简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

ETO Markets Global Pulse: Gold Breaks $4,630 on Iran, FED Turmoil

Sommario:Market Review According to ETO Markets monitoring, on January 13 (Tuesday), spot gold surged sharply as softer U.S. inflation data reinforced rate-cut expectations, while geopolitical and policy uncer

Market Review

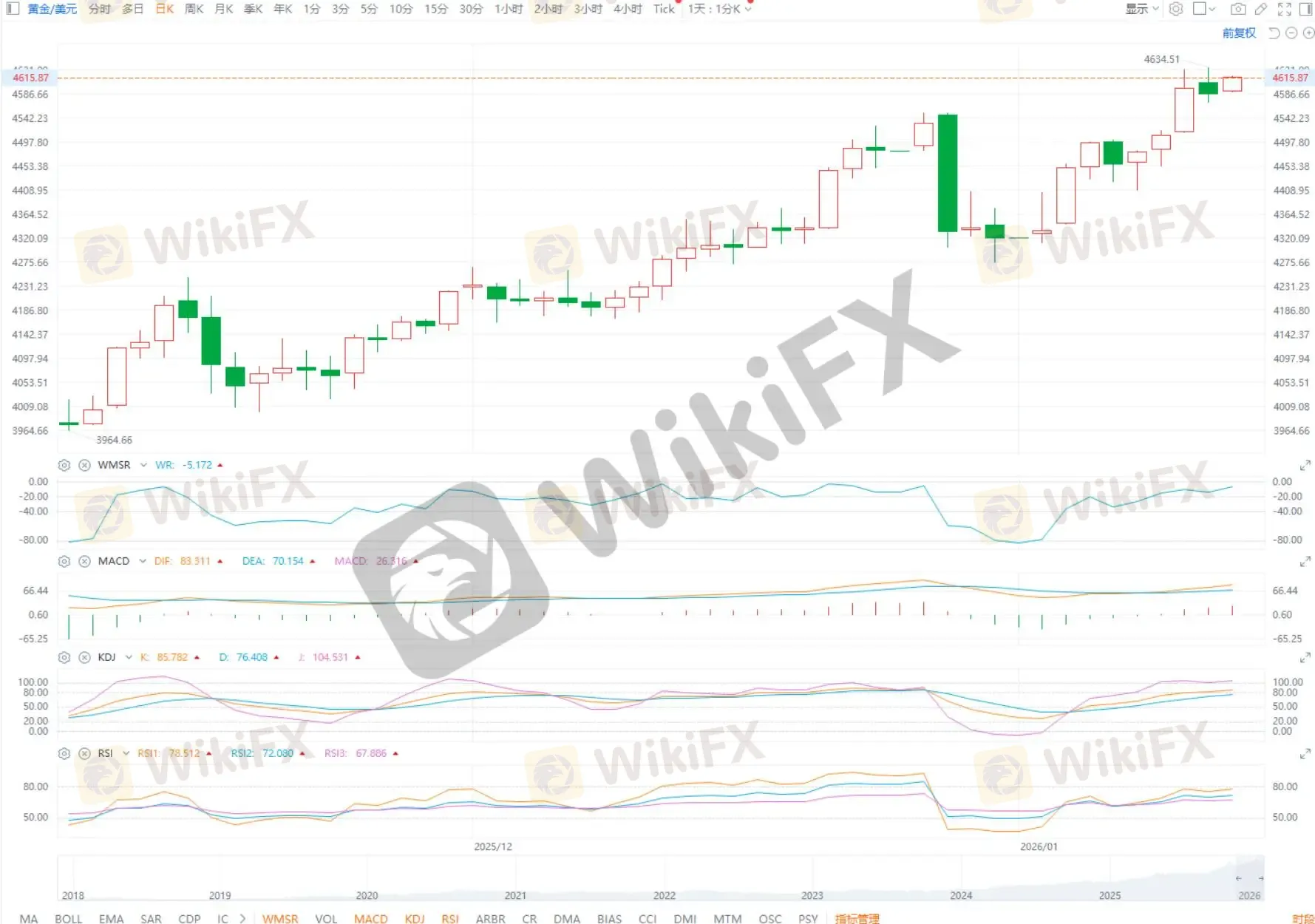

According to ETO Markets monitoring, on January 13 (Tuesday), spot gold surged sharply as softer U.S. inflation data reinforced rate-cut expectations, while geopolitical and policy uncertainty intensified. Prices hit an intraday high of USD 4,634.25 per ounce, setting a new record, before consolidating and closing near USD 4,591.49 per ounce.

During the Asian session on January 14 (Wednesday), spot gold held near record levels and is currently trading around USD 4,595 per ounce. The broader bullish trend remains intact, though short-term volatility has increased.

Global Headlines

1) Trump Renews Attacks on Powell

On Tuesday, President Trump again criticized FED Chair Jerome Powell, accusing him of mismanaging the FED headquarters renovation and overspending by billions of dollars. Trump said he will announce the next FED Chair within the coming weeks, adding to market concerns over policy independence.

2) FED Signals Rates Near Neutral

On Tuesday, St. Louis FED President Musalem said the current policy rate is close to neutral, with little urgency to ease further. He noted downside risks to employment and lingering upside inflation pressures, but expects the labor market to remain stable and inflation to continue easing toward the 2% target.

3) U.S.-Iran Tensions Reignite

On January 13, Trump said all talks with Iranian officials had been canceled and urged U.S. citizens to leave Iran immediately. Iran‘s army chief Hatami responded that Iran’s military readiness has improved significantly since prior regional conflicts, keeping geopolitical risk firmly in focus.

4) Denmark Rejects Greenland Sale

On Tuesday, Danish Prime Minister Frederiksen and Greenland leader Nielsen said they will clearly state in Washington talks on January 14 that Greenland is not for sale. The comments reinforced ongoing geopolitical tension over Arctic security and strategic influence.

5) U.S. Targets Venezuela Oil Tankers

On Tuesday, the U.S. government sought court approval to seize dozens of oil tankers linked to Venezuela. The move expands pressure on its oil export network and may further lift geopolitical risk premiums in energy and commodity markets.

6) U.S. Fiscal Data Shows Divergence

U.S. data showed the December 2025 budget deficit surged to USD 145 billion, up 67% year on year, driven by record spending and timing shifts in benefit payments. However, full-year 2025 deficit narrowed to USD 1.67 trillion, the lowest in three years, helped by higher customs revenue. Entering fiscal year 2026, interest and healthcare costs remain key pressure points.

ETO Markets Analyst View (Spot Gold)

After a rapid rally to fresh record highs, spot gold has entered a high-level consolidation phase. Prices have repeatedly tested and held above the USD 4,575 support area, suggesting solid underlying demand. Holding above this level keeps the door open for renewed tests of the USD 4,615 and USD 4,630 zones.

A sustained break below USD 4,575 could trigger a short-term pullback toward USD 4,560 and USD 4,530, as the market seeks a new balance. RSI remains in bullish territory but shows signs of short-term saturation, warning of heightened volatility at elevated levels.

With policy uncertainty and geopolitical risks still unresolved, gold is likely to digest gains through high-level consolidation. Investors should continue to monitor policy signals and regional developments and manage positioning carefully.

Disclaimer

The information contained herein is for general reference only and does not constitute investment advice, a solicitation, or an offer to buy or sell any financial products.

ETO Markets does not guarantee the accuracy, completeness, or timeliness of the information and shall not be liable for any losses incurred from reliance on such content.

Disclaimer:

Le opinioni di questo articolo rappresentano solo le opinioni personali dell’autore e non costituiscono consulenza in materia di investimenti per questa piattaforma. La piattaforma non garantisce l’accuratezza, la completezza e la tempestività delle informazioni relative all’articolo, né è responsabile delle perdite causate dall’uso o dall’affidamento delle informazioni relative all’articolo.

WikiFX Trader

AVATRADE

FXTM

VT Markets

XM

EC markets

D prime

AVATRADE

FXTM

VT Markets

XM

EC markets

D prime

WikiFX Trader

AVATRADE

FXTM

VT Markets

XM

EC markets

D prime

AVATRADE

FXTM

VT Markets

XM

EC markets

D prime

Rate Calc