公司簡介

| 東航期貨 檢討摘要 | |

| 成立年份 | 2010 |

| 註冊國家/地區 | 中國 |

| 監管 | CFFE(受監管) |

| 市場工具 | 期貨 |

| 模擬帳戶 | ✅ |

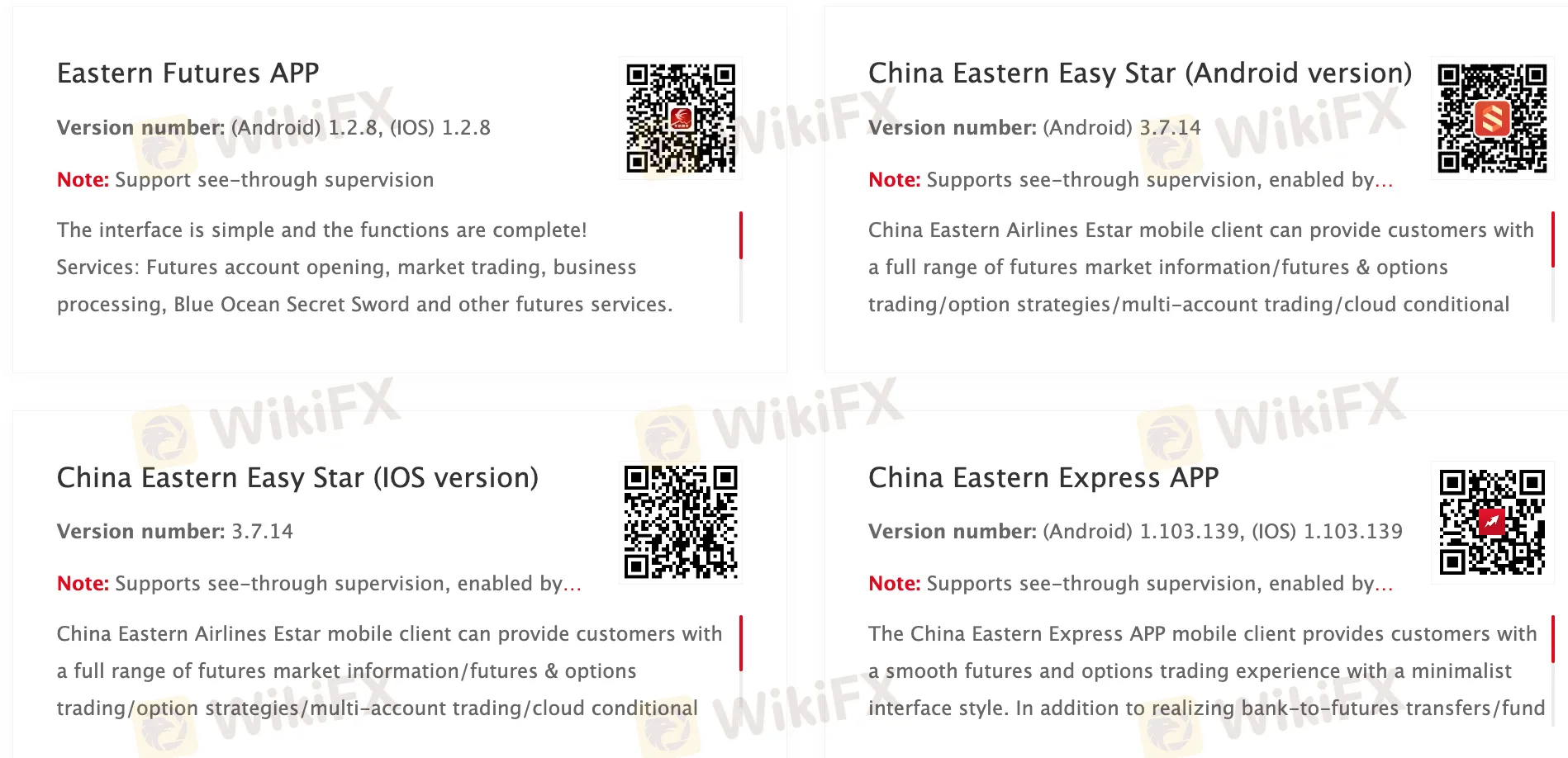

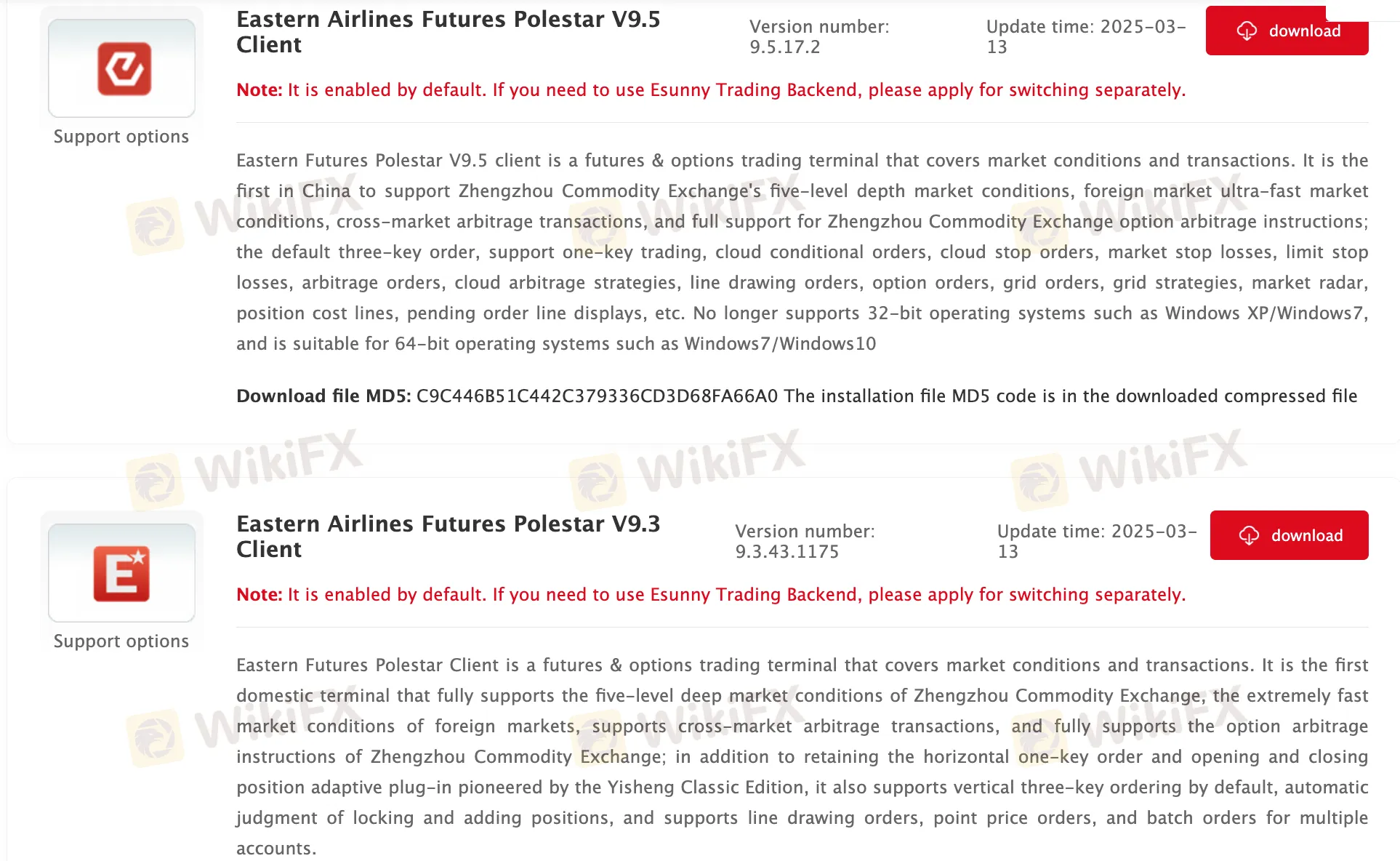

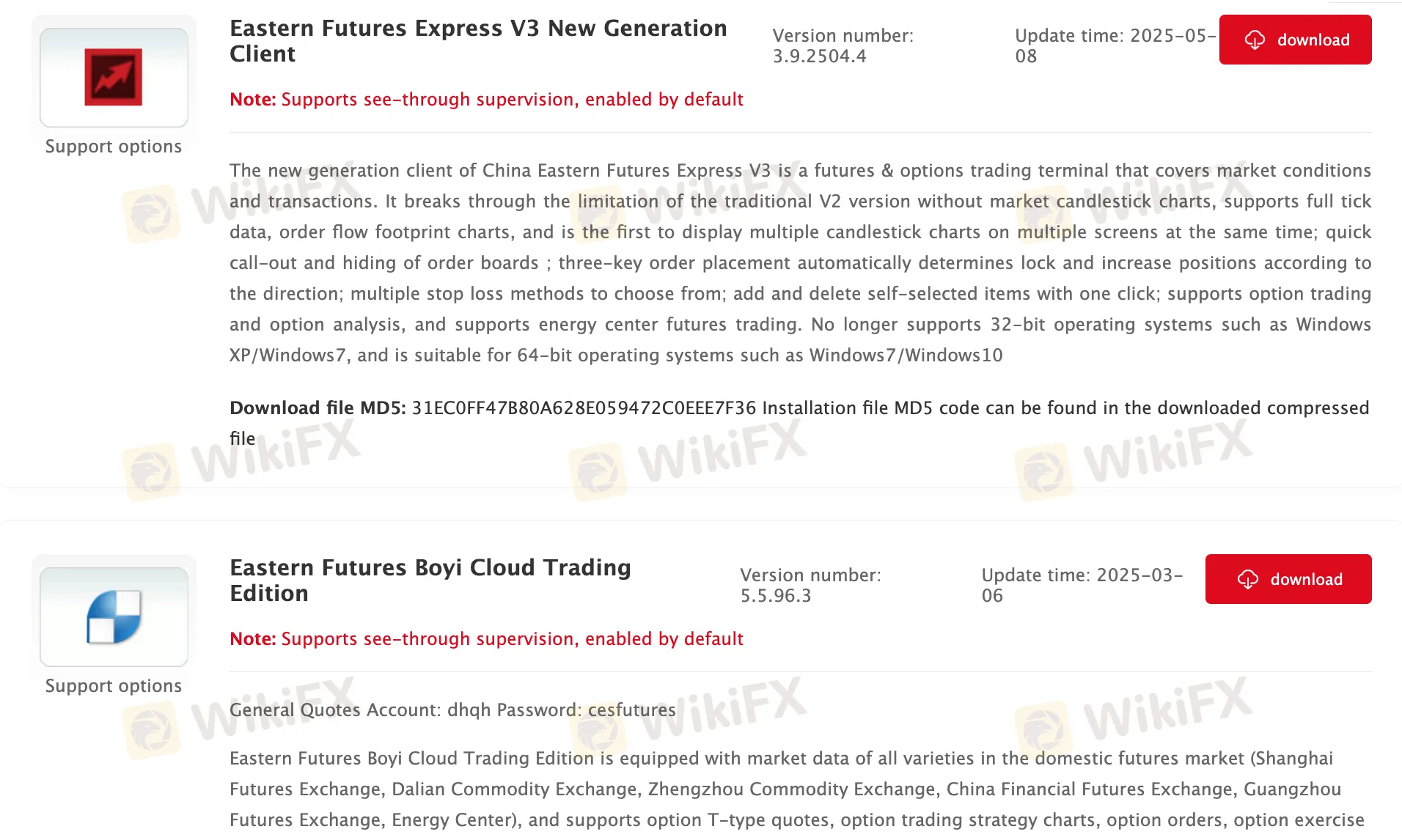

| 交易平台 | 東方期貨APP、中國東方易星(Android 版本)、中國東方易星(IOS 版本)、中國東方快遞APP、東航期貨極星V9.5客戶端、東航期貨極星V9.3客戶端、東方期貨快遞V3新一代客戶端、東方期貨博易雲交易版、東航期貨市場軟件Winshun版(文華WH6)、東方期貨快遞V2客戶端、東方期貨交易先鋒客戶端、東方期貨益盛極星V8.5客戶端、東方期貨益盛經典客戶端V8.3、快奇V2交易終端(國家機密版)、東航期貨博易雲(國家機密版)等 |

| 客戶支援 | 在線聊天 |

| 電話:4008-889-889 | |

| 微信、抖音 | |

| 電郵:service@kiiik.com | |

東航期貨 資訊

東航期貨 是一家受監管的經紀商,提供在各種交易平台上進行期貨交易的服務。

優點和缺點

| 優點 | 缺點 |

| 多種交易平台 | 交易產品類型有限 |

| 模擬帳戶 | 收取匯兌和保證金費用 |

| 受良好監管 | |

| 在線聊天支援 | |

| 長時間運作 |

東航期貨 是否合法?

是的。東航期貨 獲得中金所的許可提供服務。

| 受監管國家 | 監管機構 | 當前狀態 | 受監管實體 | 許可證類型 | 許可證號碼 |

| 中金所 | 受監管 | 東航期貨有限責任公司 | 期貨牌照 | 0153 |

我可以在 東航期貨 上交易什麼?

東航期貨 提供期貨交易。

| 可交易工具 | 支援 |

| 期貨 | ✔ |

| 外匯 | ❌ |

| 大宗商品 | ❌ |

| 指數 | ❌ |

| 股票 | ❌ |

| 加密貨幣 | ❌ |

| 債券 | ❌ |

| 期權 | ❌ |

| 交易所買賣基金 | ❌ |

帳戶類型

該經紀商並未清楚提供其提供的帳戶類型。客戶可以開設模擬帳戶開始期貨交易。

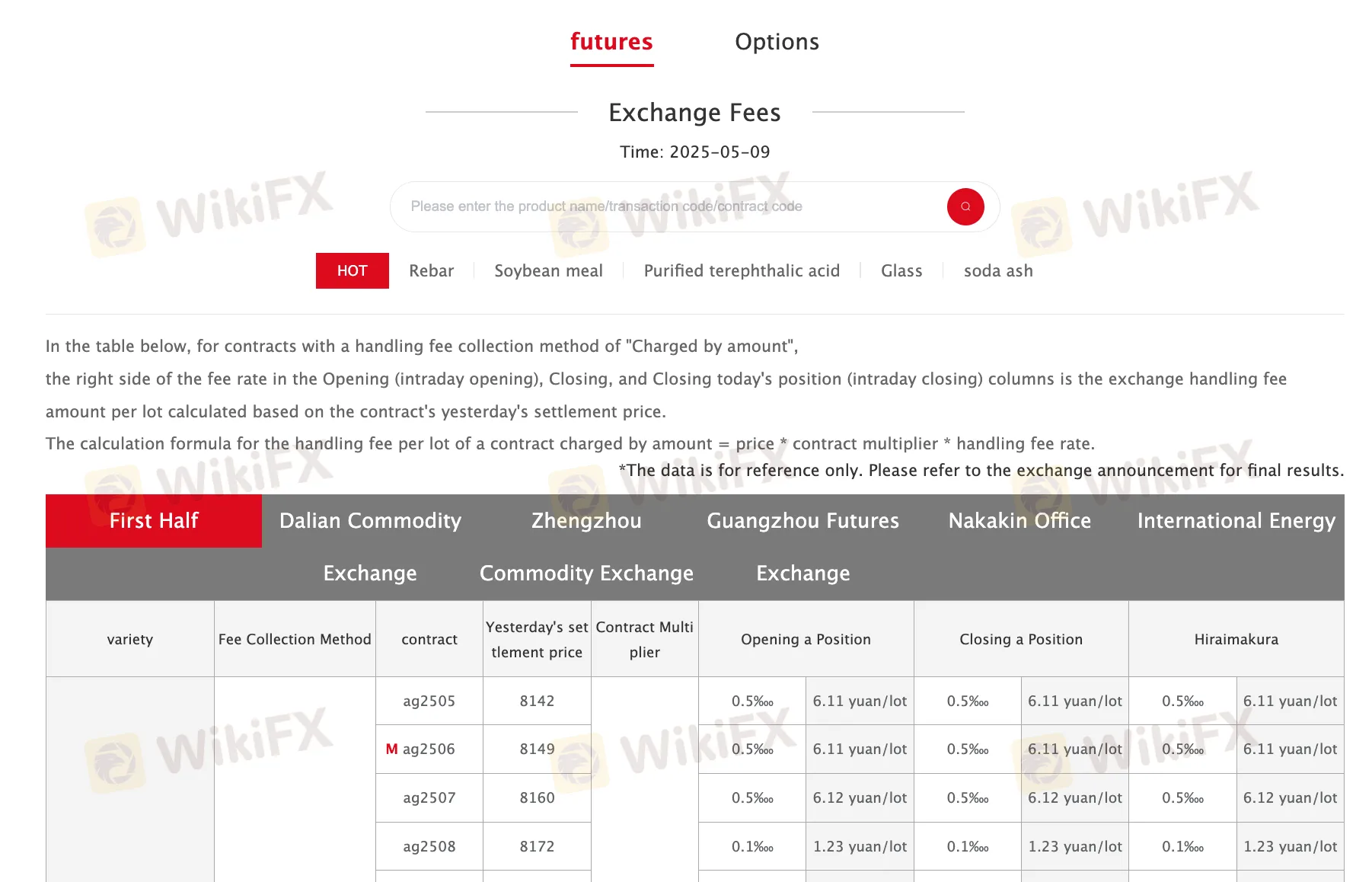

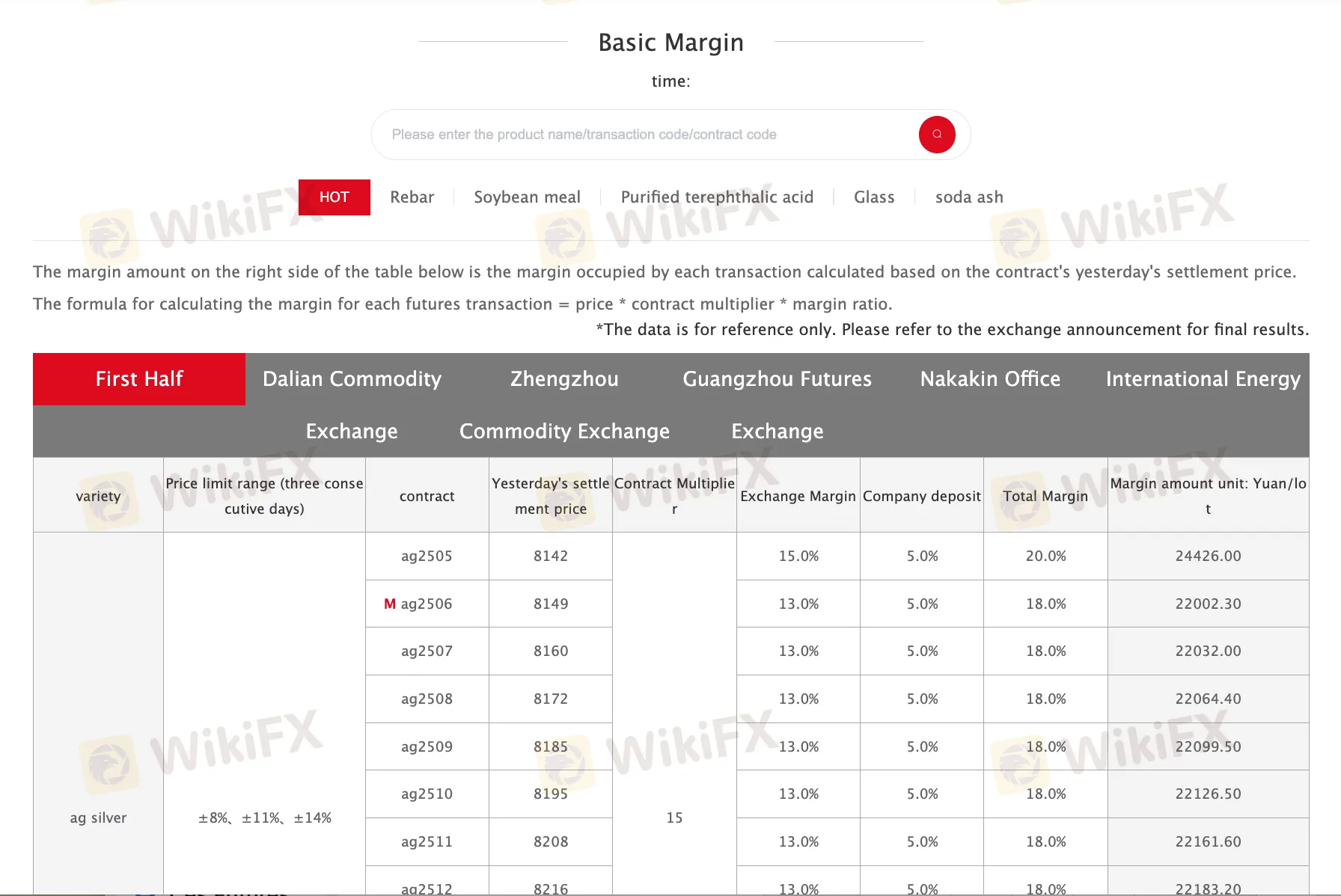

東航期貨 費用

該經紀商對不同類型的交易工具收取交易費用和保證金費用。

交易平台

該經紀商提供多種交易平台,包括東方期貨APP、中國東方易星(Android版本)、中國東方易星(IOS版本)、中國東方快遞APP、東航期貨極星V9.5客戶端、東航期貨極星V9.3客戶端、東方期貨快遞V3新一代客戶端、東方期貨博易雲交易版、東航期貨市場軟件Winshun版(文華WH6)、東方期貨快遞V2客戶端、東方期貨交易先鋒終端、東方期貨益盛極星V8.5客戶端、東方期貨益盛經典客戶端V8.3、快奇V2交易終端(國家機密版)和東航期貨博易雲(國家機密版)。

可用設備:桌面和移動設備(IOS、Android)。

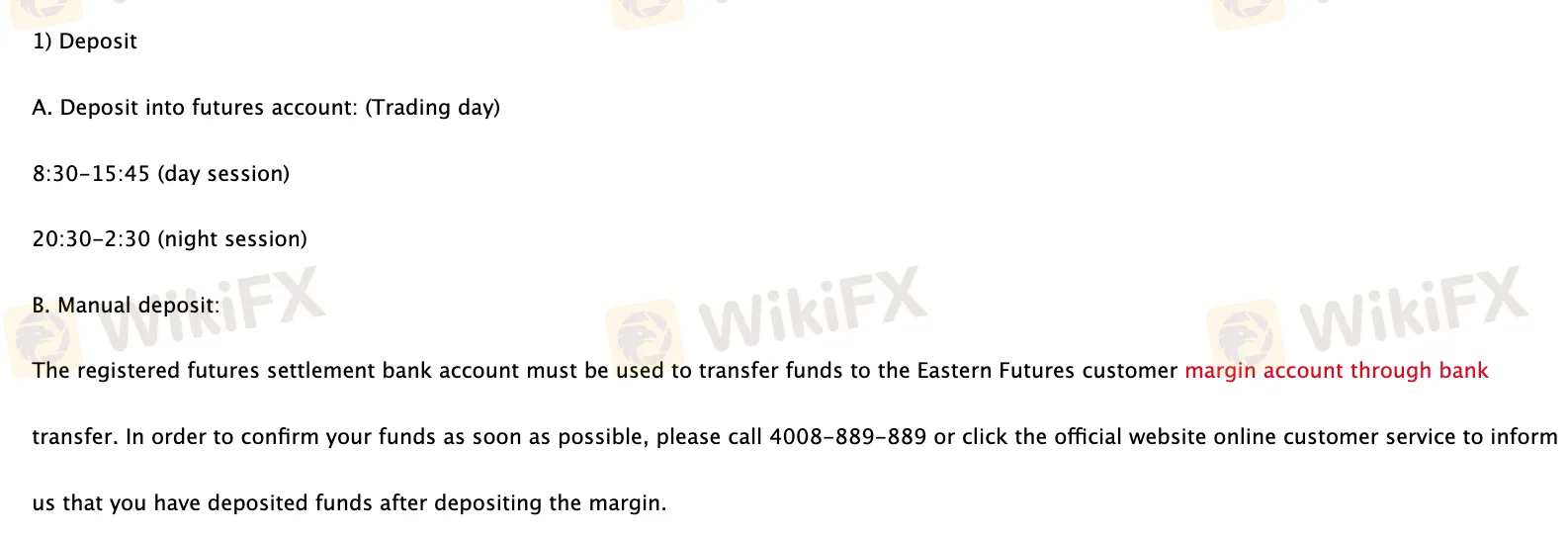

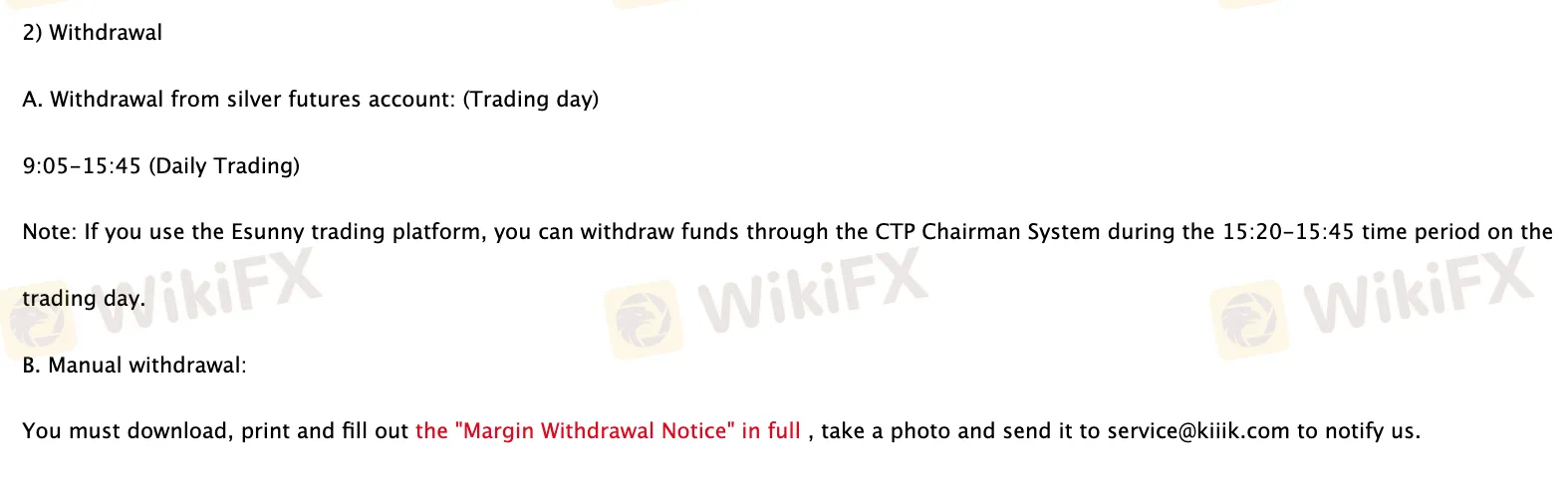

存款和提款

未設定最低存款或提款金額,也未指定任何費用或收費。網站僅顯示存款和提款時間。