简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

FPG USDCAD Market Report January 20, 2026

Sommario:On the H4 timeframe chart, USDCAD has entered an equilibrium phase after completing a relatively strong bullish rally from the 1.3642 area toward the 1.3927 zone. Following this impulsive upside move,

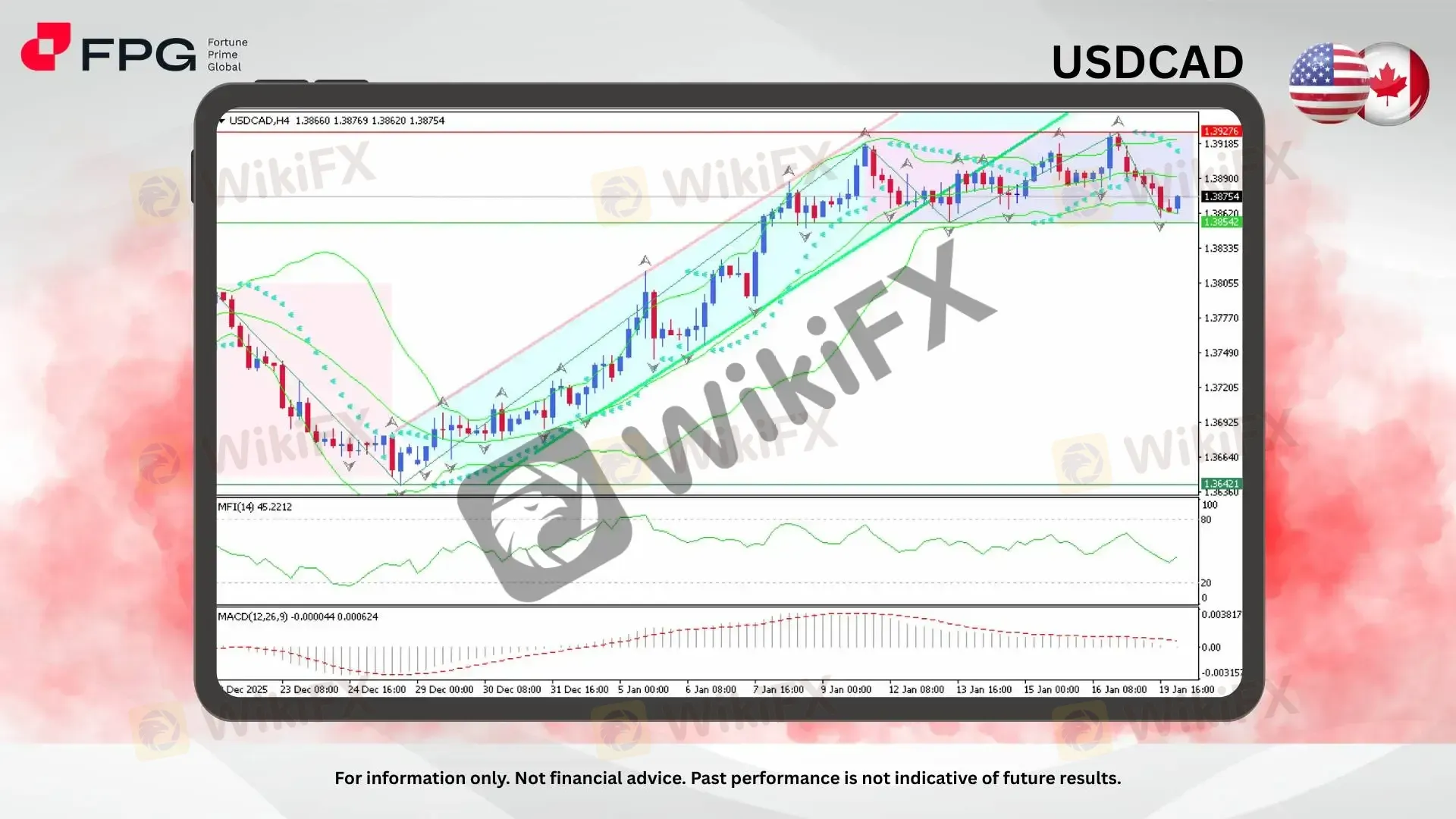

On the H4 timeframe chart, USDCAD has entered an equilibrium phase after completing a relatively strong bullish rally from the 1.3642 area toward the 1.3927 zone. Following this impulsive upside move, price action has shifted into a sideways consolidation, forming a horizontal channel structure. Currently, USDCAD is trading around 1.3875, gradually drifting lower within the range and approaching the channel support area near 1.3854, suggesting that bullish momentum has paused while the market awaits a new directional catalyst.

From a technical standpoint, the broader structure remains constructive, with price still holding above its medium-term ascending support line despite the recent consolidation. Bollinger Bands have started to narrow, indicating declining volatility after the strong rally, which aligns with the current range-bound behavior. The Money Flow Index (MFI 14) is trading around 45.22, reflecting neutral capital flow conditions and confirming the absence of aggressive buying or selling pressure at this stage. Meanwhile, MACD (12,26,9) remains above the zero line but shows a flattening histogram, signaling waning bullish momentum rather than a clear bearish reversal. Overall, the technical setup suggests a pause within an ongoing bullish context, with price likely preparing for a breakout once volatility returns.

Momentum is currently neutral-to-slightly bullish, as reflected by the stabilizing indicators and controlled price movement within the channel. In market conditions like this, price action often requires an external catalyst to break the equilibrium. Traders should remain attentive to todays key economic event schedule, as upcoming macro releases could act as the trigger that determines whether USDCAD resumes its bullish continuation toward recent highs or breaks down below the consolidation range.

Market Observation & Strategy Advice

1. Current Position: USDCAD is trading around 1.3875, consolidating after a strong bullish impulse.

2. Resistance Zone: The 1.3927 area remains the primary resistance, aligned with the recent swing high.

3. Support Zone: The 1.3854 level acts as immediate channel support, followed by deeper support near 1.3642.

4. Indicator: MFI (14) around 45.22 signals neutral flow, while MACD above zero confirms bullish bias with weakening momentum. Contracting Bollinger Bands highlight a compression phase, increasing the probability of a volatility expansion ahead.

5. Trading Strategy Suggestions:

Range Play: Consider short-term buy setups near 1.3854 if bullish rejection candles appear within the channel.

Breakout Strategy: A confirmed H4 close above 1.3927 could signal bullish continuation toward higher levels.

Risk Management: If price breaks and holds below 1.3854, reassess bullish bias and manage exposure carefully ahead of high-impact news.

Market Performance:

Forex Last Price % Change

EUR/USD 1.1633 −0.10%

USD/JPY 158.24 +0.07%

Today's Key Economic Calendar:

CN: Loan Prime Rate 1Y & 5Y

UK: Average Earnings incl. Bonus (3Mo/Yr)

UK: Employment Change

DE: PPI YoY

UK: Unemployment Rate

CN: FDI (YTD) YoY

EU: ZEW Economic Sentiment Index

US: ADP Employment Change Weekly

Risk Disclaimer: This report is for informational purposes only and does not constitute financial advice. Investments involve risks, and past performance does not guarantee future results. Consult your financial advisor for personalized investment strategies.

Disclaimer:

Le opinioni di questo articolo rappresentano solo le opinioni personali dell’autore e non costituiscono consulenza in materia di investimenti per questa piattaforma. La piattaforma non garantisce l’accuratezza, la completezza e la tempestività delle informazioni relative all’articolo, né è responsabile delle perdite causate dall’uso o dall’affidamento delle informazioni relative all’articolo.

WikiFX Trader

WikiFX Trader

Rate Calc