公司簡介

| 中信期貨 評論摘要 | |

| 成立年份 | 2007 |

| 註冊國家/地區 | 中國 |

| 監管 | CFFEX |

| 服務 | 經紀服務、投資諮詢、技術支援、資產管理 |

| 模擬帳戶 | ✅ |

| 交易平台 | Fast Issue (V2)、Fast Issue (V3)、Mandarin WH6 等 |

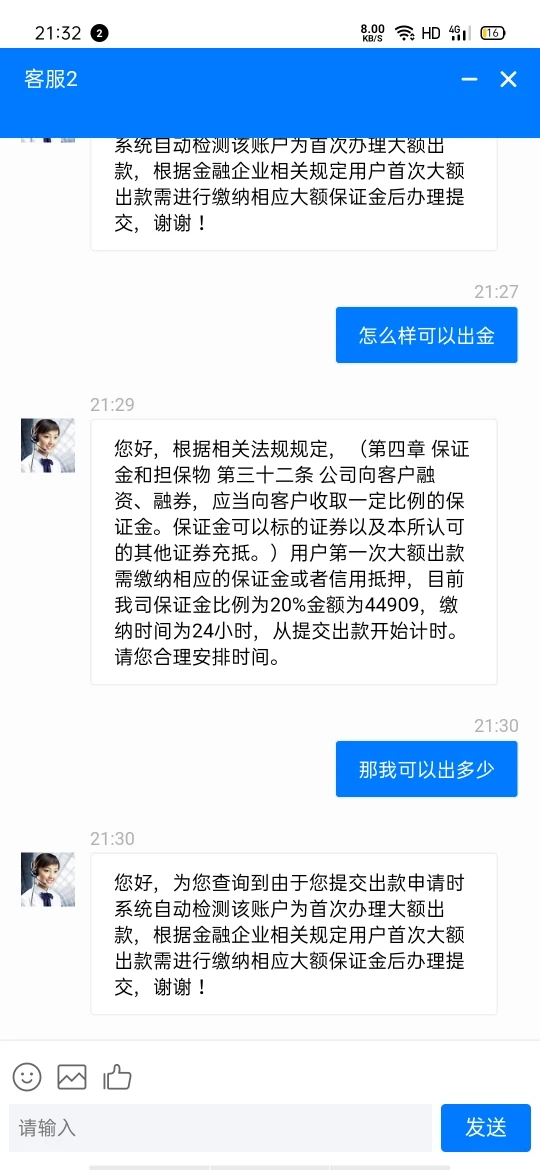

| 客戶支援 | 24/7 在線聊天 |

| 電話:400-9908-826 | |

| 傳真:0755-83217421 | |

| 郵政編碼:518048 | |

| 地址:中國深圳市福田區中心三路8號時代豪庭二期北座13樓和14樓1301-1305室,郵編518048 | |

| Facebook、X、Instagram、LinkedIn | |

中信期貨 資訊

中信期貨 是一家受監管的頂級經紀和金融服務提供商,於2007年在中國成立。提供經紀服務、投資諮詢、技術支援和資產管理等服務。

優缺點

| 優點 | 缺點 |

| 模擬帳戶 | 交易產品有限 |

| 操作時間長 | 收取各種費用 |

| 多種聯絡渠道 | |

| 監管良好 |

中信期貨 是否合法?

Yes. 中信期貨 獲中金所(CFFEX)許可提供服務。其牌照號碼為0018。中金所經中華人民共和國國務院和中國證券監督管理委員會(CSRC)批准成立,是一家專門提供金融期貨、期權和其他衍生品交易和結算服務的交易所。

| 監管國家 | 監管機構 | 當前狀態 | 受監管實體 | 牌照類型 | 牌照號碼 |

| 中金所(CFFEX) | 受監管 | 中信期货有限公司 | 期貨牌照 | 0018 |

中信期貨 服務

| 服務 | 支援 |

| 經紀服務 | ✔ |

| 投資諮詢 | ✔ |

| 技術支援 | ✔ |

| 資產管理 | ✔ |

中信期貨 費用

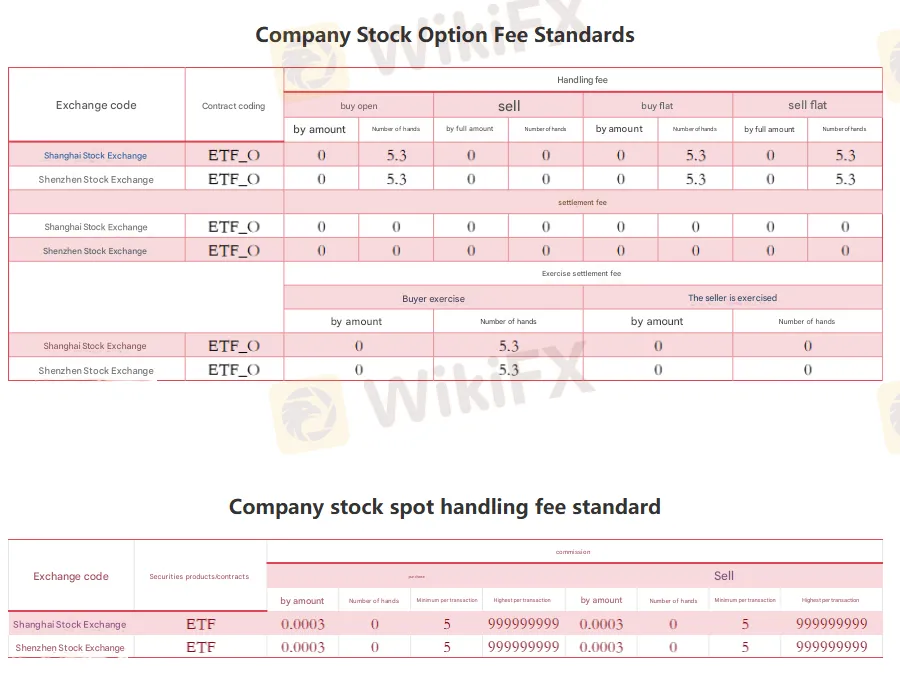

不同交易所的不同產品收取不同費用,詳情請參閱官方網站(圖片由Google翻譯,不太清晰,詳情請參閱官方網站)。

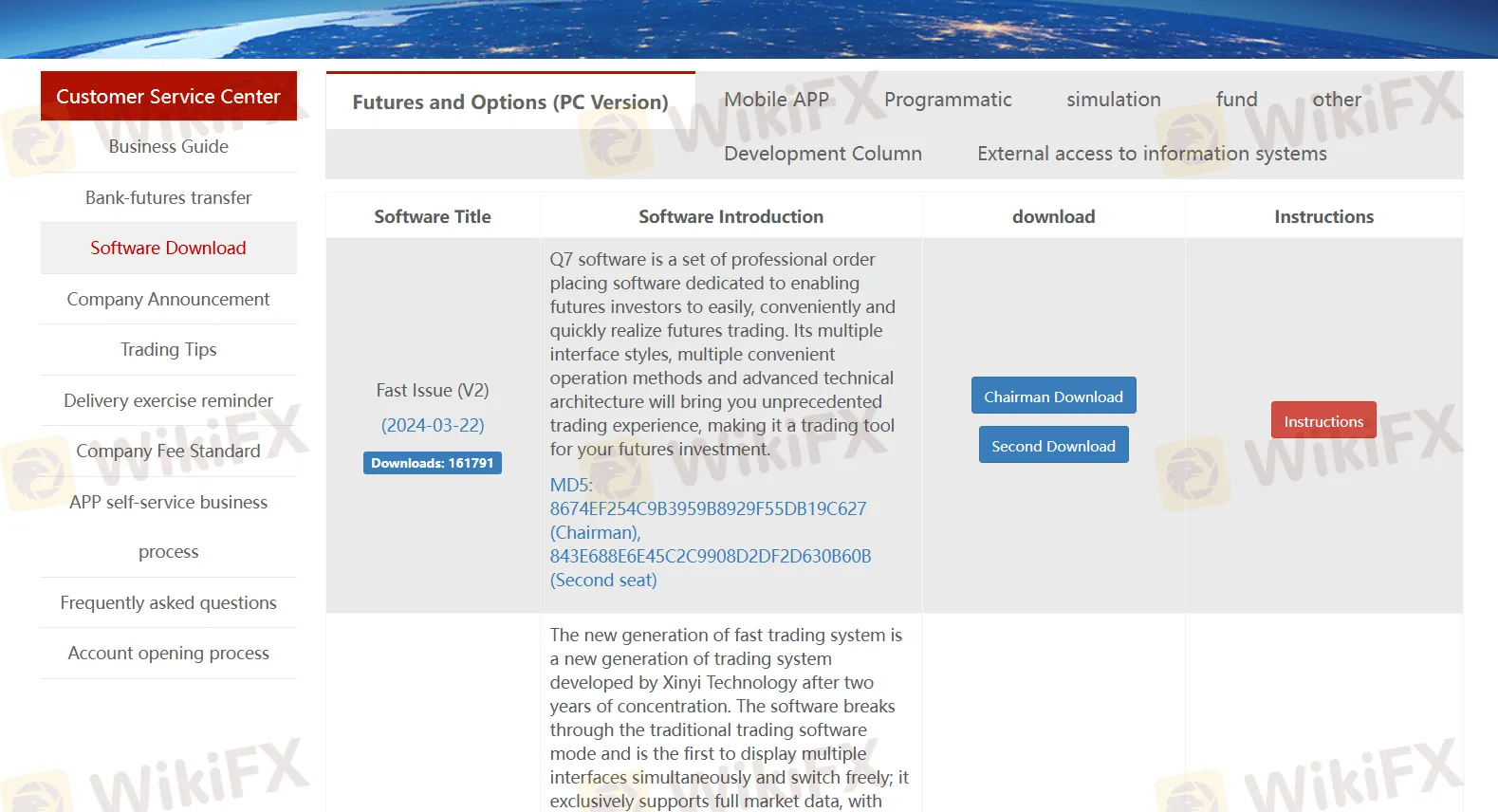

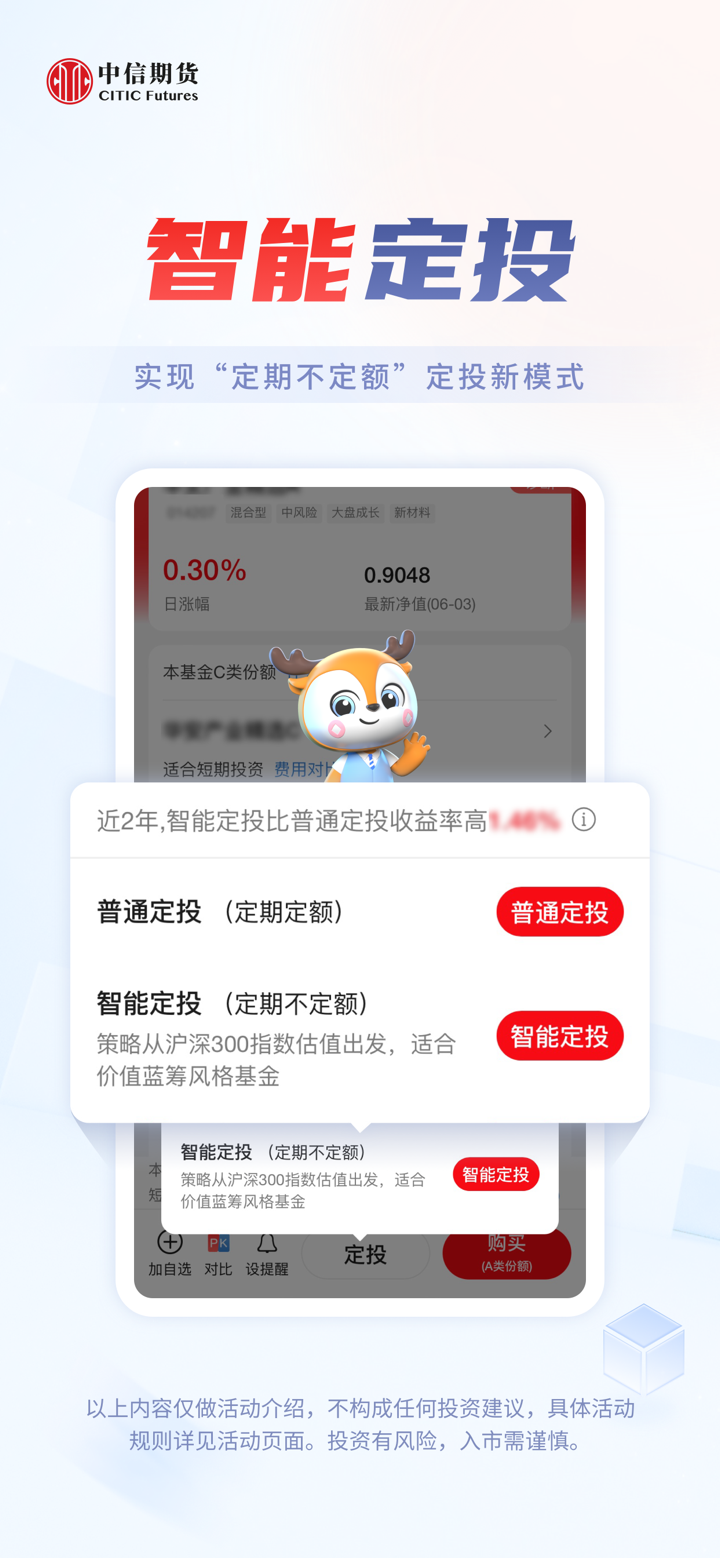

交易平台

| 交易平台 | 支援 | 可用設備 |

| Fast Issue (V2) | ✔ | PC、筆記本電腦、平板電腦 |

| Fast Issue (V3) | ✔ | PC、筆記本電腦、平板電腦 |

| Mandarin WH6 | ✔ | PC、筆記本電腦、平板電腦 |

| Boyi Master 7 | ✔ | PC、筆記本電腦、平板電腦 |

| Boyi Master 5 | ✔ | PC、筆記本電腦、平板電腦 |

| 中信期貨 通華順期貨 | ✔ | PC、筆記本電腦、平板電腦 |

| 中信期貨 無限易 | ✔ | PC、筆記本電腦、平板電腦 |

| Polestar 9.5 | ✔ | PC、筆記本電腦、平板電腦 |

| 中信 Polestar 9.3 | ✔ | PC、筆記本電腦、平板電腦 |

| 千龍期權 | ✔ | PC、筆記本電腦、平板電腦 |

| 匯點股票期權專業投資系統 | ✔ | PC、筆記本電腦、平板電腦 |

| 中信期貨-新e路 | ✔ | 手機 |

| 中信期貨-交易版 | ✔ | 手機 |