简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Fundamental Analysis in FX, Indices, and Commodities CFDs Trading

Sommario:Fundamental Analysis in FX, Indices, and Commodities CFDs TradingFundamental Analysis (FA) is a core pillar of market analysis in the world of financial trading. It focuses on evaluating the underlyin

Fundamental Analysis in FX, Indices, and Commodities CFDs Trading

Fundamental Analysis (FA) is a core pillar of market analysis in the world of financial trading. It focuses on evaluating the underlying economic, political, and policy factors that influence the supply and demand of an asset — ultimately driving its price direction.

Unlike Technical Analysis, which looks at price charts and patterns, Fundamental Analysis examines the “why” behind price movements by studying a wide range of influences — from central bank decisions and inflation rates to political events and global supply chains.

1.Fundamental Analysis in FX, Indices, Commodities CFDs Trading

While Fundamental Analysis can cover both microeconomic (e.g., corporate earnings) and macroeconomic (e.g., interest rates, inflation) aspects, when it comes to FX, commodities, and indices CFDs, traders tend to focus on macro-level forces that impact entire economies or sectors, not just in microeconomics perspective.

In the FX, commodities, and stock indices CFD markets, traders primarily focus on macroeconomic factors to understand price movements. These factors can be broadly categorized into three key areas:

By understanding these macroeconomic factors, traders can identify how capital flows into different asset classes based on changing economic conditions, policy shifts, or geopolitical developments. In the following sections, we will break down each of these key areas and explore how they influence the prices of FX, indices, and commodities.

2. Central Bank Policies & Interest Rates

Central bank policies and interest rates are among the primary drivers of the FX market A currency‘s movement is closely tied to its country’s interest rates and monetary policy.

To give you a clear concept:

· When a countrys interest rate is higher or its policy is restrictive, its currency tends to be stronger as it attracts foreign capital seeking better returns.

· When a countrys interest rate is lower or its policy is accommodative, its currency tends to be weaker as investors look for higher-yielding alternatives elsewhere.

Example: U.S. Federal Reserve vs. Bank of Japan (2022–2024)

Between 2022 and 2024, the U.S. Federal Reserve embarked on an aggressive policy-tightening cycle, raising interest rates at the fastest pace in decades. In contrast, the Bank of Japan maintained its ultra-loose monetary policy, keeping interest rates in negative territory.

This stark policy divergence led to a significant depreciation of the Japanese yen against the U.S. dollar, as investors favored the higher-yielding USD over the JPY.

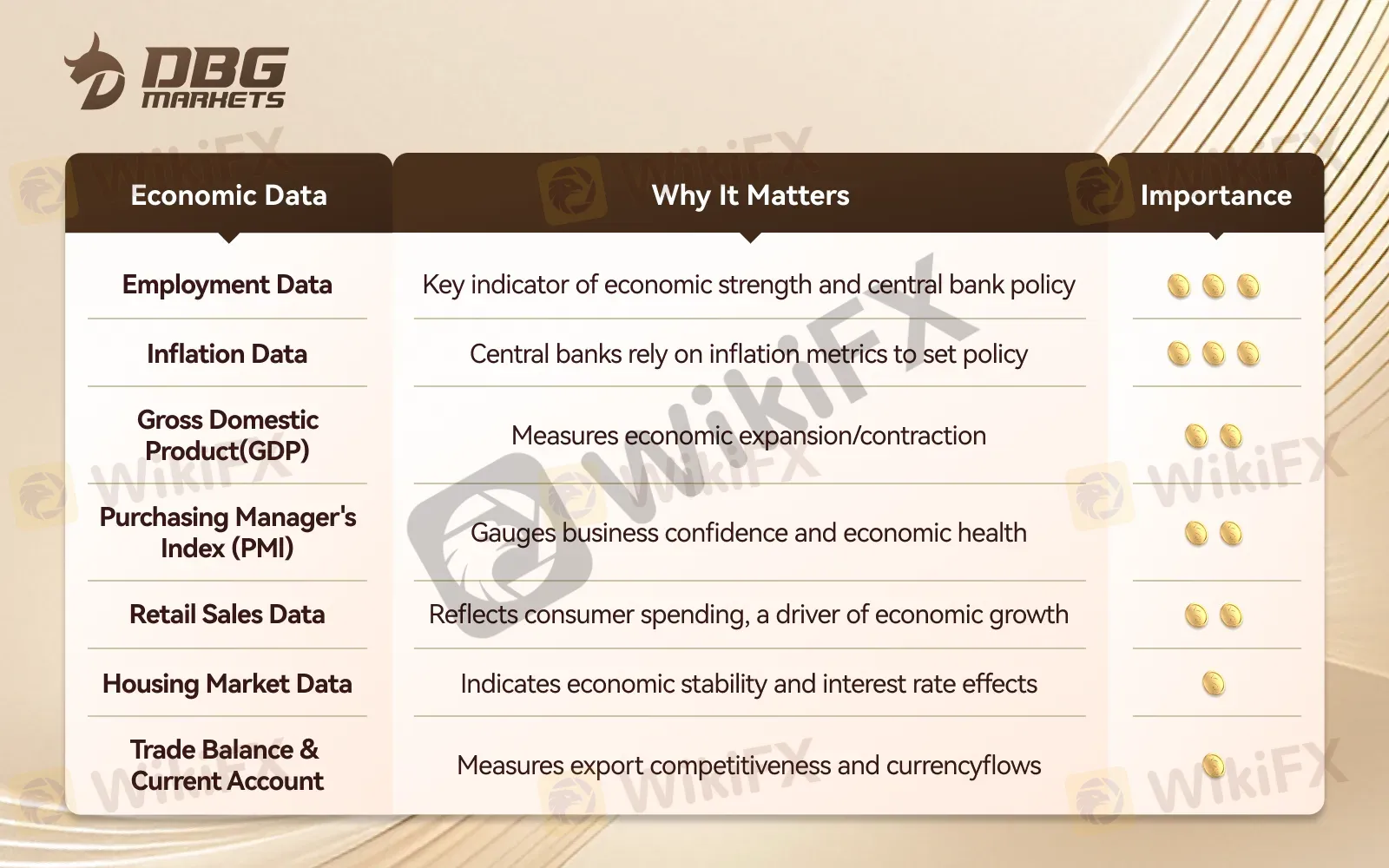

3. Economic Data & Indicators

Economic data provide insights into a countrys economic performance, helping market participants and investors assess the strength of an economy and its potential impact on currency valuation.

While there are numerous economic indicators available—which can be accessed through the DBG Markets Economic Calendar—not all have a significant impact on the FX market, especially in the short term.

To help readers understand which economic data are most important and why they matter, we have highlighted the key indicators that have the greatest impact on the market:

Among all economic indicators, inflation data—such as the Consumer Price Index (CPI) and Personal Consumption Expenditure (PCE)—along with employment data—such as the unemployment rate and non-farm payrolls (NFP) in the U.S.—are the most closely watched by investors, traders, and analysts.

4. Geopolitical and Political Event

Geopolitical and political events play a crucial role in shaping market sentiment and influencing currency movements. These events introduce uncertainty, affect investor confidence, and often lead to sharp price fluctuations in the FX market.

Political and geopolitical events impacting FX markets can be broadly categorized into three areas:

1. Elections & Political Shifts: Leadership changes, policy shifts, and political uncertainty affect a country's economic outlook and currency stability.

2. Trade Policies & Economic Sanctions: Tariffs, trade wars, and sanctions impact global trade flows, affecting currency demand and valuation.

3. Geopolitical Conflicts: Wars, territorial disputes, and international tensions often lead to risk aversion, benefiting safe-haven currencies.

5. Key Takeaways for Fundamental Analysis

By understanding these fundamental factors, traders can better anticipate the major drivers that drive the price movement, in this case, the supply and demand dynamics in the FX or even the global market.

A well-rounded fundamental analysis approach allows traders to make informed decisions by considering macroeconomic trends and their potential impact on asset prices.

However, keeping track of every central bank speech and economic report can be overwhelming. Thats why DBG Markets covers this fundamental outlook and analysis for you on a day-to-day basis.

Disclaimer:

Le opinioni di questo articolo rappresentano solo le opinioni personali dell’autore e non costituiscono consulenza in materia di investimenti per questa piattaforma. La piattaforma non garantisce l’accuratezza, la completezza e la tempestività delle informazioni relative all’articolo, né è responsabile delle perdite causate dall’uso o dall’affidamento delle informazioni relative all’articolo.

WikiFX Trader

FXTM

fpmarkets

D prime

STARTRADER

FOREX.com

AVATRADE

FXTM

fpmarkets

D prime

STARTRADER

FOREX.com

AVATRADE

WikiFX Trader

FXTM

fpmarkets

D prime

STARTRADER

FOREX.com

AVATRADE

FXTM

fpmarkets

D prime

STARTRADER

FOREX.com

AVATRADE

Rate Calc