简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

ETO Markets Global Pulse: Gold Breaks $4,560 on Iran Risk

Sommario:Market Review According to ETO Markets monitoring, during the first full trading week of 2026, spot gold extended its strong uptrend. On January 9 (Friday), gold closed at USD 4,509.36 per ounce, with

Market Review

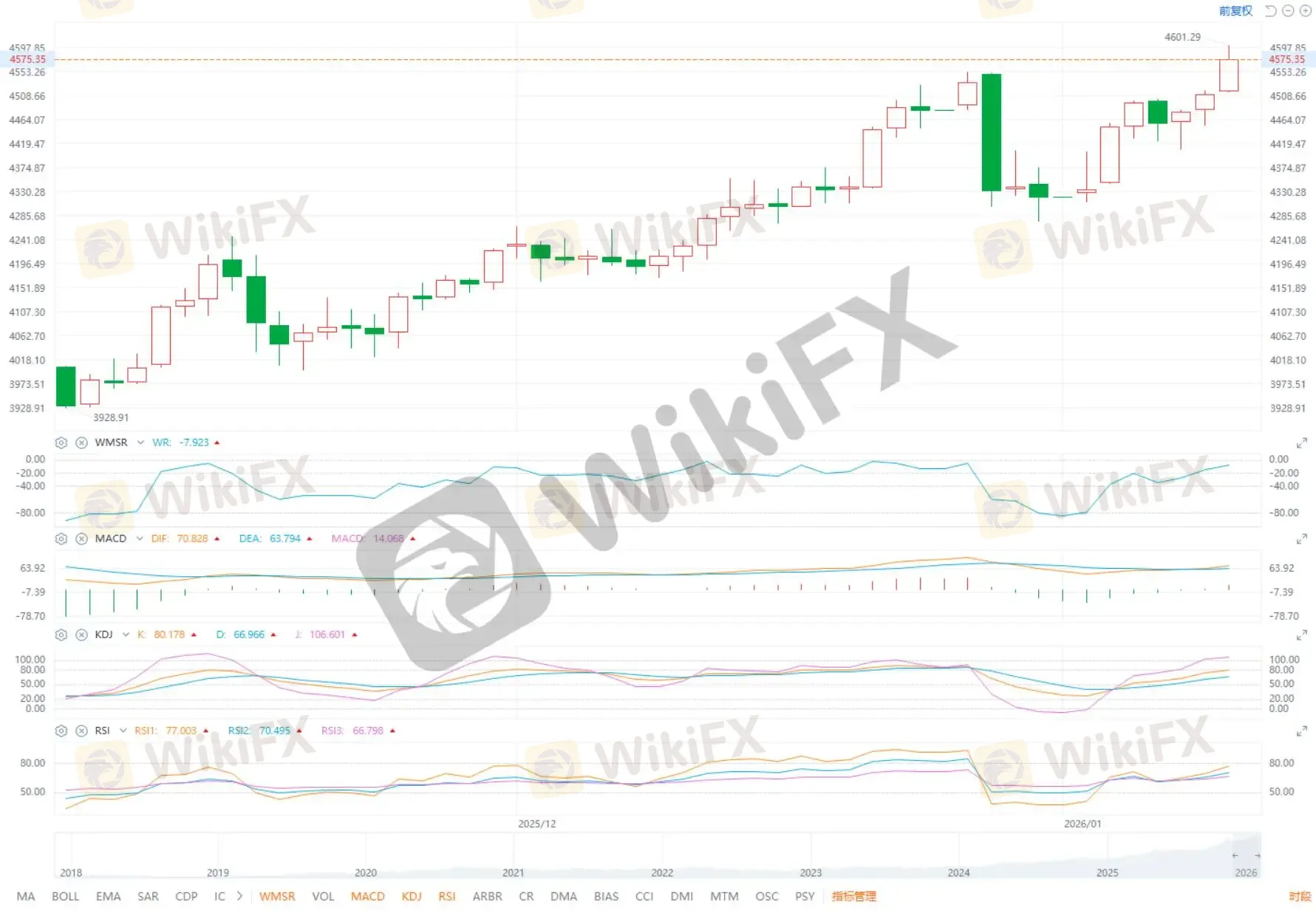

According to ETO Markets monitoring, during the first full trading week of 2026, spot gold extended its strong uptrend. On January 9 (Friday), gold closed at USD 4,509.36 per ounce, with an intraday high of USD 4,516.91. Weekly gains approached 4%, bringing prices close to the previous record high of USD 4,549.71 set in late December.

During the Asian session on January 12 (Monday), spot gold accelerated further and broke above USD 4,560 per ounce. Prices are currently trading near USD 4,562, marking a fresh all-time high as bullish sentiment strengthened.

Global Headlines

1) Iran Tensions Drive Safe-Haven Demand

On Monday, unrest in Iran continued to intensify. U.S. officials said President Trump will receive a briefing on Tuesday regarding responses to the protests. Markets interpreted this as a sign of rising geopolitical risk. Gold, silver, and crude oil all opened higher, supported by stronger safe-haven and inflation-hedging demand.

2) December NFP Soft but Stable

U.S. December NFP data showed job growth of just 50,000, below the expected 60,000. However, the unemployment rate unexpectedly fell to 4.4%. Markets concluded that the labor market is slowing but not deteriorating sharply. The so-called “new FED whisperer” noted the data allows the FED to stay on hold. Rate swap markets now price a much lower probability of a January cut, with the first rate cut pushed back to June.

3) De-Dollarization Accelerates Globally

Data shows that in 2025, global central bank gold holdings surpassed U.S. Treasury holdings for the first time in nearly 30 years. Gold now accounts for over 25% of official reserves, while U.S. Treasuries have fallen below 25%. This marks the first such crossover since 1996 and highlights the continued de-dollarization trend in global asset allocation.

4) Israel Strikes Hezbollah Facilities

Late on the 11th, the Israeli Defense Forces said they carried out additional airstrikes on Hezbollah underground weapons storage sites in Lebanon. The IDF stated the facilities had not been fully dismantled in previous operations, prompting renewed strikes. Regional tensions remain elevated.

5) Houthis Warn Saudi Arabia

On the 11th, Yemens Houthi movement warned Saudi Arabia against restarting military operations. The group said any renewed action would trigger a strong response and urged Saudi Arabia to honor peace commitments and withdraw from Yemen.

ETO Markets Analyst View (Spot Gold)

From a technical perspective, spot gold has strengthened further after breaking above prior highs. Prices are holding firmly above the USD 4,478 support zone, keeping bullish momentum intact. The current price action reflects a pattern of sharp rallies followed by brief consolidation before further upside attempts.

If key support holds, gold may continue to test the USD 4,548 and USD 4,575 regions. RSI remains in positive territory with no clear bearish divergence, suggesting momentum is still supportive.

With geopolitical risks, de-dollarization flows, and shifting rate expectations interacting, short-term volatility may increase. However, the broader upside structure remains intact. Investors should continue to monitor macro and geopolitical developments closely.

Disclaimer

The information contained herein is for general reference only and does not constitute investment advice, a solicitation, or an offer to buy or sell any financial products.

ETO Markets does not guarantee the accuracy, completeness, or timeliness of the information and shall not be liable for any losses

Disclaimer:

Le opinioni di questo articolo rappresentano solo le opinioni personali dell’autore e non costituiscono consulenza in materia di investimenti per questa piattaforma. La piattaforma non garantisce l’accuratezza, la completezza e la tempestività delle informazioni relative all’articolo, né è responsabile delle perdite causate dall’uso o dall’affidamento delle informazioni relative all’articolo.

WikiFX Trader

WikiFX Trader

Rate Calc