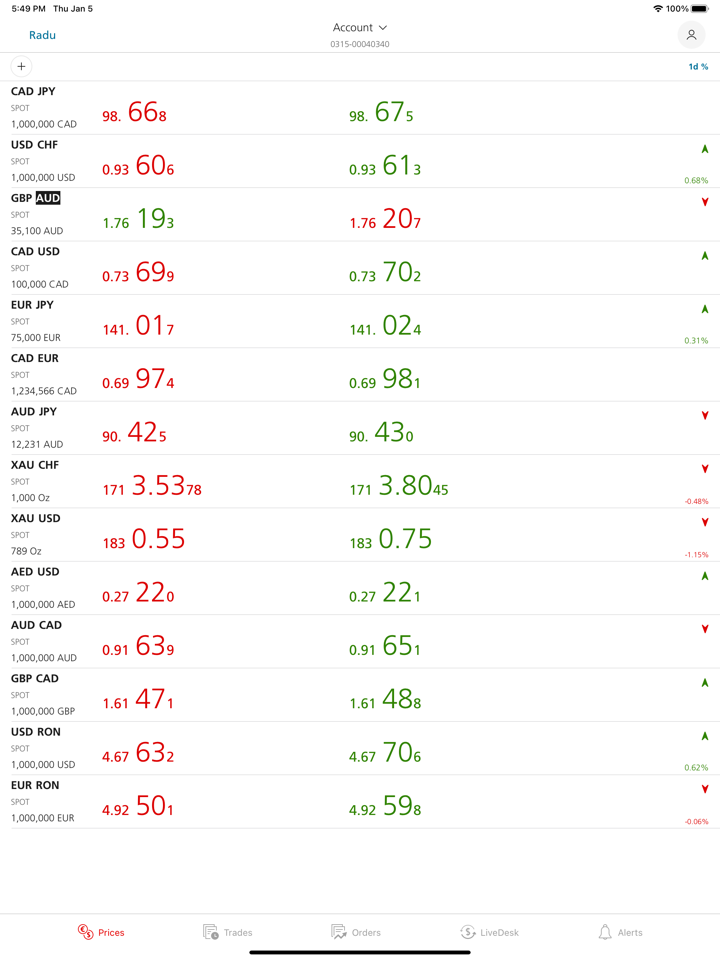

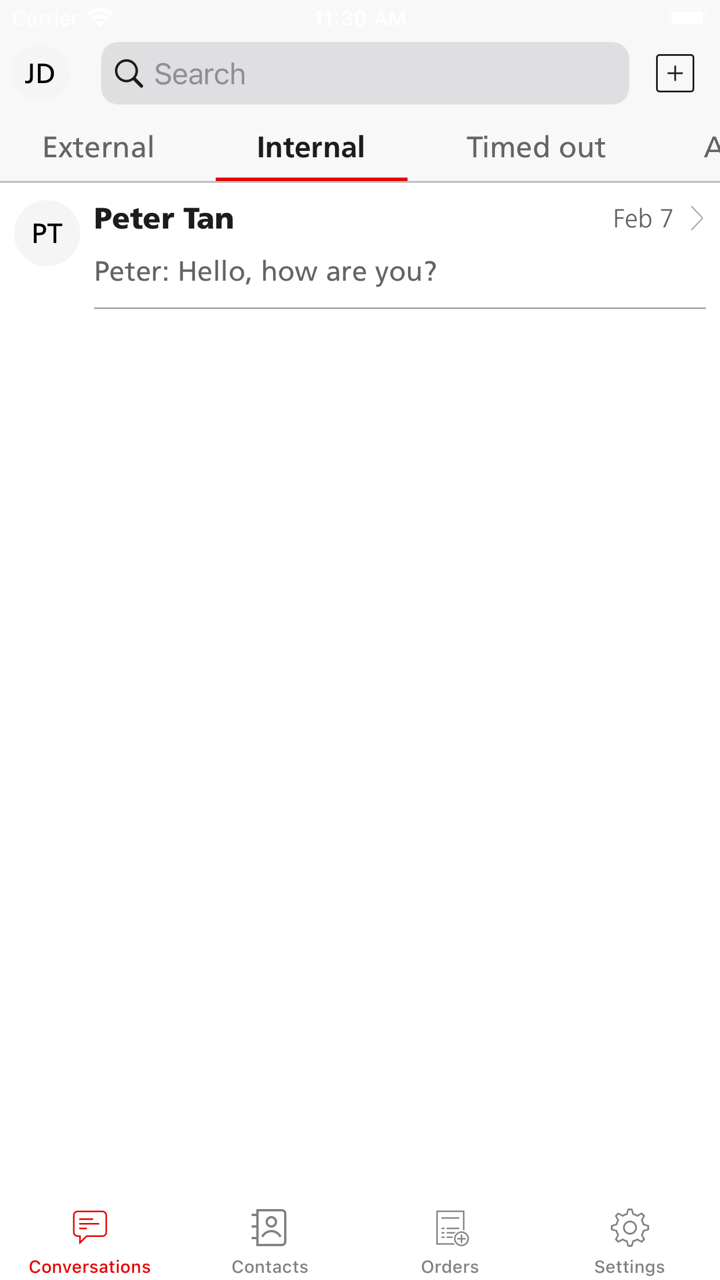

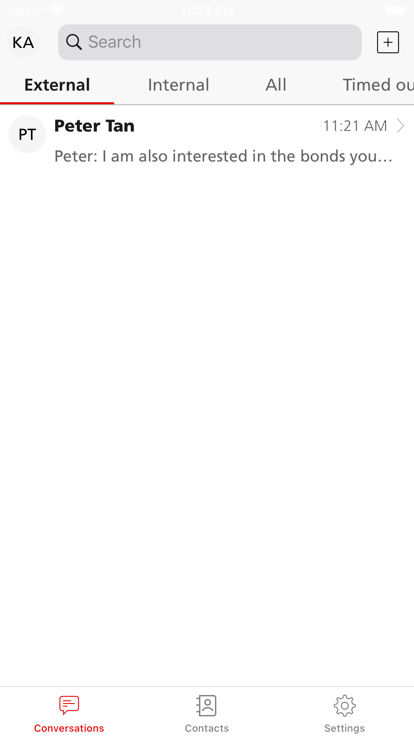

점수

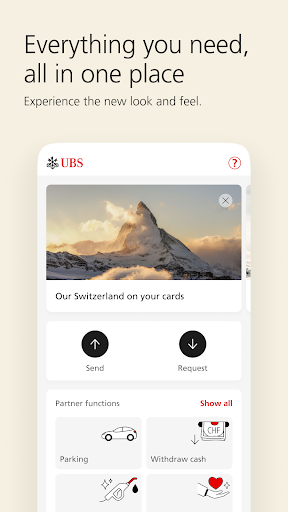

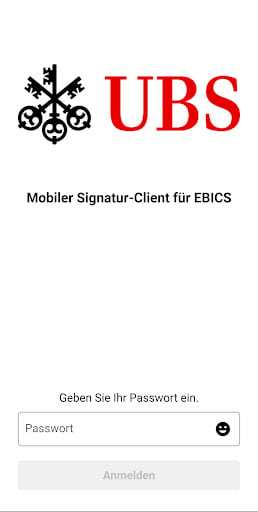

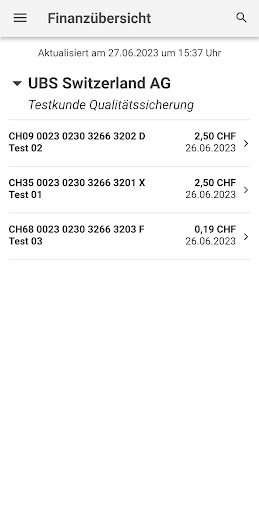

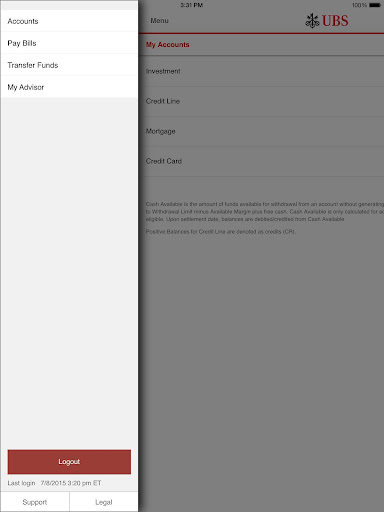

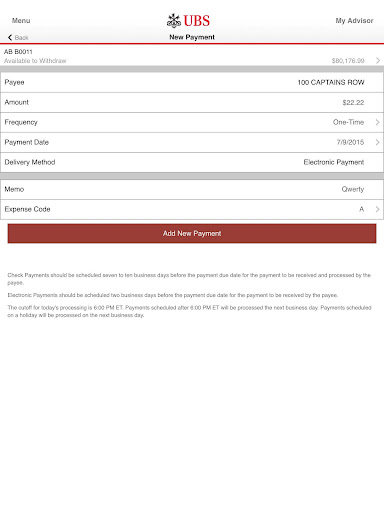

UBS

스위스 | 20년 이상 |

스위스 | 20년 이상 |https://www.ubs.com/kr/ko.html

공식 사이트

평점 지수

영향력

영향력

AAA

영향력 지수 NO.1

스위스 9.38

스위스 9.38 연락처

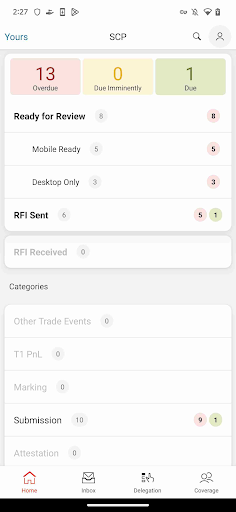

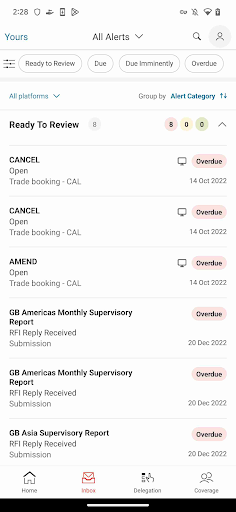

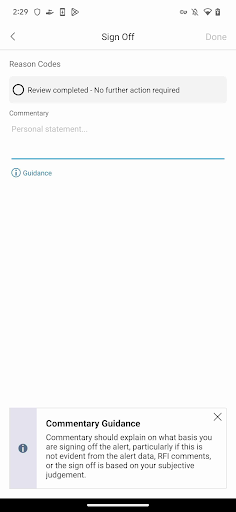

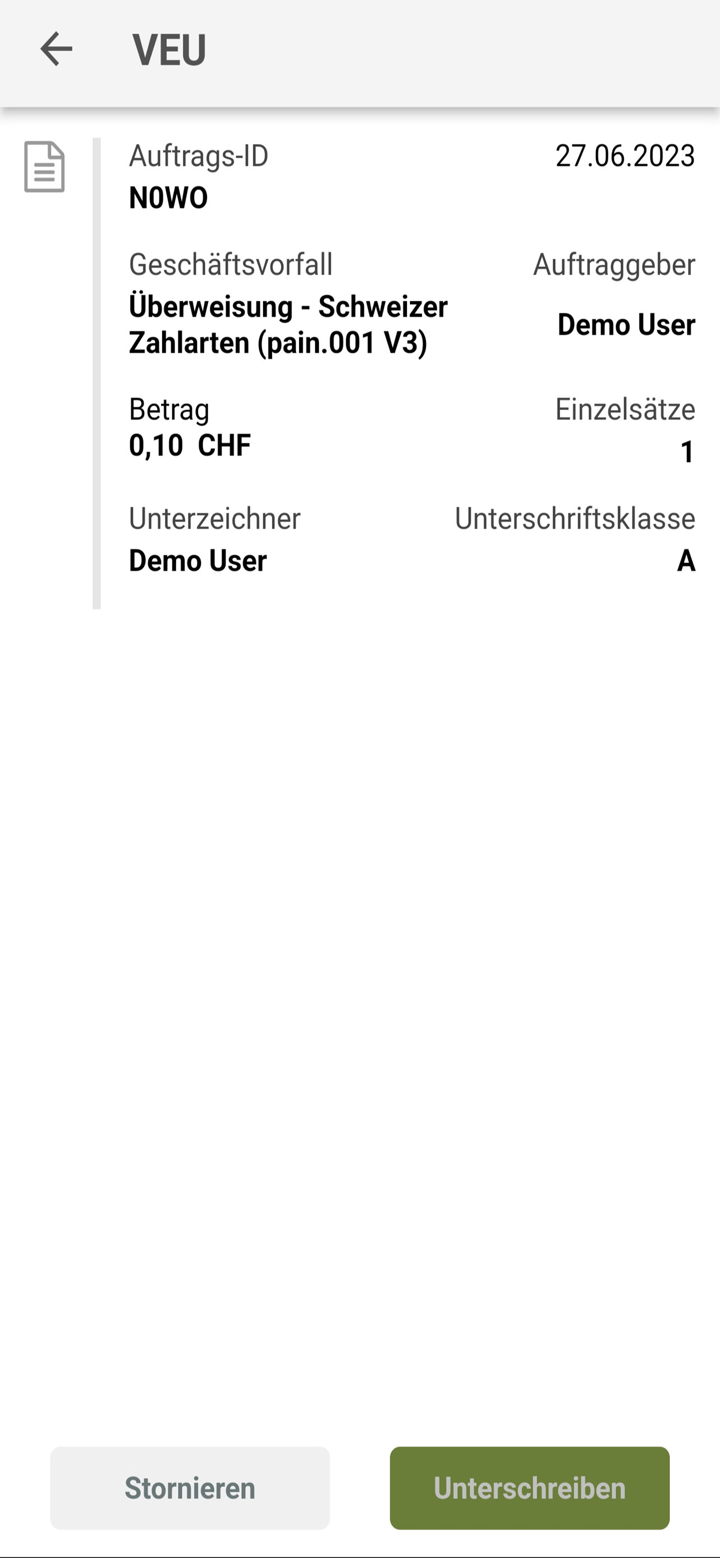

외환 규제 3

외환 규제 3

싱글 코어

1G

40G

1M*ADSL

- WikiFX가 해당 브로커에 대해 접수한 이용자 불만은 총 14건에 달합니다. 리스크에 유의하시고 피해를 예방하시기 바랍니다!

기본 정보

스위스

스위스

UBS 을(를) 본 사용자는 또다시 열람했습니다...

Exness

Vantage

Mitrade

EC markets

검색 소스

캠페인 언어

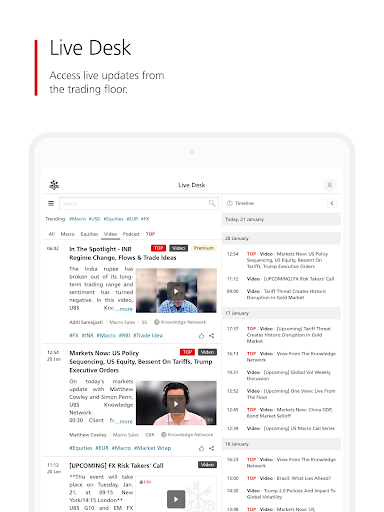

시장 분석

캠페인 소재

관계 계보

관련 회사

규제 공시

FCA 미승인 업체 경고 목록 Credit Suisse Asset Management / Credit Suisse Group AG (FCA 승인 업체의 복제).

국가/지역

UK FCA

공시 시간

2020-06-17

브로커 공시

FCA 무단 회사 경고 목록 UBS 글로벌 자산 관리 펀드 Ltd (FCA 승인 회사의 복제).

국가/지역

UK FCA

공시 시간

2015-04-23

브로커 공시

UBS 증권 회사 도쿄 지점 및 유비 에스 에이지 재일 지점에 대한 행정 처분에 대해

국가/지역

JP FSA

공시 시간

2011-12-16

브로커 공시

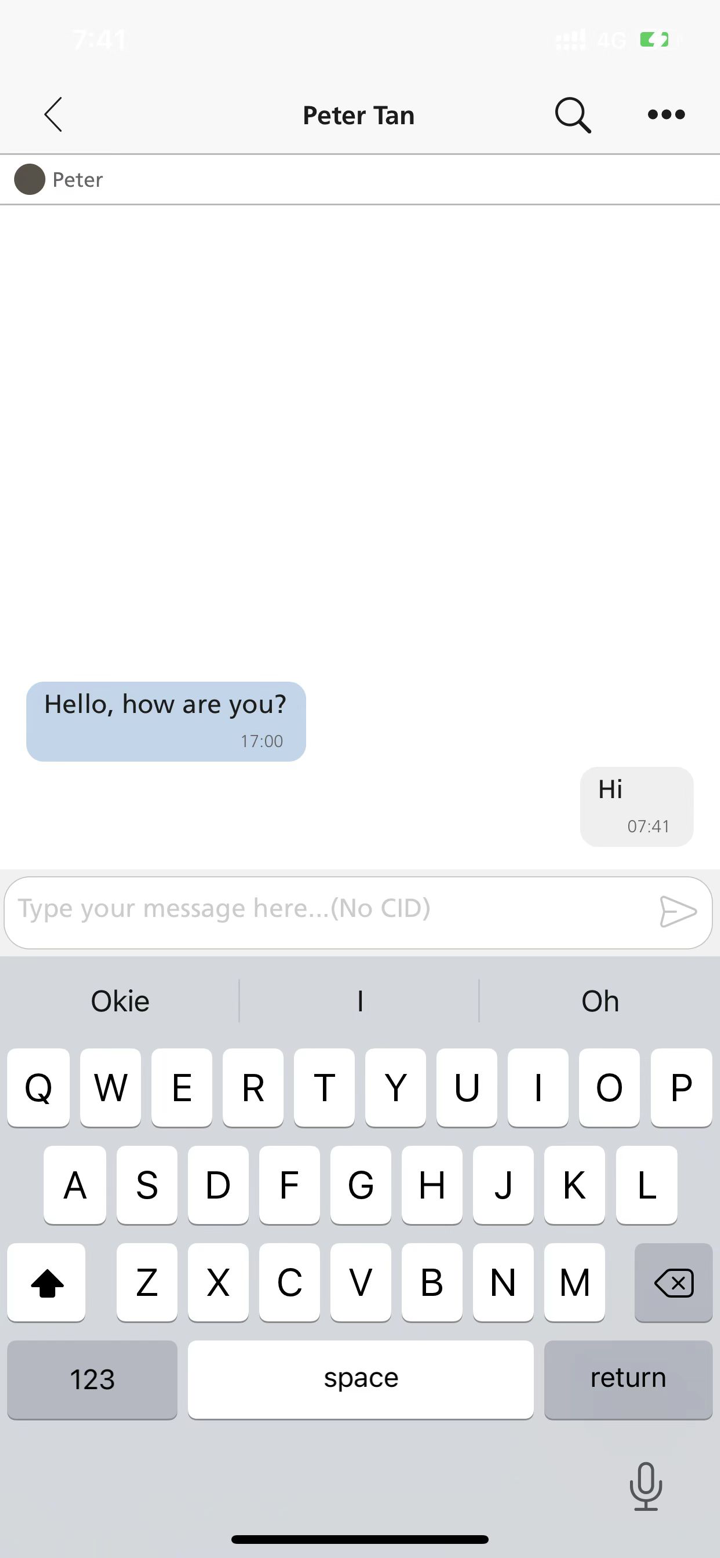

위키 Q&A

Is UBS overseen by any regulatory bodies, and if so, which financial authorities are responsible?

From my own research and experience as a trader, regulatory oversight is one of my top concerns when evaluating any broker or financial institution. In the case of UBS, I've found that it is indeed regulated by multiple well-established authorities, particularly for its operations in Asia. Specifically, UBS Securities Asia Limited and UBS Securities Hong Kong Limited are both licensed and supervised by the Securities and Futures Commission (SFC) of Hong Kong. These entities hold the necessary futures licenses, which require adherence to stringent standards set by the regulator. Understanding why this matters is straightforward—having recognized financial oversight helps ensure a certain level of operational integrity and client protection. Regulation by the SFC means regular audits, compliance requirements, and legal accountability in the services they offer, especially regarding futures contracts. However, it's crucial not to conflate the existence of regulation in certain regions with blanket security across all markets or divisions. While regulatory registration provides a baseline level of trust, it does not guarantee a trouble-free experience, as user complaints and risk alerts highlighted in public forums have shown. For me, this underlines the necessity of ongoing due diligence and a careful approach when choosing a financial partner, regardless of the brand’s global reputation.

Would it be safe and reliable to use UBS as my trading broker?

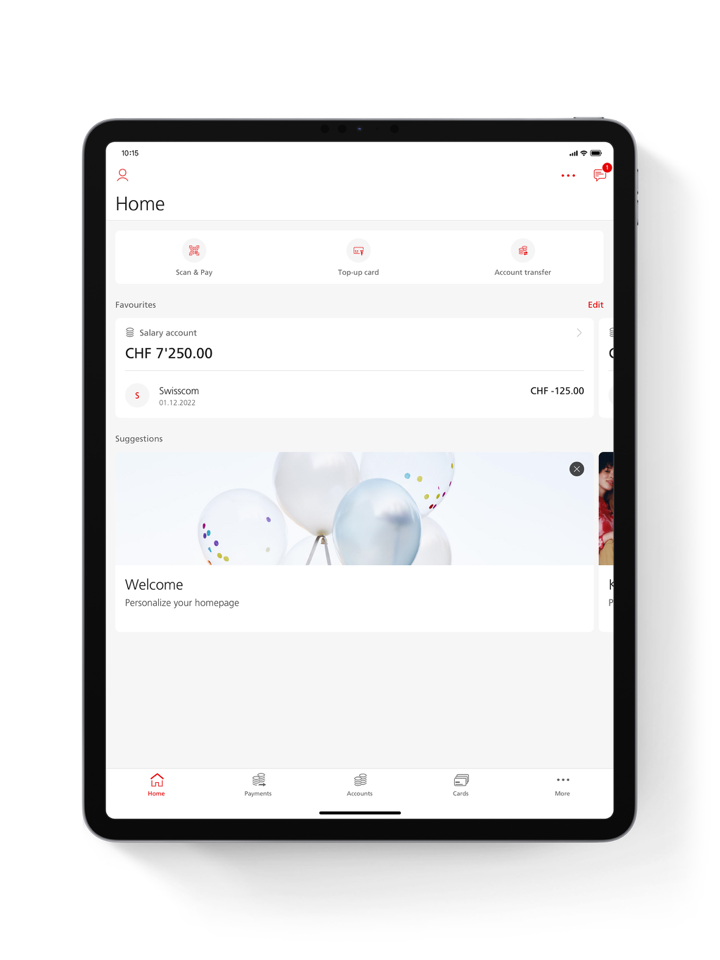

From my perspective as a seasoned forex trader, assessing whether UBS is safe and reliable as a trading broker requires a cautious and informed approach. UBS is a well-established financial institution with a strong global presence, multiple regulatory licenses, and a history exceeding two decades. Its breadth of regulated operations in regions like Switzerland, China, and Hong Kong is encouraging, as regulatory oversight typically provides an extra layer of security for client funds and operational standards. However, I cannot ignore the critical issues highlighted by numerous customer complaints. Many users have reported serious concerns such as difficulties withdrawing funds, unexpected fees or requirements for additional deposits, and, in some cases, allegations of account manipulation or customer service deficiencies. The broker's WikiFX score has been notably reduced specifically because of these complaints. For me, consistent reports of withdrawal problems are a significant red flag—reliable access to funds is paramount in choosing any broker. While UBS’s reputation, product diversity, and licensed status might appear reassuring, the pattern of unresolved disputes and negative feedback suggests a heightened level of risk that, in my experience, cannot be overlooked. As someone responsible for my own financial security, I would exercise caution, perform thorough due diligence, and consider alternative brokers with more transparent and consistently positive client histories before making any commitments. Ultimately, my trust as a trader is reserved for platforms where client protection and fund accessibility are clearly demonstrated.

How much do you need to deposit at a minimum to start a live trading account with UBS?

As someone who has explored multiple brokers, I always look for clear and accessible information about account opening requirements, especially when it comes to minimum deposit amounts. When I researched UBS as a potential trading partner, I found that while they present themselves as a long-established, globally regulated institution with many financial services, there’s a noticeable lack of transparency about the specific minimum deposit required to open a live trading account. This is not entirely unusual for large banks or institutions mainly focused on wealth management and high-net-worth clients; these types of firms often customize their requirements and conditions based on individual profiles and account types. However, as a trader, I see this absence of public detail on fundamental points like minimum deposits as an important consideration. It means that anyone interested in trading live with UBS should contact them directly for up-to-date and official requirements. In my experience, this often signals that their services may be tailored more towards larger investors rather than retail traders who prefer clearly defined barriers to entry. For me, clarity and predictable costs are essential—so I would approach UBS carefully, ensuring I receive written, transparent terms before proceeding, especially given their mixed customer feedback regarding account and fund accessibility.

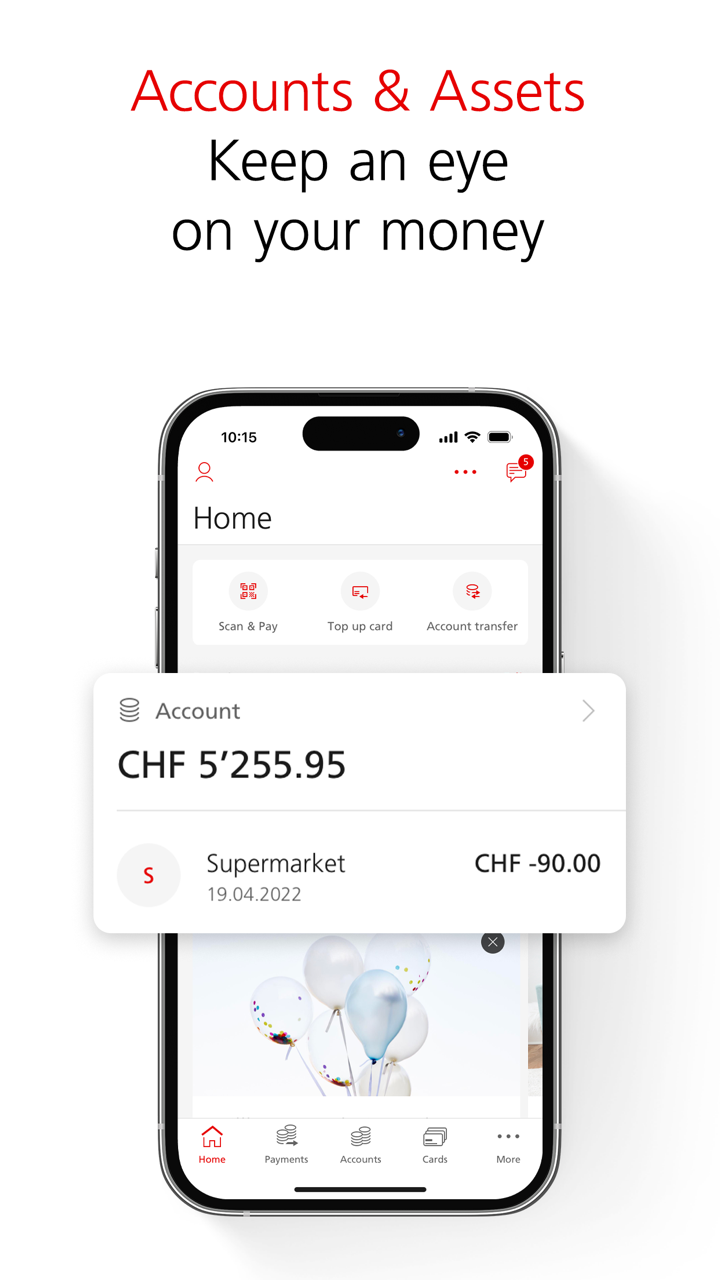

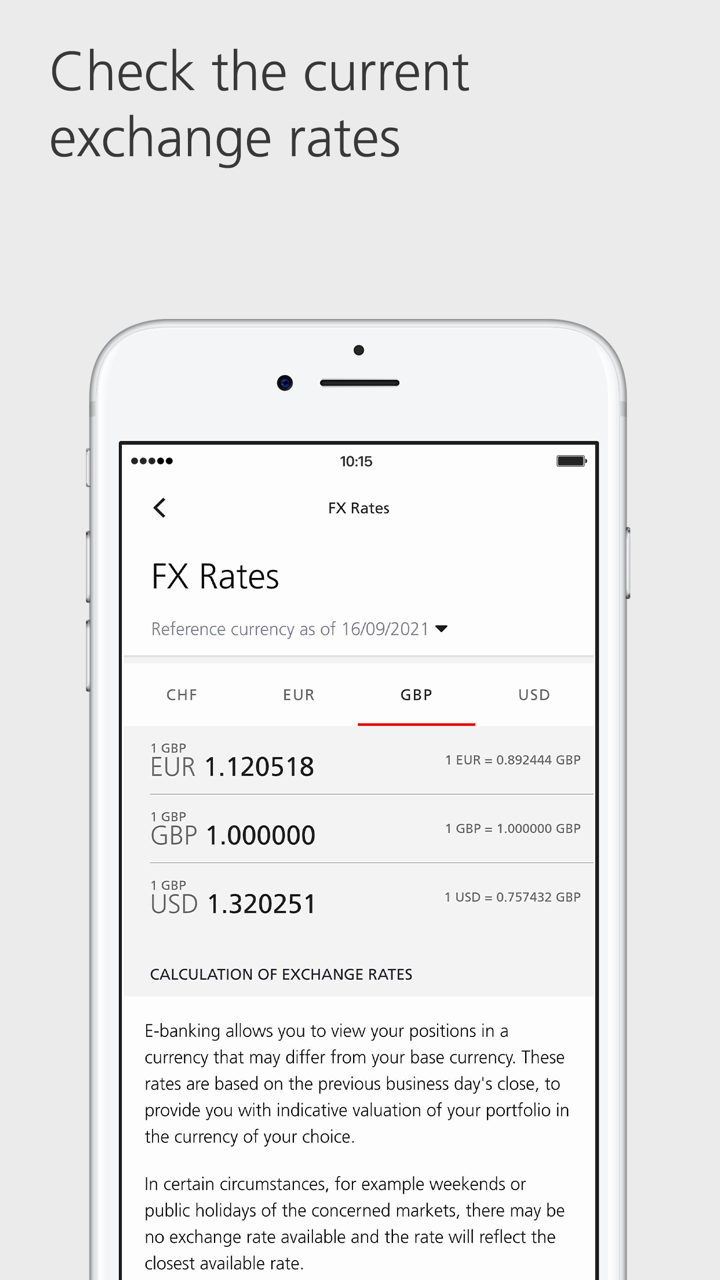

Is it possible to deposit cryptocurrencies such as Bitcoin or USDT into my UBS account?

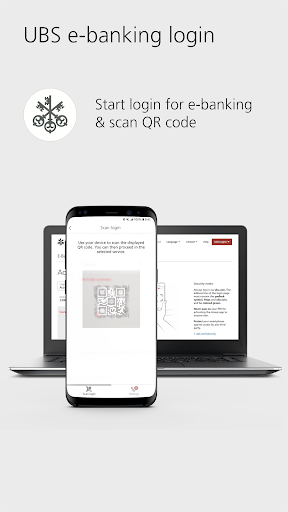

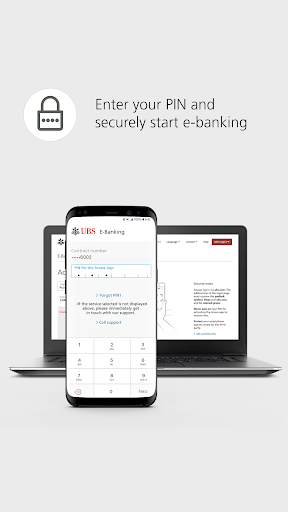

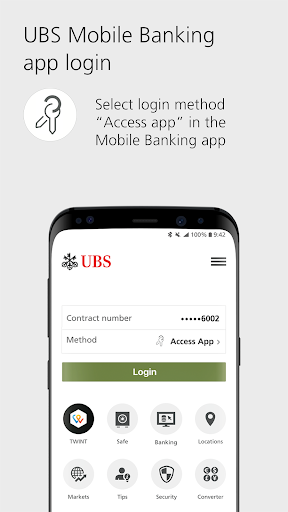

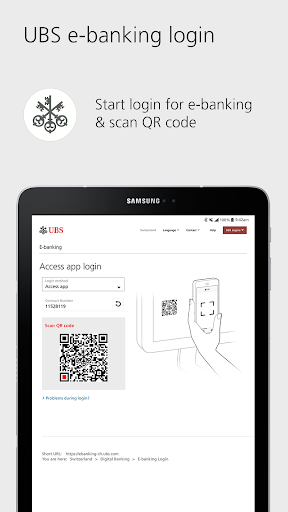

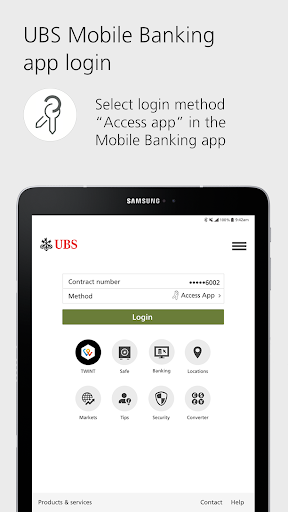

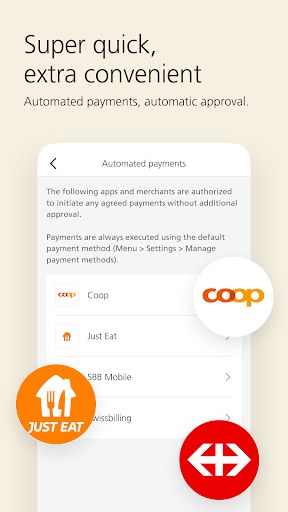

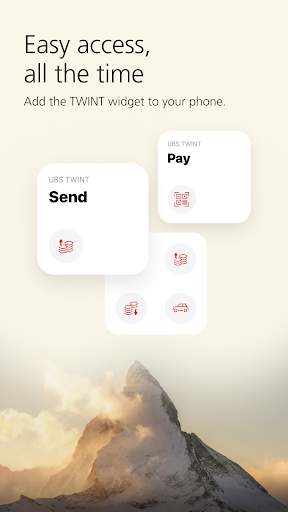

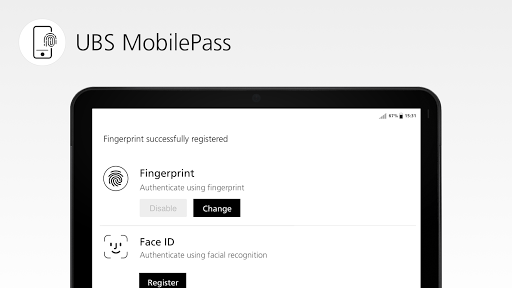

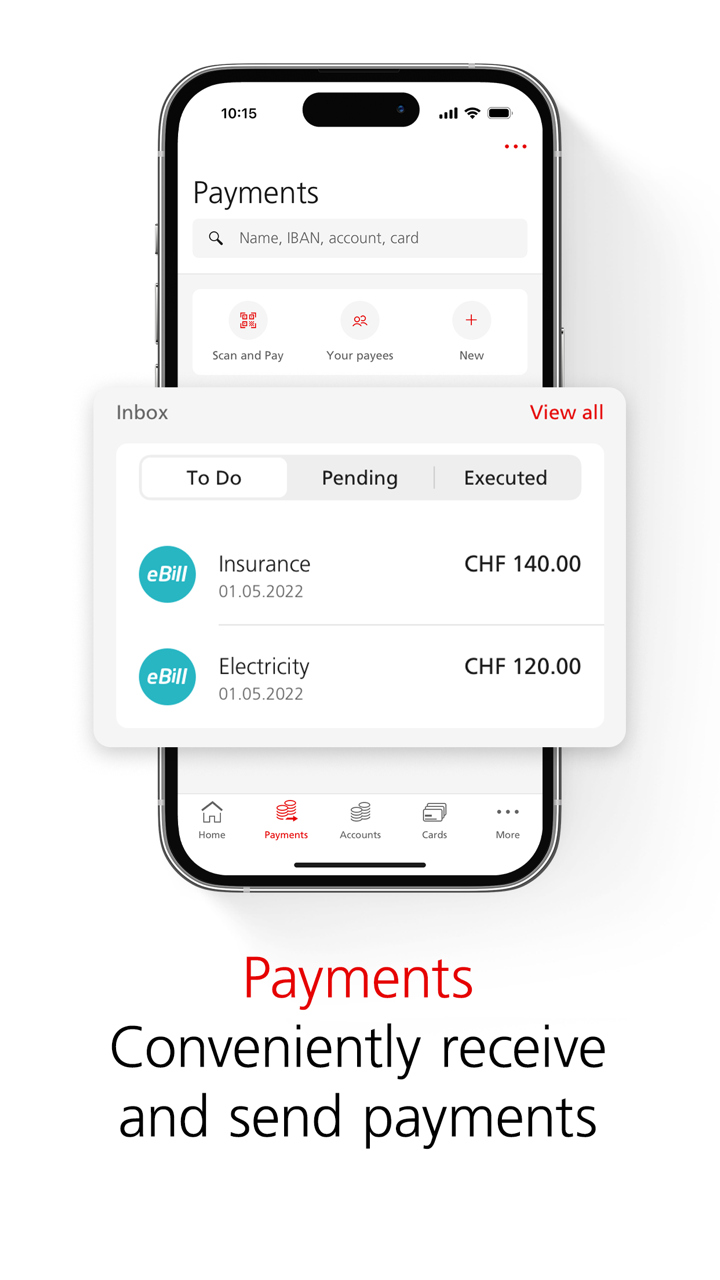

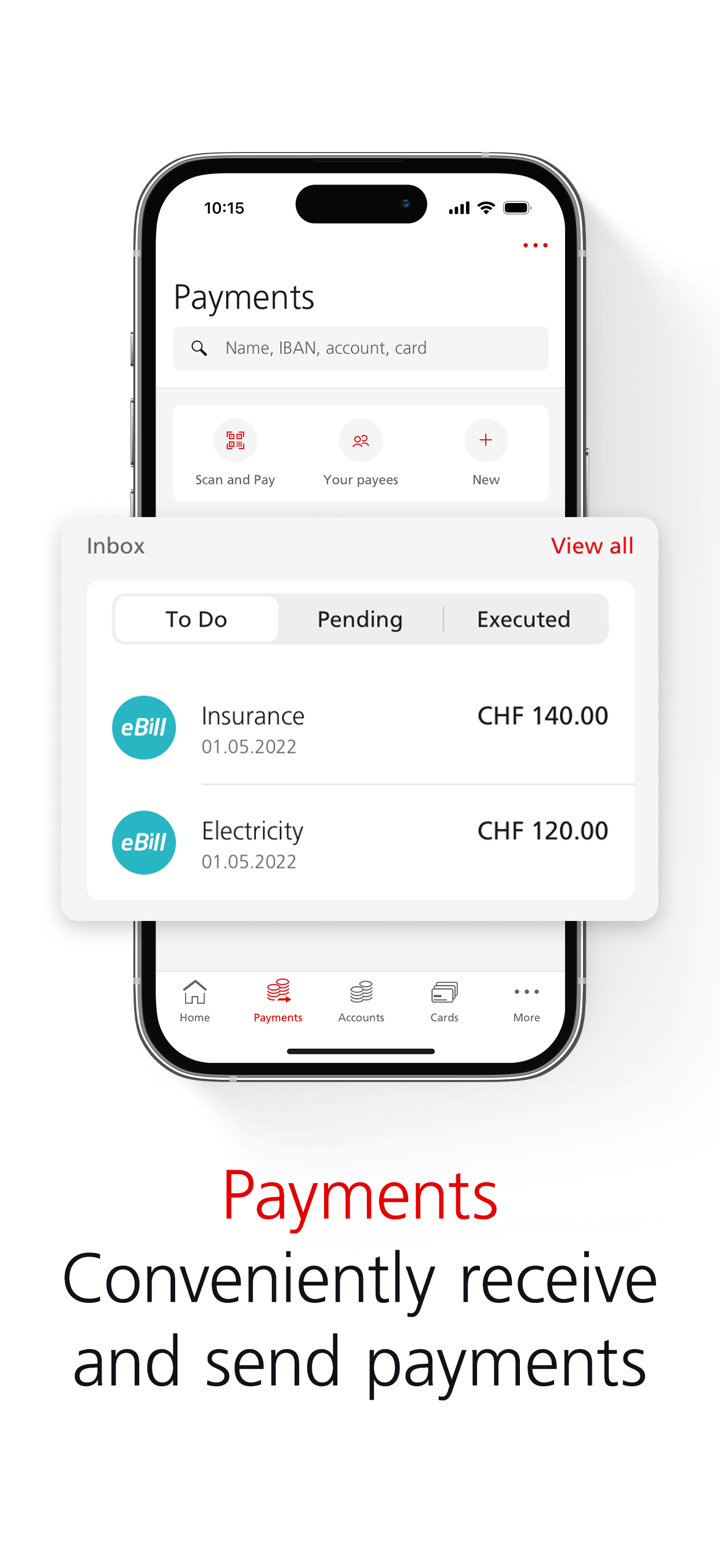

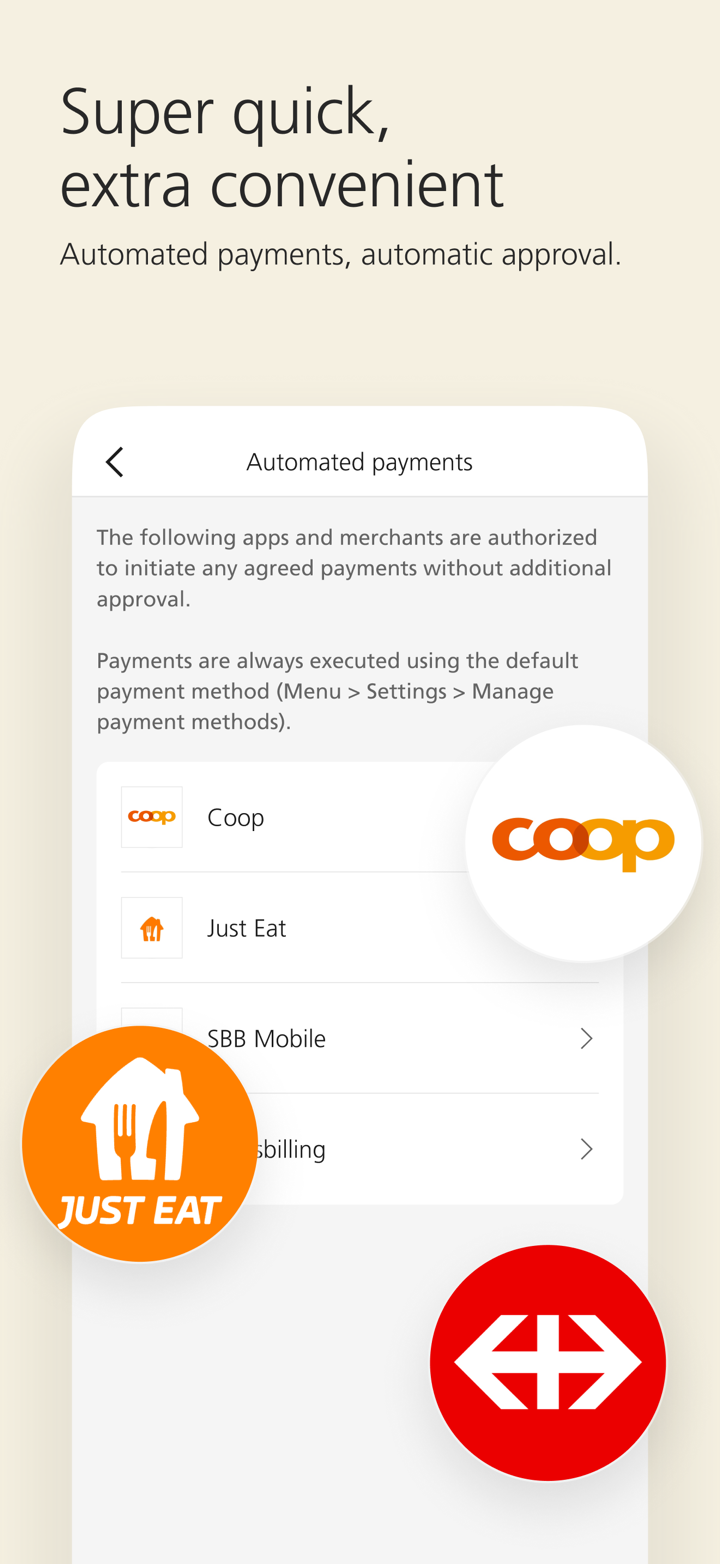

Based on my own experience as a forex trader and after carefully reviewing what is publicly known about UBS, I would approach the question of depositing cryptocurrencies like Bitcoin or USDT into a UBS account with considerable caution. UBS is a long-established, globally regulated banking institution with a broad focus on wealth and asset management, and while it offers a range of banking products and account types, its primary operations and supported payment methods are traditional fiat-based. According to their available services, UBS allows funding via methods such as QR-bill, eBill, TWINT, direct debit, and various mainstream payment platforms, but explicit support for direct deposits of cryptocurrencies into UBS accounts is not indicated. Why does this matter? Large and historically conservative banks like UBS face stringent regulations regarding digital assets, especially in jurisdictions like Switzerland and Hong Kong where they operate. While some major banks have begun to explore digital asset custody or are building frameworks for future crypto integration, UBS does not currently promote itself as a platform for direct cryptocurrency deposits into standard banking or trading accounts. This is further highlighted by several user complaints about issues with deposits and withdrawals, though these mostly involve fiat transactions rather than crypto. In summary, as of now, depositing cryptocurrencies such as Bitcoin or USDT directly into a personal or trading account at UBS does not appear to be supported. For traders considering integrating digital assets into their portfolio with UBS, I'd recommend verifying directly with the bank or looking for updates, as offerings and policies in this space can change rapidly. However, for now, I personally would not expect to be able to deposit crypto directly into a UBS account.

사용자리뷰18

댓글을 달고 싶은 내용

입력해 주세요....

평가 18

FX1739561792

이집트

내 계정과 전체 커뮤니티 계정을 닫아주세요 부탁드립니다 영구적으로 삭제해주세요

신고

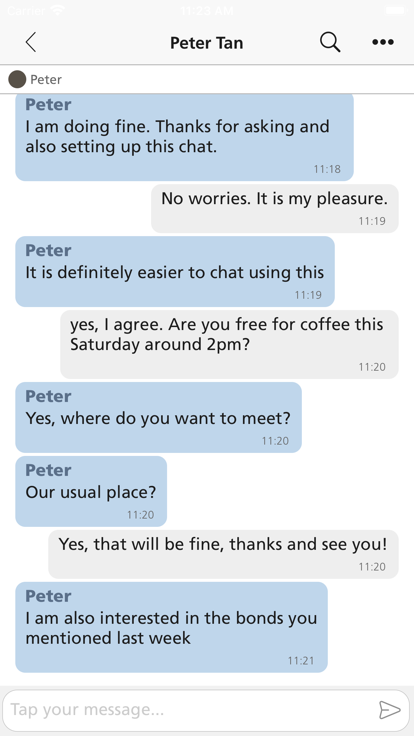

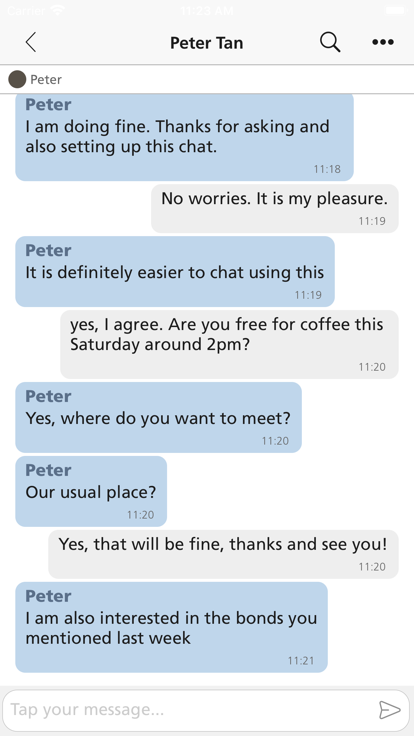

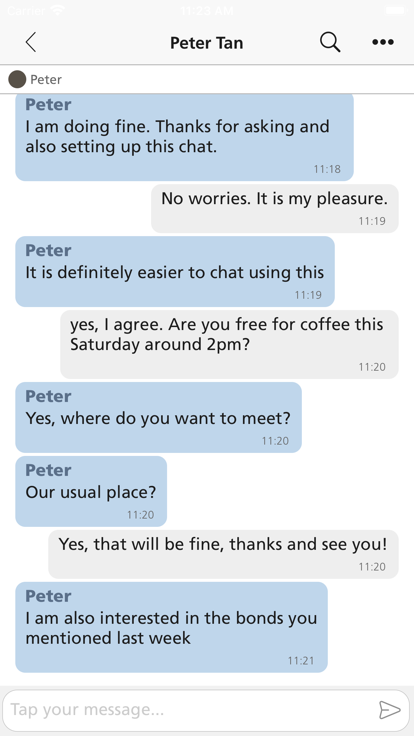

薇11六1四3零2七1

홍콩

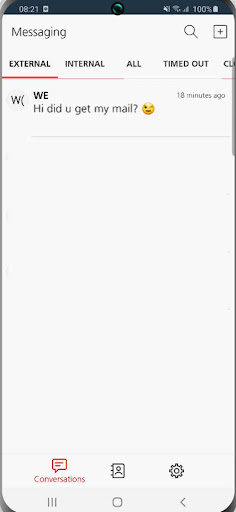

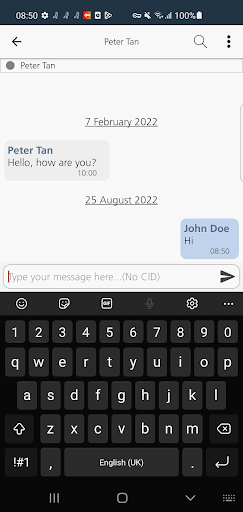

9 월 6 일 비서 선생님이 주식 시장을 분석하고 좋은 주식을 추천 한 어시스턴트에 의해 그룹으로 끌려 들어 갔는데, 소매 투자가 주식에서 이익을 얻는 것이 어렵다는 메시지를 보냈습니다. 그리고 그는 나에게 이익 스크린 샷을 보여줬다. 나는이 방법들에 대해 거의 알지 못했고, 그의 도움으로 이익을 얻었 기 때문에 그를 신뢰할 수 있다고 생각했다. 그들과 거래합니다. 그러나 고문은 500,000을 입금하고 시험해 보라고 제안했으며 일주일 이내에 높은 이익으로 나를 위로했습니다. 나는 주저했지만 그는 오후에 수익을 얻고 연락처 정보를 공유하는 데 도움이 될 수 있다고 말하면서 계정을 개설 할 것을 촉구했다. UBS 고객 서비스 담당자 9 월 10 일 밤을 고려하여 저축의 대부분을 총 6 억 RMB에 입금했으며 9 월 20 일에 주문 제안을함으로써 큰 손실을 입었고 계좌가 10000 RMB 정도 남아있었습니다. 아무 것도 설명하지 말고 손실을 되 찾으려면 기금을 추가하라고 권유한다. 나는 우울 해졌다. 그를 거절 한 후, 나는 그룹에서 탈퇴하여 그에 의해 삭제되었다.

신고

yukiiii

홍콩

인출에는 5 %의 도장 세가 필요합니다. UBS 합법적인가요?

신고

AlfredoRomero

아르헨티나

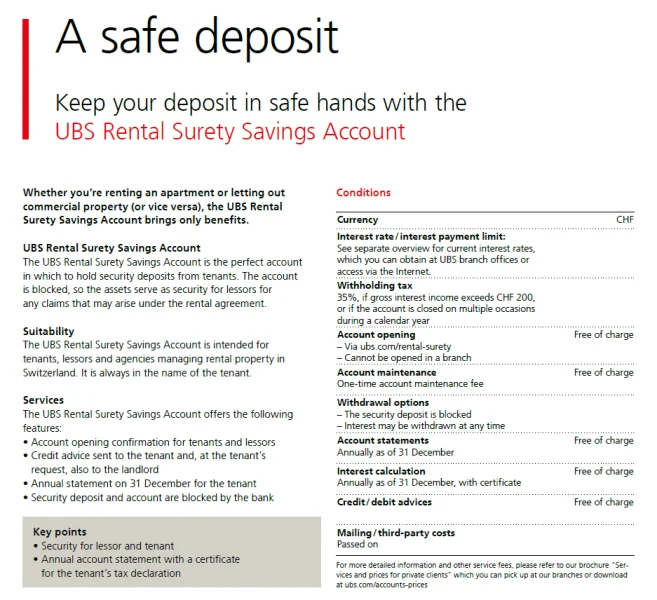

거래에 좋은 브로커라고 생각합니다. 제 계정에 많은 혜택이 있을 뿐만 아니라 제게 좋은 결과를 가져다 주었습니다. 레버리지 수준도 매우 매력적으로 보입니다. 안전한 예금입니다.

좋은 평가

Scott Walker

프랑스

8년 전에 나는 UBS와 함께 연금을 설립하여 스위스에서 관리되는 고위험 성장 펀드 중 하나에 투자하기로 결정했습니다. 솔직히 말해서, 나는 큰 비즈니스를 운영하고 연금 기여를 극대화했기 때문에 매년 검토하지 않았습니다. 그러나 이러한 시간 동안 펀드는 평균 3.5% 성장했을 뿐이며, 인플레이션을 고려할 때 순 손실을 가져왔습니다. 또한 연간 £5,000의 자문 수수료와 약 1%의 펀드 수수료가 있어 UBS에서 모든 투자를 더 나은 곳으로 이전하기로 결정했습니다.

중간 평가

Đặng Công Hà

베트남

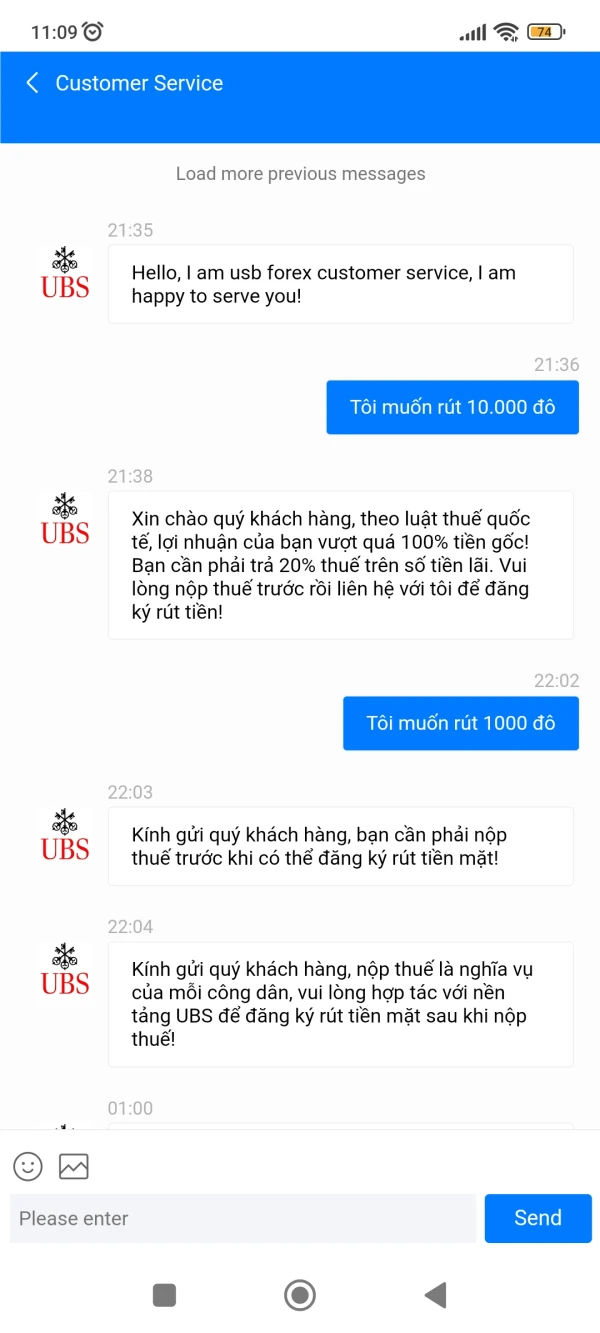

당신의 이익 계정이 100%를 초과하면 세금을 내도록 강요합니다.

신고

Ajs142

파키스탄

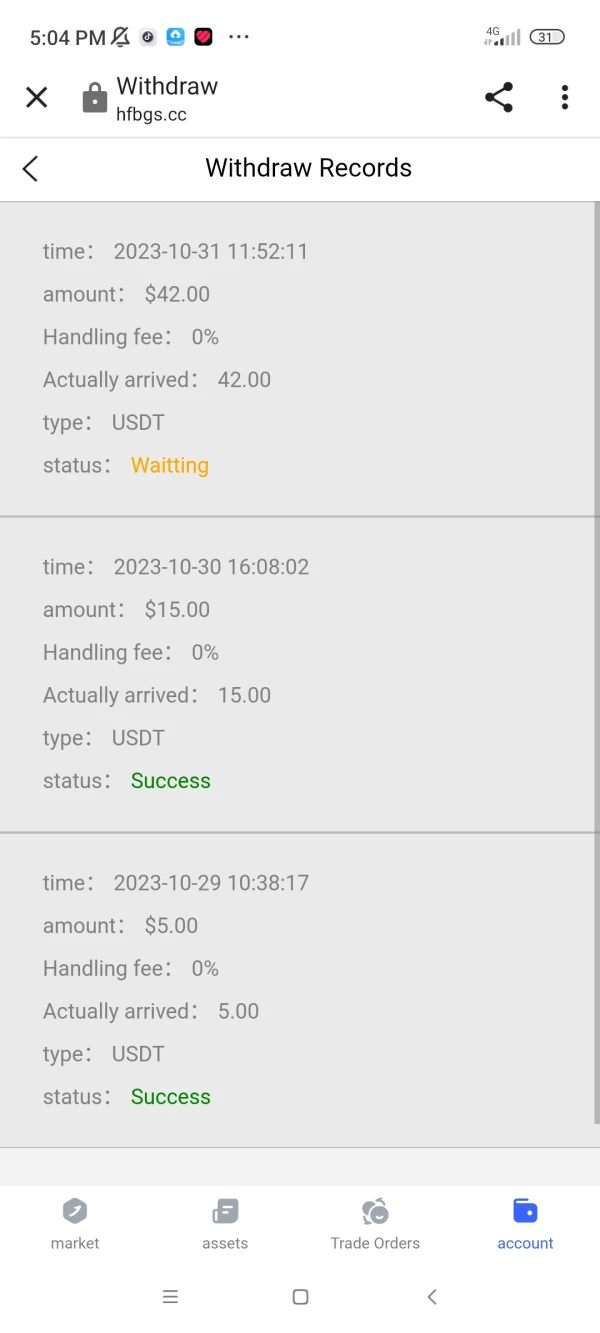

~에서 UBS 바이낸스로

신고

salman khan468

인도

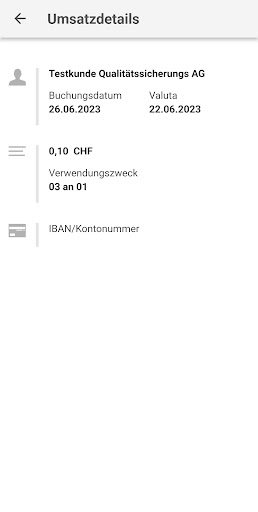

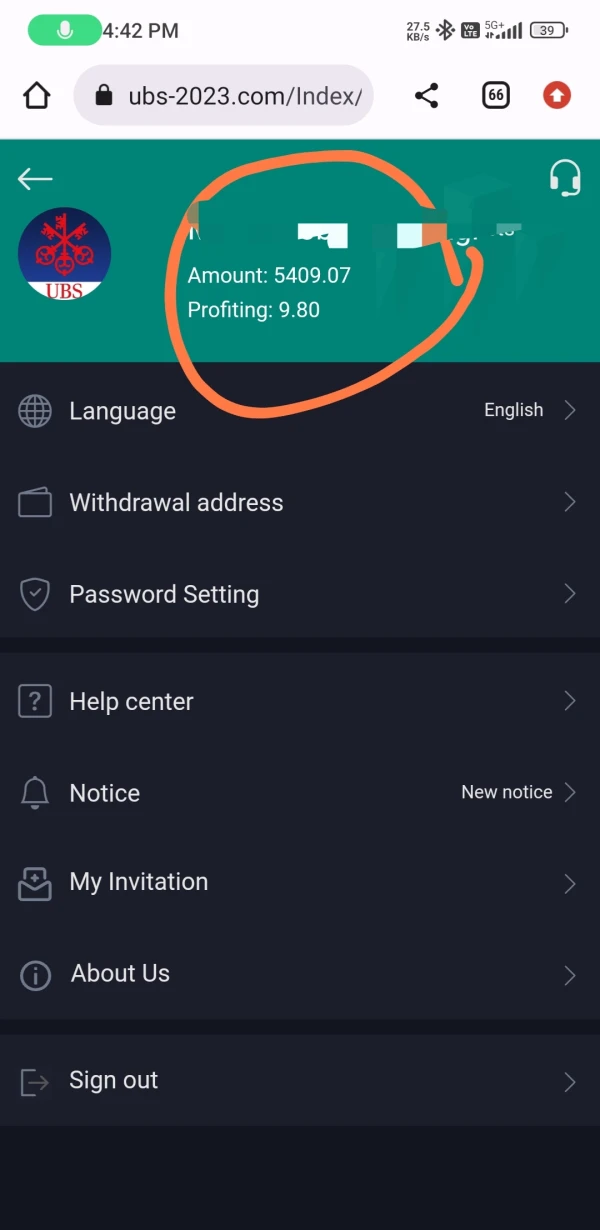

나는 2400 usdt를 입금했고 3000 usdt를 벌었습니다. 이제 내 지갑에는 5400+ usdt가 있습니다 UBS 시장 계좌에서 인출하려고 했더니 20%의 세금을 내야 한다고 합니다. 이건 완전 사기입니다. 제 계좌에서 공제할 수 있습니다.

신고

FX1352371297

인도네시아

그들은 내가 차트 조작에 대해 불평했던 내 거래 중 하나를 조사했고 그들이 뒤에 있는 계정을 조작한 것으로 밝혀졌습니다. 내가 정말로 불평하고 싶은 것은 직원들이 지식 부분에서 잘 갖추어지지 않은 것 같다는 것입니다. 그들은 고객의 요구 사항을 이해하는 기본 기술이 없으며 고객과 대화하는 것이 저를 정말 괴롭힙니다…

좋은 평가

FX4198274585

호주

거래하고 돈을 잃은 후 그들은 내가 출금을 허용하지 않았습니다. q sum of 2138.73 나는 고객 서비스에 수없이 메시지를 보냈지만 응답이 없습니다. 거래를 시도했지만 허용되지 않았습니다 내 돈을 인출하는 데 도움이 필요합니다

신고

筱飛【Graphic Design】

홍콩

100,000 위안 이상을 입금했지만 여러 가지 이유로 출금을 거부했습니다.

신고

往后7407

홍콩

그들은 내 인출을 거부 할 모든 이유를 가지고 있고, 매일 그들의 변명을 바꿨고, 그들은 인출을 위해 저에게 입금을 요청했습니다.

신고

D S Y

홍콩

UBS사람들을 속이는 것은 실제로 일련의 사기입니다.

신고

D S Y

홍콩

자금을 인출하기 전에 멤버십으로 업그레이드하려면 68888을 지불해야합니다.

신고

起风了69241

홍콩

자금을 인출 할 수있는 방법이 없습니다. 고객 서비스는 회원이 되려면 최대 50,000까지 예치해야합니다.

신고

FX3892210959

미국

나는 나를 투자하도록 유도 한 사람을 알고UBS . 이것은 사기 디지털 화폐 플랫폼입니다. 여러 번 거래 한 후 수익을 올렸습니다. 하지만 자금을 인출 할 수 없습니다. 고객 서비스에서 제 매출이 20,000에 이르지 않았다고 말했습니다 (그에 대해 들어 본 적이 없었습니다. 당시 매출은 1,000이 넘었습니다). 그런 다음 수만 달러를 계속 투자하겠다고 암시했습니다. 그래서 나는 그들이 돈을 성공적으로 인출하는 데 도움을 줄 수 있기를 바랍니다. 고객 서비스 팀은이 말을 듣고 내 신청이 시스템에 의해 자동으로 처리 될 것이라고 말했습니다 (원칙 없음). 나는 하루가 지나면 어떻게 빨리 돈을받을 수 있는지 물었다. 그리고 고객 서비스는 내가 VIP가 될 수 있다고 말했고 5,000이 필요했습니다. 나는 다른 것을 물었고 결국에는 이직률의 차이가 무엇인지 물었습니다. 고객 서비스 : 5,000

신고

Bottle

홍콩

기술자와 수술 후 철수했을 때 은행 카드 정보가 잘못되었다는 말을 들었습니다. 정보를 수정하고 자금을 인출하려면 30 % 마진을 지불해야합니다. 하지만 신분증과 은행 정보를 제공 한 후에는 할 수 없습니다.

신고

FX3393443657

홍콩

저의 요청은 아직 확인 중이며, 자금을 인출하기 전에 세금을 요구하기까지했습니다.

신고