Company Summary

| HSBC Review Summary | |

| Founded | 1865 |

| Registered Country/Region | Hong Kong |

| Regulation | SFC, LFSA, ASIC (Unverified) |

| Products | Shares, trusts, bonds/certificates of deposit (CDs), structured products, warrants & CBBCs, IPOs, gold, ESG and sustainable investing, etc. |

| Services | Banking, investment, lending, credit cards, wealth management, and insurance |

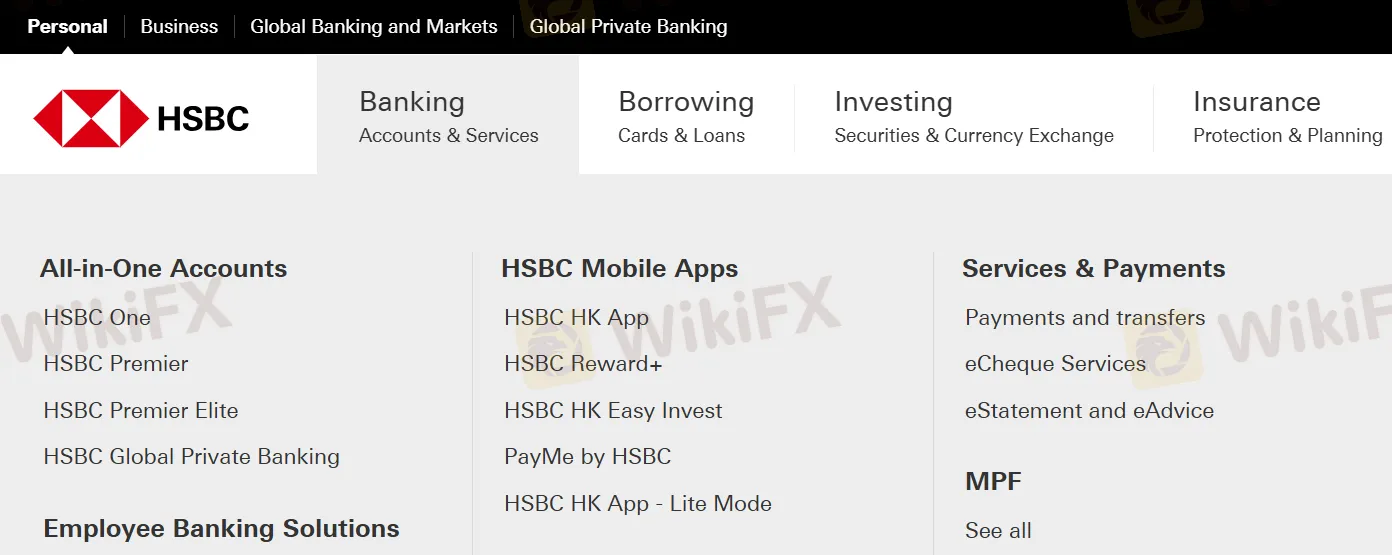

| Trading Platform | HSBC HK App, HSBC Reward+, HSBC HK Easy Invest, PayMe by HSBC, HSBC HK App - Lite Mode |

| Customer Support | 24/7 support, live chat |

| Tel: +85222333322 | |

| Address: Level 11(B1), Main OFFice Tower, Financial Park CoMplex, Jalan Merdeka, 87000 Labuan F.T. | |

HSBC Information

HSBC (HSBC) is a well-known financial institution registered in Hong Kong, regulated by the Securities and Futures Commission (SFC) of Hong Kong and the Labuan Financial Services Authority (LFSA) of Malaysia, among others. It offers a comprehensive range of financial services, including banking, investment, lending, credit cards, wealth management, and insurance. In addition, HSBC is committed to supporting environmental, social and governance (ESG) and sustainable investments, providing customers with a wide range of investment options and convenient mobility solutions.

Pros and Cons

| Pros | Cons |

| Long history | Unverified ASIC license |

| Regulated by SFC and LFSA | Complex fee structure |

| Various products and services | |

| Live chat support |

Is HSBC Legit?

HSBC is regulated in a number of countries and regions, including Hong Kong, the Labuan region of Malaysia, and Australia.

In Hong Kong, HSBC holds an AAA523 license for trading futures contracts, which is regulated by the Hong Kong Securities and Futures Commission (SFC).

In Labuan, HSBC is regulated by the Labuan Financial Services Authority (LFSA) as a Market Maker (MM), but the license number is not disclosed.

However, the license regulated by the Australian Securities and Investments Commission (ASIC) is unverified.

| Regulated Country | Regulated Authority | Regulatory Status | Regulated Entity | License Type | License Number |

| Securities and Futures Commission of Hong Kong (SFC) | Regulated | Hongkong and Shanghai Banking Corporation Limited | Dealing in futures contracts | AAA523 |

| Labuan Financial Services Authority (LFSA) | Regulated | Hongkong and Shanghai Banking Corporation Limited | Market Maker (MM) | Unreleased |

| Australia Securities & Investment Commission (ASIC) | Unverified | HSBC BANK AUSTRALIA LIMITED | Market Maker (MM) | 232595 |

What Can I Trade on HSBC?

HSBC offers a full range of trading products, including shares, trusts, bonds/certificates of deposit (CDs), structured products, warrants & CBBCs, IPOs, gold, ESG and sustainable investing, etc.

| Trading Products | Supported |

| Shares | ✔ |

| Trusts | ✔ |

| Bonds/CDs | ✔ |

| Structured products | ✔ |

| Warrants & CBBCs | ✔ |

| IPOs | ✔ |

| Gold | ✔ |

| ESG | ✔ |

| Forex | ❌ |

| Commodities | ❌ |

| Indices | ❌ |

| Cryptocurrencies | ❌ |

| Options | ❌ |

| ETFs | ❌ |

Account Type

HSBC offers an all-in-one account. All-in-one integrated bank account for deposits, credit cards, investments, insurance, and more.

HSBC Fees

Commission: Commission-free, HSBC will not charge commission to the client.

HSBC offers a wide range of financial services across a wide range of sectors, including credit cards, loans, excessive overdrafts, investments, and life insurance.

For more information, please click: https://www.hsbc.com.hk/fees/

| Service | Fees & Charges | ||

| Credit Cards | Octopus Automatic Add Value Service (AAVS) | The first time you apply for this service is free of charge. A processing fee of HKD20 will be charged for the transfer or reactivation of the AAVS service from another bank. | |

| Loans | Late Charge | Personal Instalment Loans | 2.25% per month calculated daily for amounts in arrears, plus HKD400 on each instalment due to insufficient funds |

| Personal Tax Loan | |||

| Revolving Credit Facility | 8% flat on payment in arrears (minimum HKD100, maximum HKD200) plus the Prevailing Rate | ||

| Overdrafts | Service Fee | Personal Overdraft | Annual Fee: 1% of the overdraft limit per annum (Minimum: HKD200, Maximum: HKD700) |

| HSBC One and Personal Integrated Account - Clean Credit | Monthly Fee: Pro-rated on HKD50 based on utilisation % of the credit limit in the previous month, maximum HKD50 | ||

| HSBC Premier - Clean Credit | |||

| Insurance | If the customer surrenders the policy before the end of the policy term, the customer may get back less than the amount paid. | ||

Trading Platform

| Trading Platform | Supported | Available Devices |

| HSBC HK App | ✔ | Mobile |

| HSBC Reward+ | ✔ | Mobile |

| HSBC HK Easy Invest | ✔ | Mobile |

| PayMe by HSBC | ✔ | Mobile |

| HSBC HK App - Lite Mode | ✔ | Mobile |

Deposit and Withdrawal

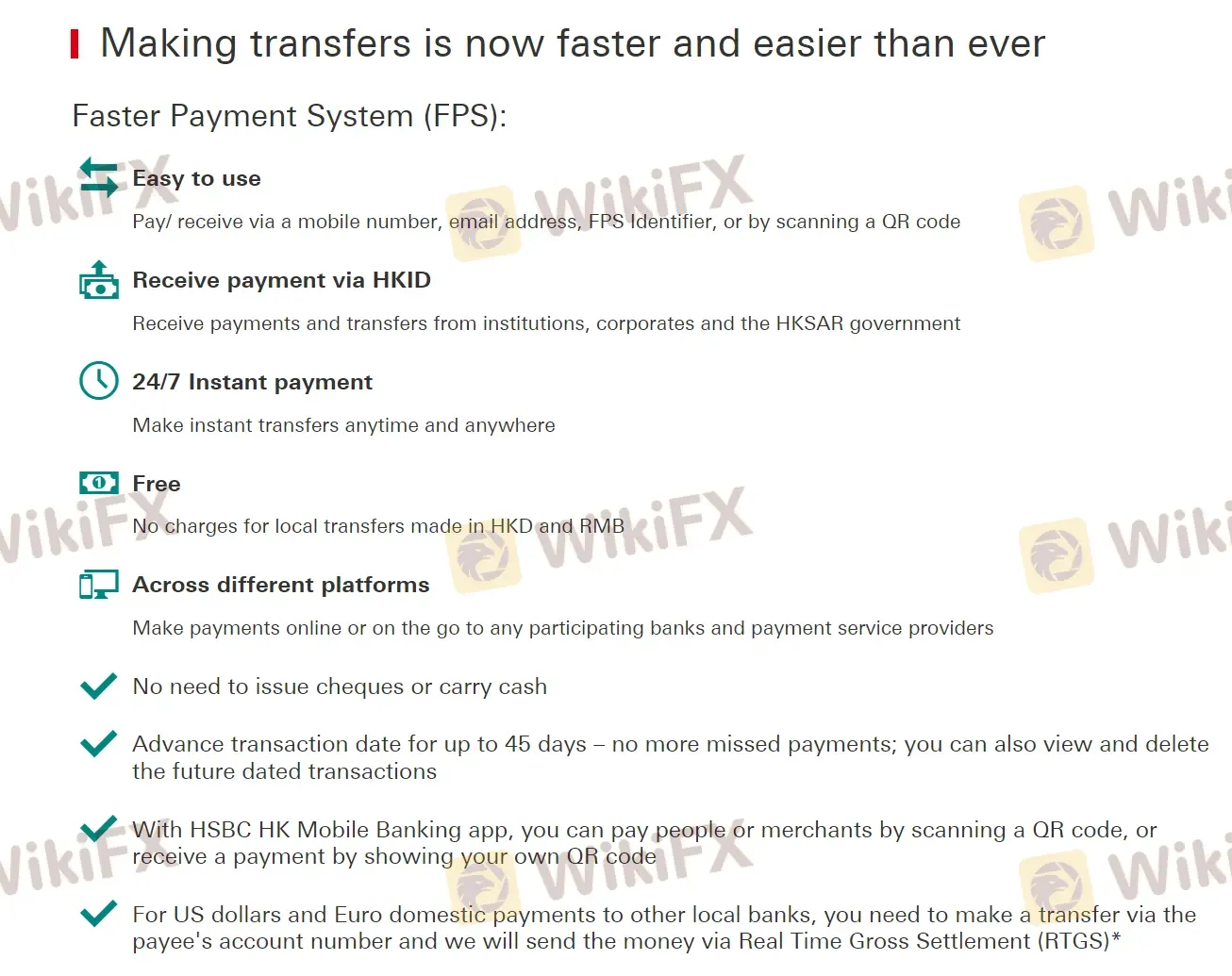

HSBC offers fast transfers via the Faster Payment System (FPS). In addition, users can scan a QR code to send or receive money via the HSBC HK Mobile Banking app, or for local transfers in USD and EUR, real-time full settlement (RTGS) via account number.