公司簡介

| 國泰君安 評論摘要 | |

| 成立日期 | 1999-04-11 |

| 註冊國家/地區 | 中國 |

| 監管 | 受監管 |

| 市場工具 | 基金、債券、股票、期貨和期權 |

| 交易平台 | 國泰君宏APP |

| 客戶支援 | 95521 |

| 95521@gtht.com | |

| 微信、微博 | |

國泰君安 資訊

國泰君安 證券(國泰君安)是中國資本市場的領先綜合金融服務機構。該公司成立於1999年,現已發展成為一家提供廣泛金融產品和服務的大型企業。該公司的網絡覆蓋全國44個省、直轄市和自治區,擁有641家證券業務部門。

優點和缺點

| 優點 | 缺點 |

| 受監管 | 複雜的費用結構 |

| 全面的金融服務 | 有限的國際關注 |

| 7x24小時在線開戶 | |

| 客戶支援 |

國泰君安 是否合法?

是的,國泰君安 是一家合法且受到嚴格監管的金融機構。該公司持有中國金融期貨交易所的許可證,許可證號碼為0001。

國泰君安 可以交易什麼?

在 國泰君安 上,客戶可以交易各種金融產品,包括在中國股票交易所上市的股票、債券(政府和企業)、基金(共同基金、交易所交易基金)以及期貨和期權等衍生品。此外,它還為符合條件的客戶提供保證金交易和賣空交易的機會。

| 可交易工具 | 支援 |

| 基金 | ✔ |

| 債券 | ✔ |

| 股票 | ✔ |

| 期貨 | ✔ |

| 期權 | ✔ |

帳戶類型

國泰君安 提供標準交易帳戶,適用於一般股票和基金交易,保證金帳戶適用於希望使用槓桿進行交易的投資者,以及針對機構客戶或高資產淨值個人量身定制的帳戶。

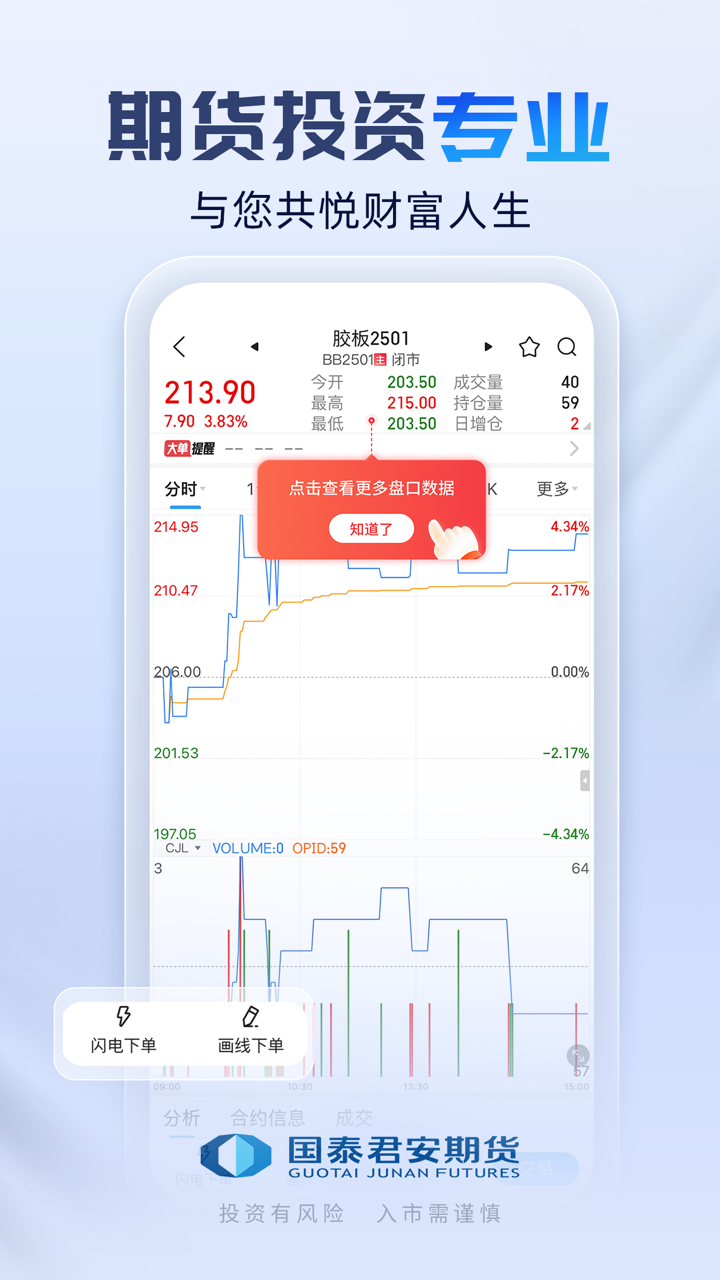

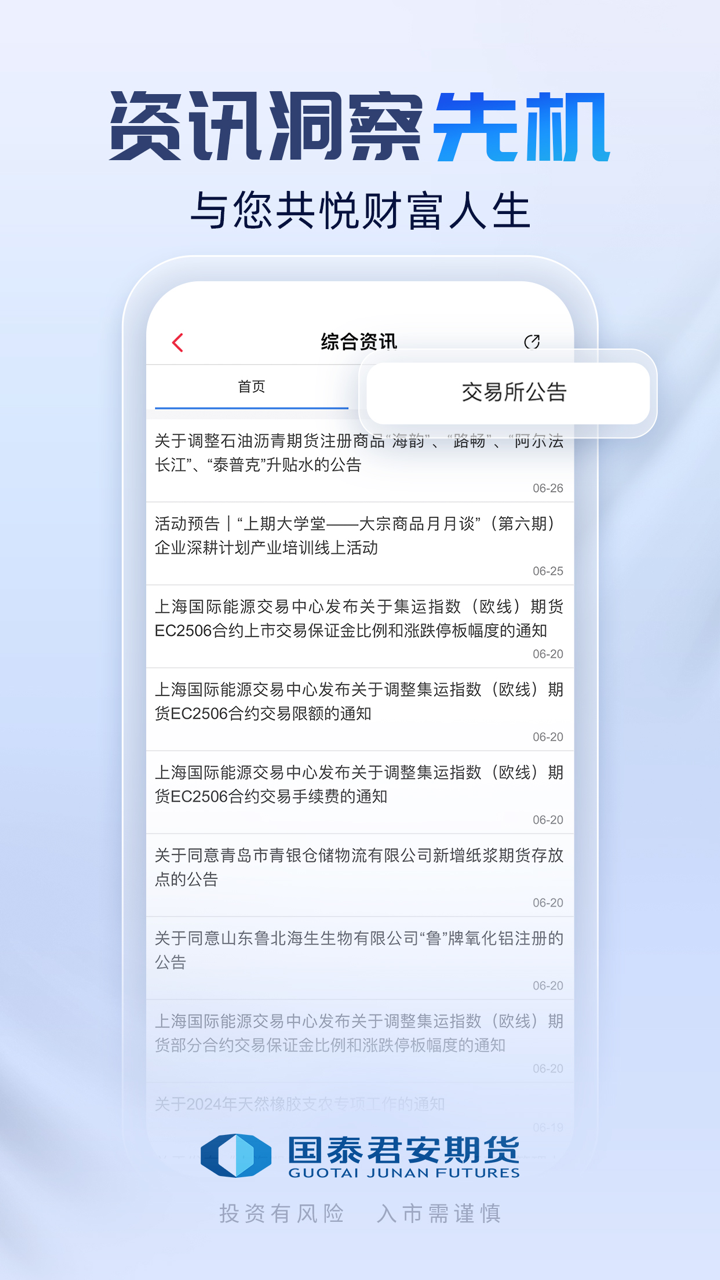

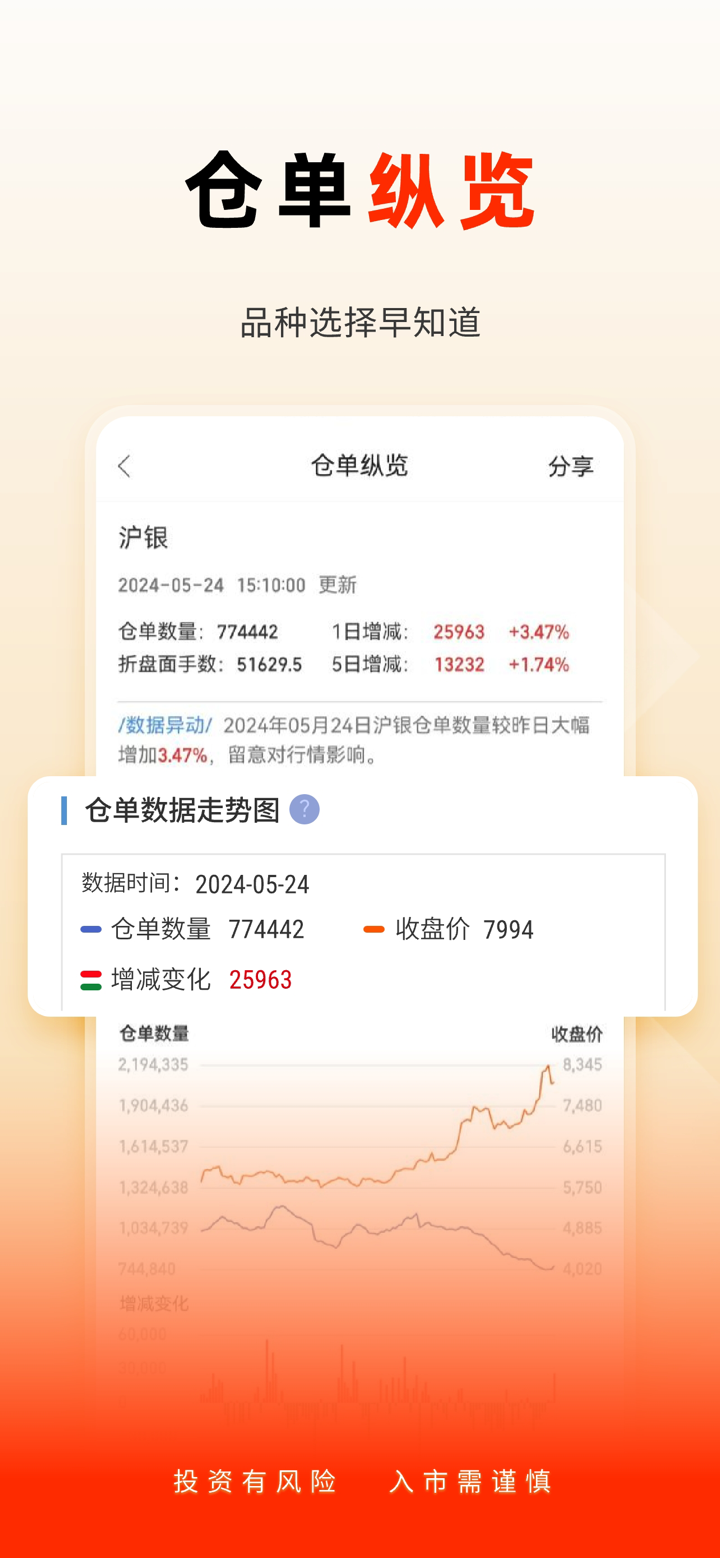

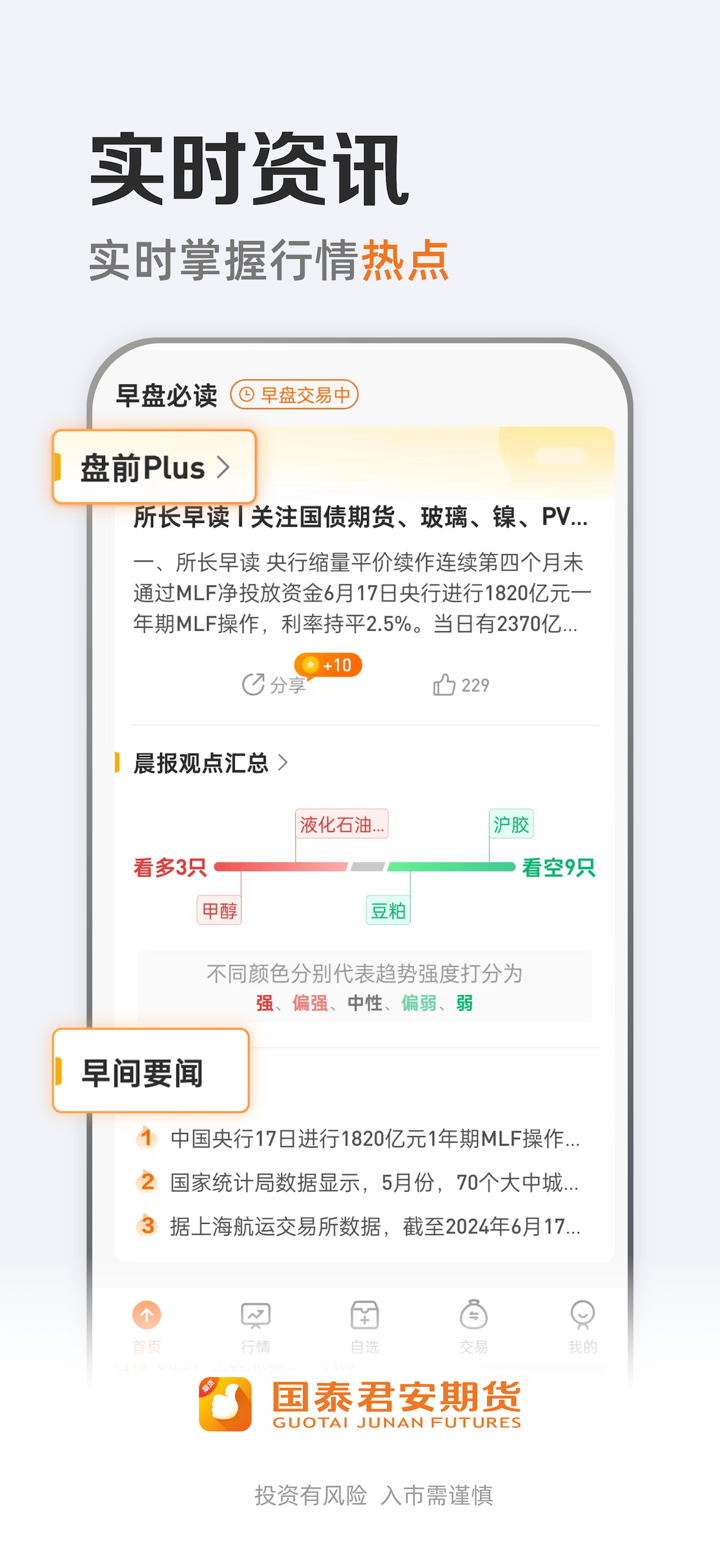

交易平台

國泰君安 提供國泰君宏APP,這是一個用戶友好的移動交易平台。它為專業和有經驗的交易者提供更深入的分析和交易功能。

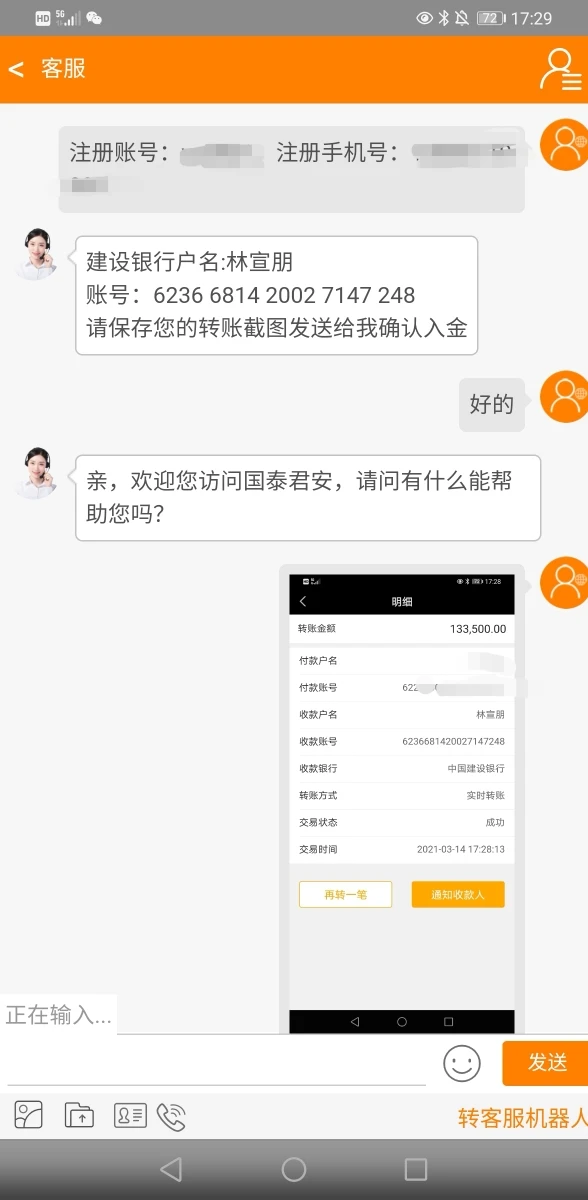

存款和提款

客戶可以通過多種渠道將資金存入他們的國泰君安帳戶,包括銀行轉帳。該公司支持中國多家主要銀行,實現無縫轉賬。提款也是通過銀行關聯帳戶進行的,通常需要1-2個工作日將資金存入客戶的銀行帳戶。

獎金

國泰君安為新客戶開戶提供有吸引力的獎金。新用戶可以享受免費18個月的二級市場數據訪問,免費使用6個月的工具,如“Xingtai Dashi”和“Panzhongbao”,以及新客戶金融產品券,年化收益率高達8.xx%。

FX6231196232

香港

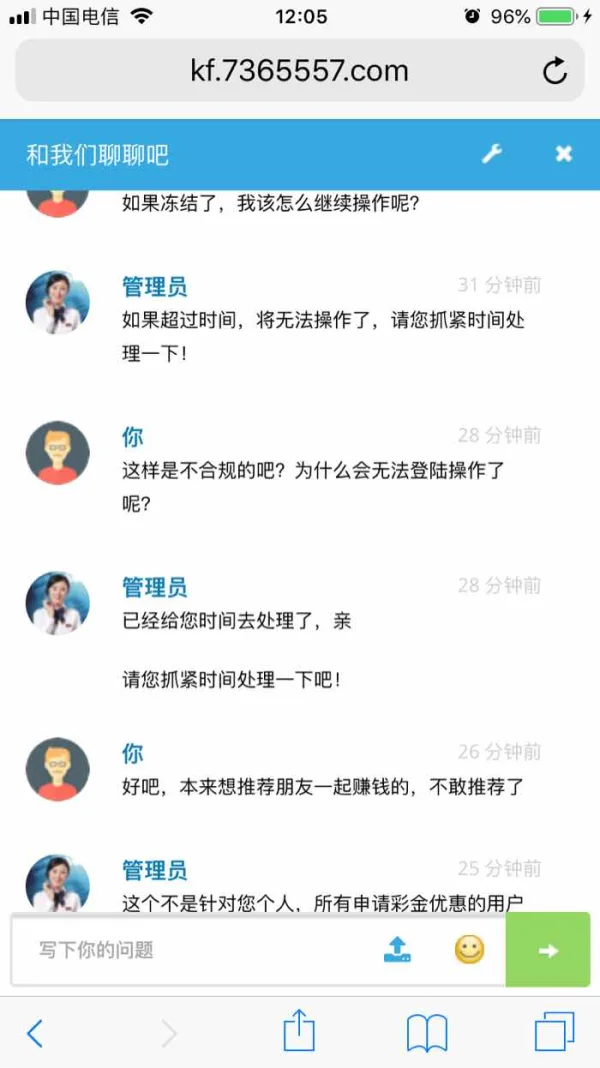

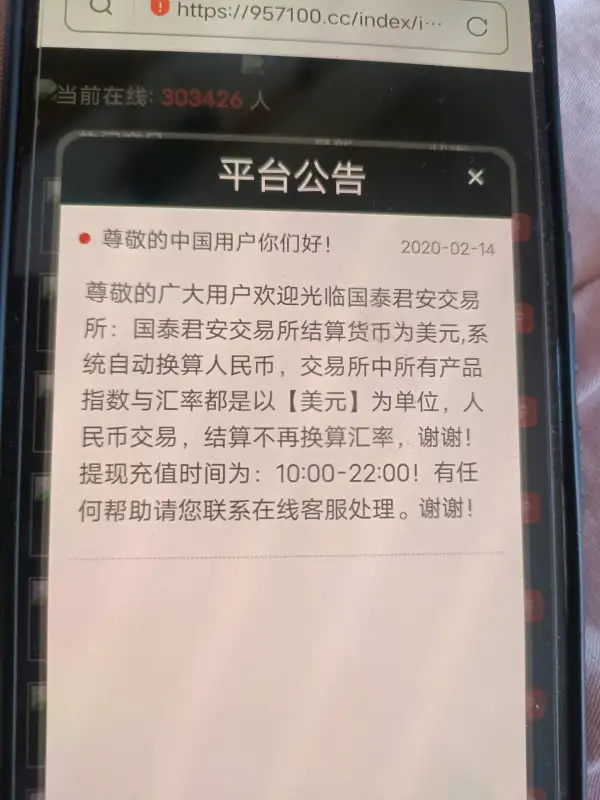

一开始不说明要求和限制,现在又必须24小时内处理完成,不然就冻结账号而且不能后续操作

爆料

傻子一个

香港

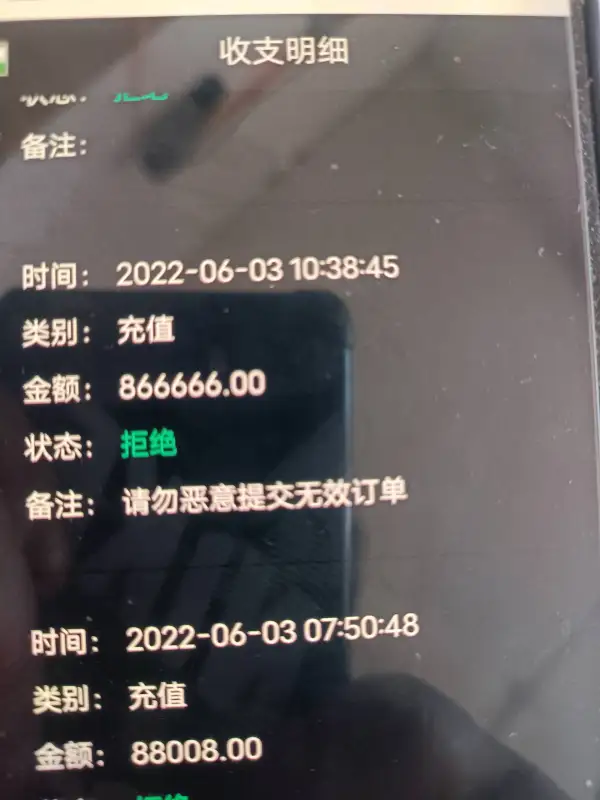

网上认识的一个人,通过各种套近乎,打着谈恋爱的幌子,说他是做外汇分析的,后来说带我做超短期外汇,从1000美金盈利30%,提现成功,到后面每次方案不同,收益在40-80%之间,但是流水必须打够80%才能提现,中途没有跟上金额大的方案,钱越投越多。每次充值是客服提供离岸账户充值入金,从1.5万美金一直追到8万美金,(转账记录九宫格放不下了),中途没有提过现,因为流水不够,最后追到8万流水够了,结果最后爆仓了,然后就联系不上这个人了,大家一定提高紧惕,擦亮眼睛,不要被骗!

爆料

持之以恒52703

香港

客服 网页打不开 需要缴纳个人所得税 现在无法跟客服务沟通 网页打不开

爆料

开门迎财神

香港

优点:是个全方位的在线交易平台,提供实时行情、交易执行、市场分析等功能。安全稳定,资金入账后,客户可以立即开始交易。客服响应比较快,可以快速解决问题,也支持多种语言沟通,比较方便。 不足:佣金对比其他平台相对较高,量化策略编辑器等专业工具难以快速掌握,交易效率会偏低,中文版研报有几小时的时差滞后,部分合约确少简体中文版。

中評

林益

香港

作为国内头部,已经有20多年的历史,佣金服务交易软件上面都算比较完整。 个人在使用时佣金上面对比其他平台费率稍微高一点, 但是通过渠道也能优惠一些,这个是唯一不足其次他们的服务现在有智能交易软件,并且里面也会有一些专业的投资建议,这方面我觉得不错,他们设计的证券方方面面也更广泛,app算是前三,也能支持同花顺大智慧这些,出金入金也算方便,绑定好提交审核通过之后就会立刻到账了。 现在作为上市公司附近网点比较多,这一点对于资金安全算是有保障,理财产品里面的公募和私募还有那些银行理财都可以做选择,涉及类目可以说是非常之为广泛,他们开户直接国内软件商城下载,然后注册个人账户,完成后需要有客户经理给介绍,这样整体的佣金费率会低一些,余下的开户就更简单,只需要你做一些基础上传。 唯一的缺点就是基础费率问题,目前大部分都是千分之三,也就是1k交易收取3的佣金,余下其他的没有什么问题,点位波动滑点那些可以忽略,比较平稳其他曝光

中評

颜大丁

印尼

樂於助人且快捷的服務。國泰君安提供的正是他們所聲稱的,他們還可以快速回答您的任何問題。強烈推薦給所有交易者。

好評

Hugo Feng

墨西哥

我已經在這家公司交易了 5 個月,我很滿意並將繼續交易。受中金所有效監管。它提供各種金融產品,如股票、期貨和證券。

好評

星火燎原47838

香港

国泰君安证券相关负责人紧急出面澄清辟谣了!该负责人还强调并提醒广大群众:谨防因违法参与交易给自身造成损失!

爆料