회사 소개

| Akatsuki 리뷰 요약 | |

| 설립 연도 | 1997 |

| 등록 국가/지역 | 일본 |

| 규제 | FSA |

| 시장 상품 | 투자신탁, 주식, 채권 |

| 데모 계정 | / |

| 거래 플랫폼 | / |

| 최소 입금액 | / |

| 고객 지원 | 문의 양식 |

| 전화: 0120-753-960 | |

| 주소: 17-10 Koamicho, Nihonbashi, Chuo-ku, Tokyo 103-0016 Nihonbashi Koamicho Square Building 5th floor | |

Akatsuki 정보

Akatsuki은 1997년에 설립된 일본 기반의 중개업체로, FSA에 의해 규제되고 있습니다. 투자신탁, 주식 및 채권 서비스를 제공합니다.

장단점

| 장점 | 단점 |

| FSA 규제 | 거래 정보 제한 |

| 실무 사무실 확인 | 다양한 수수료 부과 |

| 긴 운영 역사 |

Akatsuki 합법성

Akatsuki은 일본의 금융 서비스 규제 기관인 금융 서비스 규제청(FSA)에 의해 규제를 받고 있습니다. 리스크에 유의하시기 바랍니다!

| 규제 상태 | 규제 기관 | 라이센스 기관 | 라이센스 유형 | 라이센스 번호 |

| 규제됨 | 금융 서비스 규제청(FSA) | Akatsuki株式会社 | 소매 외환 라이센스 | 関東財務局長(金商)第67号 |

WikiFX 현장 조사

WikiFX 현장 조사팀은 Akatsuki의 주소가 일본임을 확인하였으며, 현장에서 그들의 사무실을 발견했습니다. 이는 회사가 실제 사무실을 운영하고 있음을 의미합니다.

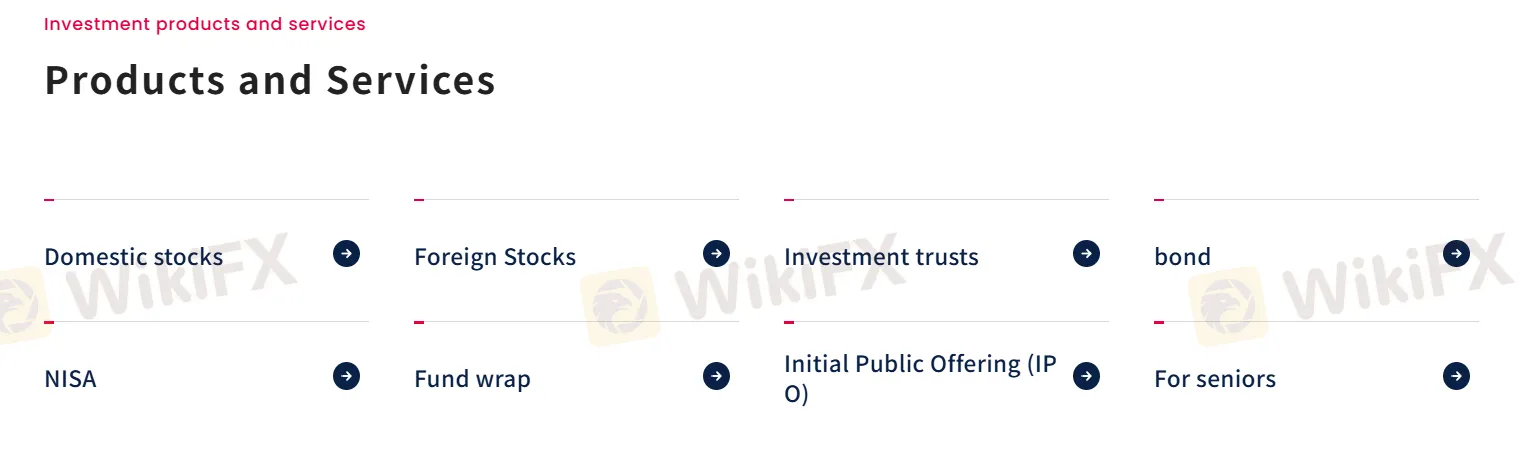

Akatsuki에서 무엇을 거래할 수 있나요?

| 거래 가능한 상품 | 지원 |

| 채권 | ✔ |

| 주식 | ✔ |

| 투자 펀드 | ✔ |

| 외환 | ❌ |

| 상품 | ❌ |

| 지수 | ❌ |

| 암호화폐 | ❌ |

| 채권 | ❌ |

| 옵션 | ❌ |

| ETFs | ❌ |

| 선물 | ❌ |

Akatsuki 수수료

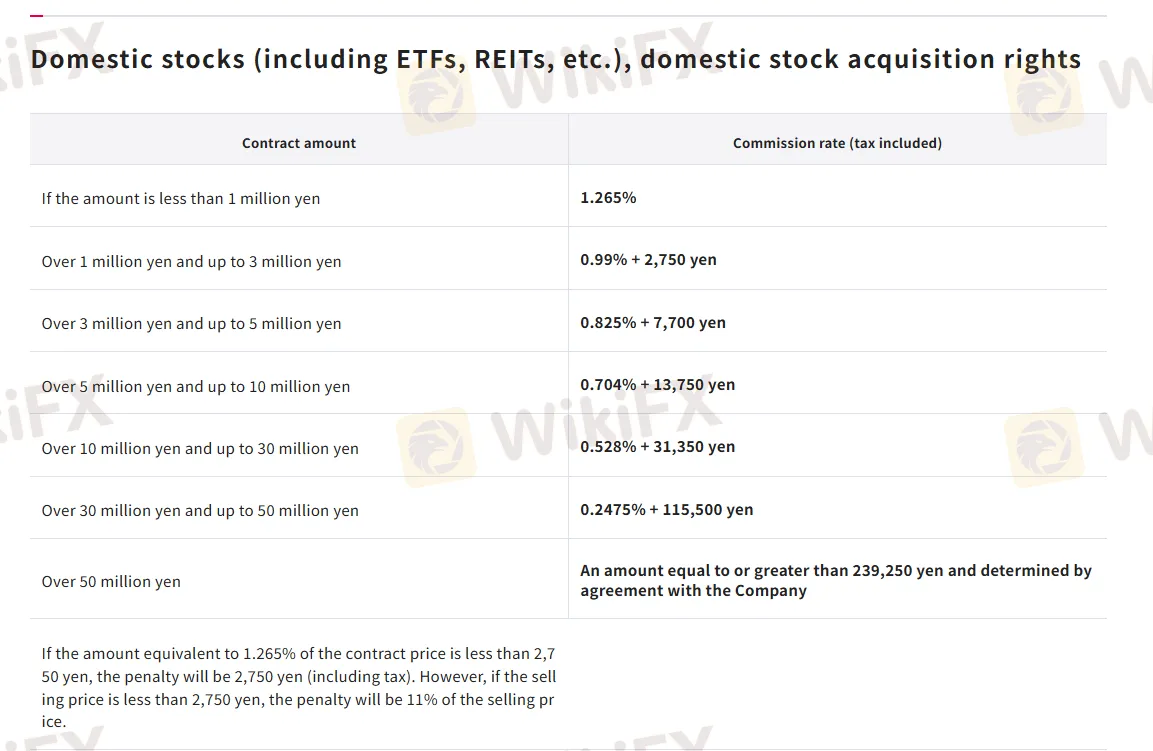

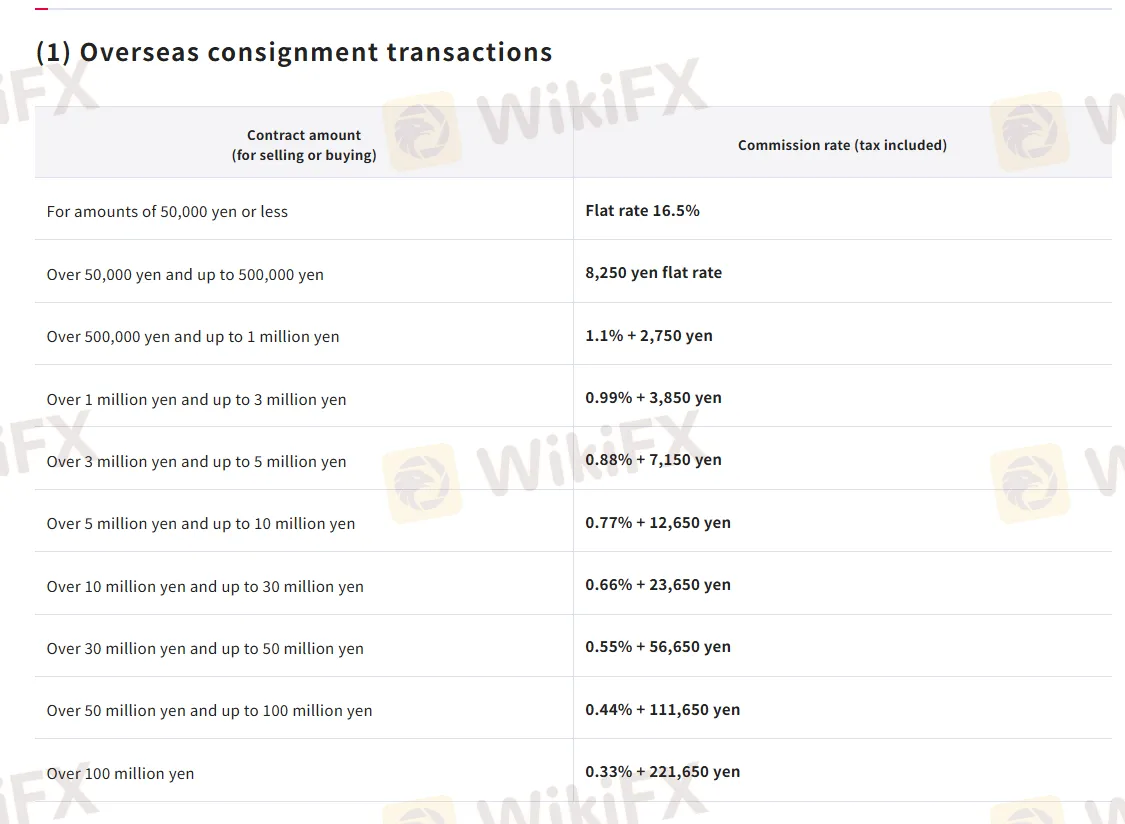

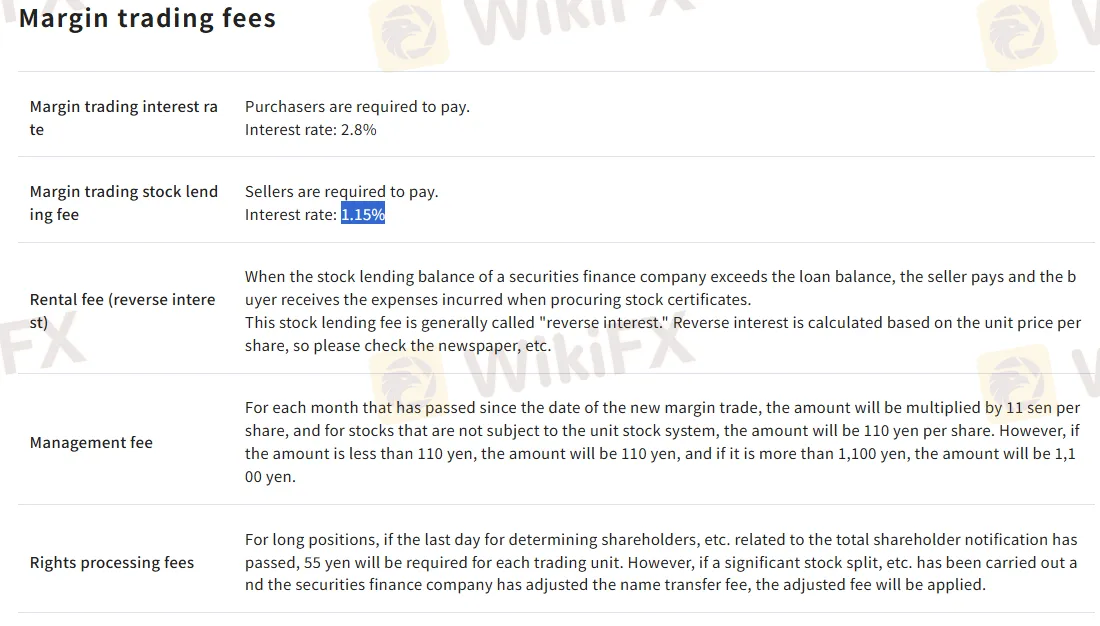

| 서비스 유형 | 기본 수수료 |

| 국내 주식 수수료율 | 0.2475% - 1.265% |

| 해외 주식 수수료율 | 0.33% - 16.5% |

| 국내 장외 거래 | 2.5% |

| 진입 및 퇴출 | 1,100 엔 |

| 마진 거래 수수료 | 1.15% - 2.8% |