Hong Kong

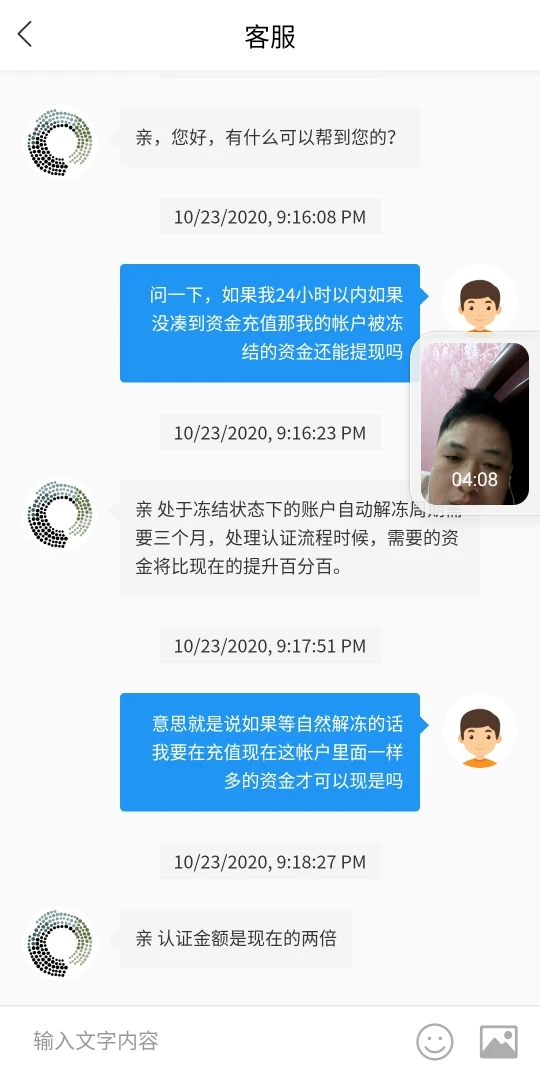

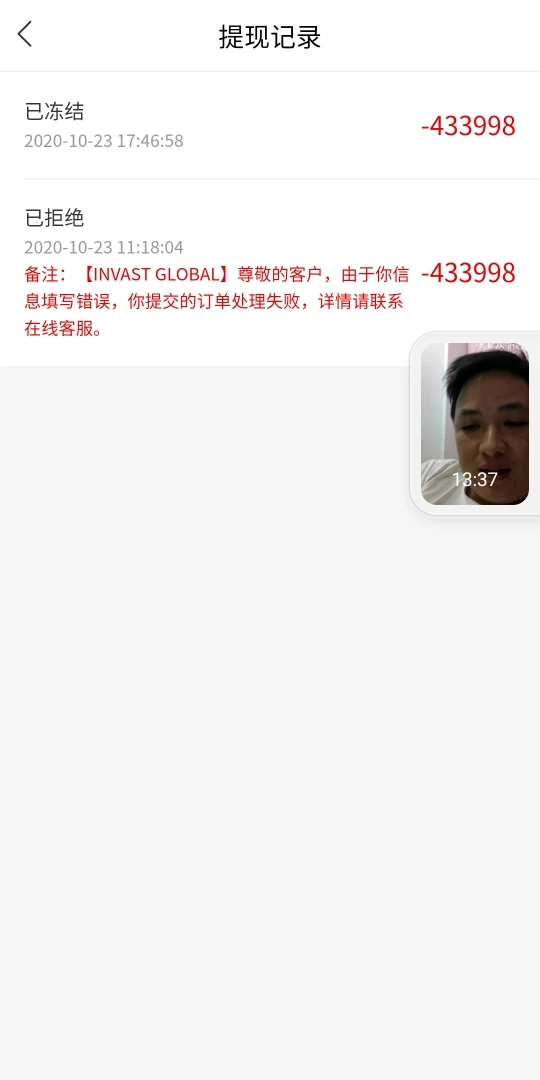

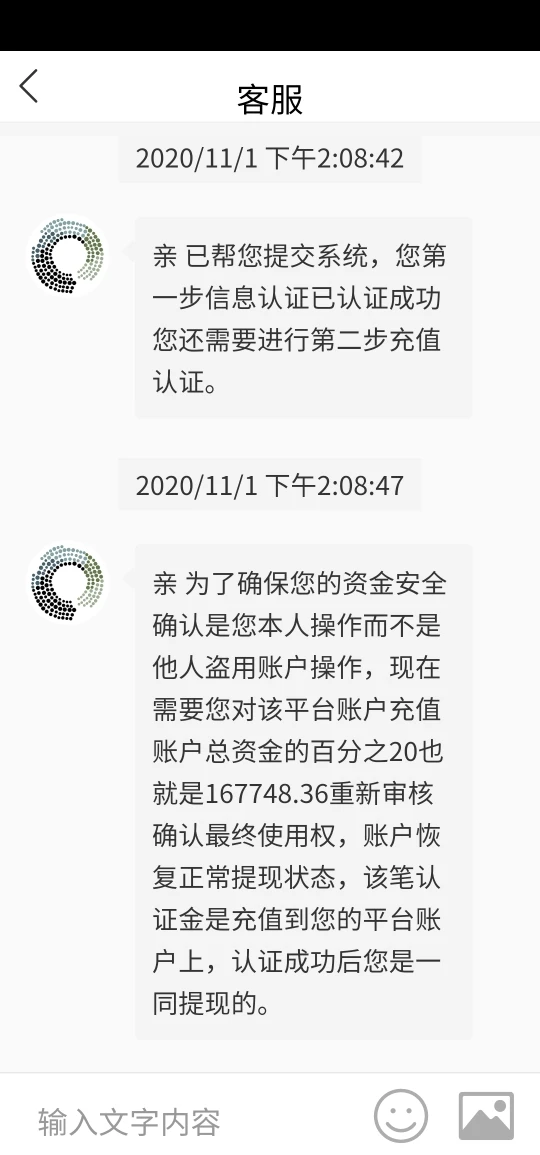

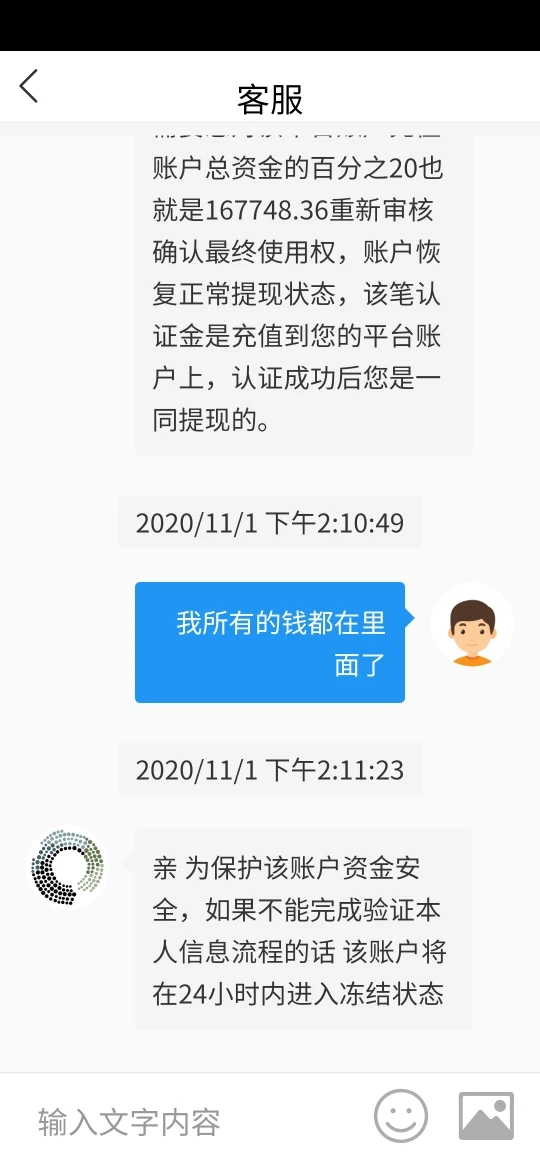

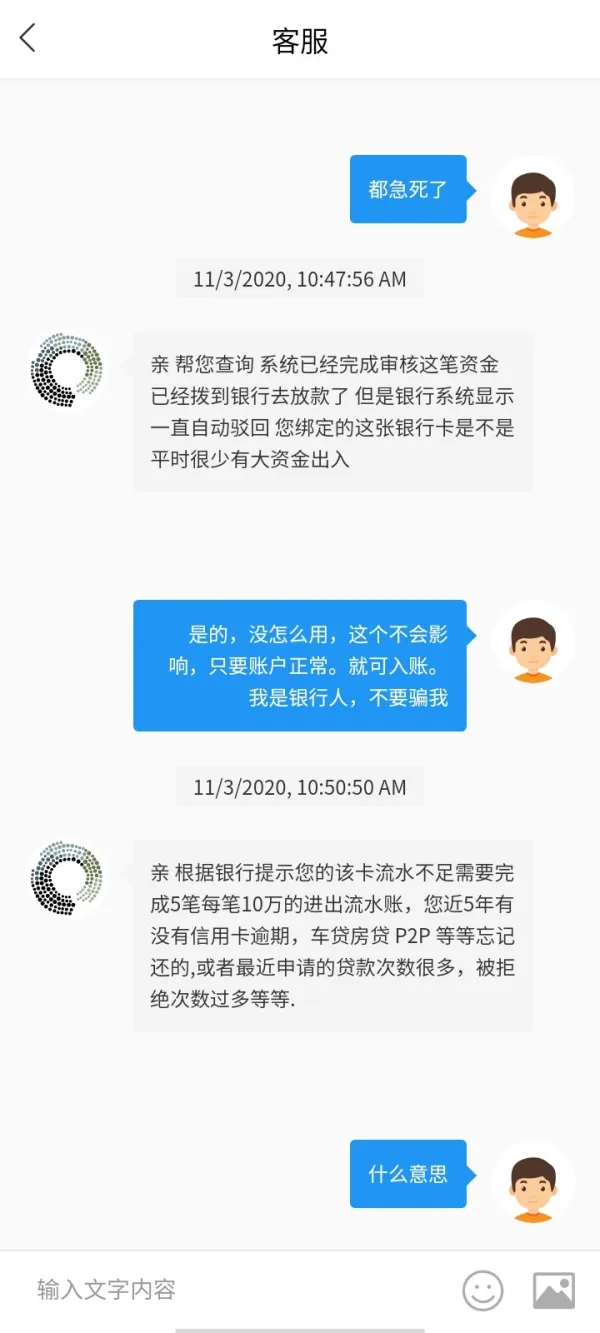

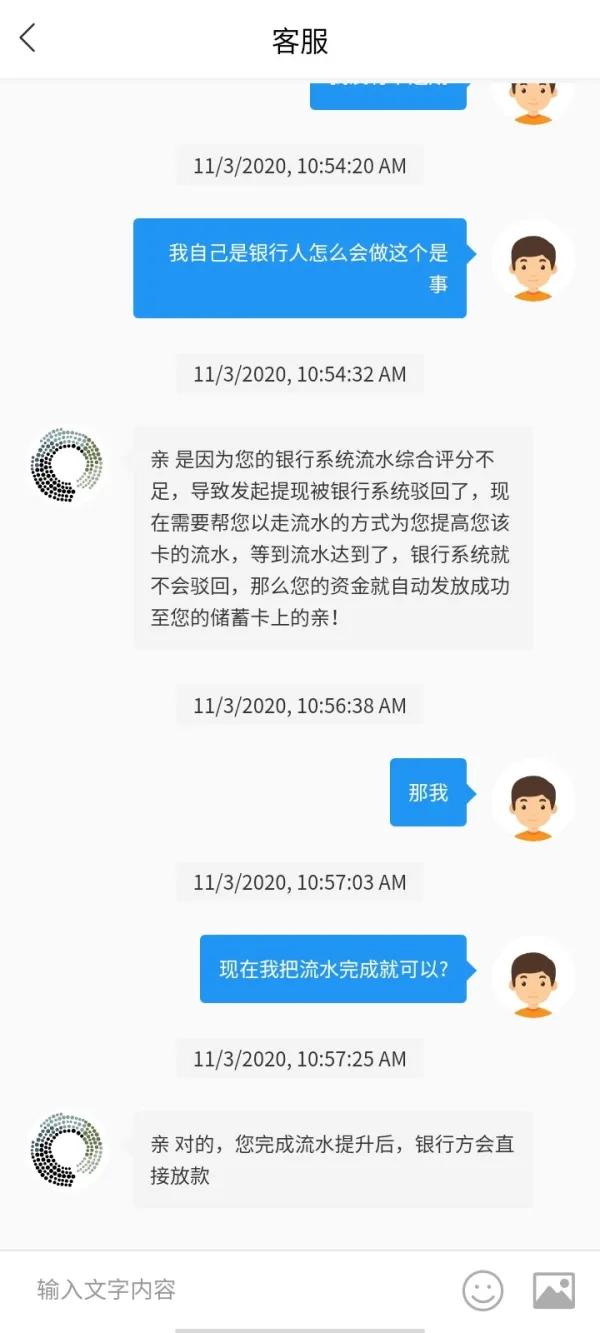

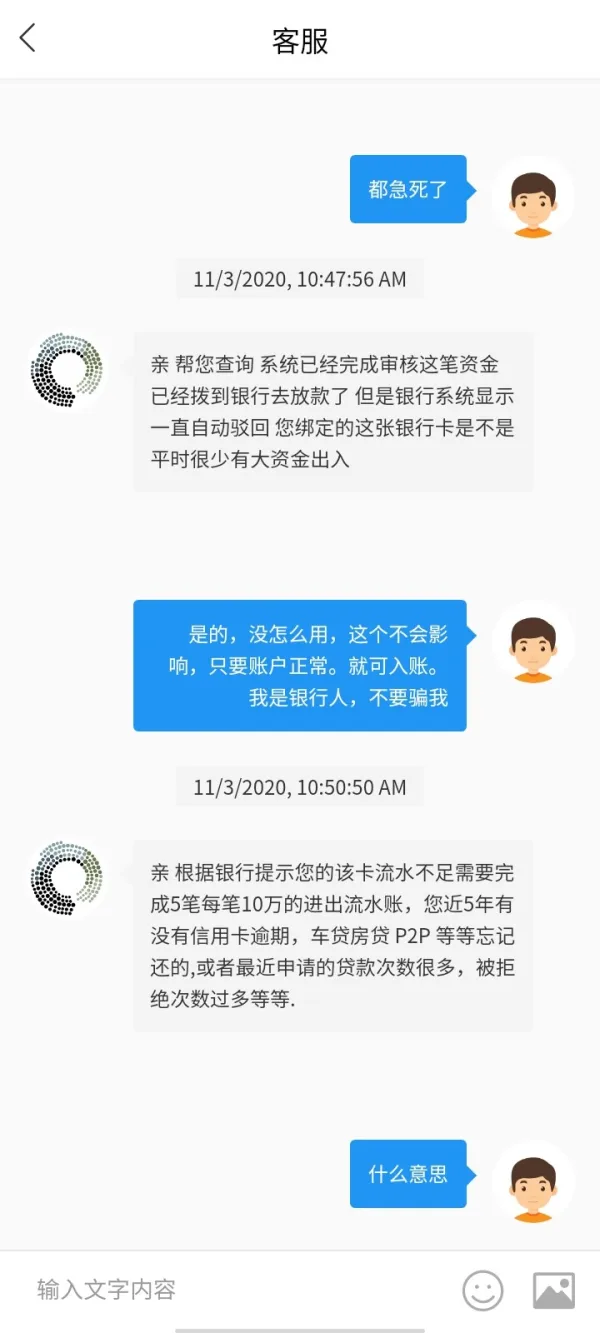

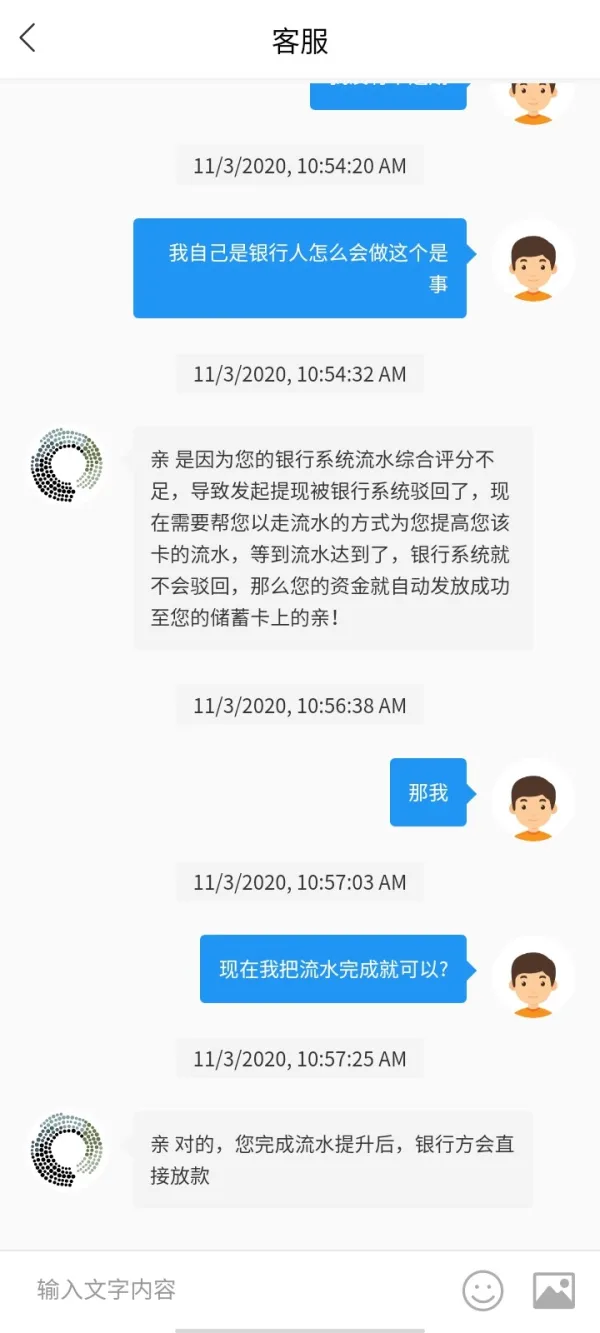

More 30% funds are needed to unfreeze the funds! And if I wait for unfreezimg the funds, the certification fee will be the double of my account balance!!

Exposure

阿三哥

Hong Kong

Can't withdraw. Have to pay 20% of the withdrawal to unfreeze my account

Exposure

币凡

Vietnam

I've had a positive experience with Invast Global and would recommend them to other traders. Competitive spreads, the wide range of markets they offer for trading, order execution is also quick.

Positive

FX2397415672

Hong Kong

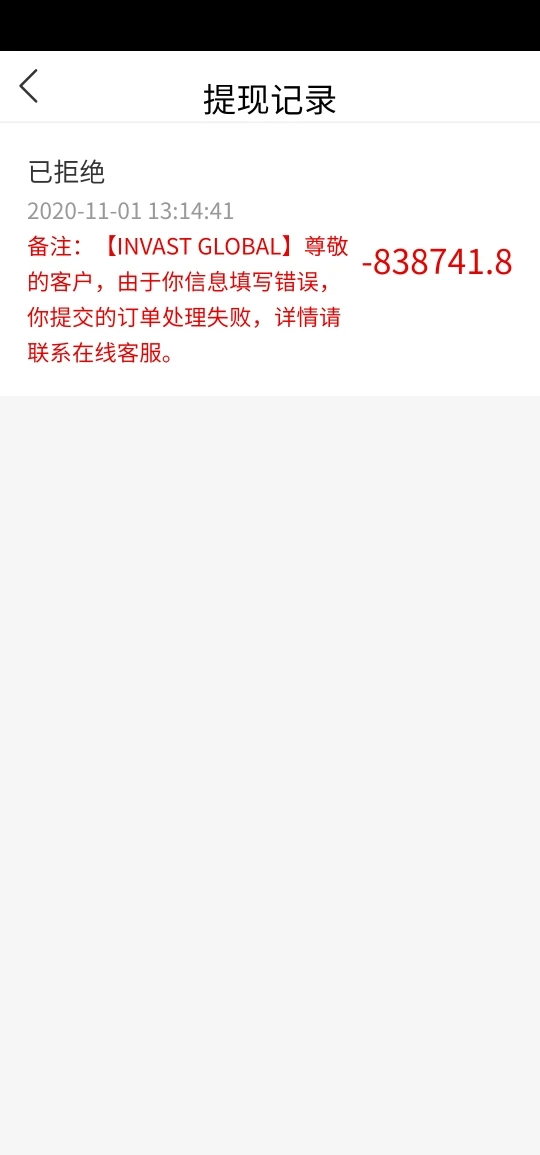

The turnover is insufficient as the platform said. My account is frozen for that. There are five sums of ¥100,000 needed which should be transferred to the platform. Please handle it.

Exposure

FX1148504473

Hong Kong

The money was transferred to personal account. It's not deposit.

Exposure

FX2397415672

Hong Kong

My account was frozen because of insufficient turnover. Have to deposit ¥100K five times to withdraw. Please solve this problem.

Exposure

FX1148504473

Hong Kong

Have to pay 30% because of the wrong card number. All my money is in it.

Exposure